Settling with auto insurance after a car accident can be a stressful and challenging process. It is generally not recommended to settle privately without the input of an insurer or lawyer, as there may be unforeseen costs or injuries that emerge later. The first offer from an insurance company is usually a lowball amount, and it is common for there to be back-and-forth negotiations before a fair settlement is reached. The time it takes to settle an insurance claim can vary from a few days to several months, depending on the circumstances of the accident and factors such as state laws, severity of injuries, and property damage.

| Characteristics | Values |

|---|---|

| Time taken to settle an insurance claim | Anywhere from a few days/weeks to several months |

| Factors affecting settlement time | Circumstances of the accident, state laws, severity of injury and property damage, involvement of lawyers, time taken to file the claim |

| Investigation time | A few weeks or months, depending on the severity of the car accident |

| Time limit for insurance companies to investigate | About 30 days, but this varies by state |

| Time limit to file and settle a claim | Depends on the state's statutes of limitations |

| Delays in receiving claim settlement | Insurer might be required to provide a written explanation |

| Separate claim payouts | May receive payouts at different times for each type of coverage |

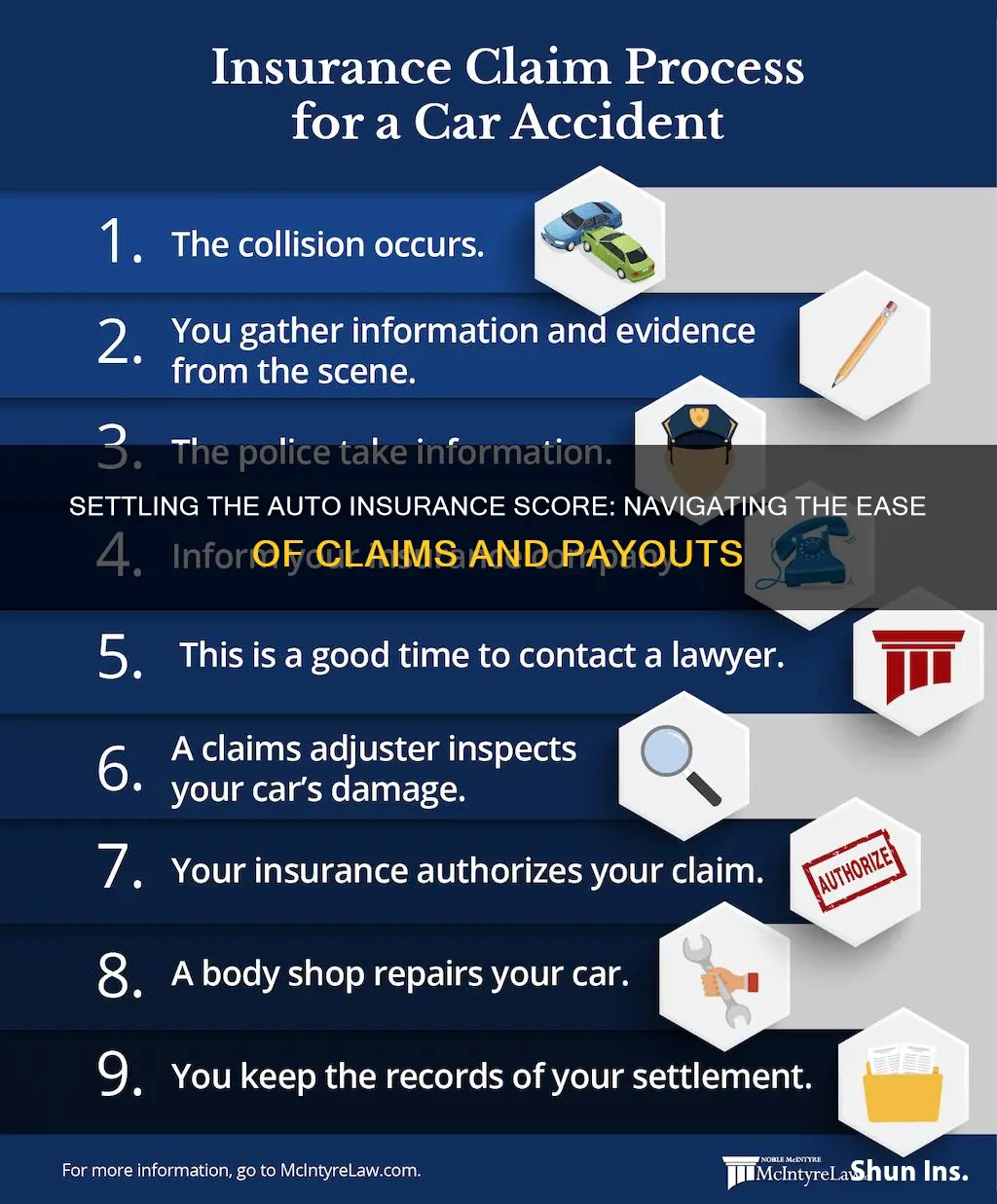

| Information required when filing a claim | Police report, photos of the damage, insurance information for all parties, etc. |

| Private settlement | Only advisable if there is minor damage and no chance of future injury claims |

| Reporting an accident | Auto insurers typically require you to report an accident as soon as possible |

What You'll Learn

The pros and cons of settling without insurance

Settling a car accident without insurance can be challenging, but it is possible. Here are some pros and cons to help you decide whether to settle without insurance:

Pros of settling without insurance:

- No insurance rate increase: Settling privately can help you avoid a potential increase in your insurance premium, especially if you are at fault.

