Understanding your medical bills can be confusing, but it's important to know what to expect financially when you need to go to the doctor. After you visit your doctor, their office will submit a claim to your insurance company, listing the services provided to you. The insurance company will then pay your doctor for those services, and you will receive a report called an Explanation of Benefits (EOB) detailing what they did when they received the bill. This is not a bill, but it's important to read and understand the EOB to know what your insurance company is paying for, what it's not paying for, and why. You may then receive a bill from your doctor's office for any remaining balance due.

| Characteristics | Values |

|---|---|

| Who sends the bill to the insurance company? | The doctor's office or the hospital |

| When is the bill sent to the insurance company? | After the patient visits the doctor |

| What does the bill contain? | A list of services provided by the doctor |

| What does the insurance company do after receiving the bill? | Pays the doctor for the services provided |

| What happens after the insurance company pays the doctor? | The patient may need to pay the doctor any remaining balance due |

| What happens if the insurance company does not pay the doctor? | Contact the insurance company if more than 60 days have passed |

| What is sent to the patient after the insurance company pays the doctor? | A report called an Explanation of Benefits (EOB) |

| What does the EOB contain? | What the insurance company did when it received the doctor's bill |

| What is sent to the patient before the insurance company pays the doctor? | A statement from the doctor's office |

| What does the statement contain? | How much the doctor's office billed the insurance company for the services received |

| What happens if the patient receives a statement before the insurance company pays the doctor? | The patient does not need to pay the amounts listed at that time |

What You'll Learn

Understanding your medical bills

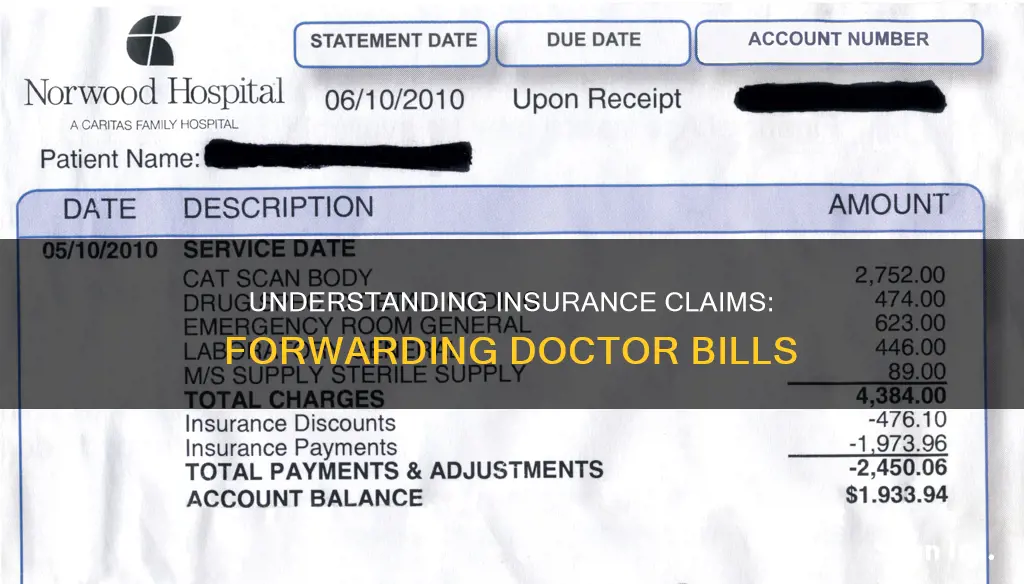

Step 1: Understand the Basics of Your Bill

Your medical bill will include several pieces of basic information:

- Statement Date: The date your healthcare provider printed the bill.

- Account Number: Your unique account number, which you'll need when contacting your healthcare provider about the bill.

- Service Date: The date you received each medical service.

- Description: A short phrase explaining the service or supplies you received.

- Charges: The full price of the services or supplies before insurance has been factored in.

- Billed Charges: The total amount charged to you or your insurance provider.

- Adjustment: The amount the healthcare provider has agreed not to charge.

- Insurance Payments: The amount your health insurance provider has paid.

- Patient Payments: The amount you are responsible for paying.

- Balance/Amount Due: The amount currently owed to the healthcare provider.

