Auto insurance is designed to protect your car against damage and could help pay medical bills if you’re injured in a car accident. You pay a monthly fee for this safety net, just like you do for disability income insurance, which provides protection if you’re unable to work due to an illness or injury. While disability income insurance focuses on protecting your income, auto insurance does not verify income for disability. Instead, auto insurance companies are more concerned with safety risks and vehicle modifications when determining insurance rates for individuals with disabilities.

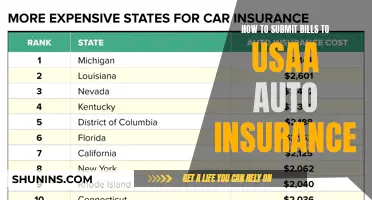

| Characteristics | Values |

|---|---|

| Type of insurance | Disability income insurance |

| Who is it for? | People who are unable to work due to sickness, injury, or other disorders |

| What does it cover? | Lost income, mortgage or rent, car loans, and other monthly expenses |

| When does it apply? | When the insured is unable to work due to a covered illness or injury |

| How long does it last? | Short-term or long-term |

| Are there any exclusions? | Disability benefits may not be available in certain states or may need to be modified to comply with state law |

| Cost | Premiums are based on chosen benefits; multiple elimination periods are available |

| Other features | 24-hour coverage, guaranteed renewable until age 67, no reduction in base coverage amount |

What You'll Learn

Disability insurance and income protection

Disability insurance, also known as disability income insurance (DI) or income protection, is a financial safety net that replaces a portion of your income if a serious illness, injury, or accident prevents you from working. It is designed to protect your income and help cover your living expenses, such as mortgage or rent payments, groceries, and other bills.

Disability income insurance is available through employers, the Social Security Administration, or private insurance companies. Most employers provide some form of disability insurance as part of their benefits packages, typically covering about 60% of the employee's income. This type of coverage is known as group insurance. However, it is important to note that this coverage may not be sufficient, and individuals may consider purchasing additional disability income insurance to supplement their existing coverage.

Disability income insurance policies pay benefits on a monthly basis, usually after a waiting period. The waiting period, also known as the elimination period, varies but is commonly around 90 days. The cost of disability income insurance depends on factors such as age, occupation, and income. Premiums are generally between 1% and 3% of an individual's gross income, with higher-risk occupations resulting in higher premiums.

There are two types of disability income insurance: short-term and long-term. Short-term disability insurance provides coverage for a shorter period, typically up to two years, and has a shorter waiting period. Long-term disability insurance covers more extended or lifelong events and usually kicks in after short-term benefits have been exhausted.

Disability insurance is an important tool to protect your financial well-being and maintain your standard of living if you become unable to work due to illness or injury. It ensures that you can continue to meet your financial obligations and provides peace of mind during challenging times.

Florida's Vehicle Insurance Law Explained

You may want to see also

Auto insurance and disability discrimination

Auto insurance companies in the US can discriminate based on disability , which affects one in four adults, if there is a greater insurance risk because of the disability. This means they can use a person's disability to decide whether to offer insurance and on what terms. However, they must base their risk assessments on reliable and relevant sources of information, such as statistics. If a person believes that a risk assessment is not based on reliable or relevant information, they can challenge the insurance provider.

Insurance providers are not allowed to have blanket policies of refusing to provide insurance or only providing insurance on certain terms to disabled people. This would be unlawful discrimination under the Equality Act. For example, an insurance company can accept to provide car insurance to a person with cancer (which counts as a disability under the Equality Act) but only if the person pays a higher premium than other drivers. The insurance company is allowed to do this, but only if they can show that there is a greater risk in insuring the person because of their disability. They would have to base their decision on the person's actual health condition and objective information about cancer. Also, they must not have a general policy to charge people with cancer more as this would be unlawful discrimination.

In the UK, disability discrimination in auto insurance is prohibited under the Disability Discrimination Act 2005, which aims to guarantee access to goods, facilities, and services. However, some insurers have been accused of exploiting a loophole designed to exclude boy racers with heavily modified cars to refuse cover to people with disabilities. A search of policies offered by 115 insurers and brokers on the price comparison website Moneysupermarket.com found only one willing to offer cover to a disabled driver with 25 years of experience and a five-year no-claims bonus. Many others declined to quote or said they were not prepared to quote on a vehicle with "modifications," despite being told that these involved a wheelchair ramp and hand controls.

Some disability insurers in the UK, such as Fish Insurance, specialise in providing cover for people with disabilities. Warren Dickson, marketing director at Fish Insurance, stated that people with disabilities are generally better risks than many other groups of motorists. Similarly, Nigel Bartram, underwriting strategy manager at Aviva, said that loading premiums for disabilities is only allowed if it can be proven that a disabled person is a worse risk than other drivers, but they have found that every type of motorist adapts to their own situation.

To address auto insurance discrimination, state and federal lawmakers and industry watchdogs in the US are calling for reforms to limit or eliminate discriminatory practices. For example, the Prohibit Auto Insurance Discrimination Act (PAID Act) and the Preventing Credit Score Discrimination in Auto Insurance Act were introduced in the US House of Representatives and Senate to combat car insurance price discrimination.

Florida's Digital Car Insurance and Registration

You may want to see also

Disability insurance and tax credits

Disability insurance is a lot like car insurance. Auto insurance is designed to protect your car against damage and could help pay medical bills if you’re injured in a car accident. Similarly, disability insurance provides income protection if you’re unable to work due to an illness or injury. It acts as a safety net, helping you pay your mortgage or rent, buy groceries, and meet other ongoing living expenses.

