Return of Premium (ROP) term life insurance is a type of insurance policy that provides a death benefit to beneficiaries if the policyholder dies during the term of their policy, but also offers a refund on premiums paid if they outlive the policy term. This type of policy is more expensive than a regular term life insurance policy, and not all insurance companies offer it. However, it can be a good option for those who want the added security of getting their money back if they outlive the policy term. When choosing an ROP term life insurance policy, it's important to compare prices, financial strength ratings, customer satisfaction, and included and optional riders.

| Characteristics | Values |

|---|---|

| Premium Rates | Affordable |

| One-time Payment | Lump Sum Premium |

| Regular Pay | Fixed Intervals (Yearly, Half-Yearly, Quarterly, Monthly) |

| Pay Till | Premiums Paid Till Age 60, Policy Till 85 |

| Limited Pay | Fixed Installments for TROP |

| Guaranteed Premium Return | Assured Returns on Total Premium, Excluding Riders/Add-ons |

| Maturity Benefits | Premium Refund if Life Assured Survives the Policy Term |

| Surrender Value | Available After Specific Payment Intervals |

| Single Premium Type | Valid After Single Payment |

| Limited/Regular Pay Type | Applicable After 2 Years |

| Paid-Up Option | Continuation with Lower Cover for Non-Earning Individuals |

| Waiver of Premium (WOP) | |

| Accidental Death Benefit | |

| Accidental Total and Permanent Disability |

What You'll Learn

Return of Premium (ROP) term life insurance explained

Return of Premium (ROP) term life insurance is a type of life insurance policy that provides a death benefit to your beneficiaries if you die during the term of your policy but refunds the premiums paid if you outlive the policy term.

With a standard term life insurance policy, you pay regular premiums to keep your policy active. If you die during that time, your beneficiaries will receive a life insurance payout known as the death benefit. If you're still alive when the term period is over and you haven't renewed the policy, there's no payout, and the policy ends.

With ROP term life insurance, you can get those premiums back if you outlive the term. In this case, you will receive a refund of your premium payments, typically in a lump sum, and this refund is tax-free. However, if you fail to make payments or cancel the policy, you may not get a refund.

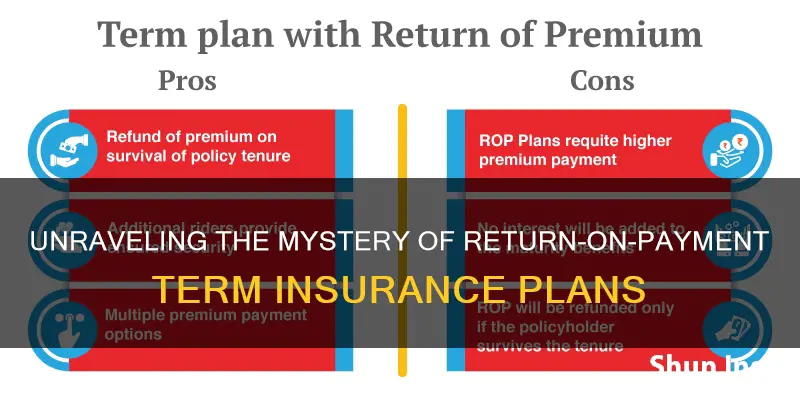

Pros and Cons of ROP Term Life Insurance

Pros:

- The ability to reclaim past premium payments if you outlive the term.

- The refund is typically tax-free.

- ROP term life insurance can function as a savings account with a bonus life insurance add-on.

Cons:

- ROP term life insurance is usually much more expensive than a traditional term life insurance policy.

- You essentially provide an interest-free loan to the insurer, and the refund doesn't include any interest.

- There is a chance you won't get a refund if you miss payments or cancel the policy.

ROP term life insurance can be a good option if you can afford the higher premiums and are uncomfortable with the idea of potentially outliving a term life policy. However, it's important to note that you aren't receiving any additional money with ROP; you're getting back the money you paid into the policy.

A traditional term life insurance policy may be a more cost-effective option, and you can invest the money saved in an account with higher returns.

ROP Term Life Insurance Providers

Not all insurance companies offer ROP term life insurance, but some providers include:

- Mutual of Omaha

- AAA

- Assurity

- State Farm

- John Hancock

- Cincinnati Life

- Illinois Mutual

- Lincoln Financial

- Pacific Life

- Protective

The Hidden Meaning of Riders: Unlocking the Full Potential of Your Insurance Policy

You may want to see also

Pros and cons of ROP life insurance

Return of Premium (ROP) life insurance is a type of term policy that refunds all your premiums at the end of the policy period if you are still alive. This type of insurance is ideal for young people who are in good health. It is also a good option for those who feel they have wasted their money on a life insurance policy that never got used.

Pros of ROP Life Insurance

- You get all or most of your money back at the end of the life insurance term if you outlive the term and haven't let the policy lapse.

- Premiums are returned tax-free.

- It is affordable when compared to universal life or whole life insurance.

- It is a no-risk option for those with a low-risk tolerance for investing in stocks and bonds.

- At the end of your term, the refund can be applied to convert your term policy into permanent coverage.

Cons of ROP Life Insurance

- It is not suitable for those of average health or middle age.

- The additional cost is often prohibitive for the ROP rider.

- If you switch to another life insurance policy in the early part of your term, you will not get any premiums returned.

- If you get to the end of your life insurance contract, you may not get 100% of your premium payments back.

