Veterans' Group Life Insurance (VGLI) is a type of group term life insurance offered to former members of the military. It allows them to keep their term insurance for life as long as they pay the premiums. VGLI is a continuation of the Servicemembers' Group Life Insurance (SGLI) coverage offered to active military personnel. This means that to qualify for VGLI, one must have had SGLI coverage at the time of discharge. VGLI offers death benefits ranging from $10,000 to $500,000, with premiums based on age and the amount of coverage. Unlike level term life insurance policies, VGLI premiums increase with age.

| Characteristics | Values |

|---|---|

| Coverage | $10,000 to $500,000 in term life insurance benefits |

| Eligibility | Former members of the military who had SGLI coverage at the time of discharge |

| Application Period | 1 year and 120 days from discharge or separation |

| Medical Exam Required | No, if applied within 240 days of discharge; Yes, if applied after 240 days |

| Premiums | Based on age and amount of coverage; increase as the insured ages |

| Premium Payment Frequency | Monthly, quarterly, semi-annually, or annually |

| Premium Discount | 5% discount for annual payments |

| Payment Methods | Automatic deduction from military retirement pay, VA compensation payment, bank account, credit card |

| Membership Fees | None |

| Coverage End Age | No specific end age; coverage continues as long as premiums are paid |

| Coverage Decrease | No decrease unless requested by the insured |

| Conversion to Commercial Policy | Allowed at any time; must be a permanent policy like whole life insurance |

| Accelerated Death Benefit | Yes, up to 50% of the coverage amount for terminal illness |

What You'll Learn

VGLI Eligibility Requirements

Veterans' Group Life Insurance (VGLI) is a term life insurance policy offered to those who were enrolled in Servicemembers' Group Life Insurance (SGLI) while serving in uniform. VGLI is available to retiring and separating military members as replacement coverage.

To be eligible for VGLI, you must meet at least one of the following requirements:

- You had part-time Servicemembers' Group Life Insurance (SGLI) as a member of the National Guard or Reserve and suffered an injury or disability while on duty—including direct travel to and from duty—that disqualified you for standard premium insurance rates.

- You had SGLI while in the military and are within one year and 120 days of being released from an active-duty period of 31 or more days. Note that this period was extended to one year and 210 days during the COVID-19 pandemic.

- You are within one year and 120 days of retiring or being released from the Ready Reserve or National Guard.

- You are within one year and 120 days of assignment to the Individual Ready Reserve (IRR) or the Inactive National Guard (ING). This includes members of the United States Public Health Service Inactive Reserve Corps (IRC).

- You are within one year and 120 days of being put on the Temporary Disability Retirement List (TDRL).

If you meet any of these requirements, you can apply for VGLI through the Office of Servicemembers' Group Life Insurance (OSGLI) or directly via the Prudential website. You can also apply by mail or fax using the Application for Veterans' Group Life Insurance (SGLV 8714).

The Surprising Benefits of Term Insurance: Unlocking Peace of Mind

You may want to see also

VGLI Coverage Amounts

Veterans' Group Life Insurance (VGLI) provides an opportunity for eligible applicants to switch coverage to a renewable term policy of insurance protection after a service member's end of service. The maximum coverage amount is $400,000, issued in $10,000 increments up to the amount of Servicemembers' Group Life Insurance (SGLI) the member had in force at the time of separation. VGLI premiums are based on the age of the separating member.

For those insured for less than $400,000, additional increments of $25,000 of coverage can be purchased after the first year of coverage and then every five years until the age of 60. This flexibility allows veterans to adjust their coverage as their needs change. It is important to note that VGLI rates increase every five years, so budgeting for these costs is crucial.

The application process for VGLI is straightforward. To qualify, individuals must apply within one year and 120 days of leaving the military. If the application is submitted within 240 days of separation, no proof of good health is required. However, if the application is made after this 240-day period, medical details must be provided to demonstrate good health.

VGLI offers guaranteed acceptance for eligible veterans, and there is no medical exam required during the 240-day application period. The death benefit remains the same unless requested otherwise and stays in force as long as premiums are paid. Additionally, VGLI policies include an accelerated death benefit, allowing access to a portion of the policy's payout if the insured becomes terminally ill.

