CH Insurance is a commercial and personal insurance company based in Syracuse, New York. The company offers a range of insurance services, including workers' compensation insurance, data breach insurance, and a national home inspector's program. CH Insurance aims to provide 5-star customer service and is committed to identifying and fulfilling all aspects of insurance and employee benefits.

| Characteristics | Values |

|---|---|

| Company Name | CH Insurance |

| Location | Syracuse, Utica, Rochester, NY |

| Specialization | Commercial & Personal Insurance |

| Services | Workers' Compensation Insurance, Data Breach Insurance, National Home Inspector's Program, National Interpreter's Program |

What You'll Learn

Accident insurance

- Lack adequate health care coverage.

- Are the sole breadwinner in your family.

- Have children involved in sports.

- Lead an active lifestyle.

- Don't receive paid time off, sick days, or workers' compensation.

- Work in a high-risk profession.

- Ambulance care.

- Intensive care costs.

- Major diagnostic test and exam fees.

- Therapy and rehabilitation costs.

- Family support benefits.

- Hospital emergency room care.

- Urgent care center service.

- Lost wages from missing work.

- High health insurance deductibles.

- Unexpected medical expenses.

Understanding VGIL Term Insurance: A Comprehensive Guide to its Benefits and Features

You may want to see also

Health insurance

When purchasing health insurance, it is essential to consider factors such as waiting periods, coverage options, and renewal terms. For instance, senior citizens should opt for health insurance plans with shorter waiting periods due to the likelihood of pre-existing conditions. Additionally, including a no-claim bonus in the policy is advantageous as it accumulates over time and helps beat medical inflation.

In the United States, health insurance can be obtained through employers or directly from insurance providers. The government also offers health insurance programs such as Medicare and Medicaid for eligible individuals. When choosing a health insurance plan, it is important to understand the different types of coverage available, such as hospital and medical expense coverage, prescription drug coverage, and vision and dental care coverage.

Furthermore, health insurance policies typically include a deductible, which is the amount the insured person must pay out-of-pocket before the insurance company begins to cover the remaining costs. Additionally, co-insurance is another cost-sharing mechanism where the insured pays a specified percentage of the medical expenses, while the insurer covers the rest.

Overall, health insurance provides financial protection in the event of unexpected medical expenses and ensures access to necessary healthcare services. It is important to carefully review the terms, conditions, and exclusions of a health insurance policy to understand the extent of coverage and any limitations.

Term Insurance: Uncovering the Human Story Behind the Numbers

You may want to see also

Property insurance

Homeowners insurance is a type of property insurance that safeguards a homeowner's financial interests. It covers damage to the home and belongings, provides liability coverage, and may also include additional living expenses if the home becomes uninhabitable due to a covered loss. The coverage extends beyond the physical structure of the home, protecting items such as furniture, appliances, and clothing. It is worth noting that homeowners insurance does not typically cover flood damage, and separate flood insurance may be necessary for homes in flood-prone areas.

Renters insurance, on the other hand, is designed for tenants and covers their personal possessions within a rented residence. While it does not include structural coverage, it protects any affixed items installed or modified by the renter. Renters insurance also provides liability coverage for the tenant.

Additionally, property insurance can include specialised coverage for valuable items such as jewellery, fine arts, antiques, and sports equipment. This extra coverage ensures that these high-value possessions are protected in the event of damage, theft, or other insured perils.

When purchasing property insurance, it is essential to carefully review the policy to understand the specific coverages, exclusions, and limitations. Policyholders should also be mindful of deductibles, which represent the amount they need to pay before the insurance company covers the remaining costs of a claim.

The Unseen Hand: Understanding the Role of Insurance Producers

You may want to see also

Liability insurance

In addition to business liability insurance, there are other types of liability insurance that individuals may want to consider. Personal liability insurance, for example, can protect individuals if someone is injured on their property or if they accidentally damage someone else's property. This type of insurance is typically included in homeowners or renters insurance policies. Individuals may also want to consider umbrella insurance, which extends the liability coverage limits of their existing insurance policies.

