Life insurance is a profitable business, with top insurers reporting billions in profits annually. But how do they make money? Life insurance companies make money in three main ways: profiting from premium payments, investing those premiums, and through lapsed policies. When you take out a life insurance policy, you complete an application and start paying premiums to the insurance company, who then pays out a death benefit to your beneficiaries when you pass away. The insurance company calculates your premium based on your mortality risk, which is determined by factors such as your health and lifestyle. This allows them to charge you a premium that covers their liabilities and ideally makes them a profit.

What You'll Learn

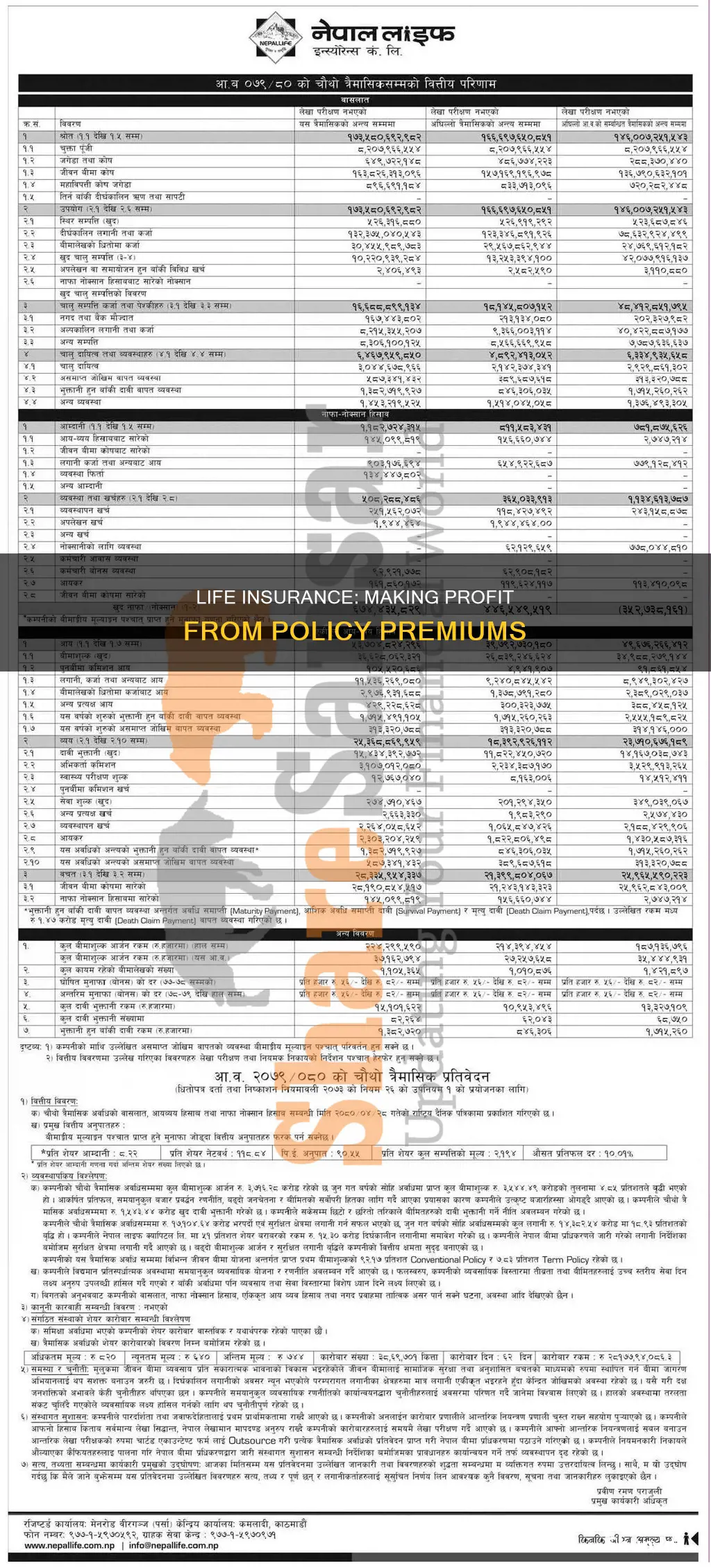

Profiting from premium payments

Life insurance companies make money in two main ways: profiting from premium payments and investing those premiums. Premium payments are calculated based on advanced statistics and probability, taking into account an individual's health conditions, habits, and other risk factors. This process, called underwriting, helps insurance companies determine an individual's mortality risk and set their premium rate. The higher the mortality risk, the higher the premium rate.