Disability insurance is particularly important because, in 2019, less than one percent of American workers missed work because of an occupational illness or injury. This means that many people who become unable to work due to disability may not be covered by workers' compensation.

Disability insurance can be short-term or long-term. Short-term disability insurance provides funds to help with monthly debt obligations like car loans, mortgage, rent, and credit cards, or to help replace lost income if you become disabled. Long-term disability insurance provides funds to help replace lost income if you become disabled.

Disability income may be taxable, depending on the type of disability income. You don’t need to pay income tax on SSI benefits or VA disability benefits, but you do need to pay tax on SSDI income if you earn more than a certain amount. Workers’ comp payments aren’t taxable, including settlements.

If you receive disability income, you may be eligible for certain tax credits. These include:

- The Credit for the Elderly or the Disabled tax credit: This credit is available to citizens and residents aged 65 or older at any time during the tax year. Taxpayers who are under 65 years of age can still claim the tax credit if they are retired on permanent and total disability, or if they receive taxable disability income during the year and do not reach the mandatory retirement age by the first day of the tax year.

- The Earned Income Tax Credit (EITC): Taxpayers with disabilities can qualify for the EITC if they have earned income and it falls within certain limits. If you have no children, the income limit is $17,640 for single filers and $24,210 for married couples filing jointly. The EITC is worth up to $600 if you have no children.

- The Child Tax Credit (CTC): The CTC is available for all parents who meet the income requirements and have a qualifying child, including children with disabilities. The maximum credit is worth up to $2,000 per child.

- The Additional Child Tax Credit (ACTC): If you qualify for the CTC but your credit amount is worth more than the total tax you owe for the year, then you can qualify for the ACTC. While the CTC isn’t refundable, the ACTC allows you to get any excess up to $1,600.

Auto Insurance Certificate Holder: Who and Why?

You may want to see also

Disability insurance and retirement benefits

Disability insurance is a way to protect your income in the event that you become unable to work due to injury or illness. It is similar to car insurance in that you pay a monthly fee for a safety net. This safety net ensures you can continue to pay your mortgage or rent, buy groceries, and meet other ongoing living expenses.

Disability income insurance can provide an income while you are disabled from sickness, injury, or other disorders as stated in the policy, even if workers' compensation and Social Security benefits don't apply. For example, if you are injured in a car accident, auto insurance will help pay medical bills, but disability insurance will provide an income while you recover and are unable to work.

There are two types of disability insurance: long-term and short-term. Long-term disability insurance provides funds to replace lost income if you become disabled for a prolonged period. Short-term disability insurance helps with monthly debt obligations and lost income for a shorter period.

In the United States, Social Security Disability Insurance (SSDI) is available for those who have worked in jobs covered by Social Security and have a medical condition that meets the strict definition of disability. SSDI benefits are paid monthly to those unable to work for a year or more due to their disability, and these benefits continue until the recipient can work again regularly. If you are receiving SSDI benefits when you reach full retirement age, your disability benefits will automatically convert to retirement benefits, but the amount remains unchanged.

Switching Auto Insurance After a Claim

You may want to see also

Short-term vs. long-term disability insurance

Short-term and long-term disability insurance are both designed to protect an employee's income in the event of illness or injury. However, they differ in terms of coverage length, elimination period, and the types of conditions they cover.

Coverage Length

Short-term disability insurance provides coverage for a shorter period, typically ranging from a few weeks to 12 months. On the other hand, long-term disability insurance offers coverage for an extended duration, usually ranging from two years to ten years or even longer in some cases.

Elimination Period

The elimination period, or waiting period, refers to the time between the onset of disability and the start of benefit payments. Short-term disability insurance has a shorter elimination period, typically ranging from 7 to 30 days, with 14 days being the most common. In contrast, the elimination period for long-term disability insurance is longer, usually lasting 90 days or more.

Types of Conditions Covered

Short-term disability insurance covers temporary disabilities that prevent an employee from performing their specific job duties. Examples include surgery rehabilitation, injuries, pregnancy, and severe illnesses. On the other hand, long-term disability insurance covers more serious and long-lasting conditions that prevent an individual from performing any job, not just their current one. Qualifying conditions for long-term disability insurance include cancer, mental illness, arthritis, back problems, stroke, and other debilitating illnesses or injuries.

Cost

Both short-term and long-term disability insurance typically cost between 1% to 3% of the employee's pre-tax salary.

Suitability

Short-term disability insurance is suitable for situations where an employee is temporarily unable to work but is expected to recover and return to work. On the other hand, long-term disability insurance is designed for more serious and long-lasting conditions that will keep an individual out of work for an extended period or even permanently.

Saskatchewan Vehicle Insurance GST Status

You may want to see also

Frequently asked questions

Disability income insurance provides benefits to replace lost income when a person becomes unable to work due to illness and/or injury.

Disability income insurance is similar to car insurance. You pay a monthly fee for a safety net, just like you do for individual disability income insurance, which provides protection if you’re unable to work due to an illness or injury.

Disability insurance covers monthly expenses such as your mortgage, rent, car loans, and credit card payments. It may also help prevent using your retirement or education savings if you can't work.

There are two main types of disability insurance: long-term disability insurance and short-term disability insurance. Long-term disability insurance provides funds to replace lost income if you become disabled for an extended period. Short-term disability insurance helps with monthly debt obligations and replaces lost income for a shorter duration.