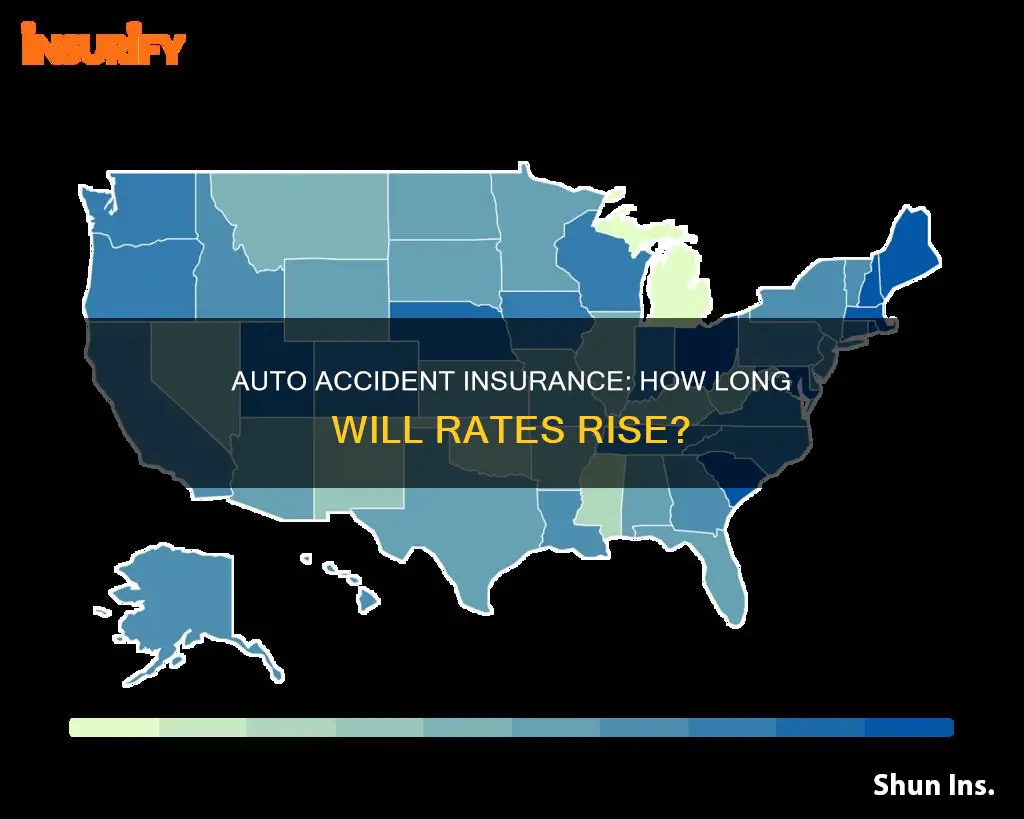

Car insurance rates typically increase after an accident, especially if it was your fault. The increase depends on various factors, including the type of accident, your insurer, and your location. The hike in insurance rates can last from three to five years, but this also depends on your state and insurer. To give you an idea, the national average rate increase is 45% after an accident with property damage and 47% for an accident resulting in injuries.

| Characteristics | Values |

|---|---|

| How long does an accident affect insurance rates? | 3-5 years |

| When does the effect of an accident on insurance rates start? | When you renew your policy |

| Does the effect of an accident on insurance rates depend on the type of accident? | Yes, the effect is greater for accidents with injuries than accidents with property damage only |

| Does the effect of an accident on insurance rates depend on the state? | Yes |

| Does the effect of an accident on insurance rates depend on the insurance company? | Yes |

| Average rate increase | 40%-49% |

| Average rate increase per year | $872 |

| Average rate increase per month | $80 |

Accident forgiveness

Insurers may have different requirements for eligibility. For example, some may require you to have a clean driving record for five years before you qualify for accident forgiveness. It is also important to note that accident forgiveness only applies to your insurance rates, and your accident will still appear on your driving history, which could affect your rates if you switch insurers.

MetLife Auto Insurance: Understanding Their Rating System

You may want to see also

No-fault accidents

No-fault insurance, also known as the Ontario Motorist Protection Plan, is a system that simplifies the process of handling claims for drivers involved in a collision. Regardless of who is at fault for the accident, each driver's insurance provider will handle their claim. This means that if you are in an accident that is not your fault, the other driver's insurance should cover the damage to your car.

However, research suggests that in some areas, even not-at-fault accidents can lead to premium hikes. A 2017 report by the Consumer Federation of America found that drivers in cities across the US saw rate hikes following accidents for which they were not at fault. Similarly, a 2018 report from insurance site Zebra found an average premium increase of 7% for US policyholders following a not-at-fault incident.

There are a few reasons why insurers may penalize safe drivers. Firstly, your insurer may believe that having any kind of accident may make you a higher-risk driver. James Lynch, chief actuary and vice president of research and education for the Insurance Information Institute, suggests that insurers may find that being in an accident, even if you were not at fault, makes you more likely to be involved in another accident in the future.

