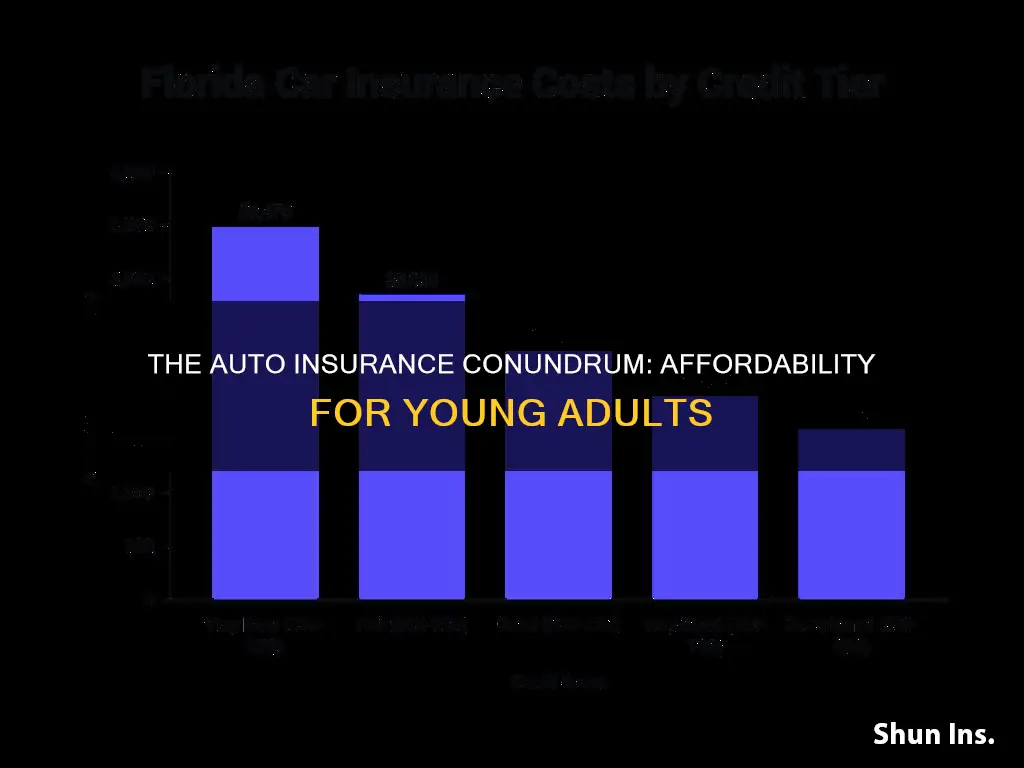

Auto insurance for 20-year-olds can be expensive, with the average cost of a full-coverage policy being $3,261 per year, or $272 per month. This is significantly higher than the national average of $1,580 for a 40-year-old driver, but lower than the cost of insurance for a 16-year-old. The high cost of insurance for young drivers is due to their lack of experience, which puts them in a higher-risk category for insurers. Male drivers in this age group also tend to pay higher rates than females, as they are statistically more likely to be involved in accidents.

While the cost of auto insurance for 20-year-olds can be daunting, there are ways to reduce premiums. Staying on a parent's insurance policy, taking advantage of discounts, such as good student discounts, and comparing quotes from multiple companies can help young drivers find more affordable coverage. Additionally, young drivers can consider lowering their coverage limits or opting for pay-per-mile insurance if they don't drive frequently.

| Characteristics | Values |

|---|---|

| Average cost of car insurance for a 20-year-old with their own policy | ~$329 per month for a full coverage policy |

| Cheapest car insurance for 20-year-old drivers | Farm Bureau ($198 per month) |

| Average cost of car insurance for a 20-year-old male | $3,495 per year |

| Average cost of car insurance for a 20-year-old female | $2,459 per year |

| Average cost of car insurance for a 20-year-old with a good GPA | $189 saved per year |

| Average cost of car insurance for a 20-year-old with a defensive driving course | $189 saved per year |

| Average cost of car insurance for a 20-year-old with a renter's insurance policy | $150 per year |

What You'll Learn

Compare quotes from multiple companies

Comparing quotes from multiple companies is a great way to find affordable car insurance for 20-year-olds. Here are some tips to help you get started:

- Use a trusted insurance comparison site: Sites like The Zebra, NerdWallet, Compare.com, Insurify, and Gabi allow you to compare quotes from multiple companies at once. This saves you time and provides a comprehensive view of your options.

- Have the necessary information ready: To get accurate quotes, you'll need to provide personal information such as your name, date of birth, address, occupation, and driver's license number. You'll also need details about your vehicle, including its make, model, year, and Vehicle Identification Number (VIN). It's important to be honest and accurate when providing this information to get the most suitable quotes.

