Term insurance is a type of life insurance that provides coverage for a specific period of time, or a specified term of years. If the insured dies during the time period specified in a term policy and the policy is active, then a death benefit will be paid. Term insurance is initially much less expensive compared to permanent life insurance, such as whole life and universal life. This is because it’s not designed to last through old age, which is when life insurance premiums are the most expensive.

When purchasing a term life insurance policy, it's crucial to understand the premium payment terms to ensure the policy remains active. The policy payment terms differ by insurance company, but there are several types to choose from, including single premium payment, regular premium payment, and limited premium payment. Each of these premium payment terms provides a different set of benefits, so you can find one that's best suited to your needs and budget.

The premium payable for life insurance is a critical factor governing purchase decisions. Term insurance premiums are typically more economical than other life insurance products. However, the mode of premium payment contributes to affordability to a significant extent. Hence, it's important to understand the available alternatives to select the payment option that best aligns with your resources.

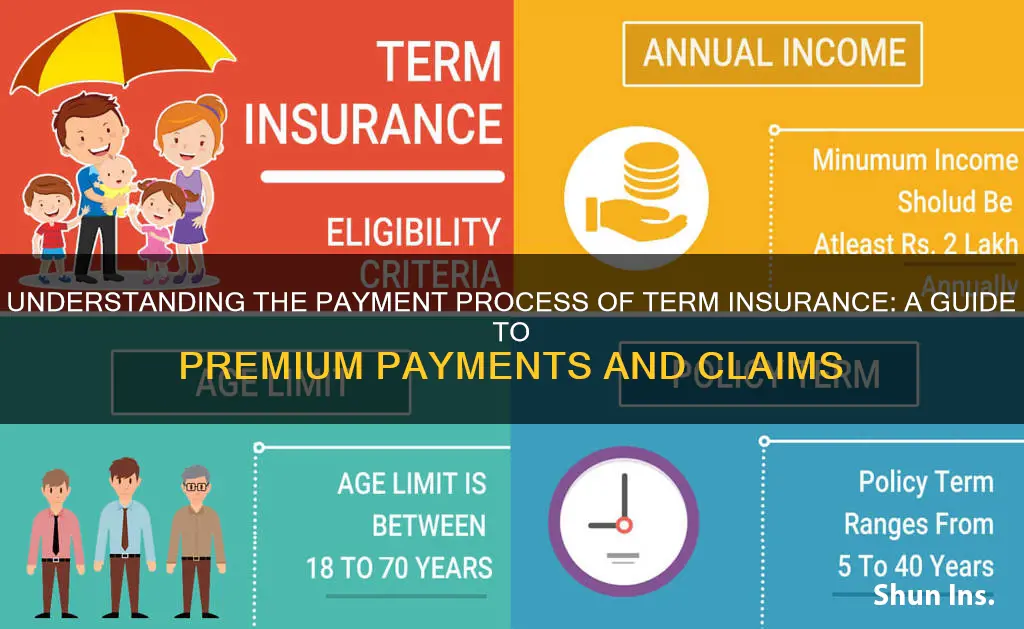

| Characteristics | Values |

|---|---|

| Type of Insurance | Term Life Insurance |

| Purpose | Provides financial protection to the policyholder's family for a fixed time or years |

| Payment Options | Annual, Semi-Annual, Quarterly, Monthly |

| Premium Payment Options | Regular, Limited, Single |

| Age Range | 18-65 years |

| Policy Term | 5-40 years |

| Premium Calculation Factors | Age, Gender, Smoking Habit, Medical History, etc. |

| Benefits | Death Benefit, Critical Illness Coverage, Disability Coverage, Tax Savings |

| Disadvantages | No Investment Factor, Premium Differs Based on Age |

What You'll Learn

Premium payment options

Term insurance is a type of life insurance that provides financial coverage to the policyholder's family for a fixed period. The policyholder can choose from various premium payment options available with term insurance plans. Here are some of the most common premium payment options:

- Regular Payment Option: This is the most opted method for making a premium payment for a term insurance plan. It allows periodic payments at monthly, quarterly, half-yearly, or yearly intervals. This option is generally advised due to its affordability factor.

- Limited Payment Option: This option allows the policyholder to choose a specific period, such as 5 or 10 years, for paying premiums while enjoying the benefits of insurance cover for a longer duration. It is suitable for those who want to be relieved of the commitment of paying insurance premiums for extended periods.

- Single-Premium Payment Option: This option is for those who do not want the financial burden of recurrent payments. It requires a one-time payment solution, where the premium is paid upfront in a single shot.

