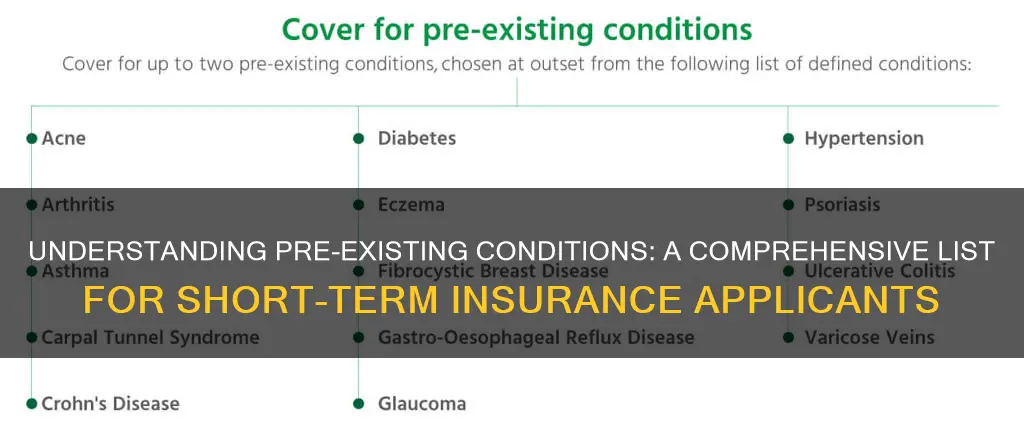

Pre-existing conditions are health problems that are present before the start of a new health insurance plan. Since 2014, the Affordable Care Act (ACA) has prohibited health insurers from denying coverage, raising prices, or limiting coverage for people with pre-existing conditions. However, short-term health insurance plans are not subject to ACA regulations and typically do not cover pre-existing conditions. These plans are designed for unforeseen emergency health needs and are not suitable for long-term health issues. While short-term plans can provide benefits such as emergency care, primary care, and specialist visits, they often exclude coverage for pre-existing conditions, ongoing health problems, medical devices, dental and vision care, and prescription drugs. It is important for individuals to carefully understand the coverage offered by short-term insurance plans and consider their specific health needs before purchasing such policies.

| Characteristics | Values |

|---|---|

| Pre-existing conditions covered | No, short-term insurance rarely covers pre-existing conditions. |

| Coverage | Emergency hospital visits, certain prescription medications, and some doctor's appointments not related to pre-existing conditions. |

| Cost | Short-term insurance is typically much more affordable than major medical plans. |

| Qualifying factors | Filling out a health questionnaire, disclosing pre-existing conditions, current weight, HIV/AIDS diagnosis or treatment, Medicaid qualification, citizenship. |

| Renewal | Can be renewed two times, for a total coverage of up to three years. |

| Waiting period | Waiting periods can range from five days to a full month. |

| Exclusions | Maternity care, mental health, substance abuse services, and prescription drugs. |

What You'll Learn

- Short-term health insurance rarely covers pre-existing conditions

- Short-term insurers can decline to insure you due to your medical history

- Short-term insurers may charge you extra due to pre-existing conditions

- Short-term plans often don't cover hospital bills for patients admitted on weekends

- Short-term health insurance is designed to cover unforeseen emergency health needs

Short-term health insurance rarely covers pre-existing conditions

Since short-term health policies are designed for unforeseen emergency health needs, they typically do not cover pre-existing conditions. This means that if you have a short-term plan and seek treatment for a pre-existing condition, your claim for payment will likely be denied. Short-term insurers can decline to insure you or charge you extra based on your medical history or current health status.

The Affordable Care Act (ACA), also known as Obamacare, prohibits health insurance companies from denying coverage or charging higher rates due to pre-existing conditions. This legislation, passed in 2010, ensures that individuals with pre-existing conditions have access to affordable health insurance. However, short-term health insurance plans with an initial term of 364 days or fewer are exempt from ACA regulations and are not required to cover pre-existing conditions.

It is important to carefully review the terms of a short-term insurance plan before purchasing it. These plans often have quirks and exclusions, such as not covering hospital bills for patients admitted on weekends or visits related to recreational drug use or sports injuries. Additionally, short-term plans rarely cover medical devices, dental care, vision care, or prescription drugs outside of hospitalizations.

