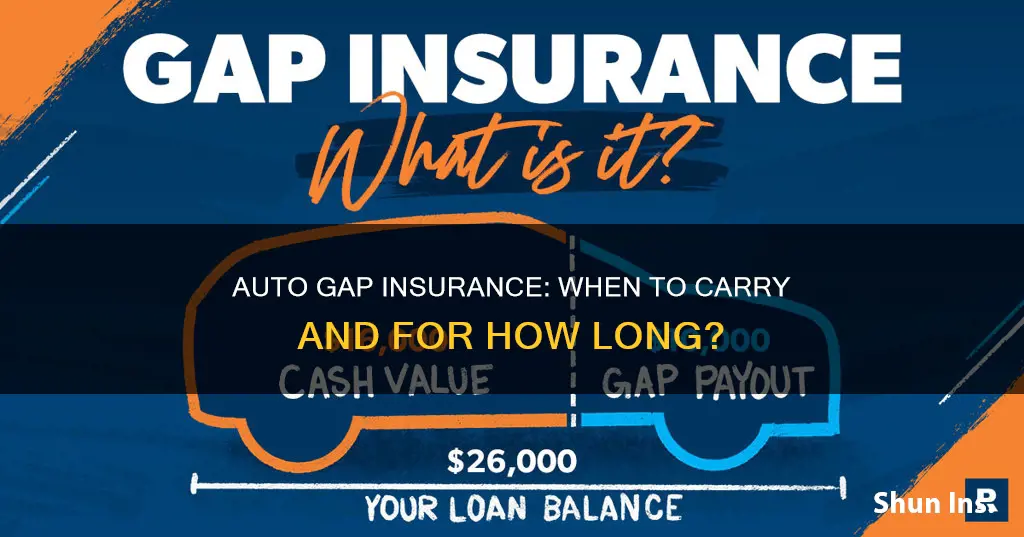

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the depreciated value of the car and the loan amount owed if the car is involved in an accident. Gap insurance is useful for drivers who owe more on their car loan than the car is worth. It is also useful for those who have a long financing term for their vehicle, as the longer the vehicle is financed, the higher the chance of owing more on the vehicle than it's worth. Gap insurance can be added to your comprehensive auto insurance policy for as little as $20 a year. It is not required by any insurer or state but some leasing companies may require you to purchase it. You can drop the insurance once you owe less than the book value of your vehicle.

| Characteristics | Values |

|---|---|

| When to get gap insurance | When you buy a car with a loan or lease and put down a small deposit |

| When to drop gap insurance | When your loan balance is equal to or lower than your vehicle's value |

| What gap insurance covers | The difference between what you owe on a car lease or loan and the amount paid out in a total loss settlement from an auto insurer |

| What gap insurance doesn't cover | Engine failure, transmission failure, death, your car insurance deductible, overdue payments and late fees on your car loan or lease, extended warranties, carry-over balances from previous loans or leases, lease penalties for high mileage or excessive use, charges for credit insurance connected to the loan, a down payment for a new car |

| When gap insurance pays out | Within 30 to 45 days of accepting a claim |

| Who gap insurance payments go to | Your lienholder or lessor |

| Where to buy gap insurance | From your car dealer or a car insurance company |

What You'll Learn

When to consider buying gap insurance

Gap insurance is an optional coverage that pays the difference between what your vehicle is worth and how much you owe on your car loan at the time it's stolen or totaled. It is worth considering buying gap insurance in the following scenarios:

- You owe more on your car loan than the car is worth. If you are currently making car loan payments, calculate the loan balance and weigh it against your car's current cash value. If there is a gap, you should strongly consider gap insurance.

- Your car loan requires gap insurance. Some lenders require gap insurance from the outset of your loan.

- Your lease requires gap insurance. Many auto leases require gap insurance as a protective measure, and it may already be included in the price of the lease.

- You made less than a 20% down payment on the car.

- You financed for 60 months or longer.

- You leased the vehicle.

- You purchased a vehicle that depreciates faster than the average.

- You rolled over negative equity from an old car loan into the new loan.

You may not need gap insurance if:

- You made a down payment of at least 20% on the car, so there is little chance of being upside down on your loan.

- You are paying off the car loan in less than five years.

- The vehicle is a make and model that historically holds its value better than average.

Cashing Out: Gap Insurance Claims

You may want to see also

When gap insurance is not required

Gap insurance is not required in the following cases:

- If you own your car outright, you don't need gap insurance. Gap insurance is only necessary if you owe more on your car loan than the car is worth. If you fully own your car, you will not have a "gap" in value to worry about.

- If you made a substantial down payment on your car (at least 20%), you may not need gap insurance. A large down payment reduces the chance of being "upside down" on your loan, even in the early years of ownership.

- If you are paying off your car loan in less than five years, you may not need gap insurance. The longer the loan period, the higher the chance of owing more on the vehicle than it is worth.

- If your car holds its value better than average, you may not need gap insurance. Some cars depreciate faster than others, so choosing a make and model that historically holds its value can eliminate the need for gap coverage.

