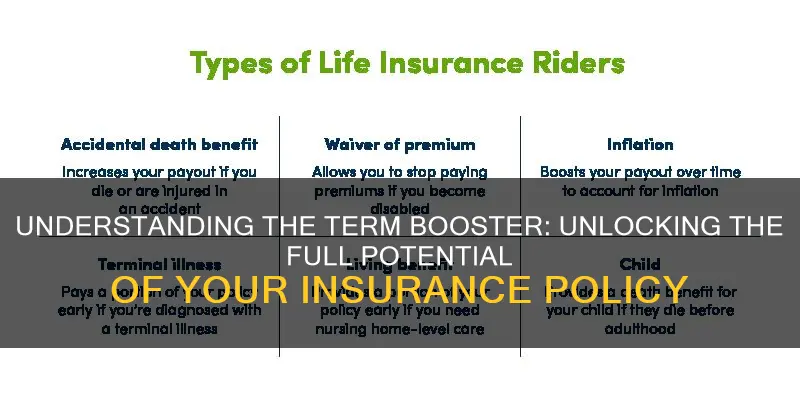

Term insurance riders, or add-ons, are additional coverage options that can be purchased with a term insurance policy to extend its scope. Each add-on comes with a cost, and for every rider chosen, the premium will increase proportionately. Despite the increase in premium, add-ons are worth buying, considering the benefits they offer if something goes wrong. Today, all insurance companies selling term insurance offer plenty of riders. Some of the most common term life insurance riders include the critical illness rider, waiver of premium rider, income benefit rider, and permanent disability rider.

| Characteristics | Values |

|---|---|

| Type | Term insurance rider |

| Purpose | Enhance your term plan |

| Cost | Proportionately increases the premium of the base insurance plan |

| Coverage | Provides additional coverage against hazards |

| Maximum Coverage | Depends on the base amount assured and the types of riders included in the plan |

| Premium Limit | The combined premium for all riders cannot be greater than 30% of the premium for the basic insurance |

| Examples | Accidental death benefit rider, critical illness rider, permanent disability rider, income benefit rider |

What You'll Learn

Critical Illness Rider

A critical illness rider is an add-on to a life insurance policy that allows the policyholder to access a lump-sum payout if they are diagnosed with a critical illness. This rider typically needs to be added to the policy when it is purchased and cannot be added later. The definition of "critical illness" varies by insurer, but generally includes serious health conditions such as heart attacks, strokes, cancer, kidney failure, and major organ transplants.

The critical illness rider provides financial protection and flexibility in using funds. The payout can be used to cover medical bills, pay off debts, compensate for lost income during recovery, or any other purpose the policyholder chooses. It is important to note that the payout from the critical illness rider will reduce the death benefit of the life insurance policy, resulting in a lower payout to beneficiaries.

The process for activating the critical illness rider involves providing proof of the serious health condition to the insurer. Once approved, the policyholder will receive a lump-sum payment, which is typically tax-free. There may be a waiting period after the start date of the rider before any claims can be made, and there could also be a survival period, requiring the policyholder to survive a certain number of days post-diagnosis to be eligible for the benefit.

The critical illness rider is ideal for individuals who want the option to access their life insurance policy's payout if they become seriously ill. It provides financial peace of mind and flexibility during challenging times. However, it is important to carefully review the policy's exclusions, specific definitions, and potential drawbacks, such as additional premiums and limited coverage.

Nature's Fury: Understanding Tornadoes and Their Impact on Home Insurance Policies

You may want to see also

Waiver of Premium Rider

A Waiver of Premium Rider is an optional add-on to a life insurance policy that allows you to stop paying your premiums if you become disabled and unable to work. This ensures your policy remains in force even if you can no longer afford the payments.

The Waiver of Premium Rider is a financial safeguard, waiving premiums during severe illness or disability. The premiums are either paid by the insurer or completely waived, ensuring the policy remains active. This rider provides comprehensive protection, often covering disabilities, critical illnesses, and even unemployment in some cases.

The specifics of this rider—such as costs, waiting periods, and coverage—can vary among insurance providers. It is important to note that adding this rider to your life insurance policy will increase your premium. The rider is typically available to anyone eligible for a life insurance policy, but specific eligibility criteria depend on factors such as age, health, occupation, and lifestyle.

The Waiver of Premium Rider offers several benefits, including financial security, peace of mind, protection against policy lapse, and flexibility in difficult times. However, it is essential to consider the potential drawbacks, such as additional cost, waiting periods, specific definitions of qualifying disabilities, and duration limits.

