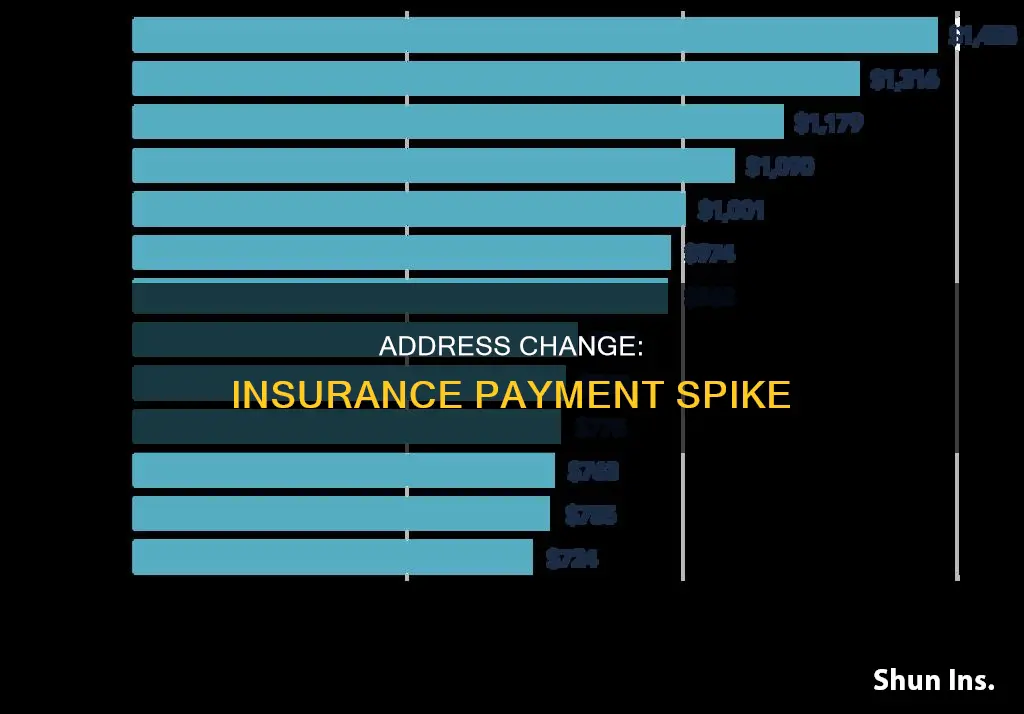

Changing your address can result in an increase or decrease in your insurance payment, depending on the risk factors associated with your new location. Insurance providers consider various statistics about an area to determine the impact of an address change on insurance rates. One of the critical factors is the population of the area; moving to a densely populated city will likely lead to higher insurance rates due to increased traffic, higher chances of accidents, and a greater number of uninsured drivers. Additionally, crime rates and parking situations can also influence your insurance premium. Higher crime rates, particularly vehicle theft and vandalism, will result in increased insurance rates. Furthermore, insurance companies consider the parking situation at your new address. If you are parking your car on the street instead of in a secure garage, your insurance rates may increase.

| Characteristics | Values |

|---|---|

| Population density | Moving to a more crowded urban area can increase your premium due to factors such as increased traffic, poor infrastructure, crime, and vandalism. |

| Crime rates | Moving to an area with higher crime rates can increase your premium as this increases the risk of car thefts and vandalism. |

| Traffic | Moving to an area with more traffic can increase your premium as there is a greater chance of accidents and encountering uninsured drivers. |

| Number of uninsured drivers | Moving to an area with more uninsured drivers can increase your premium as accidents with uninsured drivers are more financially burdensome. |

| Parking situation | Moving to an area where you have to park on the street rather than in a garage can increase your premium as cars parked on the street are more likely to be damaged or broken into. |

| State-specific insurance requirements | Moving to a different state can change your premium as each state has different insurance requirements, such as minimum liability insurance and personal injury protection (PIP) mandates. |

What You'll Learn

Population density and traffic

- More vehicles on the road

- Slower traffic and more "stop and go" operation

- Increased air pollution

- Poor infrastructure

- Higher crime rates

- More uninsured drivers

The relationship between population density and traffic congestion is so strong that it has been used to argue against the effectiveness of "smart growth" or "compact city" urban strategies in reducing traffic congestion. These strategies require higher population densities, but as densities rise, vehicle use also rises, leading to increased traffic congestion.

The impact of population density on traffic congestion is particularly notable in large, dense cities, where traffic congestion can be up to three times that of less dense areas. This is due to the higher number of vehicles on the road, as well more limited parking options, which can force drivers to park on the street, increasing the risk of vehicle damage or theft.

The impact of population density on traffic congestion is also influenced by the quality of public transport in an area. Well-established public transport systems can help to reduce traffic congestion by providing an alternative to driving. However, this is dependent on the quality of the system, with US cities tending to have lower transit capacities and usage than European cities, despite higher population densities.

In addition to population density, a number of other factors can also impact traffic congestion, including:

- Weather patterns

- Cost of medical bills and car repairs

- Frequency and cost of lawsuits due to state tort vs. no-fault laws

- Auto insurance fraud

Understanding VGIL Term Insurance: A Comprehensive Guide to its Benefits and Features

You may want to see also

Crime rates

Insurers also take into account the security of your car's parking location. If you move to an area where you have to park your car on the street instead of in a secure garage, your insurance premium may increase. This is because cars parked on the street are more vulnerable to theft and vandalism than those in secure parking spots.