Additionally, it can be difficult to determine the true cause of your rate hike following a not-at-fault accident, as there are many factors that affect auto insurance premiums. These include your driving history, your credit score, and other issues. For example, you may have had a not-at-fault accident and then seen a premium hike, but this could be due to other factors such as your credit score.

Furthermore, it is possible that even though you believe the other driver was 100% to blame, you may have actually contributed to the accident in some way. In some cases, both drivers may see a premium hike because they both played a part in the accident, or it is unclear where the blame lies.

If you feel that your insurer has punished you unfairly following an accident that was not your fault, you can shop around for a new policy. Different insurance companies handle not-at-fault incidents differently, so it is worth testing the market to find a better deal.

Tracking Devices: Are They in Your Car?

You may want to see also

Surcharging

A car insurance surcharge is an additional fee or penalty added to your premium for several months or years. It is usually the result of traffic violations or at-fault accidents, as well as administrative violations like missed payments. A surcharge is different from a rate hike, which is a permanent premium increase due to changes in your circumstances.

The surcharge percentage generally stays the same every year and won't increase or compound. Some companies may reduce the surcharge percentage each year as the violation ages. The surcharge will be removed after the designated time has passed, and your insurance premium will return to normal.

You can reduce the likelihood of surcharges by avoiding accidents, speeding tickets, and other moving violations, as well as paying your premiums on time and never letting your car insurance lapse. If a surcharge is added, you will need to pay it or find another insurer.

If you think a surcharge should not have been applied to your account, you can contact your insurance agent to dispute the charge. You may be able to have the surcharge removed, especially if you are a long-term customer with a good driving record. However, in some states, it is illegal for insurance companies to waive surcharges once they have been assessed without a change in circumstances.

NASCAR Vehicles: Insured or Not?

You may want to see also

Comprehensive claims

The exact length of time that a comprehensive claim will affect your insurance rate depends on your insurance company and state, but it's generally around three to five years. Some states, like Massachusetts, only allow insurance companies to surcharge for accidents for up to five years. Other states, like New York and Texas, only allow surcharging for accidents for up to three years.

It's important to note that not all states and insurance companies treat comprehensive claims the same. In some states, insurance companies are not allowed to raise rates if the claim is under a certain dollar amount. For example, in Massachusetts, insurers can only add a surcharge if you're more than 50% at fault, and in New York, you can't be surcharged if there were no injuries and the total damage is less than $2,000.

To lower your insurance rates after filing a comprehensive claim, you can consider adjusting your coverage, such as increasing your collision and/or comprehensive deductibles, or adding discounts to your policy. You can also shop around and compare rates from different insurance companies, as they have different viewpoints on how much to raise rates due to a crash.

Auto Insurer: Your Legal Ally

You may want to see also

Discounts

Usage-Based Insurance (UBI)

Many companies offer a discount just for signing up for their UBI program, which monitors and rates your driving practices through your smartphone. Maintaining a good driving score can help you save even more.

Low-Mileage Discounts

If you no longer commute long distances to work, inform your insurance company. You may qualify for a low-mileage discount.

Bundling Policies

If you're not already doing so, consider consolidating your insurance policies with one company. Most providers offer multipolicy discounts for bundling your car insurance with other policies like home or renters insurance.

Accident Forgiveness

Many companies offer optional accident forgiveness, which can protect you from surcharges after an accident. While it can't be applied retroactively, it may be useful in the future. Typically, you're eligible for accident forgiveness after maintaining an accident-free record for a specified period, often three to five years.

Safe Driving

If you believe you're a very good driver, consider usage-based insurance. These programs track your driving actions and produce a score. If you score well, you could earn a discount.

Shop Around

Compare quotes from different insurance companies, as rates vary widely among insurers for the same coverage. You may be able to find a cheaper rate elsewhere, even with an accident on your record.

Find Discounts

Insurance companies offer various discounts, such as good student discounts and multi-policy discounts. Ask your agent about potential discounts you may have overlooked.

Raise Your Deductible

Increasing your deductible on comprehensive and collision coverage will typically lower your premium. However, keep in mind that a higher deductible means higher out-of-pocket expenses if you file a claim.

Rural Carrier Auto Insurance: Navigating the Unique Challenges

You may want to see also

Frequently asked questions

An auto accident will generally affect your insurance rate for three to five years, depending on your insurance company and state’s regulations, as well as the nature and severity of the accident.

Yes, accidents that aren't your fault may still increase your rate depending on your state and insurer. Accidents that aren't your fault can indicate a higher likelihood of future accidents.

Car insurance rates go up by an average of 49% if you cause an accident.

Your insurance rates probably won't go up after an accident caused by another driver. However, some companies may raise your rates slightly, especially if you've filed multiple claims over the years.

You can lower your insurance rates by comparing quotes from different companies, looking for discounts, and adjusting your coverage.