Life insurance is a valuable tool that provides financial protection for your family in the event of your death. When considering the future of your loved ones, it's important to ensure they are protected financially, and life insurance can offer this security. The state of New York offers various options for life insurance, including term life insurance and permanent life insurance, such as whole life insurance and universal life insurance. It's important to understand the different types of life insurance available and choose the one that fits your budget and offers the desired financial benefits. Additionally, the New York State Department of Financial Services provides resources to help consumers familiarize themselves with basic life insurance terms, types of policies, and shopping tips to make informed decisions.

| Characteristics | Values |

|---|---|

| Contestable period | 2 years |

| Free look period | 10-30 days |

| Grace period for missed payments | 31 days |

| Guaranty Fund protection | $500,000 |

| Time to get a payout | Promptly after settling it, or with interest |

What You'll Learn

Guaranty Fund Protection

The Life and Health Insurance Company Guaranty Corporation of New York provides consumers with protection against the insolvency of a life, health, or property/casualty insurer that writes health insurance. The Guaranty Fund also covers policyholders of long-term care insurance.

The Guaranty Fund is a not-for-profit New York corporation that provides funds to New York residents and certain non-resident policyholders, insureds, healthcare providers, beneficiaries, annuitants, payees, and assignees in the event of the insolvency of a licensed (or formerly licensed) life, health, or property/casualty insurer that writes health insurance.

The Guaranty Fund is managed by a board of directors, consisting of representatives of member insurers and the Superintendent of Financial Services. Every life, health, or property/casualty insurer that writes health insurance and is licensed or formerly licensed to do business in New York State must be a member of the Guaranty Fund.

The Guaranty Fund is funded through assessments against member insurers after a member insurer is declared insolvent by a court of law. These funds are used to pay valid claims, as well as administrative expenses.

Protections and Limits on Protection

The Guaranty Fund provides up to $500,000 in coverage to a life insurance policy owner, individual annuity (such as a single premium deferred annuity) contract holder, or individual accident and health insurance (including long-term care insurance) policyholder, insured, or healthcare provider, or any beneficiary, assignee, or payee of the foregoing. There is also coverage for group and blanket accident, health, and accident and health insurance policies.

The Guaranty Fund also provides some limited coverage to funding agreements and group annuity contracts. Group annuity contracts, including guaranteed interest contracts and funding agreements, are frequently used for the investment of the assets of pension, profit-sharing, and salary reduction plans. The extent of Guaranty Fund protection for an individual participant depends upon the insurer's obligations as set forth in the contract.

If a contract does not guarantee annuity benefits with respect to any specific individual identified in the contract, then the Guaranty Fund will provide coverage for the total invested with the insurer, up to $1 million. If the contract guarantees annuity benefits with respect to specific individuals, then the Guaranty Fund provides up to $500,000 in coverage to New York residents and certain non-residents.

With respect to agreements that do not fund benefits under employee benefit plans, the Guaranty Fund provides aggregate coverage of up to $500,000.

Special Considerations

State guaranty funds were created by federal statute in 1969 and are non-profit systems operating in all 50 states, Washington, D.C., Puerto Rico, and the Virgin Islands. Most states maintain separate funds for property/casualty insurance and life/health insurance.

State guaranty funds act as a form of insurance for insurance companies and are funded by insurance companies that sell insurance in a given state. The amount of funding an insurance company is required to pay is typically a percentage, ranging from 1% to 2% of the net amount of insurance it sells within any particular state.

It is important to note that the Guaranty Fund does not apply to a municipal cooperative health benefit plan, employee welfare fund, fraternal benefit society, an institution of higher education, or a continuing care retirement community. It also does not apply to government programs such as Medicare, Medicaid, Child Health Plus, TRICARE, or the Federal Employees Program.

Selling Life Insurance: Your Path to Millionaire Status?

You may want to see also

Annuities

Fixed deferred annuities are long-term, low-risk options that grow at a guaranteed rate, with no taxes due until you make a withdrawal. Variable annuities are exposed to the performance of financial markets and offer the potential for higher returns and payouts, but they can also result in losses depending on how the investments perform. Hybrid variable annuities combine the certainty of a fixed index-linked account with the flexibility and growth potential of a variable annuity.

