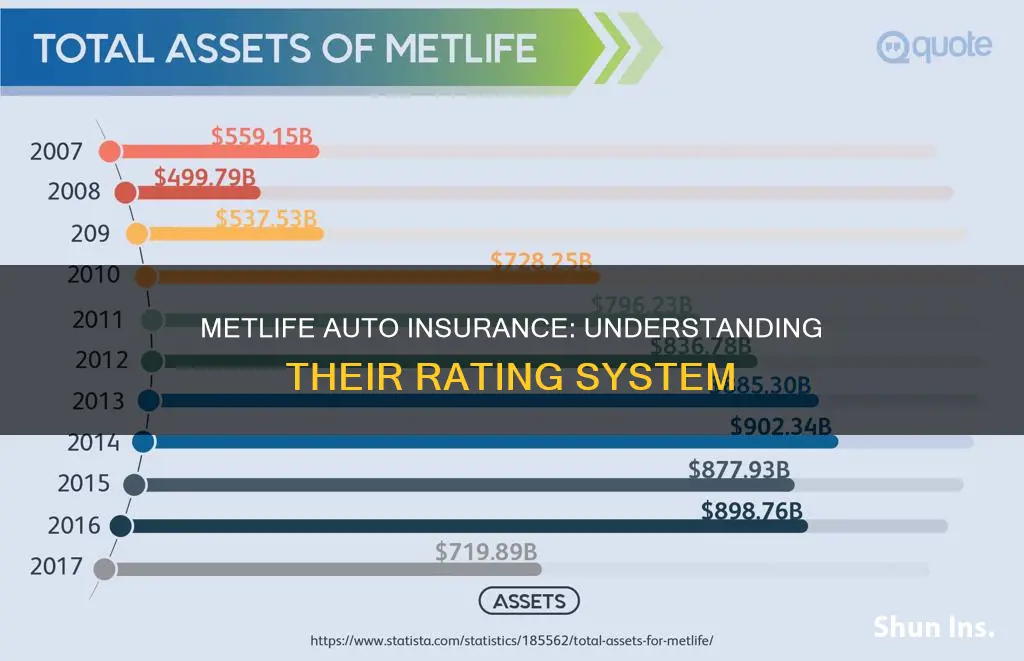

MetLife offers auto insurance with highly customisable policies, affordable rates, and special discounts, including workplace deals. The company provides insurance through its website and via some employers. MetLife's auto insurance rates depend on several variables, including the driver's age, location, and driving record. The company offers rates that are slightly cheaper than some other providers, but overall, its rates can be fairly high without discounts, averaging about $486 for six-month coverage without add-ons. MetLife has an average customer satisfaction rating and an above-average score for complaints. Its policies are typically more expensive compared to other providers, resulting in a below-average affordability rating.

| Characteristics | Values |

|---|---|

| Customer satisfaction rating | 817 out of 1,000 points |

| Customer complaint ratio | 0.89 |

| Average annual cost | $1,686 |

| Average six-month cost | $486 |

| Available in | 44 states |

| Add-ons | New car replacement, OEM coverage, custom parts coverage, glass deductible modification coverage, roadside assistance, rental car reimbursement, accident forgiveness, etc. |

| Discounts | Bundling, multiple car, defensive driving, good student, safe driving, anti-theft system, pay in full, paperless billing, no late fees for 12 months, safe driving course for those 55 or older, etc. |

| Coverage | Liability insurance, collision insurance, comprehensive insurance, etc. |

What You'll Learn

- MetLife's auto insurance rates depend on factors like the driver's age, location, and driving record

- MetLife's rates are generally high, but young drivers may benefit from its policies

- MetLife offers a wide range of discounts to lower auto insurance costs

- MetLife's customer service and satisfaction ratings are average or below average

- MetLife's auto insurance covers basics like liability and collision protection, as well as add-ons

MetLife's auto insurance rates depend on factors like the driver's age, location, and driving record

MetLife's auto insurance rates depend on several factors, including the driver's age, location, and driving record. The company offers policies through Farmers Insurance and is available in 44 states.

MetLife's rates can be relatively high, especially for full coverage, minimum coverage, or a speeding violation. However, for young drivers, MetLife's rates are more moderate. The company offers various discounts to help lower costs, such as bundling, multiple cars, defensive driving, good student, safe driving, and anti-theft systems.

When determining auto insurance rates, insurance companies consider various factors, including age, driving record, address, vehicle type, and more. MetLife's rates are influenced by these factors, and the company uses a unique 17-digit vehicle identification number (VIN) to validate specific vehicles and provide accurate quotes, including applicable discounts.

In addition to standard coverage options like liability, collision, and comprehensive insurance, MetLife offers add-on coverages such as roadside assistance, rental car reimbursement, accident forgiveness, and new car replacement. MetLife also provides special coverage options like legal defence coverage, sound system coverage, and identity theft coverage.

Can Do Auto Insurance: Boise, Idaho's Best

You may want to see also

MetLife's rates are generally high, but young drivers may benefit from its policies

MetLife's auto insurance rates are generally high, with the company receiving a low MoneyGeek score of 60 out of 100. However, its rates for young drivers are moderate, and it offers various discounts that can make its policies more affordable.

