Receiving a bill for a medical procedure or appointment that you thought your insurance would cover can be frustrating, but there are ways to contest it. Firstly, it's important to review your insurer's explanation of benefits and identify any common mistakes or discrepancies. This includes checking whether the service was provided by in-network providers and whether the claim was denied due to incorrect or outdated information. If you spot any errors, you can request an itemized bill and carefully review each charge to identify issues such as double charges, coding mistakes, or incorrect calculations. You should also compare the bill against your health insurance plan to determine which charges are your responsibility and which fall under the insurance company's purview. If you identify any issues, the next step is to contact your medical provider and insurance company to discuss the discrepancies and seek a resolution. Maintaining a polite and empathetic attitude during these conversations can be beneficial. It is also crucial to keep detailed records of all communications, including names, dates, and summaries of discussions. If the issue remains unresolved, you may need to initiate an internal appeal with your insurance provider, potentially involving a medical advocate or your employer if applicable. Understanding your patient rights and staying persistent in seeking a resolution can help ensure a favourable outcome when contesting an insurance bill.

| Characteristics | Values |

|---|---|

| First steps to take | Get an itemized copy of your bill, talk to your medical provider, and talk to your insurance company |

| What to do if the bill goes to a collection agency | File a notice with the collection agency within 30 days, stating that you're disputing the bill |

| How to avoid future problems | Review your insurance plan and know your requirements and coverages before you get medical services |

| How to get help | Work with a medical advocate |

| What to do if you still have to pay | Negotiate with the medical provider |

| Types of appeals | Internal appeal, external appeal |

| Deadlines for internal appeals | Within 180 days of receiving the denial notice from the insurance company |

| Deadlines for external appeals | Within four months after the date you receive a final determination from the internal review |

