Understanding your insurance maximum allowance is crucial for managing your financial risks and making informed decisions. This knowledge empowers you to know when to seek additional coverage or when to rely on your existing policy limits. Knowing your insurance maximum allowance involves reviewing your policy documents, which typically outline the coverage limits for various types of claims. These documents may include sections on property damage, liability, medical expenses, and other specific coverages. Additionally, insurance providers often offer resources to help policyholders understand their coverage, such as online tools or customer service representatives who can explain the details of your policy and any applicable limits. Being aware of these maximum allowances is essential for ensuring you have adequate protection and can effectively manage potential financial losses.

What You'll Learn

- Understanding Policy Limits: Know your insurance coverage limits to avoid unexpected costs

- Review Policy Documents: Carefully read and understand your insurance policy to identify maximum allowances

- Contact Customer Service: Reach out to your insurance provider for clarification on coverage limits

- Check Deductibles: Understand your deductible to know when to use your maximum allowance

- Monitor Policy Changes: Stay updated on policy changes to ensure you're aware of any new limits

Understanding Policy Limits: Know your insurance coverage limits to avoid unexpected costs

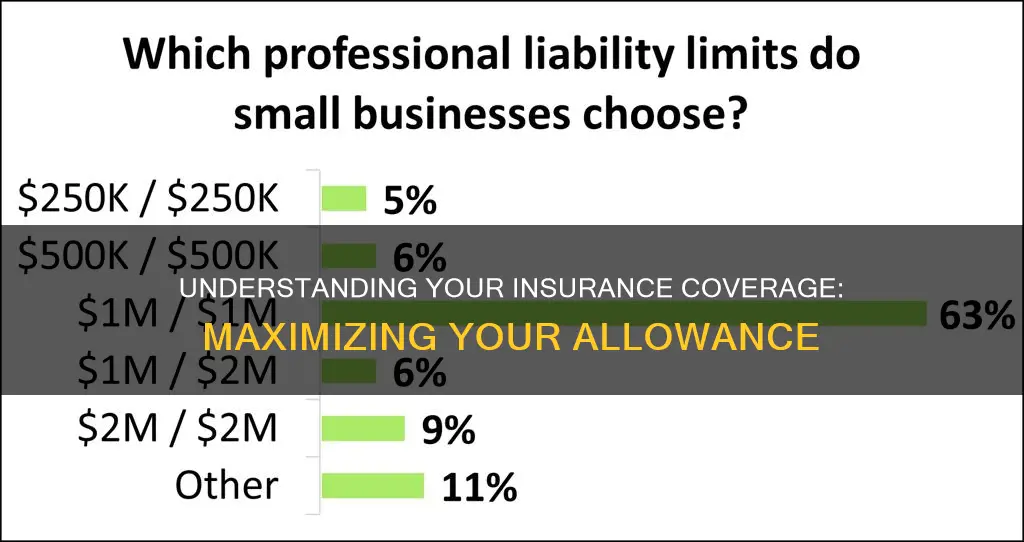

Understanding your insurance policy limits is crucial to ensuring you have adequate coverage and avoiding unexpected financial burdens. Insurance coverage limits refer to the maximum amount an insurance company will pay for a specific claim or event. These limits are set by the insurer and can vary widely depending on the type of insurance, the policy, and the coverage options chosen. Knowing your policy limits is essential for several reasons.

Firstly, it helps you understand the extent of your coverage. Different types of insurance policies have distinct coverage limits. For example, in health insurance, there might be a maximum limit on the amount paid for medical treatments, surgeries, or hospital stays. In auto insurance, the policy limit could determine the maximum payout for vehicle repairs or medical expenses after an accident. Being aware of these limits ensures you don't expect the insurer to cover more than what is provided.

Secondly, knowing your policy limits can prevent financial surprises. When an insured event occurs, such as a car accident or a natural disaster, the cost of repairs, medical bills, or property damage can be substantial. If you are unaware of your policy's maximum allowance, you might assume that the insurance will cover the entire expense, only to find out later that you are responsible for the remaining amount. This can lead to significant out-of-pocket expenses and financial strain. By understanding the limits, you can better prepare for potential costs and make informed decisions about additional coverage if needed.

To find this information, you should carefully review your insurance policy documents. These documents will outline the specific coverage limits for each type of claim or event. Look for sections titled "Coverage Limits," "Policy Limits," or "Maximum Payouts." Additionally, insurance companies often provide summaries or glossaries that explain the different terms and conditions, including policy limits. If you're still unsure, contact your insurance provider and ask for clarification on any unclear aspects of your policy.