- With an ROP policy, you are locked into a more expensive life insurance policy for the next 20 to 30 years.

- You lose money every year due to inflation.

- Liquidity is sacrificed as you are locked into a higher premium life insurance contract.

Understanding the Fundamentals of Minimum Sum Assured in Term Insurance

You may want to see also

How to choose a return of premium term policy

Return of Premium (ROP) term life insurance is a type of insurance that provides a death benefit to your beneficiaries if you die during the term of your policy but refunds the premiums paid if you outlive the policy term. Here are some factors to consider when choosing a return of premium term policy:

- Cost: Compare the price of an ROP term policy to a standard term policy to see how much more you'll pay. ROP policies are usually two to three times more expensive than standard term life insurance.

- Financial strength: Check AM Best's financial stability ratings to assess how financially stable an insurance company is and how likely it is to honour its contractual obligations.

- Customer satisfaction: Review the National Association of Insurance Commissioners (NAIC) complaint index and J.D. Power's customer survey to gauge customer satisfaction with a particular life insurance company.

- Convertibility: If you think you may want to convert your term policy to a permanent policy in the future, choose a company that offers this option.

- Included and optional riders: Some riders are included for free, while others require an additional cost. Make sure to take the cost of any desired riders into account when comparing life insurance providers.

- Death benefit payout options: Some policies offer a lump-sum payout, while others provide monthly income or a combination of both. Choose a policy with a payout option that aligns with your beneficiaries' needs.

- Policy term: ROP policies typically offer terms of 15, 20, or 30 years. Select a policy term that aligns with your desired coverage period.

- Premium payment options: ROP policies may offer different premium payment options, such as one-time payment, regular pay, pay till a certain age, or limited pay. Choose the option that best suits your financial situation and preferences.

- Company reputation and claims settlement ratio: Consider the reputation and claims settlement ratio of the insurance company. A higher claims settlement ratio indicates a faster settlement of claims.

The Intricacies of Loss Pick: Unraveling the Insurance Industry's Unique Language

You may want to see also

How does return-of-premium life insurance work?

Return of premium (ROP) life insurance is a type of term life insurance that refunds all premiums paid at the end of the policy period if the policyholder outlives the term. This type of insurance plan can be more expensive than traditional term life insurance, and not all insurance companies offer it.

With a standard term life insurance policy, you pay regular premiums to keep your policy active, but these payments are usually non-refundable if you outlive the policy term. In contrast, ROP life insurance allows policyholders to recover their premium payments if they are still alive when the policy term ends. This means that if you buy a 20-year ROP term life insurance plan and you pass away within that 20-year term, your family will receive the death benefit, and the premium payments will be kept by the insurer. However, if you outlive the 20-year term, you will be able to get a refund of your premium payments.

The main benefit of ROP life insurance is the ability to reclaim past premium payments. If you outlive the policy term, you will typically receive a lump-sum payment combining all the premiums that were paid. This can be helpful if you have new expenses to cover later in life, such as a mortgage or retirement plan. Additionally, any returns from this type of plan are generally not taxed.

However, one of the biggest drawbacks of ROP life insurance is the cost. ROP life insurance is usually much more expensive than traditional term life insurance, and the higher cost may be comparable to whole life insurance. The extra cost essentially provides an interest-free loan to the insurer, and when you factor in inflation, the real value of the money returned at the end of the term is reduced.

Another downside to ROP life insurance is that terminating the policy early or missing payments may result in losing your refund. Additionally, because it is a temporary policy, when the term is up, you will need to buy additional life insurance based on your current age and health status.

Overall, ROP life insurance may be a good option for those who can afford the higher premiums and want the added security of getting their premiums refunded if they outlive the policy term. However, it is important to consider the pros and cons carefully and consult with a qualified life insurance professional before deciding if this type of policy is right for you.

Is return-of-premium life insurance worth it?

Return-of-premium (ROP) life insurance is a type of term life insurance that refunds the premiums you've paid if you outlive the policy term. It's often added as a rider to a regular term life insurance policy, and it's more expensive than a standard term life insurance policy.

Whether ROP life insurance is worth it depends on your budget and financial plan. For most people, a standard term life insurance policy is sufficient, and they can put the money they save into a high-interest savings account or other types of investments. However, if you're uncomfortable with the idea of paying into a life insurance policy that may expire and can afford the higher premiums, ROP may be a good option.

Pros

- Most or all of your premiums are refunded if you keep the policy until the end of the term.

- The total amount of premiums returned is tax-free.

- You know exactly how much you'll receive at the end of the term.

Cons

- Term insurance policies with ROP are more expensive than those without.

- You don't earn any interest on your investment.

- If the policy lapses for any reason, no premiums are returned.

Understanding Solvency: The Lifeline of the Insurance Industry

You may want to see also

Frequently asked questions

A ROP term life insurance policy provides a death benefit to your beneficiaries if you pass away during the term of your policy. If you outlive the term, it also offers a refund on the premiums paid.

If you purchase an ROP life insurance rider with your term life policy, you'll make monthly payments to keep your policy active. If you outlive the policy term, the insurance company will pay back all or some of the money you spent on payments, depending on your policy, in the form of an ROP benefit.

You're typically only entitled to getting your term life insurance money back if you purchased an ROP rider with your term policy, made your payments on time, and are still living when the term ends.

A return of premium rider typically refunds you the total premium you paid for your base policy and the ROP rider. It may not refund fees or the premium you paid for other riders on your policy.