What You'll Learn

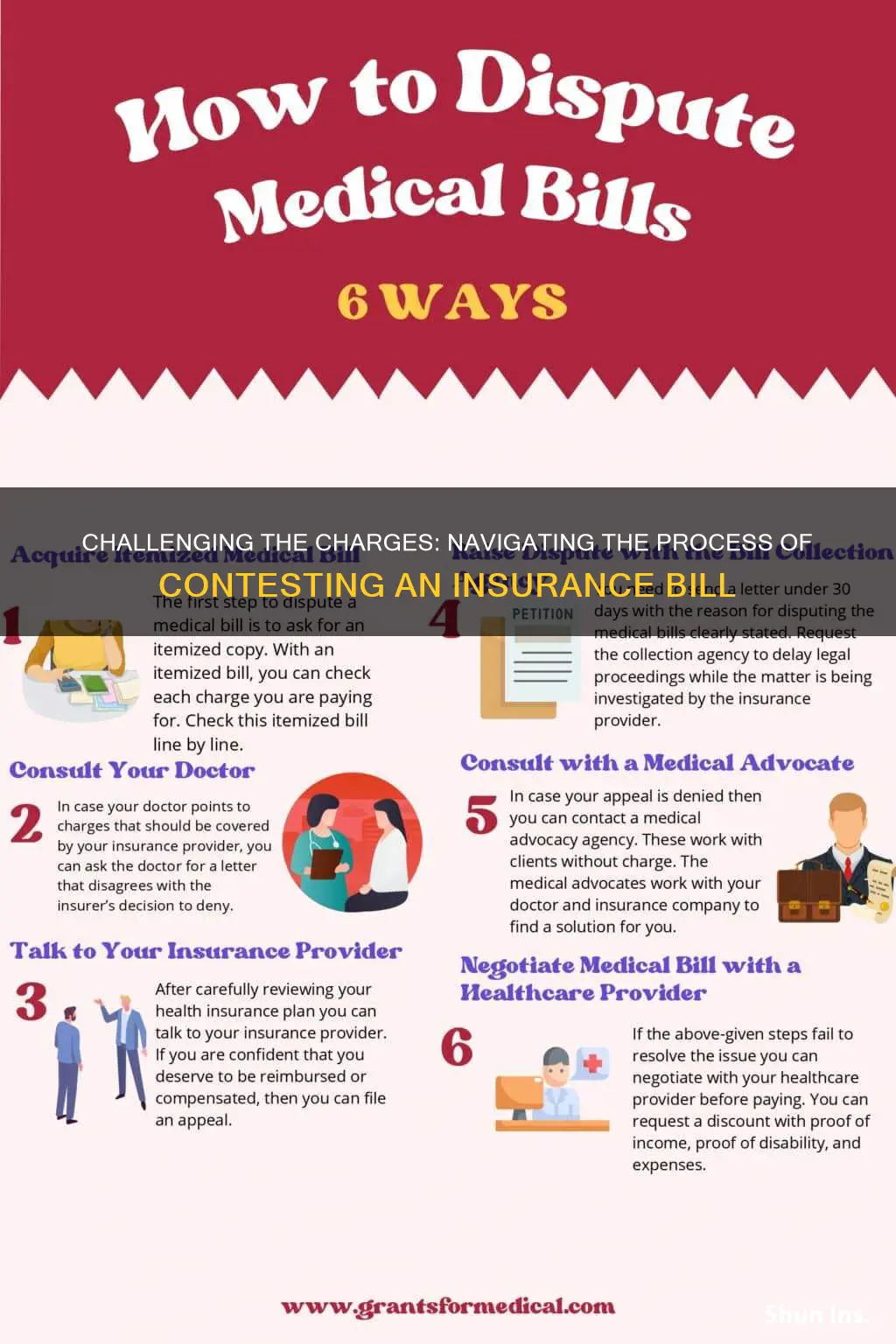

Request an itemised bill

Requesting an itemised bill is the first step in negotiating your hospital bill. While some hospital bills may resemble an itemised bill, the real deal contains procedure identifiers called CPT or HCPCS codes that break down your charges using industry-standard language, enabling you to identify duplicate charges and cross-check prices.

An itemised bill is a detailed statement provided by a healthcare provider or medical facility that lists all the individual services, procedures, and supplies used during a patient's treatment or care. The itemised bill breaks down the costs for each item, allowing patients and insurance companies to review and understand the specific charges associated with the medical care received.

- Transparency: An itemised bill provides a clear and detailed breakdown of all the individual charges associated with a patient's medical care. This transparency helps patients understand the specific costs of their treatment and allows them to review and verify the accuracy of the charges.

- Insurance claims processing: Insurance companies require itemised bills to process claims and determine the amount they will reimburse for medical services provided. The detailed information in an itemised bill allows insurers to verify the services, match them with the patient's insurance policy coverage, and detect any discrepancies or potential fraud.

- Dispute resolution: If a patient believes there is an error or discrepancy in their medical bill, the itemised statement serves as a reference to help resolve any disputes. Patients can use the itemised bill to question specific charges or to request clarification from the healthcare provider.

- Tax deductions: In some cases, patients can deduct medical expenses from their taxable income. An itemised bill helps them track and document their medical expenses to support their tax deductions.

- Reimbursement: Patients with Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) may need to submit itemised bills to get reimbursed for eligible medical expenses from these accounts.

- Budgeting and financial planning: An itemised bill allows patients to assess their healthcare costs and incorporate them into their personal budget and financial planning. Understanding these expenses can help patients make informed decisions about their healthcare and any necessary adjustments to their insurance coverage or healthcare provider choices.

- Monitoring healthcare utilisation: Itemised bills enable patients to review their healthcare utilisation and identify patterns, such as overuse of specific services or treatments, and make informed decisions about their healthcare needs and priorities.

To request an itemised bill, contact the billing department or office of your healthcare provider. Provide your full name, date of birth, contact information, and patient identification number (if applicable). Make the request for an itemised bill, specifying that you would like a detailed breakdown of all the services, procedures, and supplies used during your treatment, along with the associated costs. If you have a preference for the format of the itemised bill (e.g. email, mail, or fax), mention this during the call and provide the relevant details. If you don't receive the itemised bill within a reasonable timeframe (usually 1-2 weeks), follow up with the billing department to check on the status of your request. Remember to be polite and patient when making your request.

Understanding Pre-Existing Conditions: A Comprehensive List for Short-Term Insurance Applicants

You may want to see also

Contact your medical provider

If you think there's been a mistake on your medical bill, the first step is to contact your medical provider. Ask them to review the charges and fix any errors. It's important to do this as soon as possible, as most providers have a 60- to 90-day window for bill payment. After this, the bill will be sent to a collections agency, which can harm your credit score.

When you call your medical provider, explain why you think there's been a mistake and ask them to review the charges. They might say that your insurance company should be covering the expenses, in which case, ask for a letter that explains why your doctor disagrees with your insurer's denial. Write down the names of everyone you speak to, the dates of your conversations, and a summary of what you talked about.

If you're simply disputing the price of your bill, the customer service agent may be able to help you. They might offer you a discount on your bill if you can pay immediately. If not, ask to speak to a supervisor and explain your situation. They might be able to offer you a bigger discount.

Before contacting your medical provider, it's a good idea to do your research and understand what happened. That way, you can help troubleshoot the problem without passing blame. Realise that mistakes will happen – even if 99.99% of medical bills are done correctly, there's still room for human error. Be sympathetic and polite to the customer service representative.

Negotiating Power: Strategies for Requesting Lower Insurance Premiums

You may want to see also

Contact your insurance company

If you believe that your insurance company should be covering the bill or reimbursing you, you can contact them to file an appeal. This must be done quickly, usually within 30 to 60 days of receiving the bill. Make sure to include your medical records, letters from your doctor that explain why they disagree with the insurer's decision to deny coverage, and any other important information.

Before contacting your insurance company, it is important to review your insurance plan and understand what is and isn't covered. You should also carefully review the bill and the Explanation of Benefits report from your insurance company, which explains what they have covered for a specific date and healthcare visit. Compare the two documents to identify any discrepancies or errors.

When you contact your insurance company, remain polite and empathetic. Remember that the person you are speaking to may not be directly responsible for the issue and may be limited by office or corporate rules. Take notes during the conversation, including the names of the people you speak to, the dates of the conversations, and a summary of what was discussed or any decisions that were made. Expect delays and keep detailed records, as this information could be important if you need to file a complaint with the government.

