Mercury Insurance is a Los Angeles-based company that offers auto and home insurance. Mercury's home insurance policies are available in 10 states: Arizona, California, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas and Virginia.

Mercury's home insurance policies offer the standard coverage options, including dwelling protection, personal property coverage, extended replacement cost, additional living expenses, personal liability protection, and guest medical protection.

Mercury Insurance has received mixed reviews from customers. While some customers have praised its customer service, others have complained about its claims servicing process, unexpected rate increases, and slow claims payouts.

In terms of ratings, Mercury Insurance has received varying scores from different review platforms. WalletHub editors rated Mercury Insurance 3.7 out of 5, while WalletHub users gave it an average rating of 2.1 out of 5. Meanwhile, Bankrate gave Mercury home insurance a score of 4.3 out of 5, and The Zebra gave it a rating of 3.0 out of 5.

Overall, Mercury Insurance is recognised as one of the best insurance companies in the industry, receiving awards from Forbes and J.D. Power. It offers a range of insurance products, discounts, and additional coverage options, but it is not available in all states.

| Characteristics | Values |

|---|---|

| WalletHub editor rating | 3.7/5 |

| WalletHub user rating | 2.1/5 |

| NAIC rating | 2.51 |

| States available | 11 |

| WalletHub highlights | Top discounts, basic and extra coverage options |

| NerdWallet rating | 4/5 |

| AM Best rating | A (Excellent) |

| J.D. Power auto claims satisfaction score | 848/1000 |

| J.D. Power auto insurance customer complaints | Fluctuating |

| Bankrate car insurance score | 3.8/5 |

| Bankrate home insurance score | 4.3/5 |

| The Zebra car insurance rating | 3.5/5 |

| The Zebra home insurance rating | 3.0/5 |

What You'll Learn

Mercury's insurance coverage

Mercury Insurance offers a range of coverage options for homeowners, including protection for your home, personal property, and additional living expenses. Here is a detailed overview of Mercury's insurance coverage:

Coverage for Your Home

Personal Property Coverage

Mercury's insurance also covers items within your home, such as electronics, furniture, and clothing. This coverage ensures that your belongings can be replaced or repaired if they are damaged or lost due to a covered incident.

Extended Replacement Cost Coverage

Mercury provides extended replacement cost coverage, offering up to 150% additional coverage for the costs of rebuilding your home after a covered loss. This ensures that you have the necessary financial resources to rebuild your home, even if the costs exceed the original value.

Additional Living Expenses Coverage

In the event that your home becomes uninhabitable due to a covered loss, Mercury's insurance provides additional living expenses coverage. This helps cover the costs of temporary living arrangements, such as hotel stays or restaurant meals, while your home is being repaired or rebuilt.

Personal Liability Protection

Mercury's insurance also includes personal liability protection, which safeguards you financially if you are held liable for injuries or damages to others, whether inside or outside your home. This coverage protects you from the financial burden of legal expenses and compensation for property damage.

Guest Medical Protection

Guest medical protection is another essential component of Mercury's insurance coverage. It covers medical expenses for guests who accidentally injure themselves on your property. This aspect of the coverage ensures that your guests' medical costs are taken care of, providing peace of mind for both you and your visitors.

Identity Theft Protection

Mercury also offers identity theft protection as part of its insurance coverage. This protection helps cover the expenses you may incur as a result of criminal identity theft, including legal and recovery-related costs.

Optional Coverage Add-ons

In addition to the standard coverage options, Mercury allows you to customize your policy with optional add-ons. These include identity theft coverage, equipment breakdown coverage, service line coverage, additional coverage for valuables, personal cyber coverage, and water backup coverage.

Discounts and Savings Opportunities

Mercury Insurance also offers various discounts that can help lower your insurance premiums. These include discounts for protective devices (smoke alarms, deadbolts, etc.), fire-resistant construction materials, selecting a higher deductible, bundling multiple policies, and more.

Overall, Mercury's insurance coverage for homeowners provides a comprehensive set of protections, with additional options for customization. It is important to note that Mercury's homeowners insurance is currently available in only 10 states: Arizona, California, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas, and Virginia.