Life Insurance Post-Bariatric Surgery: What You Need to Know

You may want to see also

Life Settlements

A life settlement is the sale of an existing life insurance policy to a third party, known as a life settlement provider. The owner of the life insurance policy sells the policy and receives an immediate payment in return. The life settlement provider then becomes the new owner of the policy, paying any future premiums and receiving the death benefit when the insured person dies.

It is important to note that not all life settlement transactions are regulated. While life insurance is regulated by state insurance commissioners, and variable life insurance is also regulated at the national level, those purchasing life settlements may not always be regulated or licensed. As such, it is important to research the purchasers of life settlements.

There are several factors to consider when deciding whether to sell a life insurance policy through a life settlement:

- Ongoing life insurance needs: Evaluate whether you can obtain a new policy with equivalent coverage and at what cost.

- Less costly alternatives: Consider other options such as borrowing against your policy or accelerated death benefits if you require cash but wish to retain your coverage.

- Difficulty determining fair prices: Shopping around and obtaining multiple offers can help ensure you receive a fair price for your policy.

- Impact on your finances: The lump sum payment received from a life settlement may be taxable and could affect your eligibility for state or federal public assistance.

- Impact on your survivors: Weigh your need for current income against the future financial needs of your survivors.

- Access to your health information: Buyers of your policy may have access to personal information about your health status and may require periodic updates.

If you decide to pursue a life settlement, it is important to ask certain questions to protect yourself, including:

- Do you know who you're working with? Check if the life settlement company or broker is licensed and whether they have a history of complaints or regulatory issues.

- What will happen to my policy? Understand if the buyer will hold, sell, or package the policy with others and sell interests to investors.

- What information will I need to provide, and how will it be protected? Be aware that personal and medical information may be shared with other entities.

- What is the best price I can get for my policy? Shop around or use a broker to ensure you receive a competitive offer.

- What are the transaction costs? Understand how the person you're working with is compensated and evaluate if the product is right for you.

- What if I change my mind? Know your options for backing out of the agreement.

- Am I being pressured to make a fast decision? Beware of high-pressure sales tactics and aggressive advertising.

UFG: Life Insurance Options and Benefits

You may want to see also

Insurance Ratings

When it comes to insurance ratings, several firms provide financial soundness evaluations of insurance companies. These ratings can be a helpful indicator when selecting an insurance policy, as they give you insight into the financial stability of the company. Some firms provide these ratings free of charge, while others charge a fee, which can range from a small amount for an online rating to a larger sum for quarterly reports. It's worth noting that each firm uses its own rating scale, and their conclusions about a specific insurance company may vary. Therefore, it's advisable to check the ratings from multiple firms before making a decision.

- Fitch Ratings: 1-800-75-FITCH (https://www.fitchratings.com/)

- Moody's Investors Service: 1-212-553-0377 (https://www.moodys.com/])

- Standard & Poor's: 1-212-512-3108 (https://www.spglobal.com/ratings/en/] )

These firms use different criteria and methodologies to assess the financial health and stability of insurance companies. It's important to understand their evaluation processes and how they differ from one another.

In addition to these external ratings, it's worth noting that insurance companies may also be rated by their customers based on factors such as customer service, claims handling, and overall satisfaction. These ratings and reviews can often be found on consumer websites, review platforms, or social media. While financial stability is crucial, considering the customer experience can also provide valuable insights into the quality of an insurance company.

When considering life insurance, it's essential to look beyond just the ratings. It's important to thoroughly research the company's history, reputation, and the specific terms and conditions of their policies. Understanding the fine print, exclusions, and limitations of a policy is crucial to making an informed decision. Additionally, seeking advice from a financial advisor or insurance expert can help you navigate the complexities of different insurance products and choose the one that best suits your needs and long-term goals.

In the context of New York State life insurance, it's worth noting that New York Life, one of the insurance companies serving this state, boasts the "highest financial strength ratings" from all four major ratings agencies. This includes AM Best, Fitch Ratings, Moody's, and Standard & Poor's. Such high ratings indicate strong financial stability and reliability, which are crucial factors when choosing a life insurance provider.

Life Insurance Exam: What to Expect

You may want to see also

Contestability Period

The contestability period is a clause included in all life insurance policies that allows the insurer to review your application for incorrect information. This period usually lasts for two years after the policy begins. During this time, the insurance company can investigate your application and deny a death claim if they find evidence of fraud or misrepresentation. For example, if you purposefully concealed a depression diagnosis, the company could deny or reduce the amount your beneficiary receives.