While short-term health insurance may provide temporary coverage for unforeseen emergencies, it is not a comprehensive solution for individuals with pre-existing conditions. Those seeking insurance coverage for pre-existing conditions should consider alternatives, such as plans offered through the Obamacare marketplace, which provide protection against discrimination based on medical history.

The Intricacies of Self-Insurance: Exploring the Viable Alternative to Traditional Insurance

You may want to see also

Short-term insurers can decline to insure you due to your medical history

Short-term insurance is unlikely to cover pre-existing conditions. Short-term insurers can decline to insure you due to your medical history or current health status. They may also accept you but charge you extra. Short-term insurance is designed for unforeseen emergency health needs, so it is not suitable for long-term health issues.

Pre-existing conditions are often chronic conditions, such as chronic obstructive pulmonary disease or congestive heart failure. The length of time that short-term policies "look back" for pre-existing conditions varies by state, ranging from the previous six months to five years. If you want to purchase another short-term policy after your first policy expires, your new plan may not cover conditions that developed during your first policy term. Generally, people who remain healthy can renew, while those who are sick, especially those needing medical treatment, are typically declined or charged extra.

Before buying a plan, you should carefully ask the short-term insurer exactly what is covered. Be aware of quirks in the plan, such as not covering hospital bills for patients admitted on weekends or visits related to drinking, recreational drug use, or sports injuries. Also, ask how long the waiting period is before coverage begins. Waiting periods can range from five days to a full month.

Short-term plans usually expire after three months but can be renewed for up to three years in roughly half of US states. It is important to note that short-term health plans do not usually cover pre-existing conditions or only do so at very high prices. Certain health conditions or your medical history may also prevent you from obtaining other types of insurance, such as life insurance or disability insurance.

RH Insurance: Understanding the Whole Picture or Just a Term

You may want to see also

Short-term insurers may charge you extra due to pre-existing conditions

Short-term insurance is unlikely to cover pre-existing conditions. Short-term insurers can decline to insure you based on your medical history or current health status, or they may accept you but charge you extra. This is because short-term health policies are designed to address unforeseen emergency health needs, making them unsuitable for long-term health issue maintenance.

Pre-existing conditions are health problems you have before your new health insurance coverage begins. They can include chronic diagnoses like high blood pressure, diabetes, and cancer; acute issues like a traumatic injury; and resolved problems like a reconstructed joint. Pregnancy and asthma are also common pre-existing conditions.

The length of time that short-term policies "look back" for pre-existing conditions varies by state, ranging from the previous six months to five years. If you want to purchase another short-term policy after the first one expires, your new plan may not cover conditions that developed during the term of your first policy.

Before purchasing a short-term insurance plan, carefully ask the insurer exactly what is covered. Be aware of quirks in the plan, such as not covering hospital bills for patients admitted on weekends or visits related to drinking, recreational drug use, or sports injuries. Also, ask about the waiting period before coverage begins, which can range from five days to a full month.

While short-term insurance may not be the best option for those with pre-existing conditions, it is important to note that other types of health insurance, such as plans under the Affordable Care Act (ACA), are required to cover pre-existing conditions without raising prices or limiting coverage.

Northwestern Mutual's Level Term Insurance Option: A Comprehensive Overview

You may want to see also

Short-term plans often don't cover hospital bills for patients admitted on weekends

Short-term health insurance plans are designed to bridge the gap between permanent policies. They are a more affordable solution for those looking for limited health coverage during transitional periods in their lives. However, they often come with quirks, such as not covering hospital bills for patients admitted on weekends. Here are some reasons why short-term plans often don't cover hospital bills for patients admitted on weekends, as well as other important considerations regarding short-term health insurance.

Reasons for Non-Coverage on Weekends

- In-network requirements: Short-term health plans typically have specific networks of healthcare providers and facilities with which they have negotiated rates. If a patient is admitted to a hospital on the weekend and treated by out-of-network providers, the insurance company may deny the claim, leaving the patient with the entire bill.

- Lack of pre-approvals/referrals: Some short-term plans require referrals or pre-approvals for certain treatments or specialists. If a patient seeks emergency treatment on the weekend without the necessary pre-approvals, the insurer may deny the claim.

