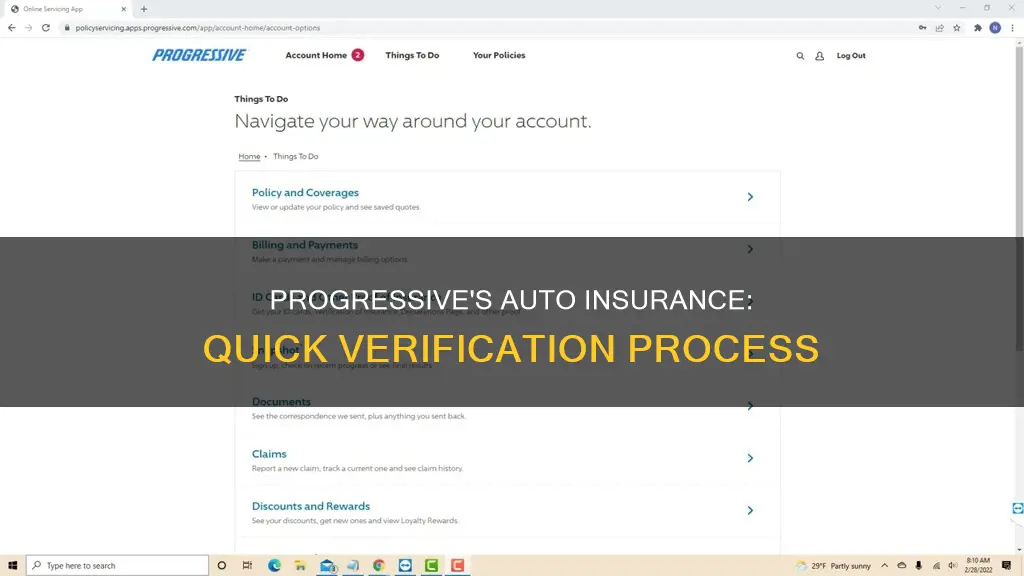

Progressive offers a range of auto insurance options, with varying coverage and benefits. The time it takes to prove auto insurance with Progressive depends on several factors, including the method of obtaining proof and the specific circumstances of the policyholder. Progressive provides its customers with convenient ways to access their proof of insurance, such as through their online account, mobile app, or by calling their customer support. The company also sends physical proof of insurance by mail to new and renewing customers unless they have opted for paperless communication. Additionally, Progressive offers a digital insurance card that can be accessed on a smartphone or tablet, which is accepted as valid proof of insurance in most states. It is important to note that proof of insurance is typically required when pulled over, involved in an accident, leasing a vehicle, or when specifically requested by law enforcement or relevant authorities.

| Characteristics | Values |

|---|---|

| How to get proof of insurance | With Progressive, you can access your auto insurance card and coverage info 24/7 by calling or logging in online. You can also access your proof of insurance card on your phone through the mobile app. |

| What's included on the auto insurance card | Basic information such as the name and address of the insurance company, NAIC number, effective date and expiration date, name of the insured, car's make and model, year, and VIN for the insured vehicle(s) |

| Ways to obtain the Progressive auto insurance card | Get a car insurance quote, and within minutes of purchasing a Progressive policy online, over the phone, or through an agent, you'll receive an email with a link to your insurance card. You can also log in to your account to print or download your ID cards anytime. |

| How to show proof of insurance | In all states, you can show a hard copy of your proof of insurance when requested by police officers, the DMV or BMV, and others. Most states also allow you to show digital ID cards as proof of insurance. |

| How long does it take to get a settlement check after a car accident | The amount of time it takes to settle an insurance claim for a car accident varies, anywhere from a few days/weeks to several months. |

| How long does it take to get a car insurance quote | You can get an online quote in minutes with Progressive. |

| How long does it take to get repairs done | Progressive resolves many property damage claims within 7 to 14 days, but repair times can vary greatly based on your vehicle, the damage, etc. |

What You'll Learn

Progressive's proof of insurance

Proof of insurance is a document that demonstrates you have an active insurance policy that meets the requirements of your state. It is usually in the form of an ID card, and it can be printed or electronic. Progressive provides its customers with a digital insurance card that can be accessed on a smartphone or tablet via the Progressive app or by logging into your account. This is accepted as proof of insurance in nearly every state.

