Proof of insurance is a document that demonstrates that you have an active car insurance policy. It is required in most states in the US and is necessary when registering a vehicle, during traffic stops, or after an accident. This document typically includes the policyholder's name, policy number, effective dates of coverage, information about the vehicle, and the insurer's name and contact information. It is recommended to keep this document in your vehicle, such as in the glove compartment, to provide proof of insurance when requested by law enforcement. Failure to provide proof of insurance may result in penalties, fines, or other consequences, depending on the state and situation.

| Characteristics | Values |

|---|---|

| Purpose | Demonstrates a driver's compliance with their state’s legal requirements and financial responsibility for operating a vehicle. |

| Required in situations such as | Registering a vehicle, during traffic stops, after an accident, leasing or financing a vehicle |

| Accepted formats | Physical document, digital document, insurance ID card, declarations page |

| Minimum details included | Insured’s name, policy number, policy effective dates, covered vehicle, policyholder name, insurance company name, insurance company address, NAIC number, vehicle year, vehicle make, vehicle model, vehicle identification number |

What You'll Learn

What to do if you lose your insurance card

If you lose your insurance card, it's important to act quickly to minimise the risk of fraud and ensure you can still provide proof of insurance when needed. Here are the steps you should take:

- Notify your insurance company immediately. Contact their customer service line and follow the necessary steps to verify your identity. They will likely issue you with a new card and account number. It may take a few weeks to receive the new card, so it is important to have alternative proof of insurance in the meantime.

- Review your medical benefits statements for any activity you don't recognise. If you see any suspicious activity, report it to your insurance company and healthcare providers immediately. Get copies of your medical records and ask your providers to correct or delete any fraudulent items via certified mail. File a police report or identity theft report through the FTC.

- Access your insurance information digitally. Many insurance companies have apps that allow you to access digital copies of your insurance cards. If your provider doesn't have an app, you may be able to access your account online and download or print a copy of your card.

- Contact your insurance agent. If you are unable to access your insurance information digitally, call your insurance agent and ask them to send you an updated copy of your insurance card.

- Keep a photocopy or photograph of your insurance card in a safe place separate from your vehicle. This will ensure you have a backup in case you lose your card again.

Remember, driving without proof of insurance can result in tickets and fines. Always keep your insurance card with you when driving, either in physical or digital form, depending on what is accepted as valid proof in your state.

Understanding Auto Insurance: Decoding the 'List' Definition

You may want to see also

What is an SR-22 form?

An SR-22 is a certificate of financial responsibility that serves as proof that a driver has purchased the minimum required auto insurance mandated by their state. It is not a type of insurance but rather a form filed with the state. This form is required for some drivers by their state or court order, typically as a result of a driving offence.

High-risk drivers, such as those convicted of multiple traffic violations or driving without insurance, are often required to obtain an SR-22. The SR-22 policy was created to make it difficult for high-risk drivers to operate a vehicle without insurance. It is also known as an SR-22 Bond or a Certificate of Financial Responsibility.

There are three types of SR-22 forms: owner certificates, operator or non-owner certificates, and owner-operator certificates. The type of form filed depends on the driver's transportation situation. Owner certificates are for people who drive their own car, while operator or non-owner certificates are for those who don't own a car but may rent or borrow one. Owner-operator certificates apply to those who drive both their own car and vehicles owned by someone else.

The cost of obtaining an SR-22 varies, with some insurers filing the certification for free and others charging a fee, typically ranging from $15 to $25. In addition to this one-time fee, there may be additional costs associated with the SR-22, such as increased insurance premiums.

To obtain an SR-22, drivers must contact their car insurance company and submit all relevant documentation. The insurance company will then file the SR-22 form on the driver's behalf. Not all insurance companies offer SR-22 documentation, so drivers may need to switch to a new provider.

Lawyers' Ethical Dilemma: Defending Auto Insurance Scammers

You may want to see also

When do you need to show proof of insurance?

Proof of insurance is a crucial document to keep in your car, and you may need to show it in several situations. Firstly, if you are pulled over by the police, they can request to see your proof of insurance, alongside your license and registration. It is also essential to have proof of insurance if you are involved in a car accident, as this document will be needed when exchanging insurance information with the other driver.