- Medical necessity: Insurers may deny claims if they deem the treatment was not medically necessary. In such cases, the patient's doctor can submit a "Medical Necessity" form to appeal the insurer's decision.

- Exclusions for specific treatments: Short-term plans often exclude coverage for specific treatments, such as elective surgeries or procedures related to pre-existing conditions. If a patient is admitted to the hospital on the weekend for one of these excluded treatments, the insurance company may deny the claim.

Other Considerations with Short-Term Plans

- Limited duration: Short-term health plans usually cover a limited period, typically less than 365 days. After this period, individuals may need to renew their plan or switch to a long-term option.

- Higher out-of-pocket costs: While short-term plans often have lower monthly premiums, they may result in higher out-of-pocket costs for individuals due to deductibles, copayments, and coinsurance.

- Exclusions for pre-existing conditions: Short-term plans often exclude coverage for pre-existing conditions. Individuals with chronic conditions or ongoing health problems may find themselves denied coverage or charged higher rates.

- Lack of comprehensive benefits: Short-term plans typically do not cover all the essential health benefits included in ACA-compliant plans, such as maternity care, mental health services, prescription drugs, and preventive care.

- Waiting periods: Short-term plans may have waiting periods before coverage begins, ranging from a few days to a month. During this time, individuals may not be covered for certain conditions.

- Limited renewability: Short-term plans may only be renewable a certain number of times, and any medical conditions treated under a previous plan may be considered pre-existing conditions in the new plan.

The Truth About Term Insurance: Unraveling the Mystery of Surrender and Refund Values

You may want to see also

Short-term health insurance is designed to cover unforeseen emergency health needs

Short-term health insurance provides benefits such as emergency care, primary care doctor visits, and specialist consultations. It covers hospital visits and ambulance trips, though only partially in some cases. It also includes follow-up care for acute issues until coverage ends. Short-term plans are accepted by most doctors and often include additional benefits like life insurance. However, they rarely cover medical devices, dental or vision care, or prescription drugs outside of hospitalizations.

While short-term insurance can provide emergency coverage, it is not a comprehensive solution for ongoing health issues. It is essential to carefully review the terms of any insurance plan before purchasing to understand what is and isn't covered. Each insurance company defines pre-existing conditions differently, so it is crucial to ask the insurer about specific coverage details.

In the United States, the Affordable Care Act (ACA), also known as Obamacare, ensures that individuals with pre-existing conditions cannot be denied coverage or charged higher rates. This legislation, passed in 2010 and implemented in 2014, protects individuals with various health conditions, including cancer, diabetes, mental health disorders, and pregnancy. However, "grandfathered" plans purchased before the ACA may not be subject to these rules and might not cover pre-existing conditions.

When considering short-term health insurance, it is important to be aware of its limitations. While it can provide temporary coverage for unforeseen emergencies, it may not be sufficient for individuals with pre-existing conditions or ongoing health needs. Exploring alternative options, such as Obamacare or other comprehensive coverage plans, may be more suitable for those requiring continuous care for pre-existing health issues.

Understanding the Nuances of Convertible Term Life Insurance: Attained vs. Original Age

You may want to see also

Frequently asked questions

Short-term insurance is a type of health insurance that provides limited coverage for a short period, usually less than a year. It is designed for individuals who need temporary coverage during transitional periods, such as those who are between jobs, waiting for coverage to begin, or attending college.

Short-term insurance typically covers emergency hospital visits, certain prescription medications, and some doctor's appointments. However, it generally does not cover pre-existing conditions, maternity care, mental health services, substance use disorder treatment, or prescription drugs.

Short-term insurance is intended to cover unforeseen emergency health needs and is not suitable for long-term maintenance of health issues. It often lacks the benefits of long-term insurance, such as coverage for pre-existing conditions, mental health, substance abuse treatment, pregnancy, and childbirth. Short-term insurance is also typically more affordable than long-term insurance.

To qualify for short-term insurance, individuals usually need to fill out a health questionnaire and disclose any pre-existing conditions, which may disqualify them from obtaining coverage. Other factors that may disqualify someone from short-term insurance include current insurance coverage under another policy, weight (over 300 pounds for men or 250 pounds for women), HIV or AIDS diagnosis or treatment, Medicaid qualification, and non-U.S. citizenship.