- Payable to: The organisation you should address cheque payments to.

Step 2: Understand the Codes on Your Bill

Your bill will also include several codes:

- Service Code: This identifies the specific services, procedures or supplies you received.

- CPT Codes: Current Procedural Terminology codes are five-digit codes that represent all the services a medical provider can give. These correspond with the Healthcare Common Procedure Coding System (HCPCS) codes used by Medicare.

- ICD Diagnostic Codes: International Classification of Diseases codes give clues about what you were tested for. There are two versions: ICD-9 and ICD-10.

Step 3: Compare Your Bill to Your EOB

An Explanation of Benefits (EOB) is a document sent by your insurance company after a claim has been submitted by your healthcare provider. It is not a bill, but it explains what your insurance company will pay for and what you are responsible for paying. Compare your bill to your EOB to ensure the information matches.

Step 4: Look Out for Common Errors

Medical billing errors are common, so scrutinise your bill carefully. Look out for:

- Incorrect quantities or duplicate charges.

- Charges for treatments, medication or procedures that were cancelled or that you didn't receive.

- Inflated surgery and recovery times.

- Charges for basic supplies like gloves or gowns.

- Incorrect room fees.

- Billing fraud, such as upcoding or unbundling.

Step 5: Take Action if Needed

If you spot an error on your bill, don't hesitate to contact your insurer and/or healthcare provider to dispute it. You may also need to contact a credit-reporting agency to ensure the error doesn't impact your credit score. If you're unable to resolve the issue, consider hiring a medical billing advocate.

The Intricacies of Physical Damage Insurance: Understanding Comprehensive Coverage

You may want to see also

What to do if you get a bill from the hospital or doctor

Step 1: Check the bill

Before taking any action, check the bill to see if it contains the words "insurance pending" or any other indication that the doctor or hospital has already submitted it to your insurance company. If so, you don't need to do anything else for now.

Step 2: Contact the doctor or hospital

If there is no indication that the bill has been sent to your insurance company, contact the doctor or hospital and ask them to bill your insurance provider. Provide them with the details from your insurance card or certificate. If they refuse to do this or are unable to, proceed to the next step.

Step 3: Fill out a reimbursement form

Fill out a reimbursement form and include an itemized statement, which is either the bill you received or a statement from the doctor's office/hospital if you paid the bill yourself. Fax or mail the form following the provided instructions. If you have already paid for your treatment, your insurance company or healthcare provider will reimburse you for the services covered under your claim. If you haven't paid yet, the insurance company will pay the doctor/hospital directly. Be sure to keep a copy of what you send for your records.

Other tips:

- If you have questions about your insurance coverage or the amount you have to pay, contact your insurance company.

- If you receive a bill from an out-of-network doctor, hospital, or healthcare provider that you weren't expecting, this is called "balance billing." Contact your health plan to ask why you received the bill and whether it is correct.

- Ask for an itemized bill and review it carefully to ensure you recognize and understand all the charges, dates, providers, and procedure codes.

- If you disagree with the charges or need more information, you have the right to appeal with your health insurance company, both internally and through an external review.

- If you still owe money on the bill, consider negotiating the bill down to an amount you can afford, asking about interest-free repayment plans, or seeking help from nonprofit organizations that provide financial assistance for medical bills.

The Mystery of "Cap" in Insurance: Unraveling the Industry's Unique Terminology

You may want to see also

The No Surprises Act

Under the NSA, if you have health insurance, you are protected from surprise billing for most emergency services, even if you receive them out-of-network and without prior authorization. The Act bans out-of-network cost-sharing for most emergency and some non-emergency services, meaning you can't be charged more than in-network cost-sharing for these services. It also bans out-of-network charges and balance bills for certain additional services, such as anesthesiology or radiology, provided by out-of-network providers as part of a patient's visit to an in-network facility.

The Act also establishes an independent dispute resolution process for payment disputes between plans and providers and provides new dispute resolution opportunities for uninsured and self-pay individuals when they receive a medical bill that is substantially higher than the good faith estimate they received from the provider.

If you don't have health insurance or choose not to use it for a particular service, the NSA ensures that you will usually get a good faith estimate of how much your care will cost before you receive it. If you are charged more than your good faith estimate, you may be able to dispute the charges.