- Understand the factors that affect your premium: Your premium is determined by various factors, including your age, gender, driving record, credit history, and the type of car you drive. Knowing these factors can help you make informed decisions when comparing quotes.

- Compare the same types and amounts of coverage: To ensure a fair comparison, make sure each quote includes the same levels of liability and uninsured/underinsured motorist protection, and deductibles for collision and comprehensive coverage (if applicable). This allows you to evaluate the cost of similar coverage options across different companies.

- Consider your needs and budget: Determine the level of coverage you require and what you can afford. You may not need all the optional coverage types, so choose the ones that best suit your needs. Keep in mind that the lowest quote may not always be the best option, as it may not provide sufficient coverage.

- Look beyond price: While cost is an important factor, also consider the company's customer service, claims satisfaction, and financial stability. Check reviews and ratings to get an idea of what it's like to be their customer.

- Get quotes regularly: Insurance rates can change over time, so it's a good idea to compare quotes periodically. This helps you stay up-to-date with the market and potentially find better deals.

By following these steps, you'll be able to effectively compare quotes from multiple companies and make a well-informed decision about your car insurance as a 20-year-old.

Auto Insurance Trackers: Worth the Cost?

You may want to see also

Take advantage of discounts

Auto insurance can be expensive, especially for young drivers. However, there are many discounts available that can help reduce the cost of your premium. Here are some ways to take advantage of discounts when it comes to your auto insurance:

Multi-Policy Discounts

If you already have other types of insurance, such as homeowners, renters, condo, life, or even boat insurance, you can often get a discount by bundling your auto insurance with the same company. This is known as a multi-policy or multi-line discount and can result in significant savings. For example, State Farm offers an average 23% discount when bundling auto and home insurance, while American Family and Farmers offer an average 18% discount.

Vehicle Safety Discounts

If your car is equipped with safety features like anti-lock brakes, airbags, and daytime running lights, you may be eligible for a discount on your insurance. Airbag discounts, in particular, can be substantial, with potential savings of up to 40% on medical-related coverage. Additionally, cars that are less than three years old may qualify for a new car discount, which can range from 10% to 15%.

Anti-Theft Device Discounts

If your vehicle has anti-theft features, you can typically receive a discount on your comprehensive coverage. This includes both factory-installed and after-market-installed devices. Examples of anti-theft devices include GPS-based systems, stolen vehicle recovery systems, and VIN etching, which permanently engraves the vehicle identification number on the windshield and windows.

Good Driver Discounts

Insurance companies often reward safe drivers with discounts. For instance, Geico offers up to 26% in potential savings if you have been accident-free for five years. Similarly, State Farm offers a discount if you maintain an accident-free driving record or take steps to become a better driver through their Drive Safe & Save® app or Steer Clear® program.

Defensive Driver Discounts

Taking an approved defensive driving course can also help you save on your insurance. This discount is typically offered to mature drivers aged 50 or older, but it may be available to younger drivers as well, depending on the company and state regulations.

Good Student Discounts

If you are a full-time student with good grades, you may be eligible for a good student discount. Most insurance companies require students to maintain at least a B average and be between the ages of 16 and 25. The discount can range from 8% to 25% and may even last until the student turns 25.

Student Away at School Discount

If you have a student on your policy who is away at school and does not have regular access to the insured vehicle, you may qualify for a discount. The student must typically be under the age of 25 and live more than 100 miles from home.

Payment Discounts

You can also save money on your auto insurance by paying your policy in full upfront or by setting up automatic payments. Additionally, some companies offer a small discount for using electronic funds transfer (EFT) or paperless billing.

Online Discounts

Some insurance companies provide discounts for getting an online quote or signing up for a policy online. This can range from 4% to 12%, so it's worth checking if your insurer offers this type of discount.

Advance Quote Discounts

Shopping around and buying a policy in advance of your current one expiring can also result in savings. Discounts typically range from 2% to 15%, and purchasing 10 days in advance can lead to significant savings.

Occupational Discounts

Your occupation may also qualify you for a discount. For example, Liberty Mutual offers special policy features for educators, while Geico provides up to a 15% discount for military personnel. It's worth asking your insurance agent if your profession qualifies for any discounts.

Usage-Based Insurance Discounts

Usage-based insurance (UBI) programs offer discounts based on your driving habits. These programs collect data through a device installed in your car or a smartphone app and provide discounts for safe driving. The discount is typically applied at policy renewal time and can range from 5% to 40%.

Remember, not all discounts are automatically applied, so it's important to regularly review your policy and discuss potential savings opportunities with your insurance agent.