In summary, being knowledgeable about your insurance policy limits is a vital aspect of responsible insurance management. It empowers you to make informed choices, avoid financial surprises, and ensure that you have the appropriate coverage for your needs. Regularly reviewing your policy and staying informed about any changes in coverage limits can help you maintain a comprehensive and effective insurance strategy.

Advertisers: Here's How to Show You Have Insurance

You may want to see also

Review Policy Documents: Carefully read and understand your insurance policy to identify maximum allowances

Reviewing your insurance policy documents is a crucial step in understanding your coverage and identifying any maximum allowances or limits. Here's a detailed guide on how to approach this process:

Locate the Policy Documents: Start by finding the insurance policy documents provided by your insurer. These documents typically include a policy statement, coverage details, and a glossary of terms. Ensure you have the most recent version, as policies can change over time.

Read the Policy Statement: The policy statement is a comprehensive overview of your insurance coverage. It outlines the types of events or incidents covered and the terms and conditions associated with each coverage type. Pay close attention to the sections that mention 'maximum benefits' or 'coverage limits'. These sections will specify the highest amount the insurer will pay out for a particular claim.

Identify Coverage Limits: Different types of insurance policies have varying coverage limits. For example, in health insurance, you might have a maximum annual benefit for medical expenses, while in auto insurance, there could be a limit on the amount covered for property damage. Look for specific sections or tables that detail these limits. These sections often provide a clear understanding of what is covered and up to what extent.

Understand Exclusions and Restrictions: In addition to maximum allowances, it's essential to know what is not covered. Exclusions and restrictions are also mentioned in the policy documents. These could include pre-existing conditions, specific treatments, or activities that are not covered. Understanding these exclusions will help you recognize when a claim might exceed the maximum allowance.

Review Policy Updates: Insurance policies can be updated, and changes might affect the maximum allowances. Stay informed about any policy revisions by regularly reviewing the documents or subscribing to updates from your insurer. This ensures that you are aware of any modifications that could impact your coverage.

By thoroughly reviewing your insurance policy documents, you can gain a clear understanding of your coverage, including the maximum allowances. This knowledge is essential for making informed decisions and ensuring you receive the appropriate level of coverage for your needs.

Florida's UnitedHealthcare AARP Supplemental Insurance: Understanding Patient Billing

You may want to see also

Contact Customer Service: Reach out to your insurance provider for clarification on coverage limits

If you want to understand your insurance coverage limits, the most direct approach is to contact your insurance provider's customer service. This is a crucial step to ensure you are aware of the maximum amount your policy covers in case of a claim. Many insurance companies provide this information on their websites, but it's often best to get a direct answer from a representative.

When you reach out to customer service, be prepared with specific questions. For instance, you might ask, "What is the maximum coverage limit for property damage in my policy?" or "How much am I covered for medical expenses?" The representative should be able to provide you with these details, ensuring you have a clear understanding of your policy's scope. It's important to note that coverage limits can vary depending on the type of insurance and the specific policy you have.

You can typically contact customer service through various channels, such as a phone number, email, or live chat on their website. If you have a direct line of communication with your insurance agent or broker, they can also provide this information. They might even offer to review your policy with you to ensure you are fully informed about all the coverage details.

In some cases, insurance providers may also offer tools or resources to help policyholders understand their coverage. These could include online calculators or interactive guides that provide personalized information based on your policy details. Utilizing these resources can be a helpful way to quickly get an overview of your coverage limits.

Remember, being proactive in understanding your insurance policy is essential. By contacting customer service, you can ensure that you are well-informed about your coverage, which can help you make better decisions regarding your insurance needs and provide peace of mind in case of unforeseen events.

Understanding VCAP Services in Michigan's No-Fault Insurance System

You may want to see also

Check Deductibles: Understand your deductible to know when to use your maximum allowance

When it comes to managing your insurance coverage, understanding your maximum allowance is crucial. This knowledge ensures you utilize your benefits effectively and make informed decisions about your healthcare. One essential aspect to consider is your deductible, which plays a significant role in determining when to use your maximum allowance.

A deductible is the amount you pay out of pocket for covered services before your insurance plan starts to pay. It is a fixed amount set by your insurance company for a specific coverage period, often a year. Knowing your deductible is the first step to maximizing your insurance benefits. For instance, if your deductible is $1,000, you should be aware of this threshold to decide when to utilize your maximum allowance.

To check your deductible, carefully review your insurance policy documents. These documents provide detailed information about your coverage, including the specific deductibles for different services. Look for sections that outline the annual deductible amount and any associated services or treatments. Understanding these details will help you recognize when you've reached your deductible and are eligible to use your maximum allowance.