Insurance companies employ thousands of actuaries who calculate the financial costs of the risks the company takes on. Actuaries use statistical data to create and modify mortality tables that underwriters use to set premiums for specific individuals based on their health conditions. This process ensures that the company charges its customers enough in premiums to cover its liabilities and make a profit.

In addition to charging premiums, life insurance companies may also profit from policy loans. Policyholders can borrow against the cash value of their policy, and the insurance company keeps some of the proceeds. This provides a source of income for the insurance company and allows policyholders to access funds at a lower interest rate than traditional loans.

While profiting directly from premiums is one way that life insurance companies make money, investing premium revenues can result in even greater profits. Insurance companies invest premium revenues in stocks, bonds, real estate, and other types of investments. The income generated from these investments can be substantial, often contributing a significant portion of total revenues and profits for life insurance companies.

In summary, life insurance companies profit from premium payments by carefully calculating and setting premiums based on an individual's mortality risk, as well as by offering policy loans and investing premium revenues in various financial markets. These strategies help ensure the company's profitability and ability to continue paying out claims.

Life Insurance: Haven's Affiliate Program Explained

You may want to see also

Investing premium revenues

Life insurance companies make money by investing the premium revenues in stocks, bonds, and other types of investments. The income generated from investing premiums is a significant contributor to their profits. With access to large amounts of money and experienced investment advisors, insurance carriers can invest in a wide range of financial markets to generate high returns.

The investment income from premium revenues is substantial, making up $186 billion of revenue for the life/annuity insurance industry in 2020, compared to $143.1 billion from life insurance premiums. This income is generated by investing a portion of each premium in the insurer's "general account," which primarily includes fixed-income securities like bonds and other investments such as stocks and real estate holdings.

Permanent life insurance policies, such as universal and whole life, contain a cash value account that accumulates over time and can be used to offset the increasing cost of insurance as the policyholder ages. This cash value component is then invested by the insurer, allowing both the insurer and the policyholder to make money. The money earned by the general account, along with the type of policy and account expenses, determines the interest credited to the policyholder's cash-value account.

However, it is important to note that cash values in variable life insurance policies are not invested in the insurer's general pool of cash reserves. Instead, they are invested in mutual fund subaccounts offered within each policy, allowing policyholders to select and manage their investments. This approach carries more risk, including the possibility of losing cash value, but also offers the potential for higher returns.

The ability to generate income by investing premium revenues is a significant advantage for life insurance companies, contributing to their profitability and ability to stay in business while continuing to pay out claims.

Cashing a $5,000 Life Insurance Check: What You Need to Know

You may want to see also

Lapsed policies

The repercussions of a lapsed policy vary depending on the type of insurance. Term life insurance policies typically have no cash value, so once a payment is missed, the policy enters a grace period, after which it lapses. Permanent life insurance policies, on the other hand, often have a cash value component that can be used to cover premium payments, at least temporarily.

Policyholders can sometimes reinstate a lapsed policy by meeting certain requirements, such as providing evidence of insurability or undergoing a new medical exam. Reinstating a policy will usually require paying all back premiums and penalties.

The overall annual policy lapse rate between 2009 and 2013 was 4.0%, with a higher rate of 6.2% for term policies.

Business Life Insurance: A Funding Tool for Entrepreneurs?

You may want to see also

Using it as a retirement vehicle

Life insurance policies, especially universal and whole life insurance, can be used as a retirement vehicle. Here are some ways to use life insurance as a retirement planning tool:

Policy Loans

You can borrow against your policy's cash value at a lower interest rate than traditional loans. This can be used for various purposes, such as purchasing a car or taking a vacation. The money borrowed can also be invested to generate additional income.