Factors Affecting the Choice of Premium Payment Option

When choosing a premium payment option, it is essential to consider factors such as affordability, payment ability, and life stage. Additionally, the premium payment option should align with your financial circumstances and goals.

- Regular Premium Payment Option: This option is often chosen due to its affordability, especially for salaried individuals who want to avoid a considerable strain on their pockets. It allows for flexibility in discontinuing the policy once there are no liabilities, and dependents are financially independent.

- Limited Premium Payment Option: This option is ideal for those with unpredictable incomes, such as business owners or professionals with fluctuating incomes. It is also suitable for those who want to be relieved of the long-term financial commitment of recurring payments.

- Single Premium Payment Option: This option may appear less expensive compared to regular plans, but it is essential to consider the impact of inflation. Consulting an advisor before investing is recommended to make an informed decision.

Factors affecting premium amounts

The premium amount for term insurance is influenced by several factors, which can be broadly categorized into two groups: demographic factors and lifestyle choices.

Demographic Factors

- Age: The younger the policyholder, the lower the premium. This is because younger individuals are generally healthier and have a lower risk of falling ill or passing away prematurely. As a result, the likelihood of the insurer having to pay out on the policy is reduced, leading to lower premiums.

- Gender: Women tend to have a longer life expectancy than men and are therefore offered lower premiums.

- Health: The policyholder's current health status and medical history can significantly impact the premium amount. Pre-existing medical conditions, especially serious illnesses, increase the likelihood of future claims, resulting in higher premiums. Insurers also consider factors such as weight, cholesterol levels, blood pressure, and other metrics that could indicate future health issues.

- Family Health History: Even if the policyholder has no current medical conditions, a family history of hereditary diseases can factor into the premium amount and increase coverage costs.

Lifestyle Choices

- Smoking: Smoking increases the risk of various health issues, including potentially fatal diseases like cancer and lung cancer. As a result, smokers are often charged higher premiums than non-smokers.

- High-Risk Hobbies: Engaging in high-risk activities such as skydiving or racing cars can lead to higher premiums. Insurers view these activities as increasing the likelihood of claims being made against the policy.

- Occupation: Certain occupations are considered riskier than others due to exposure to hazardous environments, high-stress levels, or dangerous duties. For example, loggers, pilots, and roofers may be subject to higher premiums due to the nature of their work.

- Alcohol Consumption: Regular alcohol consumption can lead to health issues, such as liver problems, and is therefore considered a factor that can increase the premium amount.

It is important to note that the specific factors and their weightings used to calculate term insurance premiums may vary across different insurance providers. Additionally, the premium amount can be influenced by the chosen sum assured, the payment tenure, and any additional riders included in the policy.

The Risky Business of Lying on Short-Term Insurance Policies

You may want to see also

Policy term and premium payment term differences

Term insurance plans offer coverage for a specified period, known as the policy term. This refers to the duration during which the insurance policy is active and the policyholder can enjoy its benefits. The policy term starts from the effective date of the policy and ends when it matures or expires. It is important to note that term insurance policies only cover deaths that occur during the policy term.

The premium payment term, on the other hand, is the total number of years for which the policyholder is required to pay the premium. This period might be shorter, equal to, or in rare cases, longer than the policy term. The premium payment term directly influences the premium amount, with shorter terms resulting in higher premiums and longer terms spreading the cost over a more extended period.

While the policy term refers to the overall duration of coverage, the premium payment term dictates when and for how long the policyholder needs to make payments to keep the policy active.

For example, if an individual purchases a term insurance plan with a policy term of 40 years, providing coverage until they turn 65, they will also need to decide on the premium payment term. They might opt for a premium payment term of 20 years, paying regular premiums during their working years, or choose a shorter premium payment term of 10 years, resulting in higher premiums for a more condensed period.

It is important to carefully consider the relationship between the policy term and premium payment term, as it can impact the overall cost of insurance and an individual's financial planning. A shorter premium payment term may result in higher upfront costs, while a longer term provides more flexibility for those with limited immediate financial resources.

Understanding Extended Term Nonforfeiture: An Important Decision for Policyholders

You may want to see also

Choosing the right payment option

When it comes to purchasing term life insurance, understanding the premium payment terms is critical. Term insurance is designed to provide financial protection to your loved ones in the event of your unexpected passing, so it's crucial to ensure that you pay your premiums on time to keep the policy active. Here are some factors to consider when selecting a payment term:

- Your age: If you are young, a regular pay term may be suitable as it allows you to spread the premium payments over the policy term. If you are close to retirement, a limited pay term may be better as it allows you to pay off the premium in a limited period.

