Direct billing is an insurance industry term that refers to a service provider directly billing the customer. The meaning varies depending on whether the term is used in a health insurance context or a property and casualty (general) insurance context. In health insurance, direct billing is when an insurer pays the treating hospital directly, and the policyholder only pays their excess. This saves the patient from having to do all the paperwork and speeds up the process. In property and casualty insurance, direct billing refers to the policyholder paying premiums to the insurance company directly instead of to the brokerage or agency.

| Characteristics | Values |

|---|---|

| Direct billing in health insurance | The process of a healthcare provider billing an insurance company directly for services rendered to a policyholder. |

| Who does it benefit? | The healthcare provider, the insurer, and the patient. |

| How does it benefit them? | The healthcare provider gets paid sooner, the insurer settles the claim faster, and the patient doesn't have to do the paperwork or pay upfront costs. |

| Direct billing in property and casualty insurance | The process of a policyholder paying premiums to the insurance company directly instead of paying the brokerage or agency. |

| Pros of direct billing in property and casualty insurance | The brokerage saves on administrative costs. |

| Cons of direct billing in property and casualty insurance | The brokerage loses out on opportunities to interact with the client and earn interest in unremitted premiums. |

What You'll Learn

- Direct billing saves the patient from having to do all the paperwork

- Direct billing speeds up the process of filing health insurance claims

- Direct billing benefits the healthcare provider as they receive payment sooner

- Direct billing in property and casualty insurance

- Direct billing relieves the stress of paying for dental treatment upfront

Direct billing saves the patient from having to do all the paperwork

Direct billing is a convenient way to pay for medical services, saving patients time and money. When direct billing is used, the patient does not have to pay for the entire amount upfront, submit a claim, or wait for reimbursement. Instead, the healthcare provider directly bills the insurance company for the services rendered to the policyholder, and the patient only has to pay the remaining amount not covered by insurance.

The process of direct billing offers two main benefits. Firstly, it ensures that healthcare providers receive payment for their services in a timely manner, as they can bill the insurance company directly and receive payment by the invoice payable date. Secondly, it benefits the patient by eliminating the need to file any paperwork or pay upfront costs. The patient only needs to pay their portion of the bill, such as any excess or co-payments, directly to the healthcare provider.

In the context of health insurance, direct billing is an alternative to individuals having to file claims themselves. This is particularly beneficial for patients as it saves them from the hassle and stress of dealing with paperwork. By streamlining the billing process, direct billing also helps to speed up the settlement of claims, benefiting all parties involved. The insurer settles the claim faster, the healthcare provider gets paid promptly, and the patient avoids the inconvenience and financial burden of paying upfront and waiting for reimbursement.

Direct billing is especially useful in situations where frequent or regular medical treatments are required. For example, a patient undergoing ongoing treatment for a chronic condition or recovering from a major injury may need to make multiple insurance claims over a short period. With direct billing, the patient can avoid the burden of submitting numerous claims and can focus on their health and recovery instead.

Understanding the Combined Ratio: A Key Metric in Insurance Performance Evaluation

You may want to see also

Direct billing speeds up the process of filing health insurance claims

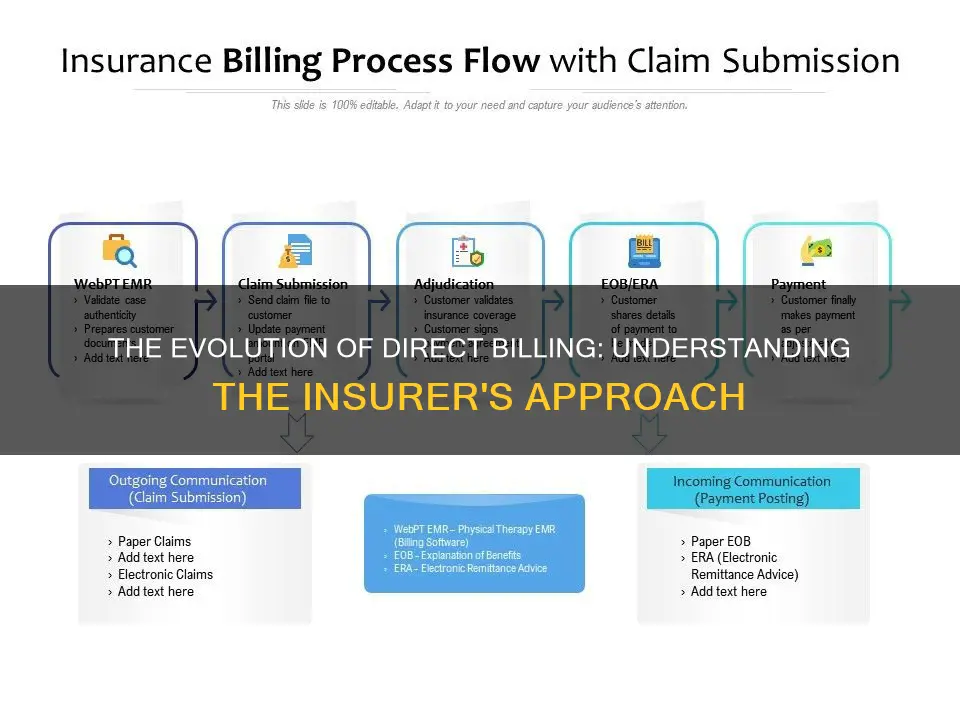

Direct billing is a process that speeds up the filing of health insurance claims. It is a system where a healthcare provider bills the insurance company directly for services rendered to a policyholder. This saves the patient from having to do the paperwork and file for insurance claims themselves.

