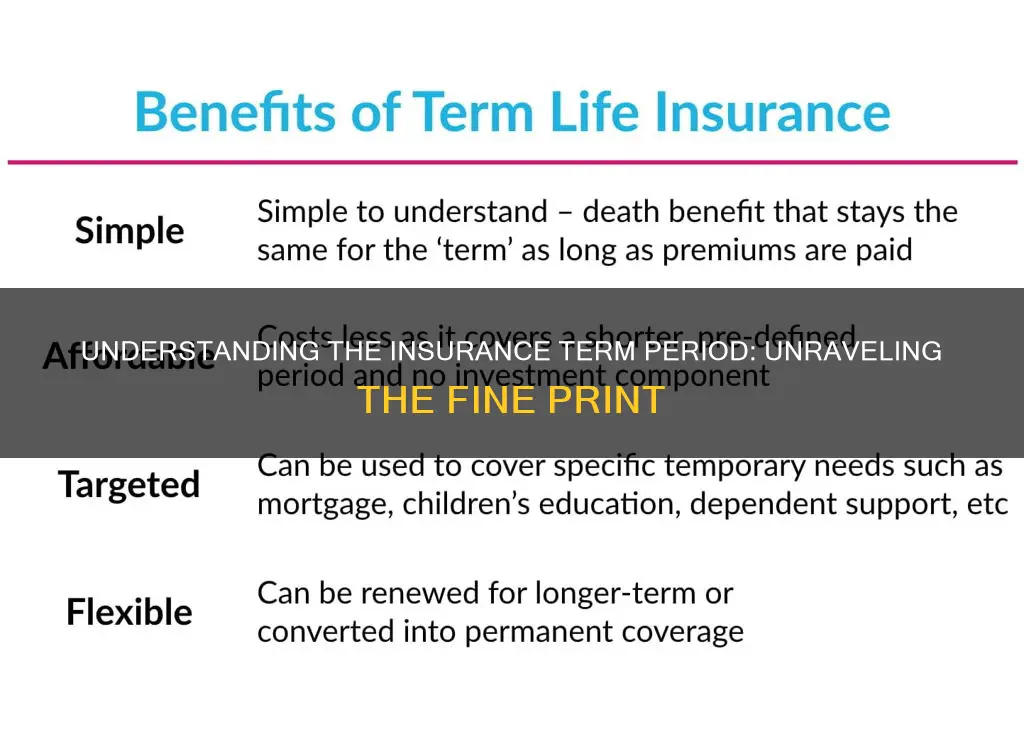

Term insurance is a type of insurance that provides financial protection for a specified period. The policy term is the length of time that you want to provide financial protection for your loved ones in the event of unexpected circumstances. This type of insurance is cost-effective and straightforward compared to other policies, such as whole life insurance or endowment policies. Typically, term insurance covers the policyholder for a certain period or 'term' of their life, and if they pass away within the policy term, the death benefit is paid to the beneficiaries/nominees.

| Characteristics | Values |

|---|---|

| Purpose | Provides financial protection for a specified period |

| Payout | Beneficiaries receive a fixed sum as a death benefit if the policyholder passes away |

| Renewal | Can be renewed for another term, converted to permanent coverage, or allowed to lapse |

| Cost | Relatively inexpensive compared to permanent insurance |

| Coverage | Usually ranges from 5 to 40 years, or until the policyholder reaches a certain age (e.g., 85 or 99) |

| Ideal Policy Term | Based on retirement age, financial goals, liabilities, and lifestyle habits |

| Premium Calculation | Based on policy value, age, gender, health, company expenses, investments, and mortality rates |

| Premium Variation | Premiums increase with age and duration of coverage |

| Premium Discounts | May be available for younger individuals, non-smokers, and women |

| Riders | Additional coverage options, such as accidental death or disability coverage, available for an extra premium |

What You'll Learn

- Term insurance provides financial protection for a specified period, with beneficiaries receiving a fixed sum as a death benefit if the policyholder passes away

- The policy term is the length of time that you want to provide financial protection for your loved ones in the event of unexpected circumstances

- The younger you are, the lower your premiums

- Premiums will be higher if your sum assured is higher as your coverage will also be more than usual

- You can purchase term life policies that last 10, 15, 20 years, or more, and can usually renew them for an additional term

Term insurance provides financial protection for a specified period, with beneficiaries receiving a fixed sum as a death benefit if the policyholder passes away

Term insurance is a type of life insurance that provides financial protection for a specified period. It guarantees a death benefit to the beneficiaries of the policyholder if the insured person dies during the policy term. This means that if the policyholder passes away within the specified period, the chosen beneficiaries will receive a fixed sum of money, known as a death benefit. This can help the beneficiaries cope with financial loss and settle healthcare and funeral costs, consumer debt, mortgage debt, and other expenses.

When deciding on the term of your insurance plan, it is crucial to consider your current age, retirement plans, financial goals, liabilities, and family circumstances. The term should ideally cover you during your working years and until your retirement age, which is usually around 65. However, if you plan to work beyond this age or have significant post-retirement financial commitments, you may want to extend the term.