Additionally, some insurers have been criticised for charging higher premiums in minority neighbourhoods compared to white neighbourhoods with similar risk profiles. This practice, known as redlining, has been found to disproportionately impact minority communities and contribute to economic inequality.

To mitigate the impact of crime rates on your insurance premium, consider taking precautions such as installing an anti-theft device in your car or parking in a secure location whenever possible.

Marriage: A Gateway to Insurance Changes

You may want to see also

Parking situation

The parking situation at your address can have a significant impact on your insurance rates. If you live in an area with ample parking, such as a residential neighbourhood with driveways or garages, you may benefit from lower insurance rates. In contrast, if you live in an area with limited parking options, such as street parking in a busy downtown area, your insurance rates may increase.

Insurance companies consider the parking situation when assessing the risk of theft, vandalism, or damage to your vehicle. Cars parked on the street are generally considered to be at a higher risk of these issues compared to those parked in secure garages or driveways. As a result, insurance providers may charge higher premiums for vehicles parked on the street to offset the potential costs of claims.

Additionally, the parking situation can also affect your insurance rates indirectly. For example, if you live in an area with limited parking, you may be more likely to accumulate parking tickets, which, if left unpaid, can impact your credit score and, consequently, your insurance rates. Furthermore, frequent parking tickets may lead to the boot being placed on your vehicle or even having your car towed or impounded, resulting in additional fines and complications.

Therefore, when considering the impact of your address on insurance rates, it is essential to factor in the parking situation. By choosing a location with secure and ample parking options, you may be able to benefit from lower insurance rates and avoid the hassles associated with parking tickets and fines.

The Intricacies of COIs: Navigating Insurance Terminology

You may want to see also

State-specific insurance requirements

When it comes to state-specific insurance requirements, it's important to understand that these requirements can vary significantly depending on the state you're in. Here are some key points to consider:

- Minimum Insurance Requirements: Each state has its own minimum auto insurance requirements, which include different types and amounts of coverage. For example, some states mandate Personal Injury Protection (PIP) coverage, while others don't. Make sure to review the specific requirements for your state to ensure you have the necessary coverage.

- At-Fault and No-Fault Systems: States also differ in their liability systems. Most states follow an at-fault system, where the driver who caused the accident is legally liable for damages. On the other hand, no-fault states require drivers to carry Personal Injury Protection to cover themselves and their passengers, resulting in higher insurance rates.

- Insurance Rates and Premiums: Insurance rates can vary significantly from state to state and are influenced by various factors such as crime rates, traffic conditions, population density, and the number of uninsured drivers. Moving from a rural area to a densely populated city will likely result in higher insurance rates.

- Address Changes: It is crucial to notify your insurance company of any change of address, even if it's just a few blocks away. Failure to do so may result in denied claims, policy cancellation, or adjusted rates. Insurance companies use your address to assess risk and determine premiums, so keeping them updated is essential.

- Moving Out of State: If you're moving out of state, you may need to change your insurance company if your current provider doesn't offer coverage in your new state. Be sure to review the insurance requirements of your new state and update your policy accordingly.

- Temporary Address Changes: Even if your address change is temporary, such as during a business trip or vacation, it's important to inform your insurance company. They can advise you on any necessary adjustments to your policy based on your temporary location.

Understanding Insurance Policy Changes: Do You Need to Inform the DMV?

You may want to see also

Weather

In addition to comprehensive coverage, collision insurance is also relevant when it comes to weather-related claims. It covers car repair expenses if you hit another car or object during a blizzard or hydroplane during a severe thunderstorm.

The frequency and severity of weather-related events, such as hurricanes, floods, wildfires, and storms, have increased due to climate change. This has led to a rise in insurance claims and, consequently, higher insurance premiums. According to the National Oceanic and Atmospheric Administration, weather-related disasters caused $175.2 billion in damage in 2022 alone.

Insurance companies use weather data to assess the risk associated with different areas. They take into account factors such as accident reports, claim filings, and statistics on accidents, claims, and crimes in specific ZIP codes or areas. As a result, moving to an area with a higher risk of adverse weather conditions can lead to an increase in your insurance premium.

In summary, while weather may not be the sole factor influencing insurance rates, it plays a significant role, especially when it comes to auto insurance and comprehensive coverage. The increase in severe weather events due to climate change has further contributed to rising insurance premiums, and insurance companies continue to assess and manage these risks to maintain affordable rates for their customers.

The Hidden Meaning of Riders: Unlocking the Full Potential of Your Insurance Policy

You may want to see also

Frequently asked questions

Insurance companies use your address to determine the level of risk involved with your policy. If you move to a location with a higher risk of accidents, crime, or car theft, your insurance payment will increase.

If you move to a busy city, there will be more traffic and a higher chance of accidents. This means insurance providers will increase your insurance rate to offset some of that risk.

Yes. If you have to park your car on the street, your insurance payment will be higher than if you can park it in a secure garage or driveway.

You can try increasing your deductible, which is the amount you pay out-of-pocket after your insurance kicks in. You can also look for discounts, such as installing an anti-theft system or paying for your insurance in full instead of monthly.