Term insurance and variable universal life (VUL) insurance are two of the most common types of life insurance, and both have their own unique advantages and disadvantages. Term insurance is generally the lowest premium per thousand insurance, whereas VUL insurance combines insurance and investment in one, giving the policyholder control over their investments. Both types of insurance can be beneficial to the insured, and it is a matter of knowing which type of benefits one prefers.

What You'll Learn

Term insurance is cheaper but doesn't last as long

Term insurance is the most basic type of life insurance policy. It is also the cheapest form of insurance in the market. It provides coverage for a specific period of time, such as 10, 20, or 30 years. If you maintain premium monthly or annual payments, your beneficiaries will receive a payment if you die before the term ends.

However, term insurance policies expire after the specified number of years. While some insurers allow you to continue the policy, it is usually at a higher rate. This means that term insurance does not last as long as other types of insurance.

The premium payments for term insurance are generally more affordable than those for permanent policies. Term insurance is often the best choice for young families on a budget, as they can buy a much larger term policy for the same amount of money. The fact that term insurance eventually ends may also be preferable for some people. For example, parents of children who are grown and financially independent may no longer need life insurance.

Overall, term insurance is a good option for those who want basic coverage at a low cost. However, it is important to consider that term insurance does not last as long as other types of insurance, and there is a possibility of not sustaining coverage if regular premiums are not paid.

Converting Term Insurance: Timing the Switch for Maximum Benefits

You may want to see also

VUL combines insurance and investment

Variable Universal Life (VUL) insurance is a type of permanent life insurance policy that combines lifelong insurance protection with flexible premiums and a cash value that can be accessed while the policyholder is alive. VUL policies are built like traditional universal life insurance policies but allow the policyholder to invest the cash value in the market via subaccounts.

VUL insurance lets you invest and grow the cash value through subaccounts that operate like mutual funds. Exposure to market fluctuations can generate high returns but may also result in substantial losses. The return on the cash component is not guaranteed year after year, and it is possible to lose money.

VUL insurance offers increased flexibility and growth potential over other life insurance options, but the risks should be carefully assessed before purchasing. VUL policies are more complicated and riskier than other types of life insurance and are not appropriate for everyone.

The cash value of a VUL policy can be invested in a variety of investment options, including stocks, bonds, mutual funds, and money market funds. The policyholder can typically choose between a fixed death benefit and a variable death benefit. The fixed death benefit will pay out a specific amount, while the variable death benefit may increase or decrease based on the cash value.

One of the unique features of VUL insurance is the ability to adjust the death benefit and premiums to match the policyholder's current coverage needs and income. The policyholder can also use the cash value to pay premiums if there is enough cash value built up in the policy. However, it is important to ensure that enough cash value remains to cover policy charges and fees to avoid a policy lapse.

VUL insurance provides tax advantages, as beneficiaries will not have to pay income taxes on the death benefit, and the cash value grows tax-deferred. However, taxes will be owed if the policyholder withdraws more from the cash value than they have paid in or takes out a policy loan that is not repaid.

In summary, VUL insurance combines insurance and investment by providing lifelong coverage, flexible premiums, and a cash value that can be invested in the market. The policyholder can adjust the death benefit and premiums to match their needs and has the potential for high returns on their investments. However, there are also risks associated with VUL insurance, including the possibility of losing money and the potential for high fees.

Term Insurance: Navigating the Fine Print to Avoid Crashes

You may want to see also

VUL offers tax-free loans

Variable Universal Life (VUL) insurance offers tax-free loans, which are a significant advantage of the policy. The insured can withdraw money from the policy, tax-free, in the form of policy loans (up to the total amount of the policy's accumulated cash value). This is a key benefit of VUL policies, and one of the primary reasons for choosing a VUL policy over other life insurance options.

The ability to take out tax-free loans is particularly beneficial for those who need access to their money while it is still invested in the policy. This feature provides flexibility and allows policyholders to utilise their funds without incurring additional tax costs.

However, it is important to note that while VUL policies offer tax advantages, they also come with high administrative costs. The complexity of VUL policies and the potential for high fees mean that it is essential to carefully consider all aspects of the policy before making a decision.

Comprehensive Guide to Purchasing 1 Cr Term Insurance

You may want to see also

Term insurance is pure protection

Term insurance is a type of insurance that is bought for protection. It is the cheapest form of insurance in the market, and it provides coverage for a specified period of time. The policy terminates as soon as premium payments stop. Term insurance is a good option for those with limited funds who wish to be adequately insured. It is also a good choice for those who want to manage their own investments and save on costs.

Term insurance has low premiums, and the regular term insurance can be converted to a VUL or a traditional life insurance policy at any time. However, there is a possibility of not sustaining coverage if regular premiums are not paid. Additionally, while the initial premium is cheap, premiums increase over time.