Additionally, proof of insurance is necessary when registering your vehicle at the DMV or an equivalent state agency. When buying a vehicle, you will need to show proof of insurance to the dealership or finance company before driving the car off the lot. This proof ensures that the vehicle is insured according to state requirements.

Moreover, specific circumstances may require additional documentation. For instance, some drivers may need an SR-22 form, also known as a certificate of financial responsibility, which proves they meet the state's minimum auto liability requirements. This form is typically ordered by the state or a judge following a DUI conviction, multiple speeding tickets, or a hardship license.

Lastly, when applying for a new auto insurance policy, you may need to provide proof of insurance from your current provider to avoid a coverage gap that could result in higher premiums.

Stolen Vehicle Investigations: Unraveling the Web of Insurance Claims

You may want to see also

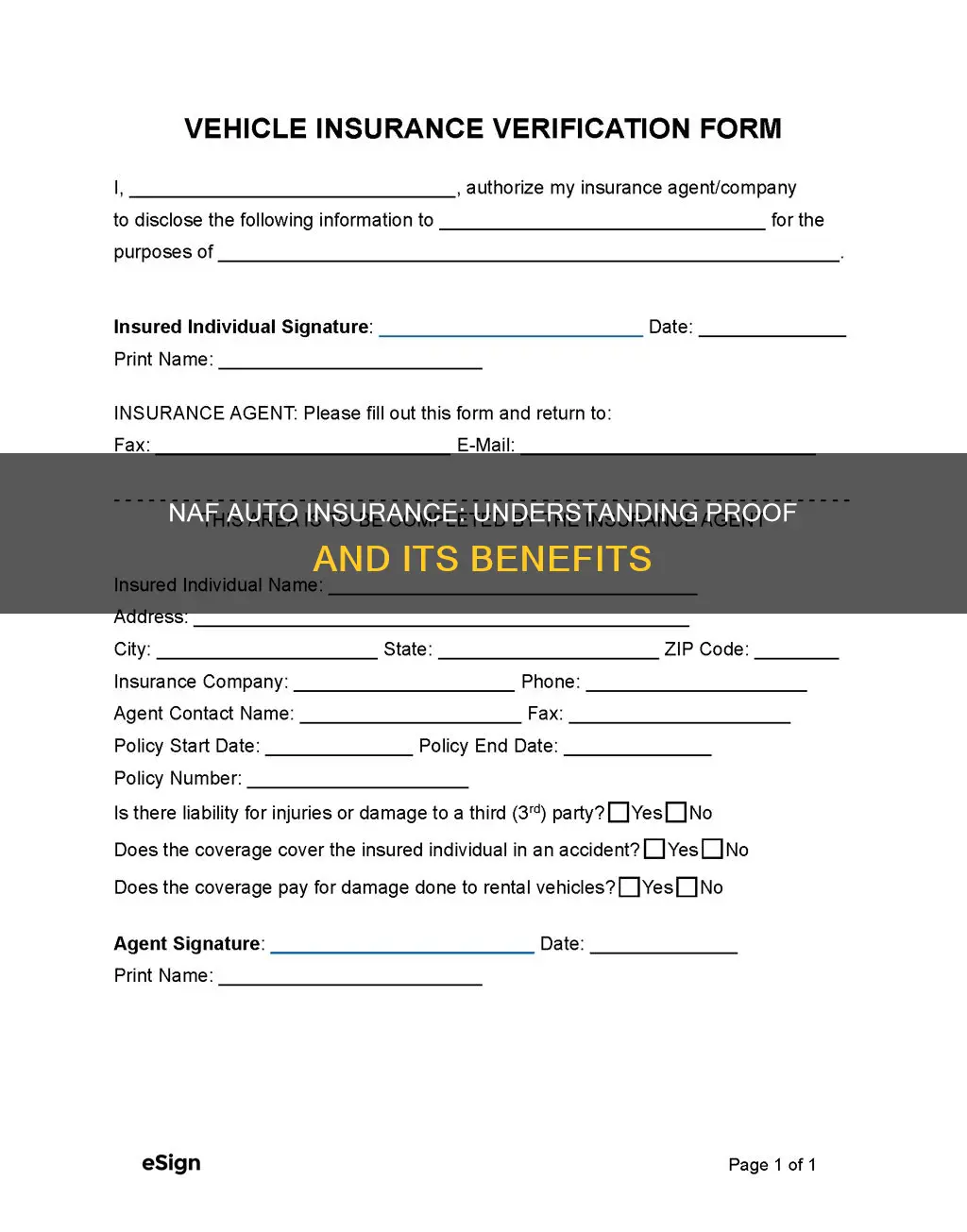

What information does proof of insurance provide?