The cost of liability insurance varies depending on several factors, including the type of business, the location, and the coverage limits. On average, general liability insurance costs around $67 per month or $805 per year. When selecting a liability insurance policy, it is recommended to choose a coverage limit that matches or exceeds your net worth to ensure adequate protection.

RH Insurance: Understanding the Whole Picture or Just a Term

You may want to see also

Life insurance

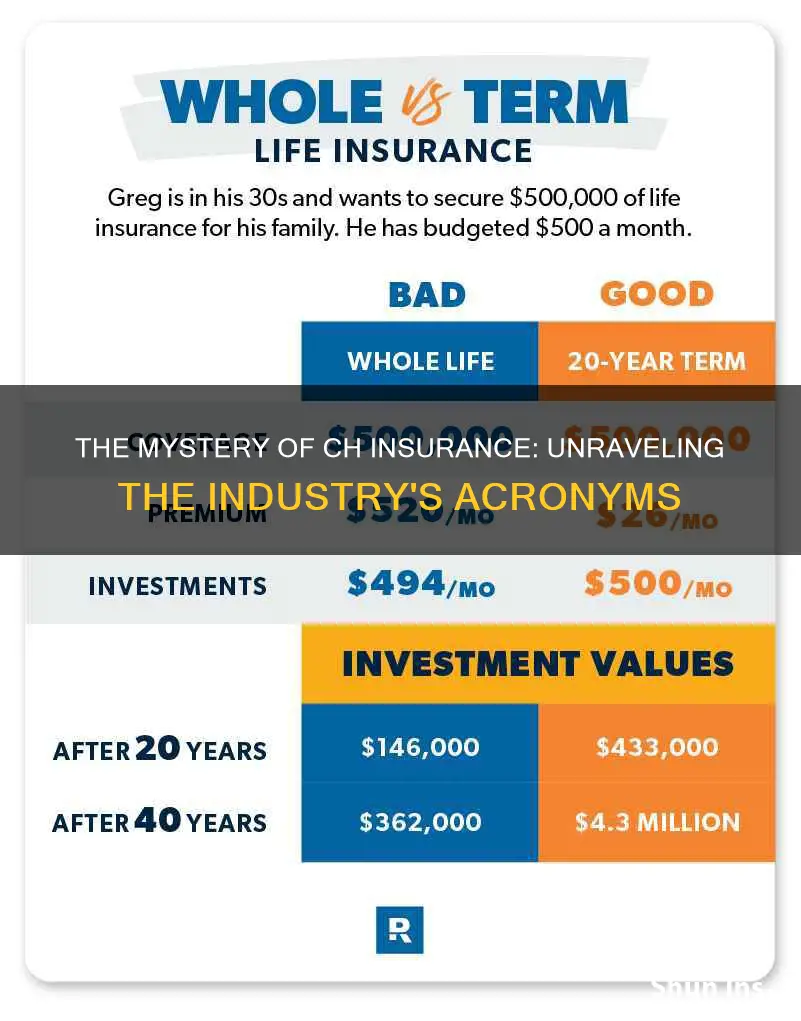

There are three types of life insurance: term life insurance, whole life insurance, and universal life insurance. Term life insurance covers a specific time period and provides financial help to the beneficiary. The benefit can help pay bills, future expenses, and even burial costs. Whole life insurance typically covers your lifetime and pays a benefit to the beneficiary upon the death of the insured. This policy may help with income replacement, supplemental income, and estate planning. Universal life insurance typically covers your lifetime and offers an optional fund that you can contribute to above and beyond your regular life insurance. The side cash fund can build over time.

The cost of life insurance depends on several factors, such as age, medical history, and lifestyle. The coverage amount and policy type also play a significant role in determining life insurance costs. Generally, the younger you are when you buy your policy, the lower your premium will be. It's recommended that you review your life insurance policy annually or whenever you experience major life events such as marriage, the birth of a child, or a significant change in your financial situation.

Term Insurance: Unraveling the Myth of Solely Death Benefits

You may want to see also