Term insurance is a straightforward and affordable way to ensure protection for a specified period. It is a good option for those who want to keep their costs low and have control over their investments. However, it is important to remember that coverage will cease if premiums are not paid, and premiums tend to increase over time.

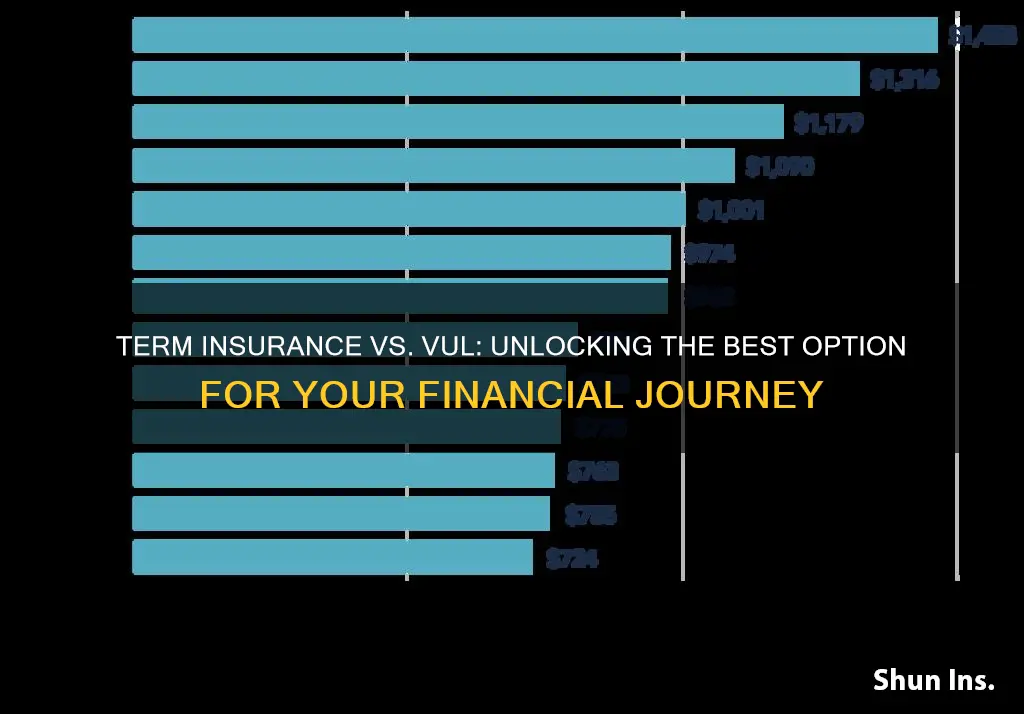

Compared to VUL, term insurance offers a more affordable option with a minimal amount. It is designed to provide maximum protection, making it ideal for those with limited funds. The low premium is one of its primary advantages. For example, a P1 million coverage for a 30-year-old male would cost only P5,600 as a term plan, while the same coverage would cost P23,100 for a VUL plan. This difference in cost can be significant, especially when considering long-term financial goals.

Unraveling the Web of Deceit: Understanding Insurance Deceits and Their Synonyms

You may want to see also

VUL has a loyalty bonus

Variable Universal Life (VUL) insurance is a permanent life insurance policy with a savings component that offers a loyalty bonus to its long-term customers. Sun Life Grepa Financial Inc. (Sun Life Grepa), one of the major insurers in the Philippines, awards loyalty bonuses to its clients with VUL policies who have remained active for the past 10 years. This bonus is equal to 2% of the average monthly fund balance of the past 5 years prior to the bonus payout, payable at the end of the 10th policy year and every 5 years thereafter.

The loyalty bonus is designed to encourage and motivate policyholders to keep their policies active so they can stay on track with their financial goals. It also demonstrates the company's commitment to its long-term customers.

VUL insurance is a combination of insurance and investment, where the investment portion may help keep the policy alive in case of missed premium payments. It offers flexibility in terms of premium payments and death benefits, as well as a variety of investment options. The investment portion is protected by the insurance part, ensuring that both the insurance and investment are released to beneficiaries in the event of the insured's death.

While VUL insurance provides the benefit of convenience and flexibility, it is important to note that it is generally more expensive than standard policies due to the numerous features and benefits offered.

Frequently asked questions

Term insurance is a type of insurance that is bought for protection, where the policyholder pays a certain amount to be protected for a specified period of time.

VUL stands for Variable Universal Life Insurance. It is a type of permanent life insurance that combines insurance and investment in one. It features flexible premiums and a flexible death benefit.

Term insurance has lower premium payments and allows the policyholder to manage their own investments and save on costs.

VUL insurance is convenient as it combines insurance and investment in one. It also has a savings component that builds up over time and can be accessed for other purposes.