U-Turn: USAA's 12-Month Auto Insurance Offering

You may want to see also

Lower your coverage limits

The average cost of car insurance for a 20-year-old driver is $300 per month or over $3,600 per year. This is a lot more than the national average across all age brackets. Motorists in their early 20s are riskier to insure than their more experienced counterparts, and this risk is reflected in the insurance rates.

One way to save money on car insurance is to lower your coverage limits. This means you will have less financial protection in the event of an accident, but it can significantly reduce your premiums.

For example, if you have a $500 deductible, your insurer would give you a check for $4,500 to cover vehicle damage. If you increase your deductible to $1,000, you will pay slightly less per month.

You can also consider dropping collision and comprehensive coverage on older cars. If your car is worth less than ten times the premium, purchasing this coverage may not be cost-effective. Review your coverage regularly to ensure it meets your needs.

It's important to remember that lowering your coverage limits means you will have to pay more out of pocket if you are in an accident. Make sure you understand the risks and have enough money set aside to cover any potential costs.

Other ways to save on auto insurance

- Compare quotes from multiple insurance companies

- Get a good student discount

- Take a defensive driving class

- Bundle your insurance policies

- Maintain a good credit record

- Take advantage of low mileage discounts

- Seek out group insurance plans

- Look for other discounts, such as good driver discounts or discounts for safety features on your car

California Auto Insurance Rates Rise Due to Fires

You may want to see also

Stay on your parents' car insurance policy

If you're a 20-year-old looking to save money on auto insurance, one option is to stay on your parents' car insurance policy. There is no age limit for car insurance, unlike health insurance, which ends at 26. As long as you live at home or are a full-time student, you can remain on your parents' policy. This can save you a lot of money, as car insurance for young drivers is significantly more expensive than for older drivers. The rates you’re quoted when purchasing your first policy will likely be much higher than what you were charged on your parents' policy, and these high rates will continue until your 25th birthday.

There are some cases, however, when you may not be able to stay on your parents' policy. If you move out of your parents' home permanently, you will typically need to get your own insurance policy. Additionally, if you own your own vehicle, you may need to purchase your own insurance, depending on the state and insurer. If you are married, insurance companies will also likely expect you to get your own policy.

If you can stay on your parents' policy, you should arrange to pay them the difference in insurance premiums as this will help you establish financial responsibility while keeping your rates low. It's also a good idea to maintain a clean driving record and practice safe driving techniques to avoid rate hikes or losing coverage.

Understanding Your Auto Insurance Score

You may want to see also

Raise your deductibles

Raising your car insurance deductible can be a great way to lower your monthly insurance payments, but it's important to understand the trade-offs involved. A deductible is the amount you pay out of pocket before your insurance company covers the rest. Typically, you can choose deductibles of $250, $500, or $1000, but they can go as high as $2500. Increasing your deductible from $500 to $1000, for example, could reduce your premium by about 28%. However, this also means you'll have to pay more if you ever need to make a claim.

Let's say you have a $500 deductible and are at fault for an accident with $5000 in property damage. You'll need to pay your $500 deductible, and your insurer will cover the remaining $4500. Now, if you had a $1000 deductible, you'd be paying double out of pocket for the same accident.

It's important to consider your financial situation when deciding on your deductible. While raising it can save you money on premiums, you also need to ensure you can afford the higher out-of-pocket costs if you ever need to make a claim. It's recommended to have enough in your emergency fund to cover your entire deductible. Additionally, if you have a history of accidents or are a new driver, a higher deductible may not be the best idea.

Another thing to keep in mind is that the savings from a higher deductible may not always be significant, especially if you have an expensive vehicle or other factors that contribute to higher premiums. It's a good idea to compare quotes from different insurers with various deductible options to find the best value.

Overall, if you have a safe driving record, want to minimize monthly expenses, and can afford a higher cost in the event of an accident, raising your deductible could be a smart move. However, if these factors don't apply to you, it may be better to stick with a lower deductible.

Finding Auto Insurance: A Quick Guide

You may want to see also

Frequently asked questions

The average cost of car insurance for a 20-year-old is $3,261 per year, or $272 per month, for a full-coverage policy. This is a lot of money for a young person, especially if you are earning minimum wage. You could try to find a higher-paying job, or take on a second job. You could also save money by buying a cheaper car, or by shopping around for the best insurance rates.

It costs an average of $1,496 a year to add a 20-year-old to a parent's car insurance policy. This is much cheaper than a 20-year-old buying their own policy, which costs an average of $4,499 a year.

You could try to get a good student discount, or a discount for completing a driver training class. You could also save money by raising your deductible, or by choosing a cheaper car to drive.