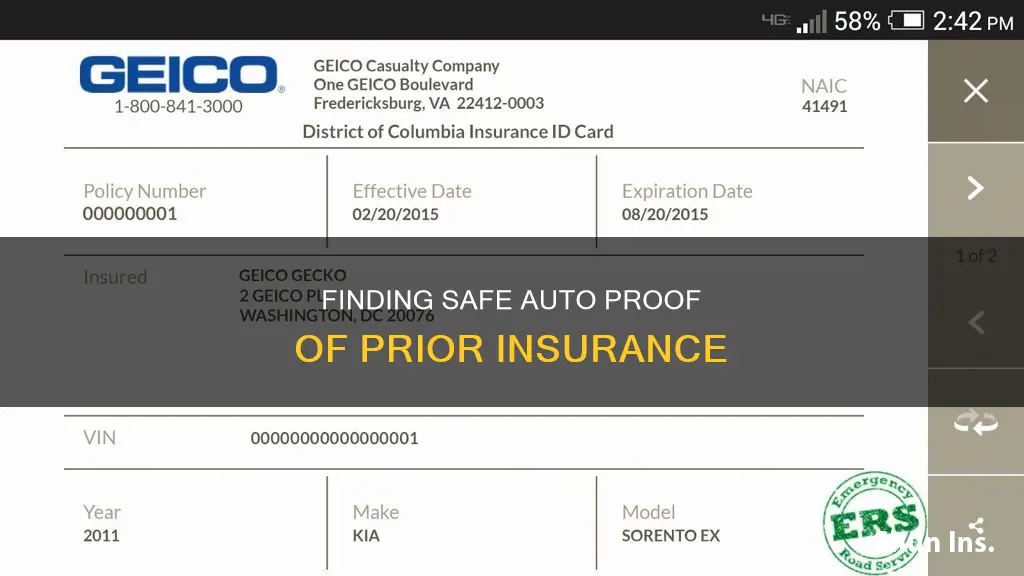

Proof of insurance is a requirement in most states and is necessary when registering a new vehicle, renewing your license, or getting pulled over by the police. It is also required in the event of a car accident. This document proves that you have a current and valid auto insurance policy and that you meet the state's minimum insurance requirements. Most insurers provide proof of insurance in the form of an ID card, which includes basic information such as the insurance company's name and address, the policy's effective date and expiration, and the insured vehicle's details. This card can be printed or electronic, with most states accepting digital proof of insurance. To obtain proof of insurance, individuals can contact their insurance company, access it through the company's mobile app, or request it by calling or logging in online.

| Characteristics | Values |

|---|---|

| How to obtain proof of insurance | Contact your insurance company, either by phone, online, or through their mobile app. |

| When to obtain proof of insurance | After purchasing a policy. |

| Format of proof of insurance | Printed card or electronic version from the insurance company's mobile app. |

| Information included on proof of insurance | Insurance company's name and address, effective date and expiration of the policy, policy number, NAIC number, name of the policyholder, insured vehicle's year, make, model, and VIN. |

| Purpose of proof of insurance | To show that you have a current and valid auto insurance policy that meets state requirements. |

| When to show proof of insurance | When pulled over by the police, in an accident, registering a vehicle, renewing a license, or when specifically requested. |

What You'll Learn

Contact your previous insurance company

If you are struggling to find proof of prior auto insurance, the best course of action is to contact your previous insurance company. They will be able to provide you with the necessary documentation. This is a straightforward process and can be done in several ways. Firstly, you can try calling them. Most insurance companies have customer service hotlines that you can call to request a copy of your insurance history. They may be able to provide this information to you over the phone or may send it to you via email or post. It is a good idea to ask them to send you a copy, so you have the documentation for your records.

Another option is to visit their website. Many insurance companies now offer online services, allowing you to access your insurance information through their website. You will likely need to create an account and log in to access your insurance details. From there, you should be able to view and download your insurance history. Some companies may also offer a mobile app, which you can download to access your insurance information on the go.