- Your income level: If you have a regular income, a regular pay term may be more suitable. If you have a large lump sum amount available, a single-pay term may be a better option as it offers lifetime coverage with no further premium payments.

- The duration of your policy term: If you have a short policy term, a regular pay term may be suitable. If you have a long policy term, a limited pay term may be preferable.

- Your expected income growth: If you expect your income to increase, a limited pay term may be a better option. If you expect your income to remain the same, a regular pay term may be more appropriate.

When choosing a payment option, it's important to consider your financial situation and life stage. Regular pay term insurance is generally recommended due to its affordability, allowing you to spread out premium payments over time. However, if you are unsure about paying premiums long into the future or prefer to pay off the premiums during your active work life, a limited pay term may be a better choice. Single pay term insurance can also be attractive if you have a large lump sum available, as it provides lifetime coverage without the need for future premium payments.

Exploring Short-Term Insurance Options with Horizon

You may want to see also

Penalties for late payments

Late payment penalties vary depending on the type of insurance and the jurisdiction. Here are some examples of penalties for late payments:

Term Insurance Late Payment Penalties

Term insurance policies typically have a grace period, often 30 or 31 days, during which the policy remains in force even if the premium is not paid on time. If the premium remains unpaid after the grace period, the policy may lapse, and the insurance coverage will end. Some policies may also charge a late fee or penalty interest on the overdue premium. It is important to review the specific terms and conditions of your term insurance policy to understand the exact consequences of late payments.

Late payment penalties can vary depending on the industry and jurisdiction. Here are some examples:

- Taxes: In the United States, the Internal Revenue Service (IRS) charges a failure-to-pay penalty of 0.5% of the unpaid taxes for each month or part of a month that the tax remains unpaid, up to a maximum of 25%. Additionally, interest accrues on unpaid taxes, calculated at the federal short-term rate plus 3% and compounded daily.

- Worker's Compensation: In California, the Labor Code imposes penalties on insurance companies for late payments of workers' compensation benefits. Section 4650 stipulates a 10% penalty for overdue temporary or permanent disability benefit payments. Section 5814 allows for penalties of up to 25% for payments that are unreasonably late, including temporary or permanent disability benefits, medical treatment, mileage reimbursement, and other required payments.

- Credit Cards and Loans: Late fees for credit cards and loans typically range from $25 to $50. These fees are added to the outstanding balance, increasing the amount subject to interest charges. Late payments can also trigger other charges, such as returned payment fees or non-sufficient funds (NSF) fees. Additionally, lenders may review and raise interest rates based on payment history, leading to higher costs for borrowers.

- Rent: Late fees for rent vary depending on the state and the terms of the lease agreement. Some states impose no specific limits, requiring only that the late fee be "reasonable." Other states may limit the late fee to a certain percentage of the rent, a specific dollar amount, or a combination of both.

- Medicare: Late enrollment in Medicare may result in an extra amount, called a late enrollment penalty, added to your monthly premium. This penalty is not a one-time fee but is typically charged for as long as you have that type of coverage. The Part B penalty, for example, is an extra 10% for each year you could have signed up but didn't.

- Contracts: Late payment penalties in contracts can vary widely. For example, a contract might stipulate a flat fee, such as $100, for late payments. Alternatively, it could impose a percentage-based penalty, such as 1% of the payment amount for each day it is late. Some contracts may also allow the creditor to declare all remaining unpaid sums due and proceed with collateral foreclosure if payments are significantly overdue.

Understanding the Role of Short-Term Insurance in Meeting FRS Requirements

You may want to see also

Frequently asked questions

There are several types of premium payment terms in term insurance, including single premium payment, regular premium payment, and limited premium payment. With a single premium payment, you pay for the entire premium in one lump sum. A regular premium payment term allows you to pay the premium in instalments—annually, semi-annually, quarterly, or monthly—for the duration of the policy. In a limited premium payment term, you pay the premiums over a shorter period than the policy term, but the coverage continues until the policy expires.

The premium payment terms depend on the insurance company. Some common options include annual payments, semi-annual payments, quarterly payments, and monthly payments.

When choosing a policy payment term, consider factors such as your age, income level, policy term, and expected income changes. If you're young or have a regular income, a regular pay term may be suitable. If you're close to retirement or have a large lump sum, a limited pay term or single-pay term may be better.

It's important to pay your premiums on time to keep your policy active. If you miss a payment and it goes past the grace period, your policy may lapse or be terminated.