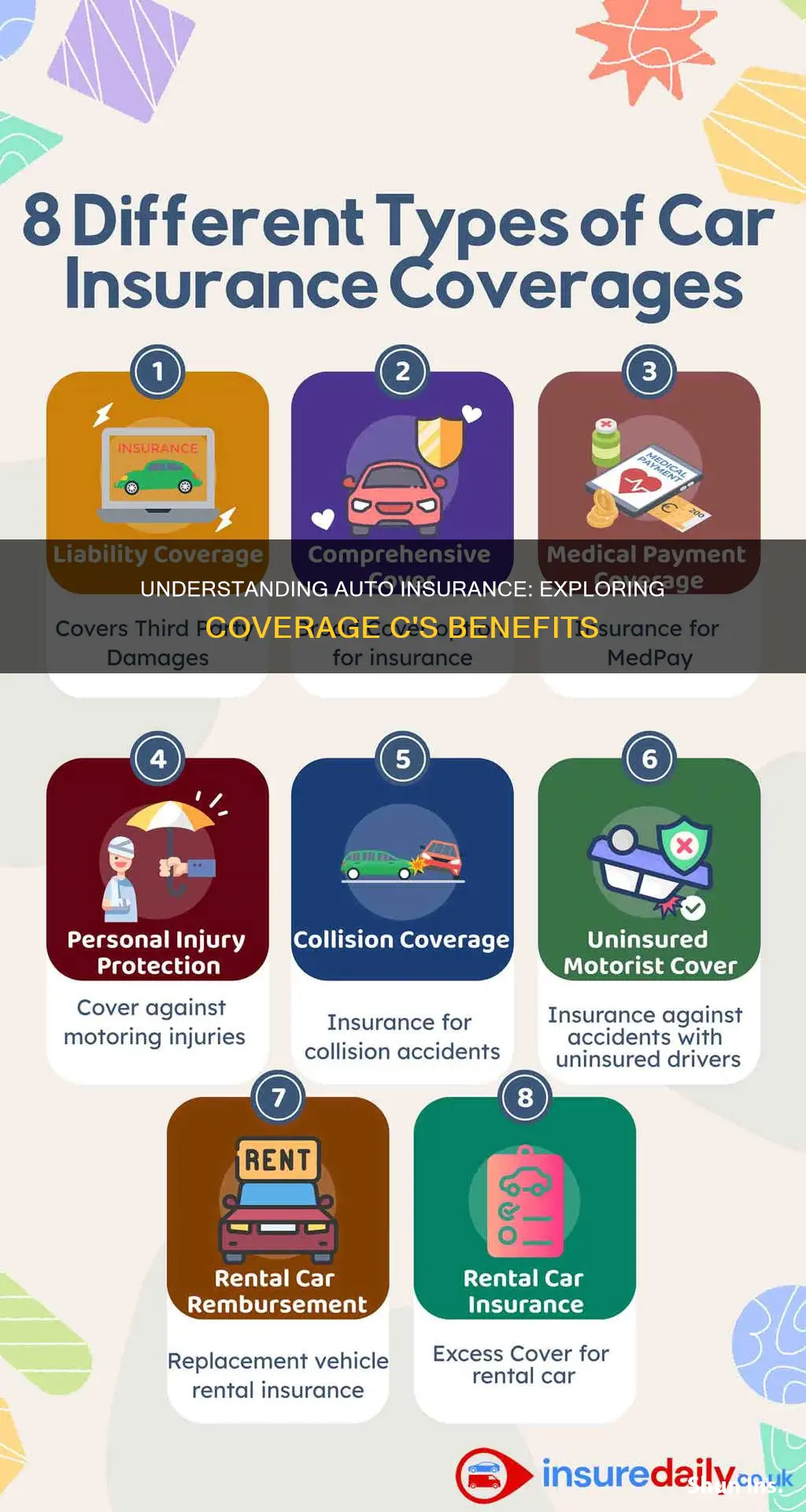

Coverage C, also known as personal property insurance, is a common protection included in most home insurance policies. It covers the cost of repairing or replacing personal belongings that have been damaged, destroyed, or stolen as a result of a covered peril. This includes tangible, movable items such as furniture, appliances, clothing, electronics, and jewellery. Coverage C is typically broad, covering everything except specific exclusions, such as motor vehicles and aircraft. It is important for individuals to understand their insurance policies and ensure they have sufficient coverage for their personal belongings.

| Characteristics | Values |

|---|---|

| Type of insurance | Home insurance |

| Other names | Personal property insurance, contents insurance |

| What it covers | Tangible, movable personal property |

| Examples of personal property | Furniture, appliances, clothing, electronics, jewellery |

| Exclusions | Motor vehicles, camping units, aircraft, and their equipment |

| Specialty items | Jewellery, watches, gems, garments, numismatic property, philatelic property, bicycles and accessories |

| Coverage limits | Around 50% of dwelling coverage |

What You'll Learn

Bodily injury liability

While most states mandate a minimum amount of bodily injury liability coverage, it is recommended to purchase higher limits to ensure adequate protection. This is especially important if you live in a state with low minimum requirements. By having sufficient coverage, you can safeguard your assets and protect yourself from potential financial ruin in the event of a serious accident.