If you are unable to find the contact information for your previous insurance company, or if they are no longer in business, you may need to try an alternative method to obtain your proof of prior insurance. However, contacting the company directly is often the quickest and most efficient way to get the documentation you need. It is worth noting that insurance companies are required to keep records of their customers' policies, so they should be able to provide you with the necessary information without any issues.

If you are unsure about what specific information you need or the best way to obtain it, it is always best to ask your previous insurance company. They will be able to guide you on the process and provide you with the correct documentation to prove your prior insurance coverage. This may include an insurance ID card, a proof of coverage letter, or a letter of experience, outlining your insurance history with the company.

The Right Auto Insurance Agent: Does it Really Make a Difference?

You may want to see also

Ask your state's Department of Motor Vehicles

If you are unsure about your insurance history, you can contact your state's Department of Motor Vehicles (DMV). They may have information on your previous insurance policies and can provide a copy of your motor vehicle record (MVR). This can be useful for clearing up any questions about tickets or accidents.

The DMV can also help you check your insurance status, and you can provide proof of insurance to them online or by mail. They will then verify your coverage with your insurance company. You can also check the status of your driver's license and vehicle registration through the DMV.

If your license or registration has been suspended due to a lapse in insurance coverage, you can provide proof of insurance to the DMV, and they will verify your coverage with your insurance company. However, you cannot provide proof by phone or in person at a DMV office.

The DMV can also provide written confirmation that a suspension or revocation has been cleared, but you must order your driving record or vehicle abstract for this. It's important to ensure that your name and address on DMV records are correct.

Additionally, the DMV can help you update your policy information and address, cancel your registration, and reinstate your license and registration if it has been suspended. They can also provide information on the specific requirements and procedures for reinstatement, including any fees, fines, or penalties that may apply.

In some cases, the DMV may require you to maintain an SR-22 insurance policy, which is a Certificate of Financial Responsibility filed by your insurance company with the DMV. This is typically required if you have had a license suspension, DUI conviction, or other serious traffic offenses.

Overall, your state's DMV can be a helpful resource for obtaining proof of prior insurance, updating your insurance information, and addressing any issues related to insurance lapses or suspensions.

State Farm Auto Insurance: Moving Truck Coverage Explained

You may want to see also

Request a copy of your CLUE report

To find Safe Auto proof of prior insurance, you can request a copy of your CLUE report. CLUE stands for Comprehensive Loss Underwriting Exchange, and it collects and reports up to seven years of auto and personal property claims. Here's how you can request your CLUE report:

- Contact LexisNexis Risk Solutions: LexisNexis C.L.U.E. Inc. is affiliated with LexisNexis Risk Solutions. You can contact LexisNexis Risk Solutions to request your CLUE report. They provide one free report every 12 months upon request.

- Provide Necessary Information: When requesting your CLUE report, you may need to provide personal information such as your name, address, and other identifying details. Make sure to have this information ready to facilitate the request process.

- Review the Report: Once you receive your CLUE report, take the time to review it thoroughly. The report will contain information about your auto and personal property claims history, including any accidents, losses, or insurance-related events.

- Dispute Inaccuracies (If Necessary) : If you identify any inaccuracies or incomplete information in your CLUE report, you have the legal right to dispute it. You can initiate a dispute with the consumer reporting company, such as LexisNexis, and the company that shared the information. Under the Fair Credit Reporting Act (FCRA), they are required to conduct a reasonable investigation of your dispute without any charges.

- Maintain Regular Requests: It is a good practice to request your CLUE report periodically, especially if you have had any changes in your insurance coverage or claims. This helps you stay updated with the information being reported and allows you to address any discrepancies promptly.

Remember, your CLUE report is an essential tool for understanding your insurance history and can impact your insurance rates and underwriting decisions. By regularly reviewing and addressing any inaccuracies, you can ensure that your insurance profile is accurately represented.

Auto Insurance and Physical Therapy: What's Covered?

