Term insurance provides financial protection to your loved ones in the event of your death. It guarantees a death benefit to the beneficiaries of the policyholder if the insured person dies during the specified term. While term insurance covers death due to natural causes, accidents, and illnesses, there are certain exclusions and limitations. For instance, term insurance typically does not cover death due to suicide within the first year of the policy, self-inflicted injuries, driving under the influence, participation in hazardous activities, and pre-existing health conditions that were not disclosed. It is important to carefully review the terms and conditions of a term insurance policy to understand what types of deaths are covered and excluded.

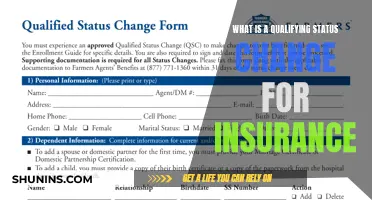

| Characteristics | Values |

|---|---|

| Death due to natural causes or health-related issues | Covered |

| Death due to accidents | Covered, unless caused by intoxication or drugs, or if the insured is involved in criminal activity |

| Death by suicide | Covered after the initial 12 months. In the first 12 months, the beneficiary receives 80% of the amount accumulated from the premiums in case of a non-linked plan, and 100% in case of a linked plan. |

| Death due to self-inflicted injuries | Not covered |

| Death due to critical illness | Covered |

| Death due to existing illness | Covered, but must be disclosed at the time of purchase |

| Death due to intoxication | Not covered |

| Death due to homicide | Covered, unless the nominee is found to be involved |

| Death due to natural calamity | Not covered, unless the policyholder opts for additional riders |

What You'll Learn

Death due to natural causes or health-related issues

Term insurance plans cover death due to natural causes or health-related issues. If the policyholder dies due to any critical illness or medical condition, the beneficiary will receive the sum assured as the death benefit. For example, if the policyholder passes away in their sleep due to a heart attack, the plan will cover the death and the beneficiary will receive the payout.

Term insurance also covers deaths caused by accidents, unless the accident happens due to intoxication or under the influence of drugs, in which case the insurer will reject the claim. If the policyholder passes away in an accident due to criminal or unlawful activity, the insurer is also not liable to pay the claim.

There are some exceptions to the coverage of accidental death. For example, if the policyholder was driving under the influence of alcohol or other narcotic drugs, or if they were engaged in adventure sports activities such as skydiving or mountaineering, the insurer may reject the claim.

It is important to note that death due to self-inflicted injuries or existing illnesses that were not disclosed when purchasing the term insurance plan is not covered. In the case of death by suicide, the treatment varies depending on the insurance company and the timing of the suicide.

Understanding Term Insurance: A Guide to This Essential Coverage

You may want to see also

Death by accident

Term insurance plans cover accidental deaths, but there are some exceptions. Accidental deaths due to intoxication or drugs, or if the insured is involved in criminal activity, are not covered. Additionally, accidental deaths that occur during adventure sports like skydiving, paragliding, bungee jumping, and others are not covered by term plans.

Accidental death is defined as a sudden, unforeseen, and involuntary event caused by an external, violent, and visible force. The death will be classified as accidental if it results from this accident and occurs without the involvement of any other cause within a set period, often 90 to 180 days, following the accident.

Some examples of accidental deaths covered by term insurance include:

- Death due to accident involving motor vehicles or by motor vehicles

- Death due to accident involving machinery at the place of work, like accidents in factories

- Death due to fire-related injuries

- Death from accidentally falling from a building or rooftop

- Death due to slipping in the bathroom

- Death due to drowning in a river

- Death due to lightning strike or earthquake or any other natural calamity

- Death from electric shock at home or somewhere else

It is important to note that different insurance companies may have different clauses for death benefits, so it is recommended to carefully review the terms and conditions of the policy before purchasing.