Cash Value Growth

By purchasing a policy that accumulates cash value, you can allow the cash value to grow over time and use these funds to supplement your income during retirement. Whole life insurance policies are permanent and have a cash value that increases over time. The premium will always stay the same, unlike term life insurance, which must be renewed at a higher rate. With each premium payment, a portion goes towards building tax-deferred cash value, which can grow to a substantial sum over time.

Tax-Free Death Benefit

The death benefit from a life insurance policy is typically paid to beneficiaries tax-free. This can be used to cover funeral costs, debts, and estate taxes, ensuring your loved ones are not burdened with these expenses.

Dividends

If you purchase whole life insurance from a mutual company, you become a partial owner of the company and may be entitled to dividends. These dividends can be disbursed as cash payouts, used to pay insurance premiums, or reinvested into the policy to increase the cash value and death benefit.

Stability and Emergency Fund

Whole life insurance can add stability to your financial portfolio, as it is not subject to stock market volatility or interest rate fluctuations. The guaranteed growth of whole life insurance can also allow you to take on other higher-risk retirement investments, potentially resulting in higher returns. Additionally, the cash value of whole life insurance can serve as an emergency fund in times of need, allowing you to avoid selling other investments that may have temporarily decreased in value.

1035 Exchange for an Annuity

You can trade your life insurance policy for an annuity without incurring taxes through a 1035 exchange. This option provides flexibility and allows you to take advantage of the guaranteed income that annuities offer in retirement.

Cigna Life Insurance: Depression History and Rejection Risk

You may want to see also

Selling it as an investment

Selling life insurance as an investment is a popular way to make money. There are several types of life insurance that can be sold as investments, including whole life insurance, universal life insurance, and term life insurance. These are called life settlements. Here's how they work:

Whole Life Insurance: Whole life insurance policies have a cash value that increases over time. The cash value can be accessed by the policyholder during their lifetime through withdrawals, loans, or by surrendering the policy. The cash value provides the policy owner with a pot of tax-free money and also lowers the insurer's risk. While whole life insurance offers predictability, it lacks flexibility and limits the growth potential of the cash value.

Universal Life Insurance: Universal life insurance policies offer both cash value and death benefit protection. They allow the policyholder to adjust their premium and death benefit within certain limits. The cash value grows based on market interest rates, so the return can vary from year to year. Universal life insurance provides flexibility but requires careful management to ensure the policy stays properly funded.

Term Life Insurance: Term life insurance only provides death benefit protection and does not accumulate cash value. It is much cheaper than permanent life insurance and is suitable for those who want coverage for a limited period. Term life insurance is the purest form of life insurance, focusing solely on paying the death benefit.

When selling life insurance as an investment, you earn a commission. The size of the commission depends on the type of policy and the company you are selling it for. Life insurance companies also profit from investing the premiums received from these policies. They invest in stocks, bonds, real estate, and other types of investments to generate high returns and maximize profits.

By offering these types of life insurance as investments, companies can attract customers looking for financial security and growth, while also generating profits for themselves through premiums and investments.

Life Insurance Options for Canadians Living with Cancer

You may want to see also

Frequently asked questions

Life insurance companies make a profit in three main ways: profiting from insurance premiums, investing premium dollars, and through lapsed policies.

Insurance companies employ actuaries who calculate the financial costs of the risks they face. They use this information to determine premiums charged to specific insured people. This allows the company to know how much to charge in premiums to cover its liabilities and make a profit.

A portion of each premium goes into a cash-value account, which is then invested in stocks, bonds, real estate, and other types of investments. The insurance company keeps some of the proceeds, and the money that the account earns determines how much interest is credited to policyholders' cash-value accounts.

When a policy lapses, it is no longer a liability for the insurance company, and they do not have to pay out a death benefit. While policies that lapse represent lost revenue, they can still be a source of profit for insurers.