Additionally, consider the types of services you typically require. Some medical expenses, like routine check-ups or prescription medications, may have separate deductibles. Being aware of these individual deductibles will enable you to plan your healthcare expenses more effectively. For example, if you know that your annual deductible for doctor visits is $500 and your maximum allowance covers the remaining costs, you can schedule necessary appointments without exceeding your insurance benefits.

In summary, checking your deductibles is a vital step in understanding your insurance coverage. By knowing your deductible amount and the specific deductibles for different services, you can make informed decisions about when to use your maximum allowance. This ensures you receive the necessary healthcare while optimizing your insurance benefits. Always refer to your policy documents and seek clarification from your insurance provider if needed to fully comprehend your coverage and make the most of your insurance maximum allowance.

Address Change: Insurance Payment Spike

You may want to see also

Monitor Policy Changes: Stay updated on policy changes to ensure you're aware of any new limits

Staying informed about policy changes is crucial for anyone who wants to ensure they are getting the most out of their insurance coverage. Insurance policies can be complex, and changes to the terms and conditions can significantly impact the coverage you receive. Here's a guide on how to monitor these changes and keep your insurance coverage up-to-date:

Regularly Review Your Policy Documents: Start by making it a habit to review your insurance policy documents periodically. Insurance companies often provide annual updates or policy renewals, which is an excellent opportunity to assess the coverage. Look for any changes in coverage limits, deductibles, or policy exclusions. These documents should be easily accessible, either physically or through your insurance provider's online portal. By regularly reviewing, you can quickly identify any modifications and understand the implications.

Utilize Online Resources: Many insurance companies now offer online resources to help policyholders stay informed. Check the company's website for policy change notifications, updates, and FAQs. Some insurers provide email alerts or notifications when changes are made, ensuring you receive timely information. Online resources can also include detailed explanations of policy updates, making it easier to understand the impact on your coverage.

Engage with Your Insurance Provider: Don't hesitate to reach out to your insurance company for clarification. If you notice any discrepancies or have questions about policy changes, contact their customer support. Insurance providers often have dedicated teams to assist with policy inquiries. They can provide personalized guidance and ensure you are aware of any new limits or adjustments that may affect your coverage.

Stay Informed on Industry Trends: Keep yourself updated on industry news and trends related to insurance. Subscribe to relevant newsletters or follow reputable insurance-focused websites and blogs. These sources often provide insights into emerging policy changes, regulatory updates, and industry best practices. By staying informed, you can anticipate potential changes and take proactive measures to adapt your insurance coverage accordingly.

Consider Policy Review Meetings: Schedule regular meetings with your insurance broker or agent to review your policy. These meetings can be an opportunity to discuss any concerns, ask questions, and ensure your coverage aligns with your current needs. Brokers and agents are knowledgeable about policy changes and can provide valuable insights, helping you navigate the complexities of insurance adjustments.

By actively monitoring policy changes, you empower yourself to make informed decisions about your insurance coverage. This proactive approach ensures that you are aware of any new limits, allowing you to adjust your policy accordingly and maintain adequate protection. Remember, staying informed is the key to managing your insurance effectively.

Maximizing Coverage, Minimizing Cost: The Benefits of Extended Term Life Insurance Plans

You may want to see also

Frequently asked questions

Your insurance maximum coverage amount, also known as the policy limit, is typically specified in your insurance policy documents. You can review your policy or contact your insurance provider directly to obtain this information. They will provide you with the details regarding the maximum payout or coverage for your specific insurance type, such as health, auto, or home insurance.

If your claim amount surpasses the insurance maximum allowance, you may need to consider the following options: file an appeal with the insurance company, seek a policy change or upgrade, or explore additional coverage options. It's important to understand the reasons for the claim denial and discuss potential solutions with your insurance agent or broker.

Increasing your insurance maximum allowance depends on the type of policy and the insurance company's guidelines. You can typically request a policy change or upgrade by contacting your insurance provider. They will assess your situation, including your risk profile and financial capacity, to determine if an increase is feasible and provide you with the necessary steps to proceed.

Yes, several factors can influence the insurance maximum allowance. These may include the type of insurance, your personal or business profile, the value of the insured item, and the insurance company's policies. For instance, in health insurance, factors like age, pre-existing conditions, and the chosen plan type can impact the maximum coverage amount.

To ensure you have adequate insurance coverage, it's essential to regularly review and assess your insurance needs. Consider factors such as the value of your assets, potential risks, and changing circumstances. Consult with insurance professionals who can provide personalized advice and help you adjust your policy limits accordingly. Regularly updating your insurance coverage will help you stay protected and aligned with your maximum allowance.