Texas Home Insurance: Is It Mandatory?

You may want to see also

Customer satisfaction

Mercury Insurance has received mixed reviews from customers, with some praising its customer service and others complaining about its claims servicing process. WalletHub gives the company an average user rating of 2.1 out of 5, while its editors rate the company 3.7 out of 5. Similarly, Mercury Insurance has a rating of 3.6 out of 5 from WalletHub's editors, based on factors such as customer reviews and watchdog-group ratings.

According to the National Association of Insurance Commissioners (NAIC), Mercury has a rating of 2.51, indicating that it has received more complaints than the average car insurance provider, adjusted for size. The company also has a higher volume of complaints to state regulators than expected for a company of its size. In 2023, the NAIC Complaint Index for Mercury was 1.66, reflecting more complaints than average.

However, Mercury Insurance has also been recognised as one of the best insurance companies in the industry, receiving awards from Forbes and J.D. Power. It also offers a range of discounts and coverage options for its home insurance policies, including extended dwelling replacement cost coverage, identity theft protection, and valuable items coverage.

Farmers Insurance: Has the Harvest Begun?

You may want to see also

Discounts and pricing

Mercury Insurance offers a range of discounts to help you save money on your homeowners insurance premium. Firstly, you can benefit from a discount of up to 17.9% on your homeowners policy and 14.5% on your auto policy when you bundle them together. This is a great option if you're looking for comprehensive protection for both your home and vehicle.

Additionally, Mercury provides a variety of other discounts to keep rates low:

- New home (0-9 years old): If you're a recent homeowner and your house is less than 10 years old, you may qualify for this discount.

- Multi-policy discount: You can save money by having multiple policies with Mercury, such as combining your homeowners insurance with an auto or California Earthquake Authority policy.

- Fire protective devices: Installing fire protective devices like fire alarms and sprinklers can help you qualify for a discount.

- Theft protective devices: Equipping your home with security systems and theft protective devices can lead to a discount on your premium.

- Water leak detection systems: Homes with automatic water shut-off systems or leak detection technology that notifies a third party can receive a discount.

- Loss-free history: If you have a claims-free history for three or more consecutive years, you may be eligible for a discount.

- Gated community: Living in a gated community can provide an additional layer of security and result in a discount.

- Safety devices: Implementing safety devices like fire prevention systems, leak detection technology, and home security systems may qualify you for a discount.

- Higher deductible: Opting for a higher deductible will lower your premium, but ensure you're comfortable with the out-of-pocket expense in the event of a claim.

- Protective construction materials: Using fire-resistant construction materials and insurance-friendly roofing materials like concrete or tile can reduce your premium.

- Homeowners association: If your dwelling or condo belongs to a homeowners association, you may be eligible for a discount.

- Wildfire mitigation: For homes located in areas prone to wildfires, Mercury offers discounts for meeting certain defensible space and home-hardening requirements, as well as community-level discounts for recognised Firewise USA sites.

It's important to note that discounts may vary by state, and certain conditions or requirements may apply for specific discounts. Be sure to contact a local Mercury agent to learn more about the discounts available in your state and find out how you can optimise your savings on homeowners insurance.

Farmers Insurance Subsidy Programs: Unraveling the Benefits for Farmers and Ranchers

You may want to see also

Availability and accessibility

Mercury Insurance is a Los Angeles-based company that offers auto and homeowners insurance in select states across the country. Mercury's home insurance is available in Arizona, California, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas, and Virginia.

Mercury's home insurance policies are sold through independent agents. The company's website allows customers to pay bills, view policy details, request changes, and file claims. However, customers need to contact an agent to get a quote for a homeowners policy.

Mercury's mobile app, available on both the App Store and Google Play Store, allows policyholders to access policy information, pay bills, and contact customer service. The app is rated above 4 out of 5 stars on both platforms.

Mercury's home insurance policies offer standard coverage options, including dwelling protection, personal property coverage, extended replacement cost, additional living expenses, personal liability protection, and guest medical protection.

The company also provides optional add-ons for further protection, such as home systems protection, service line protection, identity theft coverage, and home cyber protection.