The Dynamic Nature of Term Insurance: Unraveling the Ever-Increasing Coverage Component

You may want to see also

Death by suicide

Suicide is a leading cause of death for people aged 10-64. Life insurance policies typically include a suicide clause that prevents the insurer from paying out the claim if the insured's death was due to self-inflicted injury within a certain period from the start of the policy, usually two years. This clause is in place to prevent people from taking out a policy with the intention of committing suicide so that their loved ones receive financial benefits.

If the suicide exclusion period has ended, life insurance can cover suicide and pay out the death benefit, provided no terms in the policy have been violated.

Group Life Insurance

Group life insurance, which is often provided as a workplace benefit, typically pays a death benefit on suicide claims without the two-year contestability restriction. Military life insurance policies also usually pay out the death benefit to the insured's beneficiaries regardless of the cause of death.

Contestability Period

The contestability period is separate from the suicide clause and usually lasts for two years after the policy activates. During this time, the insurer can deny a claim if the insured dies and the insurer finds undisclosed health conditions or other discrepancies in the policy application.

Switching Policies

Switching life insurance policies restarts the suicide clause and contestability period, even if the new policy is from the same company.

Exclusions

If the policyholder passes away within 12 months of the policy being issued or revived, then the nominee will receive a specific percentage of the plan premiums paid by the policyholder. If the policy term has lapsed without the paid-up value being realized, then no claim will be paid to the nominee when the policyholder commits suicide.

In the case of linked plans, if the policyholder commits suicide during the initial 12 months from the date of policy commencement, the beneficiary receives 100% of the total premium paid.

Help for Suicide and Depression

If you or a loved one are suffering from depression, there is help available. The National Suicide Prevention Lifeline has a 24/7 hotline that is free and confidential: 1-800-273-8255.

Insurance Contract Litigation: Exploring the Enforceability of 'Against Us' Clauses

You may want to see also

Death due to pre-existing health conditions

Term insurance covers death due to pre-existing health conditions, but only if the policyholder discloses these conditions when purchasing the plan. If a policyholder dies due to a pre-existing condition that was not disclosed, the insurance company has the right to reject the claim.

In the United States, the Affordable Care Act (ACA) requires health insurers to cover pre-existing conditions without raising prices, limiting coverage, or turning away customers. This rule applies to plans purchased after January 1, 2014. Before the ACA, insurers could deny coverage or charge higher prices to people with pre-existing conditions.

In India, term insurance plans also cover death due to critical illnesses, including sexually transmitted diseases like HIV/AIDS, provided the policyholder discloses these conditions when purchasing the plan. However, it is important to note that term insurance plans do not cover death due to self-inflicted injuries or participation in hazardous activities.

Death due to participation in illegal activities

If the policyholder dies due to involvement in criminal activity, the term insurer will not pay the claim amount. However, the nominee will receive the claim amount if the policyholder has a criminal track record but dies due to a natural calamity like lightning, flu, or dengue.

Case 1: If the nominee is a criminal

If the policyholder is murdered and it is later discovered that the nominee was also involved in the crime, the insurer will not pay the claim. Only if murder charges are dismissed or there is a verdict will the compensation be given. Until the court's verdict is decided in the nominee's favour, the insurance company will always refuse to give the payout.

Case 2: If the death of the policyholder was due to involvement in criminal activity

If the policyholder is killed because of their engagement in any illegal activity, the term insurer will not pay the claim amount. However, the nominee will receive the claim amount if the policyholder has a criminal track record but dies due to a natural calamity.

The Intricacies of Insurance Twisting: Unraveling the Practice and Its Impact

You may want to see also

Frequently asked questions

Term insurance covers death due to natural causes, health-related issues, critical illnesses, accidents, and COVID-19.

Yes, term insurance typically does not cover death due to risky activities, certain occupations, suicide within the first year or two of the policy, homicide, and intoxication.

Death caused by natural disasters, such as tsunamis, earthquakes, or floods, is generally not covered by standard term insurance policies. However, policyholders can opt for additional riders or coverage to include these events.

If your term insurance claim is rejected, you can approach the grievances cell of the insurance company or the relevant insurance regulatory authority for assistance and guidance.