It is also important to evaluate your family's financial circumstances and future needs. For example, if you have young children, you may want to opt for a longer term to ensure their financial security until they become independent. On the other hand, if your spouse has a stable income and your family can be financially self-sufficient without your income, a shorter term may be sufficient.

Additionally, your age and health will impact the cost of your insurance plan. Generally, the younger and healthier you are, the lower your premiums will be. The term of your insurance plan will also affect the cost, with longer terms typically resulting in lower premiums.

When choosing the right term insurance policy, it is essential to carefully consider your current financial situation, future plans, and the needs of your loved ones. By selecting an appropriate term and a suitable coverage amount, you can provide financial security for your family in the unfortunate event of your untimely death.

The Intricacies of Direct Loss in Insurance: Unraveling the Complexities for a Clearer Understanding

You may want to see also

The policy term is the length of time that you want to provide financial protection for your loved ones in the event of unexpected circumstances

The policy term is a crucial aspect of insurance planning, as it determines the length of time your loved ones will receive financial protection in the event of unforeseen circumstances. Here are some detailed paragraphs explaining the concept and factors to consider when determining the policy term:

Understanding Policy Term

The policy term is the duration of financial protection provided by your insurance plan. It is the period during which your beneficiaries will receive the death benefit if something unexpected happens to you. Most insurance companies offer policy terms ranging from 5 to 40 years, or even up to the age of 99. The goal is to choose a term that aligns with your retirement age, typically around 65 years, as financial responsibilities are expected to decrease post-retirement. However, if you plan to work beyond retirement or have significant financial commitments after retirement, extending the term may be advisable.

Age as a Deciding Factor

Your current age plays a significant role in determining the suitable policy term. Younger individuals often opt for longer-term policies as they have more working years ahead of them. On the other hand, older individuals might prefer shorter terms, aligning with their remaining active years and decreasing financial responsibilities. For example, if you are in your 20s, a 35-40 year term plan is recommended to provide coverage until your desired retirement age.

Financial Goals and Milestones

When selecting a policy term, consider your short-term and long-term financial goals. If you have recurring financial commitments, such as loans or children's education fees, opt for a lower premium plan. Additionally, consider the various financial milestones you hope to achieve throughout your life, such as marriage, saving for your children's education, and creating a retirement corpus. Each of these milestones requires adequate financial protection, and a term plan can provide peace of mind by safeguarding your loved ones in case of an unexpected event.

Family Circumstances and Dependents

Every family has unique financial needs, and it's essential to evaluate these circumstances when deciding on the term period. If you have young children, a long-term insurance plan is advisable to ensure their financial security until they become independent. On the other hand, if your spouse has a stable income and your family can be financially self-sufficient without your income, a shorter-term policy may be sufficient.

Lifestyle Habits and Health

Your lifestyle habits can also impact the duration of your term plan. Certain habits, such as tobacco or alcohol consumption, may increase the risk of critical illnesses. In such cases, opting for a term plan with critical illness coverage can help manage treatment costs and provide additional protection for you and your family.

In conclusion, when determining the policy term, carefully consider your age, financial goals, family circumstances, and lifestyle habits. By choosing an appropriate term, you can ensure that your loved ones receive the financial protection they need during unexpected circumstances, providing both peace of mind and financial security.

Unraveling the Intricacies of Insurance Reserves: A Guide to Understanding This Crucial Concept

You may want to see also

The younger you are, the lower your premiums

Term insurance is a type of insurance that provides financial protection for a specified period. The policy term is the length of time that you want to provide financial protection for your loved ones in the event of unexpected circumstances. The younger you are, the lower your premiums tend to be. This is because younger people have more working years ahead of them and are less likely to have developed health problems that make insurance more expensive.

When it comes to buying term insurance, your age and retirement goals are crucial factors to consider. If you're in your 20s and plan to retire by age 60, a 35-40 year term plan is recommended. This will provide coverage until your desired retirement age. It's important to plan ahead and invest in a term plan early on, as premiums tend to be lower when you're younger. By doing so, you can ensure that you're adequately covered while still being able to afford the premiums.

As you enter your 30s and 40s, you may get married and start a family, meaning you now have loved ones who depend on you financially. At this point, it's advisable to choose a policy duration of up to 35-40 years, taking into account your financial requirements, retirement goals, and employment status. This will ensure that your family is adequately protected in case of unexpected circumstances.

Once you reach the age of 50-60, your children are likely to have settled down, and your financial responsibilities may decrease. This is an ideal time to consider purchasing a term insurance plan with a 15-year term. With fewer bills to pay and financial obligations, a shorter-term policy can still provide you with the necessary coverage at a more affordable premium.

In addition to age, other factors that can influence the cost of your insurance premium include gender, sum assured, lifestyle, and policy period. Women may get offers or discounts from companies as the risk of death is lower than men. Premiums will be higher if your sum assured is higher, as your coverage will also be more than usual. If you are a non-smoker, you may also get discounts on premiums.