Mercury offers several discounts for homeowners insurance, including multi-policy, protective devices, fire-resistant construction materials, newer homes, and gated community discounts.

While Mercury's home insurance is not available in most states, the company provides a wide range of coverage options and discounts for customers in the eligible states.

Roadside Rescue: Exploring Farmers Insurance's Take on Roadside Assistance

You may want to see also

Complaints and claims

Mercury Insurance has received a mixed bag of reviews from its customers. While some customers have praised the company for its helpful customer service and affordable rates, others have expressed dissatisfaction with its claims servicing process and unexpected rate increases.

On WalletHub, Mercury Insurance has an average rating of 2.1 out of 5 stars from users. Several negative reviews highlight issues with the company's claims process, including slow claims payouts and difficulty in reaching the right person to handle their claim. One user even had to hire a public insurance adjuster to fight their case with Mercury.

Mercury Insurance has also received more complaints than expected for a company of its size, according to data from the National Association of Insurance Commissioners (NAIC). The company's NAIC rating is 2.51, indicating that it has received more complaints than the average car insurance provider, adjusted for size.

In terms of filing a claim, Mercury Insurance offers a 24/7 claims hotline at (800) 503-3724, which is the same number for general customer service inquiries. Claims can also be filed online through the Mercury website or mobile app. According to the company, customers can file a residence insurance claim at any time, day or night.

When filing a residence claim, Mercury Insurance advises customers to first ensure their safety and then contact the company as soon as possible to report their loss. If the loss is due to burglary or theft, customers should notify the police immediately and then contact Mercury. Customers are also advised to take an inventory of the damaged or stolen property, take pictures, make temporary repairs, and protect their property from further damage. If the residence is unlivable, customers should vacate the premises and keep itemized receipts for any living-related costs incurred.

Overall, while Mercury Insurance offers affordable rates and helpful customer service to some customers, it appears that there is room for improvement when it comes to handling customer complaints and claims.

Home Insurance: Criminal Convictions and You

You may want to see also

Frequently asked questions

Mercury's house insurance is rated 4 out of 5 stars by NerdWallet, 3.7 out of 5 by WalletHub, and 3 out of 5 by The Zebra.

Mercury's house insurance offers extended dwelling replacement cost coverage, identity theft protection, and valuable items coverage. However, it is only available in 10 states, does not offer a loyalty discount, and does not provide 24/7 customer service.

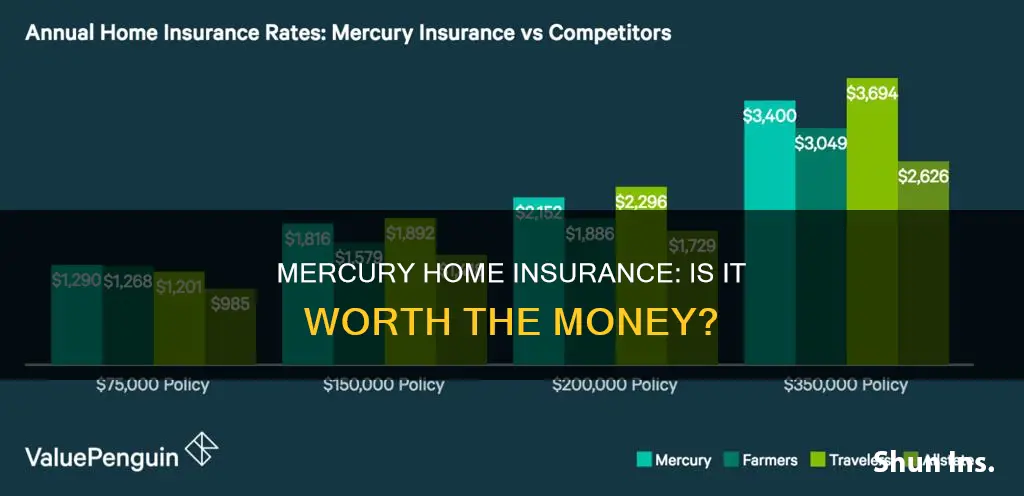

Mercury's house insurance is more affordable than major, nationwide carriers. However, larger insurance companies may offer more optional coverage options and discounts.