If your insurance company has denied a claim, they are required to notify you in writing and explain the reason for the denial. They must do this within specific time frames, depending on the type of treatment:

- Within 15 days if you are seeking prior authorization for a treatment

- Within 30 days for medical services already received

- Within 72 hours for urgent care cases

If you are filing an appeal, there are two types: internal appeals and external appeals. For an internal appeal, you will need to complete any required forms, which can usually be found on your insurance company's website or mailed to you. Be sure to include the claim number, your health insurance ID number, and any relevant documentation, such as a letter from your doctor. You can also submit a formal letter requesting the appeal, including all relevant details such as your name, contact information, claim number, and health insurance ID number.

If you are not satisfied with the outcome of the internal appeal, you can proceed with an external appeal. This involves sending your disputed claim for review by a non-biased third party, usually an independent physician. The external reviewer will issue a final decision, which your insurer is legally required to abide by.

Aetna's Short-Term Insurance Plans: Exploring the Pros and Cons

You may want to see also

File an appeal

Appealing an insurance bill is a good way to make progress on disputing your medical bill. If you discover an error, your insurance company might be incentivized to go back to the medical provider to resolve it.

There are two types of appeals: internal and external. An internal appeal involves asking your insurance company to conduct a full and fair review of its decision. By law, your health plan cannot drop your coverage or raise your rates because you ask them to reconsider a denial through the appeals process. An external appeal involves sending your disputed claim for external review by a non-biased third party (usually an independent physician).

Before filing an appeal, it's important to do your research and understand what happened. That way, you can help troubleshoot the problem without passing blame. Also, remember that mistakes will happen, so be sympathetic to the situation.

To file an internal appeal, you will need to:

- Complete all forms required by your health insurer, including the claim number and your health insurance ID number. You can usually find these forms on their website or request that they mail them to you.

- Submit a formal letter requesting the appeal, including your name and contact information, claim number, and health insurance ID number.

- Contact your state's Consumer Assistance Program to file an appeal for you.

- Keep copies of all forms and letters you send, and send them by certified mail.

- Meet the deadline: you must file your internal appeal within 180 days of receiving the denial notice from the insurance company.

To file an external appeal, you will need to:

- File a written request with the insurance company within four months of receiving a final determination from the internal review.

- Keep copies of all your external review documents and send your written request by certified mail.

If you need help with this, a representative from your state's Consumer Assistance Program can file the external review for you.

Outpatient Physician's Guide to Navigating Insurance Billing: Strategies for Accuracy and Compliance

You may want to see also

Work with a medical advocate

If you're unable to resolve a medical billing dispute on your own, you can enlist the help of a medical advocate. Medical advocates can work with your insurance company or doctor to find a solution on your behalf. They can help you understand your bill, apply for financial assistance, and access your medical records. Many hospitals have patient advocates on staff, so you can start by calling the hospital and asking if they have an advocate who can help you. You can also search online for a patient advocate or patient representative at the hospital where you received treatment.

There are also independent medical advocacy agencies that can assist you for free. These agencies work with clients to resolve billing issues and find solutions. They can be a great resource if you're feeling overwhelmed or unsure of how to navigate the complex world of medical billing and insurance. To find an independent medical advocate, you can check with local community resources or disease-specific organizations. For example, the Patient Advocate Foundation is a nonprofit organization that helps people with chronic or life-threatening illnesses navigate and pay for their care. They offer one-on-one counselling and have a downloadable guide with detailed advice on the insurance appeals process, including sample appeal letters.

In some cases, you may need to hire a medical billing advocate, especially for complex or large bills. These experts typically charge by the hour or take a percentage of the money they save you. When hiring a medical billing advocate, look for someone who offers a free initial consultation, and be sure to get references and ask about their experience with medical billing, especially with cases similar to yours. You can search for medical billing advocates through professional membership groups such as the Alliance of Professional Health Advocates, the National Association of Healthcare Advocacy, and the Alliance of Claims Assistance Professionals.

Working with a medical advocate can be a great way to get support and guidance when contesting an insurance bill. They can help you understand your rights, navigate the complex healthcare system, and find a resolution that works for you.

The Intricacies of ILS: Unraveling the World of Insurance-Linked Securities

You may want to see also

Frequently asked questions

First, review your insurer's explanation of benefits. Check whether the service was in-network, then call your insurer and ask them to explain why the claim was denied. If you believe the bill was sent in error or the amount is incorrect, you can and should fight back.

There are two types of appeals: internal and external. For an internal appeal, you must complete all the required forms, including the claim number and your health insurance ID number, and submit a formal letter requesting the appeal. For an external appeal, you must file a written request with the insurance company within four months of receiving a final determination from the internal review.

Ask for an itemized copy of your bill and go through it line by line. Look for double charges, coding mistakes, and incorrect calculations. Compare the items on the bill to your health insurance plan to determine which charges you are responsible for and which your insurance company should cover.