The direct billing process primarily involves the healthcare provider and the insurance company. However, it is the patient's responsibility to initiate the claim after receiving medical treatment. The hospital or physician sends the bill directly to the insurance company and provides the patient with a copy of the bill. The patient then needs to file a claim for the medical services received, along with supporting documents as required by the insurance company.

Direct billing offers several benefits to all parties involved. The healthcare provider generally receives payment for their services sooner, as they can bill the insurance company directly without waiting for the patient to complete the paperwork. The insurer also settles the claim faster, as they deal directly with the healthcare provider.

Most importantly, direct billing benefits the patient by saving them time and hassle. They do not have to front the cost of healthcare services and wait for reimbursement from the insurer. Instead, they can focus on their recovery without dealing with insurance paperwork and payment processing. This is especially advantageous in countries with expensive healthcare markets, such as the United States, where medical costs can be prohibitive for many individuals.

In addition, direct billing is beneficial in cases where health insurance claims are filed more frequently than in other types of insurance. For example, an individual may file one auto insurance claim in a five-year period but dozens of health insurance claims during the same period. The higher frequency of health insurance claims makes direct billing a more efficient and convenient option for all parties involved.

Jiffy Lube's Insurance Coverage for Rock Chip Repairs: Understanding the Process

You may want to see also

Direct billing benefits the healthcare provider as they receive payment sooner

Direct billing is an insurance industry term that refers to a service provider directly billing the customer. In a health insurance context, direct billing is when a healthcare provider bills an insurance company directly for services rendered to a policyholder. This saves the patient from having to do all the paperwork themselves and speeds up the process of filing health insurance claims.

Direct billing also has benefits for the patient. They do not need to file any paperwork or pay for the costs upfront and wait for reimbursement. This is especially beneficial in expensive markets such as the United States, where a broken arm could cost thousands of dollars. Direct billing also speeds up the process for the insurer, who can settle the claim faster.

However, direct billing does add a lot of risk for the healthcare provider. They now take responsibility for the funds from the insurance company and are liable if there are any problems with the claim. Client claims can be denied, and the healthcare provider may not find out until later, after the patient has left. In this case, the insurance company does not have to ask the customer for payment, and the healthcare provider must bear the loss. Additionally, providers who submit claims are liable to be audited, which can be stressful and time-consuming. Insurance companies can also take up to 30 days to pay providers, causing cash flow problems for the provider.

The Insurance Conundrum: Unraveling the Mystery of T-Bill Insurance Coverage

You may want to see also

Direct billing in property and casualty insurance

Direct billing is an insurance industry term with a slightly different meaning depending on whether it is used in a health insurance context or a property and casualty insurance context. This text will focus on the latter.

In property and casualty insurance, direct billing refers to the process of a policyholder paying premiums directly to the insurance company instead of to a brokerage, agency, or intermediary. This is in contrast to agency billing, where the intermediary who sold the policy collects the premiums on behalf of the insurance company.

There are pros and cons to both direct billing and agency billing in property and casualty insurance. With direct billing, the brokerage saves on administrative costs associated with issuing invoices, processing payments, sending receipts, paying credit card processing fees, and following up on accounts receivables. However, with agency billing, the brokerage gets an additional touchpoint with the client, which can strengthen the relationship and provide opportunities for upsells.

The decision to use agency billing or direct billing on property and casualty policies usually depends on the size of the premiums involved. Policies with large premiums or from important clients are typically handled through agency billing, while smaller policies like condo owners' or tenants' policies are direct billed to reduce administrative costs.

Casualty insurance is a broad category of insurance coverage that protects individuals, employers, and businesses against loss of property, damage, or other liabilities. It includes vehicle insurance, liability insurance, and theft insurance. Property insurance, on the other hand, specifically covers losses and damage to an owner's residence, furnishings, and other possessions, as well as providing liability protection.

The Dynamic Nature of Term Insurance: Unraveling the Ever-Increasing Coverage Component

You may want to see also

Direct billing relieves the stress of paying for dental treatment upfront

Direct billing is a convenient arrangement that saves patients from the stress of paying for dental treatment upfront. It is an insurance industry term that refers to a service provider directly billing the customer. In the context of health insurance, direct billing is when a healthcare provider bills the insurance company directly for services rendered to a policyholder. This saves the patient from having to complete all the paperwork themselves when filing health insurance claims.

Direct billing offers two main benefits: the healthcare provider generally receives payment sooner, and the policyholder does not need to pay for the costs upfront and wait for reimbursement. This is especially helpful for dental treatments, which can be expensive. With direct billing, patients can avoid the stress of paying a large sum upfront and then having to wait for their claim to be processed and reimbursed. Instead, the insurance company pays the dental clinic directly for a percentage of the total cost, and the patient only pays the remaining difference.

For example, if a patient has dental work costing $250 and their insurance covers 90% of the cost, the insurer would pay the dental clinic $225 directly, and the patient would only pay $25 out of pocket. This makes it easier for patients to get the treatments they need without worrying about high upfront costs.

Direct billing is a quick and convenient way to pay for dental visits, helping patients save time and money. It relieves the stress of paying for dental treatment upfront and allows patients to get the necessary treatments before their dental problems worsen.

Understanding VA Healthcare and Insurance Billing: A Guide for Veterans

You may want to see also

Frequently asked questions

What is direct billing in insurance?

How does direct billing work in health insurance?

What are the benefits of direct billing in health insurance?

How does direct billing work in property and casualty insurance?