While VGLI provides valuable coverage, it is important to consider the pros and cons. The rates for older veterans can be relatively high compared to standard term life rates, and VGLI offers only term life insurance without the option for a permanent policy. The coverage amounts may also be considered low, with a maximum death benefit of $500,000.

In conclusion, VGLI provides eligible veterans with the opportunity to maintain life insurance coverage after their military service. The coverage amounts range from $10,000 to $500,000, and premiums are based on age and coverage amount. It is essential to carefully consider the benefits and drawbacks of VGLI before making a decision regarding life insurance coverage.

Understanding Term Insurance: A Guide to This Essential Coverage

You may want to see also

VGLI Premiums and Costs

Veterans' Group Life Insurance (VGLI) is a type of group term life insurance offered to former members of the military. It is a continuation of the Servicemembers' Group Life Insurance (SGLI) coverage offered to active military personnel. VGLI helps eligible applicants switch their coverage to a renewable term policy after their military service ends.

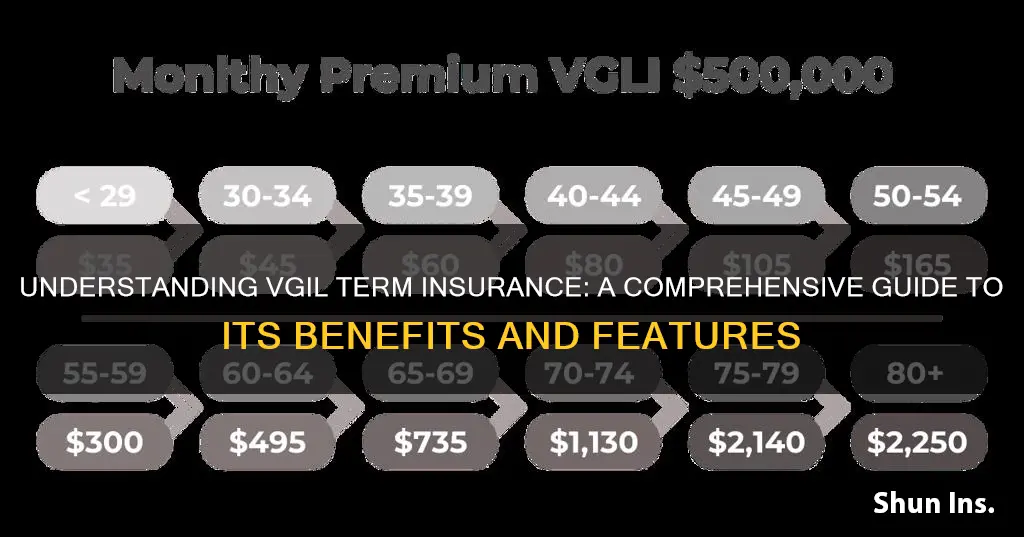

VGLI premium rates are based on the age of the veteran and the amount of insurance coverage desired. The rates increase as the insured person ages and vary depending on the death benefit selected. The lowest prices are offered to applicants younger than 30, with rates increasing every five years until age 80, when they top out.

For example, a $100,000 policy would cost $12 a month at age 35, but the same coverage would cost $60 a month at age 55. The monthly premium for $500,000 of coverage at age 30 is $45, increasing to $165 per month by age 50.

VGLI premiums are generally more expensive than SGLI, and they increase with age. While VGLI may be a good option for younger veterans, it can become costly for older individuals.

It is important to note that VGLI does not build cash value, and there are no permanent policy options. Additionally, VGLI has a relatively low death benefit cap of $400,000 to $500,000, depending on the source.

To avoid higher costs, it is recommended to continue an existing VGLI policy into retirement rather than dropping it and signing up for an individual plan.

Understanding the Tax Implications of Term Insurance: A Comprehensive Guide

You may want to see also

VGLI Conversion Options

Veterans' Group Life Insurance (VGLI) is a popular choice of life insurance for veterans. It allows them to retain their life insurance coverage after leaving the military. However, there are certain VGLI conversion options to be aware of.

Converting SGLI to VGLI

Servicemembers Group Life Insurance (SGLI) coverage can be converted to VGLI within a specific timeframe. This option is ideal for those who may have a medical condition that makes obtaining a commercial life insurance policy challenging or costly.