- No restrictions on repair shops: When settling privately, you are free to choose any repair shop without being restricted to those approved by your insurance company.

- Faster compensation: Settling without insurance can often lead to receiving your compensation faster, as you skip the lengthy insurance claim process and potential court proceedings.

Cons of settling without insurance:

- Risk of insufficient compensation: Settling privately may result in receiving less compensation than you deserve, especially if you accept the initial offer from the other party's insurance company.

- Risk of future injury claims: If the accident resulted in injuries that appear later, you may be liable for additional damages if you settle privately without considering future injury claims.

- Risk of financial burden: If the other party is at fault and agrees to pay for your damages, they may struggle to pay or back out of the agreement, leaving you with the financial burden of repair costs.

- No legal protection: Settling privately means forgoing the legal protection provided by your insurance company, which can leave you vulnerable to future claims or lawsuits.

Insurance Decisions: Can They Change?

You may want to see also

The role of a lawyer in getting a fair settlement

It is generally not recommended to settle a car accident claim without consulting a lawyer, as they can help you get a fair settlement. While it is possible to settle a car accident claim without a lawyer, there are several risks involved, and a lawyer can help mitigate these risks and improve the chances of a fair settlement.

A lawyer can help you get a fair settlement by:

- Determining who is at fault for the accident, including any partial fault.

- Considering all future damages, such as ongoing medical care and future lost earnings.

- Accounting for pain and suffering damages that don’t have a set dollar amount.

- Preparing for the possibility of a trial, in case a lawsuit needs to be filed.

- Knowing your total damages and understanding your full rights.

- Gathering evidence from the accident scene, such as witness statements or a police report.

- Taking pictures of your injuries and documenting all costs associated with the accident.

- Calculating your total economic and non-economic damages, including future losses.

- Negotiating with the insurance company on your behalf.

- Helping you determine what your case is worth, so you don’t settle for an unreasonably low amount.

- Maximizing the chances of settling without going to court.

Additionally, insurance companies often have a team of lawyers on their side, and a personal injury lawyer can help level the playing field. A lawyer can also help you avoid making mistakes that could impact your claim, such as signing a settlement agreement too soon or missing the statute of limitations.

Overall, while it is possible to settle a car accident claim without a lawyer, it is generally advisable to seek legal representation to improve the chances of a fair settlement and protect your rights.

Auto Insurance: Reinstating Policies After Cancellation

You may want to see also

How to calculate a fair settlement amount

When it comes to calculating a fair settlement amount for auto insurance, there are several factors to consider. Firstly, it's important to understand the different types of damages involved. These can be broadly categorised into two types: special damages and general damages.

Special damages, also known as economic damages, refer to the monetary losses suffered as a result of the accident. This includes past and future medical expenses, costs related to repairing or replacing damaged property, lost wages, and other lost income or business opportunities. These damages are relatively straightforward to calculate, as they are based on actual financial losses that can be verified through records and documents.

General damages, on the other hand, are non-economic in nature and are meant to compensate for the pain, suffering, and loss of enjoyment of life that the victim experiences due to the accident. These damages are more challenging to quantify as they are subjective and vary from case to case.

To calculate a fair settlement amount, the insurance adjuster or your personal injury lawyer will use the multiplier method. This involves taking into account all the special damages and multiplying them by a certain factor, typically between 1.5 and 5. The multiplier depends on the severity of the injuries and the impact the accident has had on the victim's life. The more serious and long-lasting the injuries, the higher the multiplier. This calculation provides an estimate of the general damages.

Next, add the estimated general damages to the total special damages, including any lost income or future lost income. This sum will give you a ballpark figure for the total settlement amount. It's important to note that this is just a starting point for negotiations, and the final settlement amount may differ based on various factors and circumstances.

It's worth mentioning that punitive damages, which are intended to punish the defendant and deter similar behaviour, are rarely awarded in car accident cases. However, they may be applicable if the defendant's actions were found to be intentional, malicious, or extremely reckless.

To ensure you receive a fair settlement, it's recommended to consult with an experienced personal injury lawyer who can guide you through the process, assess the true value of your claim, and negotiate on your behalf. They will also be able to advise you on any specific laws or regulations in your state that may impact your settlement calculation.