You may want to see also

Contact your insurance company

If you are a customer of a large insurance company, such as GEICO, Progressive, or State Farm, obtaining proof of prior insurance is a straightforward process. Here is a detailed guide on how to contact your insurance company and get the required documentation:

Most major insurance providers offer multiple ways to get in touch with their customer support teams. You can typically reach out to them through their website, mobile app, email, or phone. Some companies may also have physical offices where you can walk in and request assistance.

When you contact your insurance company, be prepared to provide them with relevant information, such as your full name, policy number, vehicle details (make, model, year, and VIN), and the specific type of proof of insurance you require.

Online or via Mobile App:

Many insurance companies offer online portals or mobile apps where you can access your policy information and download or print your proof of insurance. Simply log in to your account using the credentials you created when you signed up for the policy. From there, you should be able to find a section that allows you to view and download your insurance card or coverage information.

By Phone:

Calling your insurance company is another effective way to obtain proof of prior insurance. Have your policy number and other relevant information ready when you call. Explain to the customer service representative that you need proof of prior insurance, and they will guide you through the process. They may be able to fax or email the documentation to you directly or provide instructions on how to access it through your online account.

By Email or Contact Form:

If you prefer written communication, you can send an email to your insurance company's customer support email address or use the contact form on their website. Clearly state your request for proof of prior insurance and include all the necessary details, such as your name, policy number, and vehicle information. They will typically respond with instructions on how to access your proof of insurance or send you the required documentation directly.

In-Person:

If your insurance company has a local office or branch, you can visit them in person and request proof of prior insurance. Bring along your policy documents and any other relevant information. Their staff will be able to assist you in obtaining the necessary documentation.

Remember, it is always a good idea to keep your proof of insurance card or documentation in your vehicle, either physically or electronically, to avoid any hassles if you need to provide proof during a traffic stop, accident, or registration process.

Full Coverage Auto Insurance: Understanding Vandalism Protection

You may want to see also

Keep a printed copy in your car

Keeping a printed copy of your proof of insurance in your car is a safe and simple way to ensure you always have it to hand. You can obtain a printed copy of your proof of insurance in several ways. Firstly, your insurance company will typically send you a physical copy of your insurance ID card when you purchase a policy. You can also request that they send you an updated copy if you need one. Secondly, you can download a temporary insurance card from your insurance company's website or app to use until your hard copy arrives. Thirdly, you can log in to your account on your insurance company's website, download a card, and print it out.

It is a good idea to keep your proof of insurance in your car's glove compartment. This way, it is easily accessible if you need to show it. You may need to show proof of insurance when registering your car, if you get pulled over by the police, or if you are in a car accident. In these situations, you can show your printed proof of insurance card.

While almost all states allow you to show electronic proof of insurance, it is always a good idea to have a printed copy in your car as well. This is because, in some situations, you may be required to show a physical copy. For example, if your phone is damaged or lost, or if you are unable to access your insurance information on your phone, a printed copy ensures that you can still provide proof of insurance. Additionally, while 49 states and Washington, D.C., allow digital proof of insurance, New Mexico does not recognize it during a traffic stop. Therefore, if you are driving in New Mexico, it is particularly important to have a printed copy of your proof of insurance in your car.

It is also a good idea to keep a printed copy of your proof of insurance somewhere other than your car, such as in your home. This way, if you need to access it and you do not have your car with you, or if something happens to the copy in your car, you have a backup.

Kai Insurance: Unraveling the Auto Claims Adjustment Process

You may want to see also

Frequently asked questions

Contact your previous insurance company and request a letter of experience, which will detail your auto insurance coverages and claims.

Basic information such as the insurance company's name and address, the effective date and expiration of the policy, the policyholder's name, and the insured vehicle's year, make, model, and vehicle identification number (VIN).

You can show a printed card from your insurance company or use an electronic version from your insurance company's mobile app.

If you're unable to provide proof of insurance, you could face fines or even jail time, depending on the state.