The contestability period exists to protect the insurance company from fraud. It is very unlikely that you will die during the first two years of a life insurance policy, so the period helps the insurer to confirm that you didn't withhold or lie about any health or lifestyle-related information during the application process. For instance, if you die in a car accident but failed to disclose a history of alcohol abuse, the insurance company can deny your death claim.

If you get a new policy or reinstate your policy after a lapse, the period of contestability restarts. Unless your policy includes an incontestability clause, you can still be punished for false information after two years.

The best way to ensure that your beneficiaries are taken care of in the event of your death is to be honest and forthcoming on your life insurance application. That way, the insurer won’t have any concerns during the contestability period.

Life Insurance and Debt Collection in New York

You may want to see also

Frequently asked questions

Your life insurance is valid for your entire lifetime as long as premiums are paid and the policy has not been surrendered.

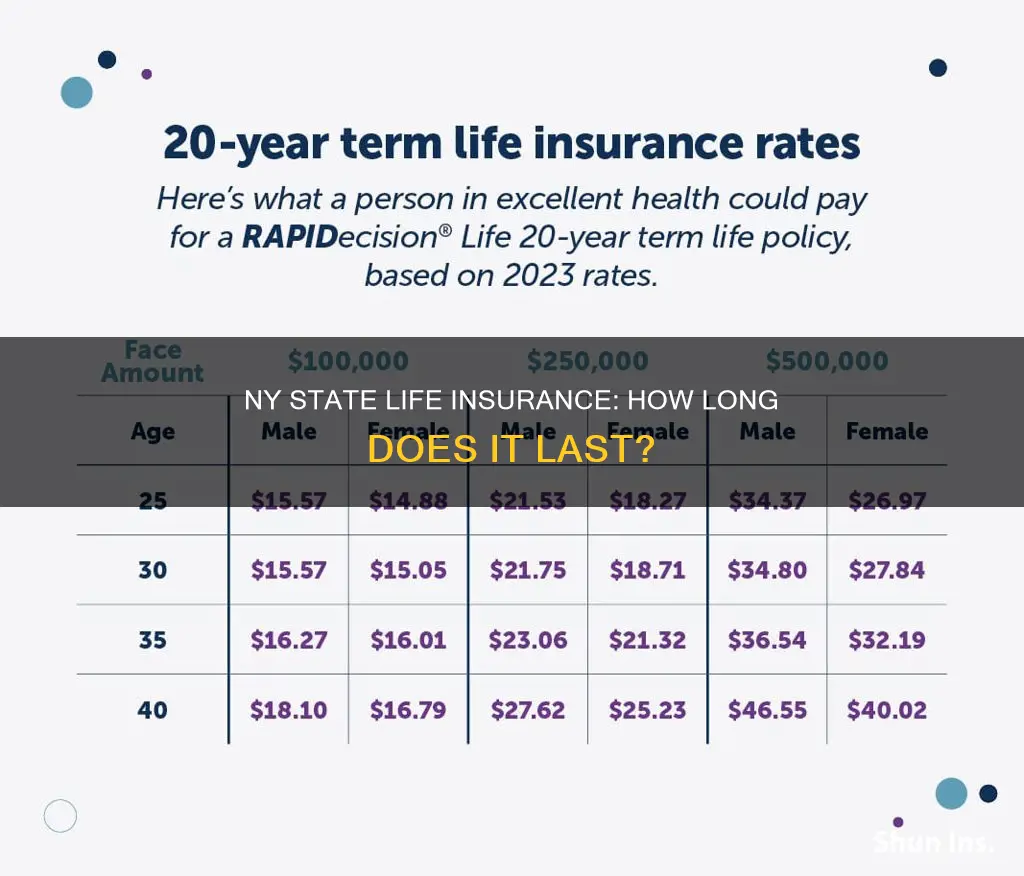

Whole life insurance is designed to provide coverage for the entire life of the insured, whereas term life insurance only provides coverage for a fixed period.

There are two main types of traditional whole life policies: non-participating and participating. Non-participating whole life insurance has a level premium and face amount, while participating whole life insurance pays dividends.

Yes, you can generally borrow money from your whole life insurance policy as long as there are sufficient funds in the cash value. There may be a waiting period of up to three years before a loan is available.