Insurance Notes: Vehicle Contingency Disclosure

You may want to see also

The two main types of claims: first-party and third-party

When it comes to auto insurance, there are two primary types of claims: first-party claims and third-party claims. Understanding the differences between these two types of claims is crucial if you ever need to file a claim or seek compensation after a car accident.

First-party insurance claims involve filing a claim directly with your own insurance company for damages or losses covered by your policy. This type of claim typically covers incidents affecting you or your property. For example, if you damage your car by backing into a pole, you would file a first-party claim with your insurance company. They will then review your policy to determine if you have the necessary coverage and reimburse you for the repair costs, minus any deductible.

Third-party insurance claims, on the other hand, are filed with someone else's insurance provider, usually after an incident where you are not at fault. For instance, if another driver runs a red light and collides with your vehicle, you would file a third-party claim with the drunk driver's insurance company. In this case, you, as the victim, have the right to seek compensation for your accident-related expenses, such as medical expenses, lost wages, pain and suffering, and property damage.

The key distinction between first-party and third-party claims lies in who gets paid by the insurer. First-party insurance pays the policyholder for their covered losses, while third-party insurance, also known as liability insurance, pays the victim who has been harmed by the policyholder's negligence. In the context of auto insurance, most states require vehicle owners to carry at least some form of third-party liability insurance to protect against claims made by other drivers in the event of an accident.

It is worth noting that the claims process can be complex and overwhelming, and it is always recommended to seek advice from an experienced personal injury attorney, regardless of whether you are dealing with a first-party or third-party claim.

AAA Auto Insurance: What You Need to Know

You may want to see also

What to do if the insurance company is delaying your claim

Dealing with insurance companies can be a stressful experience, and it can be frustrating when your claim is delayed. Here are some steps you can take if you find yourself in this situation:

Understand Common Delay Reasons:

Insurance companies may delay claims for various reasons, some valid and others not. Common reasons include:

- Investigating the accident and determining liability, especially in cases with multiple parties involved.

- Damage reviews, contested claims, or unfair claim settlement practices.

- Incomplete or incorrect claim forms, or missing information from another party.

- Waiting for evidence or records from other parties, such as medical records in health insurance claims.

- Disputes by other parties involved in the claim.

Communicate Frequently:

Stay in regular contact with the insurance company to understand the status of your claim and any outstanding requirements. Keep all messages, letters, and emails you receive from them, as these may be important if you need to take legal action later.

Know When the Delay Is Invalid or Illegal:

It can be challenging to determine when a delay is unjustified. Look out for red flags, such as a lack of reasonable explanation for the delay or vague reasons provided by the insurance company. If you suspect bad faith dealings, consult an attorney, as you may have grounds for legal action.

Consider Hiring an Attorney:

If you feel that your insurance company is intentionally delaying your claim, consider seeking legal counsel. An attorney can review your case and determine if the insurance company is handling your claim in bad faith. They can also guide you through the process of filing a lawsuit and help you seek compensation for any damages caused by the delay.

File a Complaint:

If you believe the insurance company is stalling or refusing to pay your claim, you can file a complaint with the relevant state department, such as the Department of Financial Services or the Department of Insurance, depending on your location. This creates a record of your complaint, which can be useful if you need to take further legal action.

Remember that each state has its own laws and regulations regarding insurance claims and deadlines for taking legal action. It's important to be aware of these timelines to protect your rights and ensure you don't miss any crucial deadlines.

CCTV Evidence: A Game-changer for Auto Insurance Claims?

You may want to see also

Frequently asked questions

If you don't have auto insurance and are involved in a car accident, there are a few important steps to take: First, ensure the safety of everyone involved and call emergency services if necessary. Then, exchange information with the other party, including names, contact details, and vehicle information. Document the accident scene by taking photos and gathering evidence. If there are witnesses, obtain their contact information. Finally, notify the local law enforcement agency about the accident.

Driving without auto insurance can result in legal penalties, personal liability, and difficulty obtaining insurance in the future. Legal penalties can include fines, license suspension, or even criminal charges. Without insurance, you may be held personally responsible for all costs associated with an accident, including property damage, medical bills, and legal fees. Additionally, insurance companies may consider you high-risk, making it challenging to find affordable coverage in the future.

Settling a car accident privately can help avoid potential rate hikes by your insurance company, especially if you are an at-fault driver with multiple accidents. It can also be a way to handle minor accidents without involving insurance companies or lawyers. However, it is important to consider the potential risks and ensure that the damage and injuries are truly minor.

Settling a car accident privately carries several risks. First, there may be undetected vehicle damage that only becomes apparent later, resulting in higher repair costs. Second, medical issues may arise for the involved parties, leading to unexpected treatment costs. Finally, most auto insurers require you to report an accident as soon as possible, and failing to do so may result in future claims being denied.