- If you have fully comprehensive auto insurance, you may not need gap insurance. Comprehensive insurance includes collision insurance and covers every unexpected calamity that can destroy a car, from vandalism to floods. However, it is still worth considering gap insurance as an add-on to comprehensive insurance if you owe more on your car than it is worth.

Auto Insurance Surcharges: Do They Follow You?

You may want to see also

When to drop gap insurance

Gap insurance is a valuable form of protection for newer vehicles, but it can become unnecessary as your car ages and its loan amount drops below its value. Here are some key points to consider when deciding to drop gap insurance:

Dropping gap insurance is generally recommended when your loan balance is less than the current market value of your vehicle. This typically happens after a few years of payments. You can use resources like Kelley Blue Book or Edmunds to check your car's value. If your car is worth more than the remaining loan balance, you no longer need gap insurance.

Selling or Paying Off Your Vehicle

If you pay off your auto loan early, sell your vehicle, or trade it in, you may no longer need gap insurance. In these cases, it is advisable to wait until the sale or trade is completed before cancelling the policy to ensure continuous coverage.

Lease or Finance Agreement Requirements

Review your lease or finance agreement to determine if gap insurance is required for the entire term. In some cases, leasing companies or lenders may mandate that you keep the coverage until the end of the loan or lease period. Make sure to check the specific requirements in your contract before deciding to drop the coverage.

Early Cancellation Fees and Penalties

Before cancelling your gap insurance, be aware of any early cancellation fees or penalties that may apply. Understand the terms and conditions of your policy to ensure that cancelling does not result in any financial penalties or violate the terms of your agreement.

Actual Cash Value (ACV) Considerations

It is important to ensure that the car's actual cash value (ACV) is less than what you owe on the loan. If your vehicle is totalled after an accident, you don't want to be responsible for the difference in value. Confirm that the ACV is lower to avoid potential financial burden.

Requesting a Refund

If you decide to cancel your gap insurance, you may be entitled to a refund for the unused portion of the coverage. Contact your insurance company, lender, or dealership to inquire about their specific refund policies and processes. Keep in mind that the amount and timing of the refund can vary depending on the provider and the length of coverage you have remaining.

Commercial Driving and Progressive Auto Insurance

You may want to see also

How gap insurance works

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the depreciated value of the car and the loan amount owed if the car is involved in an accident.

Here's how gap insurance works:

When to Get Gap Insurance

Gap insurance is worth considering if you've put no money down and chosen a long payoff period, as you may owe more than the car's current value. You may be able to skip gap insurance if you made a down payment of at least 20% on the car when you bought it, or if you’re paying off the car loan in less than five years.

If your vehicle is stolen or totaled in an accident, your comprehensive or collision coverage will pay the actual cash value (ACV) of your vehicle, minus your deductible. Gap insurance may then pay the difference between your vehicle's ACV and the outstanding balance of your loan or lease. Note that gap insurance doesn't cover additional charges related to your loan, such as finance or excess mileage charges. It also doesn't cover other property or injuries as a result of an accident, nor does it cover engine failure or other repairs.

When to Drop Gap Insurance

Once your loan balance is about equal to or lower than your vehicle's value, you can drop gap insurance from your policy.

Auto Workers' Healthcare: Exploring the United Auto Workers Union's Health Insurance Provisions

You may want to see also

How to buy gap insurance

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap coverage can cover the $5,000 gap, minus your deductible.

Gap insurance is available from car insurers and dealers. It is typically only available for brand-new vehicles or for models that are less than three years old.

Where to Buy Gap Insurance

You can buy gap insurance from the dealer or your auto insurance company. If you're leasing a vehicle, gap insurance might not be optional.

How to Get Gap Insurance from a Dealer

When you buy or lease a car, the dealer will likely ask if you want to purchase gap insurance when you discuss your financing options. Buying gap insurance from a dealer can be more expensive if the cost of the coverage is bundled into your loan amount, which means you'd be paying interest on your gap coverage.

You can typically add gap coverage to an existing car insurance policy or a new policy, as long as your loan or lease hasn't been paid off. Buying gap insurance from an insurance company may be less expensive, and you won't pay interest on your coverage. If you already have car insurance, you can check with your current insurer to determine how much it would cost to add gap coverage to your existing policy.

When to Buy Gap Insurance

You can typically buy gap coverage for a used car or new car at any time as long as the loan or lease isn't paid off, though some insurance companies may only offer a limited amount of time to purchase coverage.

How Long to Keep Gap Insurance

Once you add gap insurance, it applies for the duration of your policy. However, you won't need gap coverage for the entire length of the loan. Once you owe less than what the car is worth, you can drop the insurance.

Insurance Payouts: Beyond Policy Limits?

You may want to see also

Frequently asked questions

You should carry auto gap insurance for as long as the loan balance exceeds the car's value. Once the loan balance is equal to or lower than the car's value, you can drop the insurance.

You need auto gap insurance if you owe more on your car loan than the car is worth. This is more likely to be the case if you made a small down payment (less than 20%) and/or have a long payoff period.

The cost of auto gap insurance varies by insurer, but it is relatively inexpensive, with an average cost of $61 per year according to Forbes Advisor.