The cost of the Waiver of Premium Rider depends on various factors, including the insurance company, the policyholder's age, health, lifestyle, and occupation. It typically increases term life insurance premiums by 10% to 25%.

To activate the rider, you will need to file a claim with your insurance company, providing evidence of your disability or illness, such as medical reports. There is usually a waiting period of around six months before the waiver takes effect, confirming that the disability or illness is long-term. The waiver will remain in effect until you recover or, in the case of a permanent disability, indefinitely.

Unraveling the ROP Acronym: Understanding Insurance's Return of Premium

You may want to see also

Income Benefit Rider

An Income Benefit Rider, often referred to as a "

The primary benefit of an Income Benefit Rider is the assurance of a steady income stream for the remainder of one's life, or their spouse's life as well. This can provide peace of mind and financial security during retirement. Income Benefit Riders also offer flexibility in retirement planning, as they allow the policyholder to choose when to activate the income stream and adjust their retirement income strategy based on their needs, preferences, and changing circumstances.

Additionally, Income Benefit Riders protect against market fluctuations by guaranteeing income even if the annuity investments underperform. This provides a safety net in uncertain financial times. Some Income Benefit Riders may also offer the opportunity to increase payments over time to keep up with inflation.

It is important to note that adding an Income Benefit Rider to an annuity will likely increase the cost of the contract. This fee can be a flat amount, a percentage of the account value, or based on the guaranteed income amount. Therefore, it is crucial to understand and compare the costs of different riders before making a decision.

When considering an Income Benefit Rider, careful selection of a strong annuity provider is crucial for a secure retirement strategy. It is also important to evaluate the insurance company's financial ratings, reputation, and history of honouring commitments to policyholders.

Telemedicine's Role in Term Insurance: Revolutionizing Access and Efficiency

You may want to see also

Permanent Disability Rider

If you become totally and permanently disabled, a permanent disability rider will provide you with a steady source of income to cover medical expenses or everyday living expenses. The amount you are able to draw from a permanent disability rider depends on the terms of the policy. Insurers commonly pay 1% to 2% of the policy's face value in income. For example, if you have a $1 million life insurance policy, you might be able to receive $10,000 per month in benefits.

There may be limits on how much you can receive in disability income over your lifetime or how long payments will continue. It is important to note that permanent disability riders typically have a waiting period before you can begin drawing income benefits. This waiting period can range from a few months to a year. Additionally, permanent disability riders often have an age limit, typically terminating around retirement age.

Understanding the Ins and Outs of PDP Plans: Unraveling the Insurance Acronym

You may want to see also

Accidental Death Rider

An accidental death benefit rider is an optional add-on to a life insurance policy. It provides an additional death benefit if the policyholder passes away due to an accident. This is also known as "double indemnity" or "triple indemnity" as the benefit paid out to beneficiaries may be double or triple the amount they would receive if the policyholder died of natural causes.

Accidental death benefit riders are a common option for most types of life insurance, including term and permanent life policies. They are slightly different from accidental death and dismemberment (AD&D) riders, which offer a payout if the policyholder survives an accident or loses a limb or experiences another debilitating injury, like blindness or paralysis.

The definition of "accident" varies by policy, so it is important to carefully review the terms and conditions of the rider. For example, some policies may exclude certain types of accidents or risky activities. Many policies won't pay out if the policyholder was participating in dangerous recreational activities or under the influence of drugs or alcohol at the time of the accident. Some insurers might not offer accidental death benefit riders to those in risky occupations, such as firefighting or law enforcement.

Accidental death benefit riders are suitable for those who face high risks at work, engage in dangerous activities, or have dependents. They can provide peace of mind that your loved ones will be financially secure in the event of your accidental death.

However, it is important to note that adding an accidental death benefit rider to your life insurance policy could significantly increase your premium payments. Therefore, it is essential to carefully evaluate whether the additional coverage is worth the extra cost.

Understanding the Insurance Coverage of Short-Term Bonds

You may want to see also

Frequently asked questions

A term booster is an add-on or rider that can be purchased with a term insurance policy to extend its scope. It is an additional benefit that can be added to life insurance coverage to enhance the term plan.

A term booster provides extra security and coverage against hazards. It is a cost-effective addition to a life insurance policy, increasing its comprehensiveness.

Examples of term boosters include the Critical Illness Rider, the Waiver of Premium Rider, the Income Benefit Rider, and the Permanent Disability Rider.

A term booster is an optional, supplemental term that often comes with an additional charge. It goes into effect at the same time as the base policy.

The cost of a term booster varies depending on the specific term policy, premiums, and insurance company. The additional premium is generally low because relatively little underwriting is required, and the sum assured is typically less than the insurance cover.