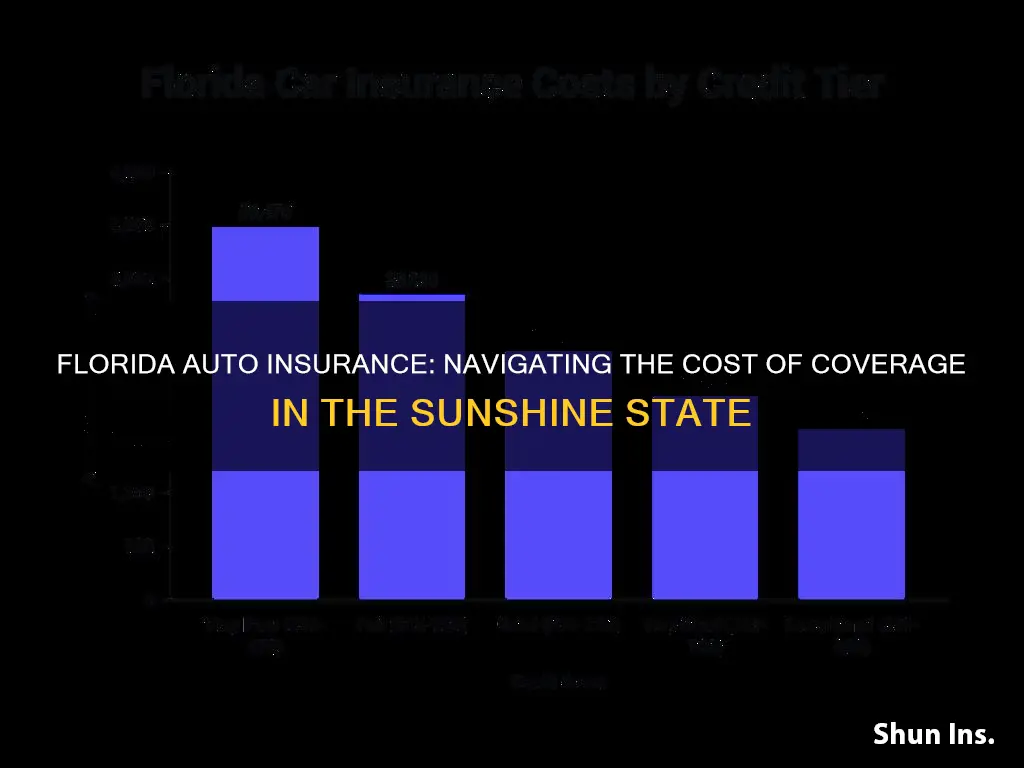

Florida has some of the most expensive car insurance rates in the US. The average annual full-coverage premium in Florida was $3,941 as of January 2024, 55% higher than the national average. There are several reasons for this, including the high number of uninsured drivers, the high cost of repairs, severe weather events, and the high rate of car accidents in the state. Florida's status as a no-fault state also contributes to the high insurance costs. While there may be some relief in 2024, with one of the largest insurance carriers filing for a rate reduction, Floridians continue to face significantly higher costs for car insurance compared to the rest of the country.

What You'll Learn

Florida's high rate of uninsured drivers

Florida has the highest rate of uninsured drivers in the US, with about 26.7% of drivers being uninsured. This is substantially higher than the national average of 13% or 14%, equating to around 29-32 million uninsured drivers across the country.

The high rate of uninsured drivers in Florida is one of the main reasons for the state's increased insurance costs since 2009. The issue is so significant that many insurance companies in Florida offer additional coverage to address it, which protects insured drivers and their families in the event of a collision with an uninsured driver. This added insurance coverage is worth considering, as it takes the place of the uninsured at-fault driver and pays for injuries and property damage.