Proof of insurance is a vital document for motorists, providing essential details about their insurance coverage and demonstrating compliance with state laws. Here's a breakdown of the information typically found on proof of insurance:

Policyholder Information:

The proof of insurance will include the name of the policyholder, confirming the individual or entity responsible for the insurance policy. This is crucial for identifying the insured person and ensuring accountability.

Insurance Company Details:

The document will feature the name and contact information of the insurance company providing the coverage. This information allows for easy reference and verification by authorities or other parties.

Effective Dates of Coverage:

The effective dates listed on the proof of insurance indicate the period during which the policy is active and valid. This is important for confirming that the insurance is current and not expired.

Insured Vehicle Information:

The document will contain details about the insured vehicle, including its make, model, and vehicle identification number (VIN). This information uniquely identifies the vehicle associated with the insurance policy, ensuring that the coverage applies to the specific car.

Policy Number:

The policy number is a unique identifier for the insurance policy. It helps in quickly referencing the specific policy and can be used for various purposes, such as filing claims or making inquiries.

Types of Coverage and Policy Limits:

While not always included, the proof of insurance may outline the types of coverage the policyholder has, such as liability, collision, or comprehensive insurance. Additionally, it might indicate the policy limits, which define the maximum amount the insurance company will pay in the event of a claim.

It's important to note that the specific information on proof of insurance may vary slightly depending on the insurance company and the state requirements. However, the details mentioned above are typically considered essential components of proof of insurance documentation.

Switching Auto Insurance: Anytime Changes

You may want to see also

How to get proof of insurance

Proof of insurance is a document that shows you have an active insurance policy that meets state requirements. It is required in most states in the US and is usually needed when registering for a new vehicle, renewing your license, or getting pulled over by the police. Here are the ways to get proof of insurance:

Request a Physical Copy by Mail

When you purchase a car insurance policy, your insurance company will typically send you proof of insurance. You will receive a new insurance card every time your policy renews or when you make changes to your coverage. You can keep this card in your vehicle's glove compartment or store it elsewhere for safekeeping.

Print a Copy Yourself

If you misplace your physical copy, you can request that your insurance company emails you a copy of the card. You can then print out this copy and store it in your vehicle. Alternatively, you can access your account on your insurance company's website and print out a card from there.

Access Proof of Insurance on Your Phone

Several insurance companies, including Allstate, Geico, Progressive, and State Farm, offer access to your insurance card through their mobile apps. This allows you to show proof of insurance directly from your smartphone or tablet. However, it is important to note that New Mexico is the only state where police are not required to accept digital proof of insurance, so it is recommended to carry a physical copy as well.

Contact Your Insurance Agent

If you are unable to access your proof of insurance through the above methods, you can reach out to your insurance agent or company. They can send you an updated copy of your insurance card or provide assistance in obtaining the necessary documentation.

It is important to remember that driving without proof of insurance can result in penalties, fines, or even license suspension, depending on the state. Therefore, it is crucial to keep your proof of insurance up to date and easily accessible.

Get Auto Insurance Without Broker Fees: A Smart Guide

You may want to see also

Frequently asked questions

Proof of auto insurance is a physical or digital document that shows you have an active insurance policy that meets state requirements.

The proof of insurance document includes the insured's name, identifying information about the car, the policy number, and the effective dates of the policy.

You may need to show proof of auto insurance when registering a new vehicle, renewing your license, during a traffic stop, or after a car accident.

You can obtain proof of auto insurance from your insurance company after purchasing a policy. They will typically send you an insurance ID card with the basic information authorities need to confirm that you have insurance. You can also access your proof of insurance through your insurance company's mobile app or online portal.