The length of the term is another primary factor that influences your term insurance premium. The longer the term, the lower the premium. This is because the financial risk to the insurer is lower over a shorter period. Most insurance companies offer policy terms ranging from 5 to 40 years, or until the policyholder reaches a certain age, typically between 85 and 99 years old.

It's important to choose the right term insurance policy period based on careful consideration of your age, financial goals, liabilities, and lifestyle habits. By selecting an appropriate term duration, you can ensure that you have the right level of protection for your changing circumstances.

The Hidden Meaning of Riders: Unlocking the Full Potential of Your Insurance Policy

You may want to see also

Premiums will be higher if your sum assured is higher as your coverage will also be more than usual

Term life insurance is a type of insurance that provides financial protection for a specified period. The policy term is the length of time that you want to provide financial protection for your loved ones in the event of unexpected circumstances. The policy term is a crucial factor in determining the premium of a life insurance policy. The premium of a life insurance policy is a one-time or recurring expense that you pay for the policy. The insurance company determines the premium based on the policy's value (the payout amount) and factors such as your age, gender, and health.

When it comes to the premium of a term life insurance policy, one of the key factors that influence the cost is the sum assured. The sum assured refers to the pre-decided amount payable to the policyholder or beneficiary on the occurrence of an insured event, such as death or critical illness. As the sum assured increases, the premium amount also tends to increase. This is because a higher sum assured provides more coverage and financial protection for the insured and their beneficiaries.

In the context of term life insurance, a higher sum assured typically leads to higher premiums. This is because the insurance company assumes more risk by providing a larger death benefit or coverage amount. The premium amount is calculated based on the likelihood of a claim being made, and a higher sum assured increases the potential payout. Additionally, the insurance company may require additional medical tests or assessments for policies with higher sum assured amounts, as they want to ensure that the insured's health is good enough to mitigate the risk of a claim.

It is important to note that the relationship between the sum assured and the premium is not linear. The increase in premium for a higher sum assured may not be proportional, and there can be other factors that influence the premium amount. For example, age, gender, smoking status, and lifestyle habits can also impact the premium. However, in general, a higher sum assured will result in a higher premium for term life insurance policies.

When deciding on the appropriate sum assured, it is crucial to consider your financial needs, goals, and obligations. The sum assured should be sufficient to cover your liabilities, provide for your dependents, and meet your short-term and long-term financial goals. Additionally, it is recommended to choose a sum assured that is at least 10 to 15 times your annual income to ensure adequate financial protection for your loved ones.

You can purchase term life policies that last 10, 15, 20 years, or more, and can usually renew them for an additional term

Term life insurance is a type of insurance that provides a death benefit to the beneficiaries of the policyholder for a specified period of time. The length of the policy term is an important factor in determining the premium. The policy term is the length of time that financial protection is provided to loved ones in the event of unexpected circumstances.

You can purchase term life policies that last 10, 15, 20 years, or more, and they can usually be renewed for an additional term. The most common term lengths are 10, 15, 20, and 30 years. The appropriate term length depends on individual circumstances, such as age, financial goals, liabilities, and lifestyle habits.

For those in their 20s, a term plan of 35-40 years is recommended, as it will provide coverage until retirement age. Similarly, individuals in their 30s and 40s can opt for a term length of up to 35-40 years, depending on their financial requirements and retirement plans. As people reach their 50s and 60s, a shorter term of 15 years is often sufficient, as financial responsibilities tend to decrease during this stage of life.

The decision to renew a term life insurance policy depends on whether there is still a need for coverage. If the policyholder's circumstances have changed and they no longer have financial dependents, they may choose to let the policy lapse. However, if the need for coverage persists, the policy can usually be renewed for an additional term, although the premiums will be recalculated based on the policyholder's age at the time of renewal.

Term Insurance Payout Frequency: Unraveling the Mystery of When Benefits Are Disbursed

You may want to see also

Frequently asked questions

There are several factors to consider, including your current age, financial goals, liabilities, lifestyle habits, and family circumstances. Younger individuals may opt for longer-term policies, while older individuals might prefer shorter terms. You should also take into account your short-term and long-term financial goals, such as saving for your children's education or creating a retirement corpus.

The duration of your insurance plan depends on your age. Generally, the younger you are, the longer the term available to you. For example, a 30-year-old may be offered a tenure of up to 50 years, while a 50-year-old may only be offered 35 years.

The length of the term is a primary factor influencing your insurance premium. Longer terms result in higher premiums. Additionally, the younger you are, the lower your premiums tend to be.

This decision depends on your specific circumstances. Consider your retirement age, financial goals, and liabilities. Generally, it is recommended to choose a term that covers you until your retirement age, usually around 65 years. However, if you have significant post-retirement financial commitments, you may consider extending the term.

Yes, some term insurance policies allow you to extend your coverage beyond the initial term period, usually up to a specific age. However, this may come with additional premium payments and underwriting requirements. Check with your insurance provider for specific details.