The percentage of uninsured drivers varies across the US, with some states having notably lower rates than Florida. For example, New Jersey has the fewest uninsured drivers, with only 3% lacking insurance—a rate that is about a quarter of the national average. Massachusetts also has a low rate of uninsured drivers, at 6.2%.

In contrast, several other states have high rates of uninsured drivers, including Mississippi (29% or 23.7%), New Mexico (20.8%), Michigan, Tennessee, and Washington (all over 20%).

Auto Insurance: Home Insurance Loophole

You may want to see also

High-risk drivers

Florida is known for its high car insurance rates, which are influenced by a number of factors. One of the key factors is the presence of high-risk drivers in the state, including tourists, students, and the elderly. These drivers contribute to the high number of accidents in Florida, leading to increased insurance costs.

Who is a high-risk driver?

High-risk car insurance rates in Florida

Strategies to lower your rate as a high-risk driver

While high-risk drivers in Florida will generally face higher insurance rates, there are some strategies they can employ to mitigate the costs:

- Shop around: Different insurance companies will charge varying rates, so it's worth comparing quotes from multiple providers to find the most competitive option.

- Compare discounts: Most insurance companies offer a range of discounts, so it's beneficial to explore these options to lower your premium.

- Consider your vehicle: Newer cars tend to be more expensive to insure. Opting for an older car or one with a high safety rating can help reduce your insurance costs.

- Improve your credit: A low credit score is often associated with a higher risk of filing claims. By improving your credit score and asking your insurance provider to reassess your credit information, you may be able to lower your premium.

- Adjust your deductibles: Choosing higher deductibles for collision and comprehensive insurance can lower your premium, but keep in mind that this means you'll have to pay more out of pocket if you need to file a claim.

- Drive safely: Maintaining a clean driving record is crucial. Avoiding further tickets and accidents can help you move out of the high-risk category over time. Enrolling in a telematics program can also demonstrate safe driving habits to your insurer.

Kayak Conundrum: Unraveling Auto Insurance Coverage for Strapped Watercraft

You may want to see also

Severe weather events

Florida's unpredictable weather, including hurricanes, flooding, and storms, has a significant impact on auto insurance rates. The state's hurricane season, from June 1st to November 30th, poses risks of strong winds, heavy rain, flooding, and hail, which can cause extensive vehicle damage. This results in increased insurance claims and, consequently, higher insurance premiums for Floridians.

The frequency and severity of severe weather events, exacerbated by climate change, have led to a rise in insurance claims and costs. Florida's vulnerability to hurricanes and flooding has made it particularly susceptible to weather-related damage. Hurricane Ian, which struck Florida in 2022, was one of the costliest and deadliest hurricanes in the state's history. The increasing intensity of hurricanes and storms has contributed to the destabilization of the insurance market in Florida, with insurers facing challenges in covering claims.

The impact of severe weather on auto insurance rates in Florida is twofold. Firstly, the increased risk of damage or loss due to hurricanes, flooding, and storms results in higher insurance claims. Insurance companies, bearing the burden of these claims, pass on the costs to policyholders by raising premiums. Secondly, the increased demand for comprehensive coverage, which includes protection against weather-related damage, influences the overall cost of auto insurance in the state. Floridians must grapple with higher insurance rates due to the heightened risk and impact of severe weather events.

In addition to severe weather, other factors contribute to Florida's high auto insurance costs. The state has a high number of uninsured motorists, with 26.7% of drivers lacking insurance coverage. This increases the financial burden on insured drivers, as the costs of accidents involving uninsured drivers are often covered by the insured party's insurance company. Florida also attracts high-risk drivers, including tourists, students, and the elderly, who contribute to the high number of car accidents in the state. Busy roadways, resulting from Florida's status as the third-busiest state, further increase the likelihood of accidents and insurance claims.

Iowa Auto Insurance: Is Aut-Owners Insurance Accepted?