You can obtain proof of Progressive car insurance right after you purchase a policy. You will receive an email with a link to your insurance card, and you can also log in to your account to print or download your ID card at any time. Progressive also sends new and renewing customers a physical proof of insurance card in the mail, unless you have opted to go paperless. If you don't have access to a computer or printer, Progressive can mail your insurance card to you, although this may cause you to lose your paperless discount.

If you are pulled over by a police officer and asked to show proof of insurance, you can simply show the ID card on your phone in most states. Progressive also lets you access your insurance coverage information through the app.

In addition to proof of insurance, Progressive offers a range of benefits and services to its customers, including 24/7 claims support and online service. You can file a claim by logging into your policy online, through the mobile app, or by calling the claims centre. Progressive representatives will help you through the process and make sure your repairs are handled quickly and efficiently.

Gap Insurance Tax Rules in New Jersey

You may want to see also

Payment options and methods

Progressive offers a variety of payment options and methods for its auto insurance policyholders. You can choose to pay monthly or pay for your six-month policy upfront, with the latter option earning you a discount. Here are the ways you can pay for your Progressive auto insurance policy:

- Credit card

- PayPal

- Online check

- Personal check

- Money order

- Electronic funds transfer (EFT) from your checking account

You can set up automatic payments or pay manually through the Progressive mobile app, online by logging into your policy, or by downloading the Progressive app to your smartphone. You can also send a check by mail. If you mail your payment, Progressive will consider the postmarked date on the envelope as your payment date.

Progressive also allows you to manage your policy online, including making payments, updating payment methods, scheduling payments, and more. You can log in to your account and click "Payments" in the top navigation bar to access billing and payment information.

VRI Gap Insurance: Protection for Your Car Loan

You may want to see also

Claim settlement times

Progressive works to resolve property damage claims within 7 to 14 days, but repair times can vary based on factors such as the vehicle and the extent of the damage. The company provides customers with the option of getting their repairs completed or receiving payment. If customers choose to get their vehicles repaired, Progressive offers a network of repair shops across the country or customers can choose their own repair shop. Progressive guarantees repairs completed at network shops for as long as the customer owns or leases their vehicle.

The investigation process can significantly impact the time it takes to receive a settlement cheque. For example, accidents involving multiple serious injuries and uncertainty about which driver was at fault can take longer to investigate than minor accidents with a clear at-fault driver. In general, insurance companies have approximately 30 days to investigate a claim, although this timeframe can differ between states. Most states mandate that claims be processed without unnecessary delays.

To expedite the claim settlement process, it is advisable to promptly provide any requested information, such as the police report, photographs of the damage, and insurance details of all involved parties. Communicating frequently with the insurance adjuster is also recommended, as the investigation process can last from a few weeks to several months, depending on the severity of the accident.

MCE Insurance Auto-Renew: What You Need to Know

You may want to see also

Total loss claims

A total loss claim is when the cost of repairing a vehicle exceeds its value, or when the damage is over a certain percentage of the car's value. Progressive, an insurance company, offers guidance on total loss claims and how to file them.

A total loss claim is when the cost of repairing a vehicle is greater than the value of the vehicle itself. This can also be triggered if the repair costs exceed a certain percentage of the vehicle's value, which varies by state. For example, in some states, if the repair costs exceed 80% of the vehicle's value, it is considered a total loss.

Progressive's Total Loss Claims Process:

Progressive, an insurance company, offers guidance and support to customers who need to file a total loss claim. They provide a step-by-step process to make the claims experience as smooth as possible.

Step 1: Inspection and Determination of Total Loss

Progressive will inspect the damaged vehicle to determine if it is a total loss. This involves reviewing the vehicle's mileage, options, condition, and comparing it to the values of comparable vehicles.

Step 2: Payment for the Totaled Vehicle

If Progressive determines that the vehicle is a total loss, they will issue a payment for the value of the car, minus any applicable deductible. This payment is made to the vehicle owner, the lender, or both. Progressive works with a third party to help determine the actual cash value of the vehicle.