It is worth noting that bodily injury liability coverage does not apply to the policyholder's own injuries or property damage. Separate coverage options, such as medical payments coverage and property damage liability coverage, are available to address those specific needs. When purchasing auto insurance, it is essential to carefully review the different types of coverage offered and select the ones that best suit your individual needs and circumstances.

In summary, bodily injury liability coverage is a vital aspect of auto insurance, providing financial protection and peace of mind in the event of an accident resulting in injuries to others. By understanding the specifics of this coverage and ensuring you have adequate limits, you can drive with the confidence that you are prepared for the unexpected.

Guardian Auto Insurance: Is It Worth the Hype?

You may want to see also

Medical payments

MedPay covers medical expenses that your health insurance might not, including ambulance fees, chiropractic care, dental work, prosthetics, and funeral expenses. It also covers copays and deductibles that your health insurance leaves behind. Unlike health insurance, MedPay has no deductibles or copayments, and it starts paying from the first dollar of incurred expenses.

The coverage limit for MedPay is typically set per person, rather than per accident. This means that each injured individual can claim up to the coverage limit, regardless of the total number of claims. For example, if you have a $5,000 medical payments limit and you, your spouse, and two children are injured in an accident, each of you could collect up to $5,000 in medical payments coverage, for a total of $20,000.

While MedPay is not required in most states, it is a low-cost option that can provide financial security and peace of mind in the event of a car accident. The average cost of medical payments coverage is often quite low, and it can save you from high out-of-pocket expenses, especially if your medical insurance doesn't cover all your expenses.

StateFarm Auto-Renew: Opt-Out and Take Control of Your Insurance

You may want to see also

Property damage liability

The amount of property damage liability coverage you need will depend on the state you live in and your personal circumstances. Each state sets its own minimum requirements for property damage liability coverage, but you may need to purchase additional coverage if you feel you need more protection. For example, if you own a home or other expensive items, or if you regularly travel in high-traffic areas, you may want to consider raising your coverage limit.

When choosing an auto insurance policy, it's important to shop around and compare different options to find the best coverage for your needs. In addition to property damage liability coverage, you may also want to consider other types of insurance, such as bodily injury liability coverage, personal injury protection, collision coverage, and comprehensive coverage. By choosing a comprehensive auto insurance policy, you can ensure that you are protected in the event of an accident, helping to reduce financial stress and providing peace of mind.

Canceling Auto Payments on National General Insurance: A Guide

You may want to see also

Uninsured motorist coverage

Underinsured motorist coverage, on the other hand, protects you when you are hit by a driver who has some insurance but not enough to cover the full extent of the damages or injuries caused. This coverage ensures that you are not left paying out of pocket for medical bills or vehicle repairs.

Both types of coverage are designed to provide financial protection and peace of mind in the event of an accident with an uninsured or underinsured driver. While not all states mandate these coverages, it is a serious risk to drive without them. According to the Insurance Information Institute, nearly 13% of drivers countrywide are uninsured, and this number rises above 20% in some states. Therefore, having uninsured motorist coverage can provide valuable protection and help cover expenses related to injuries, vehicle damage, and even lost wages resulting from an accident with an uninsured or underinsured driver.

Best Auto Insurance Companies: Comprehensive List and Comparison

You may want to see also

Underinsured motorist coverage

When purchasing underinsured motorist coverage, you may have the option to choose the insurance limits of your coverage. For the bodily injury portion, it is recommended to match the amount of your liability coverage. For example, if your liability coverage limits are $50,000 per person and $100,000 per accident, you would choose the same limits for your underinsured motorist coverage. This ensures that each injured passenger can collect up to $50,000, with a maximum of $100,000 per accident.

In summary, underinsured motorist coverage is an important type of auto insurance that can protect you financially if you are in an accident with a driver who does not have sufficient insurance. By understanding the risks associated with uninsured and underinsured drivers, you can make informed decisions about your coverage limits and protect yourself and your passengers in the event of an accident.

Full Coverage Auto Insurance: Illinois' Essential Requirements

You may want to see also