The NSA also outlines a process for your insurance company and the provider to settle disputes over the provider's charges, ensuring a fair resolution. Additionally, the Act requires some healthcare facilities and providers to disclose federal and state patient protections against balance billing and sets forth complaint processes for violations of these protections.

The NSA is designed to address unexpected gaps in insurance coverage that result in surprise medical bills when patients unknowingly obtain medical services from physicians and providers outside their health insurance network. It is important to note that surprise medical bills can pose a significant financial burden on consumers when health plans deny out-of-network claims or apply higher out-of-network cost-sharing.

The Mystery of CH Insurance: Unraveling the Industry's Acronyms

You may want to see also

Cost-sharing agreements

A cost-sharing agreement is a legal agreement between business entities where the expenses incurred by one entity are allocated to another entity, usually for taxation or accounting purposes. Cost-sharing agreements are an essential tool for related parties to share costs related to the development of intangibles.

The IRS requires a cost-sharing agreement to be a Qualified Cost Sharing Agreement (QCSA) under Section 482 to be able to benefit from domestic rules. A QCSA must include two or more participants, provide a method to calculate each controlled participant's share of intangible development costs, provide for adjustments to be made to the controlled participants' shares of intangible development costs, and be recorded in a document that is contemporaneous with the formation of the cost-sharing agreement.

The US follows the OECD Guidelines when it comes to the practical administration of cost-sharing agreements. However, in the case of a conflict between Section 482 and the OECD Guidelines, the US would respect its obligations under the double tax treaty provisions.

Contributions to a cost-sharing agreement are treated as deductible tax expenses. Cost-sharing expenses that are often included in a cost-sharing agreement are lease payments, advertising and marketing, staff training and development, hiring, and things like office supplies. Expenses that cannot be included in cost-sharing agreements are insurance, parking costs, and any expense that solely benefits an individual party.

Accidental Death Benefit: Understanding the Extra Layer of Protection in Term Insurance

You may want to see also

Explanation of Benefits (EOB)

An Explanation of Benefits (EOB) is a statement from your health insurance company that outlines the costs of the healthcare services you received. It is generated when your healthcare provider submits a claim for the services you received. An EOB is not a bill, but it is an important tool that shows you how your bill is broken down between the medical service provider(s), your insurance, and you. It can help ensure you are receiving the full benefit or discount that you are entitled to under your insurance plan.

An EOB typically includes:

- A summary of your account information, including the patient's name, date(s), and claim number.

- A list of the dates the service was provided and a description of the service.

- The amount your insurance has agreed to pay per their contract with the provider/facility.

- The difference or discount between what the facility or provider charged and what your insurance paid.

- Details of any deductibles that have been applied according to your health plan.

- The amount of the total charges that insurance is paying toward the claim.

- The amount you may be responsible for paying.

It is important to note that not all insurance companies send EOBs, and you may receive a statement from your doctor's office instead. This statement will show how much your doctor's office billed your insurance company for the services you received. If you receive a statement before your insurance company pays your doctor, you do not need to pay the amounts listed. After your insurance company pays your doctor, you may need to pay your doctor any remaining balance.

The Role of an Insurance Broker: Navigating the Complex World of Insurance

You may want to see also

Frequently asked questions

Yes, you should forward your doctor bill to your insurance company. After you receive care, the medical facility will send a bill to your insurance company, who will then determine how much they will pay and how much you owe.

If you don't forward your bill, you may be responsible for the full amount of the bill. Contact your insurance company directly if you have any questions about what and how much was covered.

An EOB is a report sent by your insurance company that shows what they did when they received your doctor's bill. It outlines what they are paying for, what they are not, and why. It is not a bill.

A statement is sent by your doctor's office and shows how much they billed your insurance company for the services you received. You may receive a statement before your insurance company pays your doctor, but you do not need to pay the listed amounts at that time.

First, check if the bill contains the words "insurance pending" or any other indication that it has been submitted to your insurance company. If it has not, call the doctor and ask them to bill your insurance company. If they refuse or are unable to do so, you may need to fill out a reimbursement form and submit it to your insurance company.