Step 3: Paperwork and Title Transfer

Progressive will need the physical title of the vehicle and will require the customer to fill out the necessary fields, including an odometer disclosure statement. If a lender holds the title, Progressive will obtain it after the customer signs a Power of Attorney and odometer disclosure statement.

Step 4: Handling any Remaining Loan or Lease Balance

If the customer still owes money on their loan or lease, Progressive will work with the at-fault driver's insurance company to recover the remaining balance. Progressive also offers gap insurance, which can cover the difference between what is owed and the vehicle's value.

Step 5: Options for the Totaled Vehicle

The customer has the option to either retain the salvage of the totaled vehicle or transfer the title to Progressive. If the customer chooses to transfer the vehicle, Progressive will dispose of it in accordance with applicable laws and regulations.

Step 6: Rental Car Coverage

If the customer has rental coverage on their policy, Progressive will cover the cost of a rental vehicle for a specified period, typically a few days.

Step 7: Updating Insurance for a Replacement Vehicle

Progressive advises customers to log in to their online account or contact their agent to remove the totaled vehicle from their policy. If a replacement vehicle is purchased, it must be added to the auto insurance policy within a specified timeframe, usually around 30 days.

Customer Experience and Lawsuits:

There are mixed reviews and experiences shared by customers who have gone through the total loss claims process with Progressive. While some customers have shared positive experiences, there have also been lawsuits and complaints about Progressive underpaying total loss claims.

Some customers have shared their satisfaction with Progressive's handling of total loss claims, stating that they received fair payouts and appreciated the option to keep their totaled vehicles.

However, there have also been lawsuits filed against Progressive, alleging that they routinely underpay total loss settlements by not including certain fees, such as title transfer fees, registration fees, and accurate sales tax calculations. These lawsuits claim that Progressive failed to fulfill their contractual obligation to pay the full actual cash value of the totaled vehicles.

Florida Auto Insurance: Best Options

You may want to see also

Repair options

Progressive offers a range of repair options for its customers. Firstly, it's important to note that Progressive guarantees repairs for as long as you own or lease your vehicle when you take it to one of their network shops. Progressive representatives will help you through the claims process and make sure your repairs are handled quickly and efficiently. They will connect you with the right experts and you can contact a claims representative if you have any questions. You will likely work with an estimator who will inspect your car and write an estimate for the cost of repairs.

If you choose to get your vehicle repaired, you can select one of Progressive's network shop locations or any other shop of your choice. Progressive will then schedule a time for an estimator to inspect your vehicle (if they haven't already) and manage the repairs from start to finish. Once the repairs are complete, you can pick up your car and be on your way. If you opt for a shop in Progressive's approved network, your repairs are guaranteed for as long as you own or lease your vehicle.

For windshield and glass repairs, Progressive recommends Safelite AutoGlass or one of its affiliate shops for a quick and easy repair option. In most cases, they can repair or replace your glass at your home or workplace, or you can visit one of their shops. Repairs usually take less than 30 minutes, while replacements take around 60 minutes. It is recommended that you do not drive your vehicle for at least one hour after a replacement.

Progressive also offers a vehicle protection plan in certain states, which can cover non-accident-related car system repairs and breakdowns. This plan has an affordable rate that can be renewed or cancelled every six months.

Skoolie Insurance: A Tricky Road

You may want to see also

Frequently asked questions

With Progressive, you can obtain proof of car insurance right after you purchase a policy. You can access your auto insurance card and coverage information by calling or logging in online 24/7. You can also access your proof of insurance card on your phone through the Progressive mobile app.

You can get an online quote from Progressive in minutes. If you prefer, you can also call and chat with someone about your options.

You can file a Progressive auto insurance claim by logging in to your policy online, through the mobile app, or by calling the claims center. Filing a claim is easy and Progressive representatives will help you through the process.

The amount of time it takes to settle an insurance claim for a car accident varies, anywhere from a few days/weeks to several months. The timing ultimately depends on the circumstances of the accident and factors like state laws, the severity of injuries and property damage, whether lawyers are involved, and how quickly you filed the claim.