MetLife's auto insurance rates depend on several factors, including the driver's age, location, driving record, and vehicle type. While its rates can be high, averaging about $486 for six-month coverage without add-ons, it offers a range of discounts that can lower costs. These include common discounts such as bundling, multiple-car policies, defensive driving, good student, safe driving, anti-theft systems, and paperless billing. MetLife also offers unique discounts, such as for customers over 55 who have completed a state-approved safe driving course and for those with no late fees in the past 12 months.

For young drivers, MetLife's rates are moderately priced. While its rates are typically high for most driver types, young drivers may benefit from its policies due to their relatively lower costs for this demographic.

In addition to its range of discounts, MetLife also provides highly customizable car insurance policies with various add-on options. These include identity theft coverage, enhanced car rental damage coverage, new car replacement, and major parts replacement. However, it's important to note that MetLife does not offer accident forgiveness, gap insurance, or better car replacement coverage.

Overall, while MetLife's auto insurance rates are generally high, its policies may be a good option for young drivers and those who can take advantage of its wide range of discounts and customizable coverage options.

Auto Owners Insurance: What You Need to Know About Roof Leak Coverage

You may want to see also

MetLife offers a wide range of discounts to lower auto insurance costs

MetLife offers all of the most common auto insurance discounts, including bundling, multiple cars, defensive driving, good student, safe driving, anti-theft system, pay-in-full, and paperless billing. It also provides unique discounts, such as for not having any late fees assessed over 12 months and for drivers aged 55 or older who have completed a state-approved safe driving course.

In addition to these, MetLife also offers special workplace and association discounts. For example, if you work for a company that has partnered with MetLife, you may be eligible for a discount on your auto insurance.

You can also receive additional discounts by bundling your auto insurance with other MetLife policies, such as life insurance and home insurance.

Overall, MetLife offers a variety of ways to lower your auto insurance costs through its range of discounts and special offers. By taking advantage of these opportunities, you can help offset the potentially high costs of their insurance policies.

Vehicle Tracking: Lower Insurance Rates?

You may want to see also

MetLife's customer service and satisfaction ratings are average or below average

While MetLife has an average or above-average number of complaints, some customers have reported issues with the company's customer service. There are reports of long wait times when calling customer service, difficulty making changes to policies, and problems with the claims process. Some customers have also reported unexpected fees and issues with receiving payments for claims. However, other customers have praised MetLife for its great customer service, ease of purchasing insurance, and helpful 24/7 customer service representatives.

Auto Insurance Claims: Payout Process Explained

You may want to see also

MetLife's auto insurance covers basics like liability and collision protection, as well as add-ons

MetLife offers auto insurance with a range of coverage options, including the basics such as liability and collision protection, as well as various add-ons. The company provides highly customizable car insurance policies, with special discounts and workplace deals.

Liability Protection

MetLife auto insurance covers liability, which is a standard component of car insurance policies. Liability insurance provides financial protection in the event of a car accident where you are at fault. It helps cover the costs of any property damage or bodily injuries sustained by the other party involved in the accident.

Collision Protection

Collision insurance is another essential coverage offered by MetLife. This type of protection covers the costs of repairing or replacing your vehicle if it collides with another car or object. It applies regardless of who is at fault in the accident, providing valuable financial assistance to get your car back on the road.

Add-ons

In addition to the fundamental coverages, MetLife offers a variety of add-ons to enhance your auto insurance policy. These include:

- Roadside assistance: This add-on provides assistance if your vehicle breaks down or experiences mechanical issues while on the road. It can include services such as towing, battery jump-starts, and fuel delivery.

- Rental car reimbursement: If your vehicle is being repaired due to a covered claim, this coverage will reimburse you for the cost of renting a car during that period.

- Accident forgiveness: This add-on helps to waive the increase in insurance premiums that typically occurs after an at-fault accident. It can provide some financial relief if you have a clean driving record but experience an unexpected accident.

- New car replacement: If your new car is totaled in a covered accident, MetLife will replace it with a new vehicle of the same make and model. This ensures you don't suffer any depreciation costs.

- Major parts replacement: This coverage option replaces major car parts damaged in a covered accident, although it may not be available in all states.

- Gap coverage: This add-on is useful if your car is totaled, as it helps cover the gap between the insurance payout and the remaining balance on your car loan or lease.

- Ride-share coverage: If you drive for a ride-sharing company, this coverage ensures that both you and your vehicle are fully protected.

- Legal defense coverage: This add-on assists with legal fees associated with a covered accident, including substantial legal fees and court costs.

- Sound system coverage: MetLife offers protection for your vehicle's sound system, ensuring that any damage or loss is covered.

- Identity theft coverage: In the event of identity theft, this coverage helps restore your identity and protects your personal information.

Whose Auto Insurance Covers You?

You may want to see also

Frequently asked questions

MetLife's auto insurance rates depend on several factors, including the driver's age, location, driving record, and vehicle type.

MetLife considers various factors when calculating auto insurance rates, including the driver's age, driving history, vehicle type, and location. Additionally, MetLife offers a range of discounts that can lower the overall cost of auto insurance.

MetLife's auto insurance rates tend to be higher than those of other providers, especially for full coverage, minimum coverage, and drivers with speeding violations. However, their rates for young drivers are more competitive.

Yes, MetLife offers a variety of discounts that can help lower your auto insurance rates. These include bundling policies, insuring multiple cars, having a good student status, safe driving record, and anti-theft system installation. Additionally, completing a defensive driving course or a state-approved safe driving course (for those over 55) can also reduce your premium.