Insurance is considered a financial service. The financial services sector includes a broad array of different types of financial services companies, and insurance companies are among them. Insurance services are available for protection against death or injury (e.g. life insurance, disability income insurance, health insurance), against property loss or damage (e.g. homeowners insurance, car insurance), or against liability or lawsuit.

The financial services sector is the primary driver of a nation's economy. It provides the free flow of capital and liquidity in the marketplace. When the sector is strong, the economy grows, and companies in this industry are better able to manage risk.

| Characteristics | Values |

|---|---|

| Definition | Financial services are economic services tied to finance provided by financial institutions. |

| Importance | Financial services are considered to be one of the most important parts of the economy in many different countries. |

| Types | Financial services include accountancy, investment banking, investment management, and personal asset management. |

| Examples | Examples of financial services include depositing your check at a bank, obtaining a mortgage from a lender, purchasing insurance for your car, and similar transactions. |

| Institutions | Financial services institutions include commercial banks, investment banks, insurance companies, brokerage firms, and planning firms. |

What You'll Learn

- Insurance is a safety net for large, unforeseen expenses

- Insurance agents represent providers, brokers work for insured entities

- Types of insurance include health, auto, home, renters, and life insurance

- Insurance companies are a part of the financial services sector

- Insurance is a financial good, a tangible asset

Insurance is a safety net for large, unforeseen expenses

Insurance is a critical component of the financial services sector, offering individuals and businesses a safety net against unforeseen financial burdens. It serves as a shield, protecting people from the financial hardships that arise from unexpected events such as accidents, illnesses, and natural disasters.

The principle of insurance is based on spreading risk among a large group of people. When an individual purchases insurance, they pay a regular premium to the insurance company, and in return, the company agrees to provide financial compensation or assistance in the event of specified incidents. This compensation provides access to a range of coverage options, helping to minimise the financial impact of these incidents.

There are various types of insurance available, including life insurance, health insurance, vehicle insurance, and property insurance, each offering tailored protection. For example, health insurance covers medical expenses, ensuring access to quality healthcare. Similarly, property insurance protects against property damage or loss, enabling homeowners and businesses to recover from incidents such as fires, theft, or natural disasters.

Insurance also encourages responsible risk management. By assessing potential risks, individuals and businesses are incentivised to take preventive measures, thereby reducing the likelihood of financial losses. Furthermore, insurance fosters economic stability by reducing the impact of large-scale losses on individuals, businesses, and the broader economy.

In addition to the financial protection it offers, insurance provides peace of mind and emotional security. Knowing that one is covered in the event of an emergency reduces stress and anxiety, contributing to overall well-being and mental health.

Overall, insurance acts as a safety net, shielding individuals and businesses from large, unforeseen expenses. It helps to safeguard assets, mitigate liability risks, and encourage responsible behaviour. By transferring specific risks to insurance companies, individuals can protect their financial goals and ensure peace of mind, even when life takes an unexpected turn.

Elevating Coverage: Transitioning from Third-Party to First-Party Insurance

You may want to see also

Insurance agents represent providers, brokers work for insured entities

Insurance is considered a financial service, and insurance agents and brokers are licensed professionals who help individuals and businesses get insured. However, there are some key differences between the two roles.

An insurance agent represents and sells the policies of one or more insurance companies. They can be categorised as either captive or independent agents. Captive agents work for a single insurance company, either as full-time employees or independent contractors, and have in-depth knowledge of that company's products. On the other hand, independent agents work with multiple insurers, offering a wider range of insurance products. Agents can complete insurance sales and have the ability to bind coverage. They are contracted or employed by insurance providers and are paid through commissions or a salary.

In contrast, an insurance broker represents and works for the insured individual or business. They do not sell insurance policies directly but help their clients find and purchase the best policies for their needs from various insurance companies. Brokers are independent sales specialists who are legally required to act in their client's best interests in some states. They assess their client's needs and budget and compare insurance rates and policies to find the most suitable option. Like agents, brokers are also paid through commissions, which may vary depending on the insurance provider. However, they may also charge additional broker fees.

While both insurance agents and brokers can help individuals and businesses obtain the necessary coverage, the choice between the two depends on the client's specific needs. Insurance agents are suitable for clients who know the type of policy they want and do not require specialised coverage. In contrast, insurance brokers are better suited for clients with complex insurance needs or those who want to explore various options before choosing a plan.

Unraveling the Intricacies of Survival Benefits in Term Insurance: A Comprehensive Guide

You may want to see also

Types of insurance include health, auto, home, renters, and life insurance

Insurance is an essential component of modern life, offering individuals and families a safety net against financial hardships caused by unexpected events. While there are various forms of insurance available, four fundamental categories stand out: health insurance, auto insurance, home insurance, and life insurance. Each type of insurance serves a specific purpose and provides valuable protection in different areas of our lives.