You may want to see also

High auto theft rates

Florida's auto insurance rates are the highest in the country, with an average annual cost of $3,945 for full coverage. This is 55% higher than the national average of $2,500. One of the reasons for this is the state's high auto theft rate. In fact, Florida has the fourth-highest vehicle theft rate in the nation. In 2022, Floridians lost 45,973 vehicles to thieves, a 6% increase from 2021.

The high rate of auto theft in Florida can be attributed to several factors. One key factor is the lack of immobilizers in many Hyundai and Kia vehicles manufactured between 2011 and 2022. Immobilizers are passive security systems that require a programmed key fob to match the car's security system before the vehicle can be turned on. The absence of these devices makes it easier for thieves to steal these cars. This vulnerability was exploited by a viral TikTok trend known as the "#KiaChallenge", which showed users how to easily steal certain Kia and Hyundai models. As a result, theft claims for these vehicles increased significantly in 2022 and 2023.

In addition to the social media trend, other factors contributing to Florida's high auto theft rate include the state's high population and tourist destination status. As one of the most populous states, Florida has a large number of vehicles on the road, providing more opportunities for thieves. Additionally, Florida attracts a significant number of tourists, including high-risk drivers who may be unfamiliar with the area and more likely to become victims of auto theft.

To combat auto theft, Florida residents can take several precautions. These include installing security devices such as immobilizers, steering wheel locks, and GPS tracking devices. Keeping vehicles locked and parked in well-lit, secure areas can also deter thieves. Taking these measures can help reduce the risk of auto theft and lower insurance costs in the state.

Auto Insurance: Unaffordable for Many

You may want to see also

Claims fraud

Florida has the most expensive car insurance rates in the United States. The average annual cost of car insurance in Florida is $3,945 for full coverage, which is 55% higher than the national average of $2,500. The high cost of car insurance in Florida is attributed to several factors, one of which is claims fraud.

Florida has a high number of uninsured motorists, with 26.7% of drivers in the state lacking insurance coverage. This is one of the main reasons for the increased insurance costs in Florida. The high number of uninsured motorists leads to more litigated claims, as insured drivers seek compensation for accidents caused by uninsured drivers.

In addition, Florida has a substantial number of high-risk drivers, including elderly drivers, tourists, and students. These high-risk drivers contribute to the high number of car accidents in the state, with over 400,000 accidents reported annually. The high accident rate leads to an increased number of insurance claims, which drives up the cost of insurance for all Florida drivers.

Florida is also known for its unpredictable weather, including intense storms and hurricanes, which can cause significant property damage. The cost of repairing weather-related damage is often reflected in higher insurance premiums.

Another factor contributing to the high cost of car insurance in Florida is insurance fraud. According to the National Insurance Crime Bureau, Miami is ranked third in the nation for PIP (Personal Injury Protection) fraud. PIP fraud occurs when individuals or businesses submit exaggerated or false claims to insurance companies, seeking compensation for injuries or damages that never occurred or were less severe than claimed. This type of fraud costs insurers close to $1 billion annually in Florida alone.

To combat insurance fraud, the Florida Office of Insurance Regulation encourages people to report suspected insurance fraud to the Department of Financial Services. Reporting fraud helps protect consumers from the financial consequences of fraud and assists in keeping insurance rates as low as possible.

Who Pays First in a Car Accident: Driver or Owner's Insurance?

You may want to see also

Frequently asked questions

Florida car insurance is expensive due to a high number of factors, including the high number of uninsured drivers, the high-risk drivers who live in and visit the state, and unpredictable weather.

The average cost of auto insurance in Florida is $3,945 annually for full coverage. This is 55% higher than the national average of $2,500.

Florida has the highest car insurance premiums in the US for the second year in a row.

There are several ways to save on auto insurance in Florida, including taking a defensive driving course, establishing yourself as a good driver with a clean record, and enrolling in a telematics program.

In addition to the high number of uninsured drivers and severe weather, auto insurance in Florida is expensive due to the high rate of auto theft and claims fraud.