To convert SGLI to VGLI, you must apply within one year and 120 days from discharge. If you apply within 240 days of discharge, you are not required to submit evidence of good health. However, if you apply after this period, you must provide proof of good health through a doctor's examination.

The conversion process can be done online using the VA's online application, which instantly evaluates your application and provides a decision. Alternatively, you can apply via mail using form SGLV 8714, along with the first month's premium and proof of service.

Converting VGLI Coverage to a Commercial Policy

VGLI policyholders can convert their coverage to a commercial insurance policy at any time. To do so, they must select a company from the list of participating companies, apply to a local sales office, and obtain a letter from OSGLI verifying coverage (VGLI Conversion Notice).

It's important to note that the conversion policy must be a permanent policy, such as whole life insurance. Other types of policies, such as term, variable life, or universal life insurance, are not allowed. Additionally, supplementary policy benefits, such as Accidental Death and Dismemberment or Waiver of Premium for Disability, are not included in the conversion.

Spousal SGLI Conversion

Spouses insured under the Family SGLI program can convert their coverage to an individual policy within 120 days of specific events, including the servicemember's separation, divorce, or election to terminate spousal coverage.

To convert, spouses must select a company from the participating companies list, apply to a local sales office, and provide relevant documentation, such as the servicemember's separation document or proof of divorce.

In summary, VGLI provides valuable conversion options for both servicemembers and their spouses. These options offer flexibility and continued coverage as individuals transition from military to civilian life.

Understanding BICE Calculations and Their Impact on Term Insurance Policies

You may want to see also

VGLI Benefits

Veterans' Group Life Insurance (VGLI) is a form of term life insurance for veterans. It allows veterans to continue their Servicemembers' Group Life Insurance (SGLI) coverage after they separate from military service. Here are some key benefits of VGLI:

Continuation of Coverage

VGLI enables veterans to seamlessly continue their life insurance coverage after leaving the military, providing uninterrupted protection for themselves and their families. This is especially beneficial for those who may have health issues that would otherwise make obtaining new insurance difficult or costly.

Guaranteed Eligibility for Veterans

Eligible veterans cannot be turned down for VGLI coverage. As long as they meet certain requirements, such as having SGLI coverage while in the military and applying within the specified time frame after separation, they are guaranteed to receive VGLI coverage.

No Medical Exam Required

If veterans apply for VGLI within 240 days of leaving the military, they are not required to undergo a medical examination or provide proof of good health. This makes the transition to VGLI convenient and accessible, even for those with health issues.

Flexible Coverage Amounts

VGLI offers flexible coverage amounts ranging from $10,000 to $500,000 in term life insurance benefits. The amount is based on the veteran's previous SGLI coverage, with the option to increase coverage by $25,000 every five years up to a maximum of $500,000.

Accelerated Benefit Option

VGLI includes an Accelerated Benefit Option (ABO) that allows terminally ill insureds to access a portion of their death benefit while still living. If the insured has a valid prognosis from a physician stating they have nine months or fewer to live, they can receive a lump-sum payment of up to 50% of the policy's face value.

Conversion to Civilian Policy

VGLI policies can be converted into civilian life insurance policies at any time without providing proof of good health. This flexibility allows veterans to maintain continuous coverage and choose from a range of participating commercial insurance companies.

Competitive Rates for Veterans

VGLI premiums are calculated based on age, and veterans with risk factors or pre-existing medical conditions may find VGLI rates more favourable than those offered by private insurers. However, it's important to note that VGLI premiums increase with age and every five years.

Supplemental Insurance: Understanding Its Role and Relationship with Short-Term Coverage

You may want to see also

Frequently asked questions

VGLI is a type of group term life insurance offered to former members of the military. It allows them to keep their term insurance for life as long as they pay the premiums.

To qualify for VGLI, you must have participated in Servicemembers' Group Life Insurance (SGLI) during your military service and apply for VGLI within one year and 120 days of leaving the service.

VGLI rates are determined by your age and the value of the death benefit you select. The monthly premiums increase every five years until the age of 80.

You can sign up for VGLI through the Office of Servicemembers' Group Life Insurance (OSGLI) online, by mail, or by fax. You must apply within one year and 120 days of leaving the military, and within 240 days to avoid a health screening.