Health Insurance

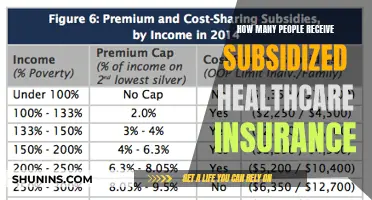

Health insurance is crucial for maintaining our well-being and managing the ever-increasing costs of medical care. It ensures that individuals and families have access to necessary healthcare services without facing financial difficulties. Health insurance plans come in various forms, including employer-sponsored plans, individual plans, and government programs like Medicare and Medicaid. These plans can be categorized into Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs), each offering different levels of coverage and flexibility. Health insurance provides coverage for preventive care, doctor visits, hospital stays, prescription medications, and specialized treatments, shielding individuals from financial hardships due to unexpected medical emergencies.

Auto Insurance

Auto insurance, or car insurance, is a legal requirement in many places. It offers financial protection against damages resulting from accidents, theft, or vandalism involving a vehicle. There are different types of auto insurance coverage, including liability coverage, which pays for damages and injuries caused to others if the insured is at fault in an accident. Other types of coverage include uninsured/underinsured motorist coverage, personal injury protection (PIP), medical payment coverage, and comprehensive and collision coverage. Auto insurance premiums are influenced by factors such as the driver's age, driving record, type of vehicle, and location, with safe driving habits often resulting in lower premiums.

Home Insurance

Home insurance, also known as homeowner's insurance, is designed to protect an individual's home and personal belongings from various risks, such as damage from natural disasters, theft, and liability claims. Home insurance policies vary in coverage and price, depending on factors like the home's location, value, and the desired level of protection. Home insurance typically includes coverage for the structure of the home, personal belongings, liability protection, and additional living expenses if the home becomes uninhabitable due to a covered event. It is important to note that standard home insurance policies usually exclude coverage for damage caused by floods or earthquakes, but separate insurance can be purchased for these perils.

Life Insurance

Life insurance is a fundamental pillar of financial planning, providing a safety net for loved ones in the event of the policyholder's death. It helps replace the income of the insured and ensures financial stability for dependents. There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance covers the insured for a specific period, while permanent life insurance provides lifelong coverage. Permanent life insurance also includes a cash value component that accumulates over time and can be borrowed against or used as an investment tool.

Updating Your Address: A Guide to Mercury Insurance Address Changes

You may want to see also

Insurance companies are a part of the financial services sector

Financial services make up one of the economy's most important and influential sectors. The financial services sector is the primary driver of a nation's economy. It provides the free flow of capital and liquidity in the marketplace. When the sector is strong, the economy grows, and companies in this industry are better able to manage risk.

The financial services sector includes a broad array of different types of financial services companies. Financial services companies are considered to be one of the most important parts of the economy in many different countries. Their profits make up a large portion of the gross domestic product (GDP) each year.

Insurance is another important subsector of the financial services industry. Insurance services are available for protection against death or injury (e.g., life insurance, disability income insurance, health insurance), against property loss or damage (e.g., homeowners insurance, car insurance), or against liability or lawsuit.

Unraveling the RCV Mystery: A Comprehensive Guide to Insurance Terminology

You may want to see also

Insurance is a financial good, a tangible asset

Insurance is a financial good and a service that is integral to the financial services sector. It is a system that individuals and businesses pay into monthly or annually, which acts as a safety net to cover the costs of large, often unforeseen, expenditures.

Insurance is a financial good because it is a product that lasts beyond its initial provision. It is also a financial service because it is a process by which consumers obtain economic goods.

Insurance is a tangible asset because it has a finite monetary value and usually a physical form. It is an asset that can be transacted for monetary value. However, it is worth noting that a life insurance policy is not typically considered a tangible asset as it does not have a physical form and cannot be touched or seen.

The financial services sector is a broad range of service sector activities, especially concerning financial management and consumer finance. It includes a variety of financial firms such as banks, investment institutions, finance companies, and insurance providers. These firms provide financial services to people and corporations, helping them manage their money and meet their financial goals.

Insurance is an important part of a financial plan as it helps protect individuals, their assets, and their loved ones. It also provides peace of mind and financial security, knowing that savings will not be threatened in emergencies. Additionally, insurance can help diversify investment portfolios, add predictability, reduce tax burdens, and mitigate risks.

There are different types of insurance plans to cover different risks, including health insurance, life insurance, disability insurance, homeowners insurance, auto insurance, liability insurance, and long-term care insurance. These insurance plans can be tailored to meet the specific needs of individuals, depending on factors such as lifestyle, age, preferences, and marital status.

In conclusion, insurance is a financial good, a service, and a tangible asset that plays a crucial role in the financial services sector and individuals' financial plans.

Understanding Insurance Claims: Forwarding Doctor Bills

You may want to see also

Frequently asked questions

Yes, insurance is considered a financial service. It is one of the most common types of financial services, acting as a safety net for individuals and businesses against death, injury, property damage, and liability.

Examples of insurance as a financial service include health insurance, auto insurance, home insurance, renters insurance, and life insurance.

Financial services are economic services provided by financial institutions. These services include a broad range of activities, especially financial management and consumer finance.