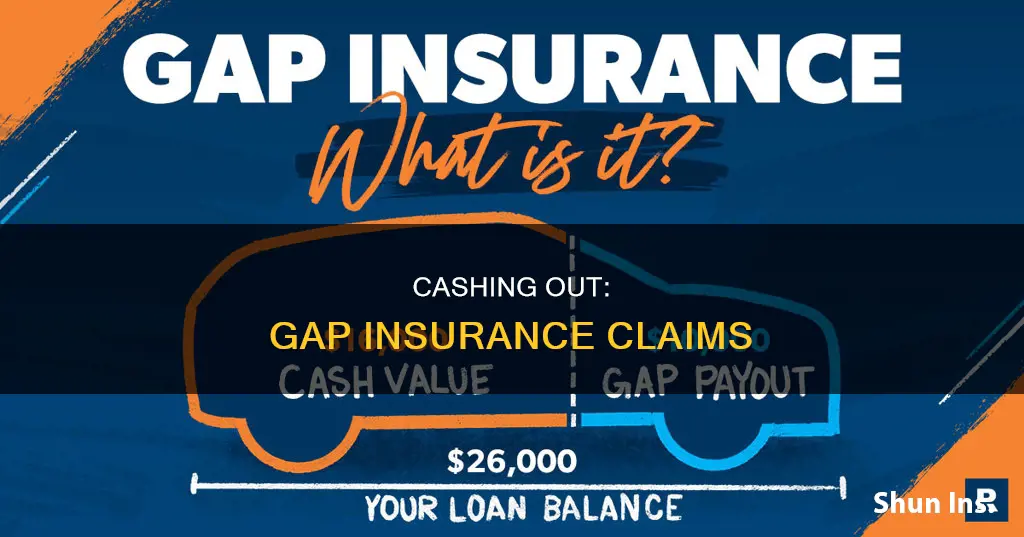

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap coverage covers the $5,000 gap, minus your deductible.

| Characteristics | Values |

|---|---|

| What is gap insurance? | "Gap" is an acronym for "guaranteed auto protection" or "guaranteed asset protection" |

| What does it cover? | The difference between the depreciated value of a car and the loan amount owed if the car is involved in an accident |

| When to consider it? | When there is a significant difference between the car's value and the loan amount; when leasing a car; when making a smaller down payment; when financing for a longer term |

| Cost | $20 a year according to the Insurance Information Institute; $61 a year according to Forbes Advisor's analysis; $400 to $700 a year according to WalletHub |

| Where to buy it? | Car insurance companies, banks, credit unions, or car dealerships |

| How to buy it? | Lump-sum payment or monthly payments |

| When does it not pay? | When the vehicle is damaged but repairable; it does not cover engine failure or other repairs, injuries, death, or funeral costs |

| How long does it last? | Until you drop it; once you owe less than the book value of the vehicle, the insurance can be cancelled |

What You'll Learn

When to consider cashing out on gap insurance

- Significant difference between car value and amount owed: If there is a significant difference between the actual value of your car and the amount you still owe on it, gap insurance can help protect you from a financial loss. This is especially true if you're leasing your car or have a small down payment.

- Longer financing term: If you have a longer financing term for your vehicle, you may want to consider gap insurance. The longer your vehicle is financed, the higher the chance of owing more than it's worth.

- Protection against depreciation: If you want to protect yourself against depreciation, gap insurance can help. Some cars have a higher depreciation rate than others, so calculating the average depreciation for your car can help determine if you need gap coverage.

- Loan rollover: If you owe more on your loan than your car's worth at the time of renewal, gap insurance can help protect you from negative equity.

- Requirements by lenders or leasing companies: Some lenders or leasing companies may require you to have gap insurance, especially if you lease your vehicle.

- High-value or luxury vehicles: If you own a high-value or luxury vehicle that depreciates in value faster than other vehicles, gap insurance can provide added protection.

Remember, gap insurance is not required by law and may not be necessary if you have enough money to cover the difference between your car's value and your loan amount. It's important to evaluate your financial situation and the value of your vehicle before deciding whether to cash out on gap insurance.

Santander Loans: Gap Insurance Included?

You may want to see also

How to cash out on gap insurance

Gap insurance covers the difference between the compensation you receive after a total loss of your vehicle and the amount you still owe on a car loan. It is optional and not required by law, but it can be a valuable safeguard if your car is stolen or declared a total loss.

- Understand the terms and conditions: Before cashing out, carefully review the terms and conditions of your gap insurance policy. Be aware of any cancellation fees, deadlines, or other relevant details specified in your policy.

- Assess your loan balance and vehicle value: Compare your current loan balance with the actual cash value of your vehicle. You can use resources like the National Automobile Dealers Association (NADA) guide or Kelley Blue Book to determine the car's value. If the balance is higher than the vehicle's value and you would benefit from a payout, proceed to the next step.

- Contact your insurance company: Get in touch with your gap insurance provider and inform them of your intention to cash out. Ask about the specific steps and requirements for making a claim and requesting a refund.

- Provide necessary information: Be prepared to provide relevant information and documents, such as proof of vehicle ownership, loan details, and current mileage. Your insurance company will guide you on the specific documents needed to process your claim.

- Fill out the required forms: Your insurance company will likely provide you with forms or paperwork that you need to fill out to initiate the claim process. Carefully fill out all the necessary documentation and submit it to your insurance company.

- Wait for the refund: The processing time for gap insurance refunds can vary, but it typically takes around 30 days. Keep in mind that the refund amount will depend on the cost of your premium and the unused portion of your policy.

- Maintain thorough records: Throughout the process, make sure to maintain thorough records of all correspondence, policy numbers, cancellation letters, and any other relevant documentation. This will help you keep track of the process and address any queries that may arise.

By following these steps, you can effectively cash out on your gap insurance policy and receive a refund for the unused portion of your coverage.

Cars with the Cheapest Insurance Rates

You may want to see also

Where to cash out on gap insurance

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the gap between what you owe on your car loan and what your car is actually worth.

There are two primary options for where to buy gap insurance: the dealership or an insurance company.

Buying Gap Insurance from a Dealership

When you buy or lease a car from a dealer, they will typically ask if you want to add this optional coverage. Buying gap insurance from a dealer can be more expensive if the cost of the coverage is bundled into your loan amount, which means you'll be paying interest on your gap coverage. Dealerships typically charge a flat rate of $500 to $700 for gap insurance.

Buying Gap Insurance from an Insurance Company

You can typically add gap coverage to an existing car insurance policy or a new policy, as long as your loan or lease hasn't been paid off. Buying gap insurance from an insurance company may be less expensive, and you won't pay interest on your coverage. It can be added to your comprehensive auto insurance policy for as little as $20 a year, according to the Insurance Information Institute.

Dropping Gap Coverage

You can typically drop gap coverage once it's no longer needed. If your vehicle is worth more than your remaining balance, it doesn't make sense to keep your coverage because there's no longer a "gap" between your car's value and what you owe.

Leasing a Vehicle: Insurance Impact

You may want to see also

The cost of cashing out on gap insurance

According to the Insurance Information Institute, you can add gap insurance to your comprehensive auto insurance policy for as little as $20 a year. An insurer typically prices it at 5% to 6% of the collision and comprehensive premiums on your auto insurance policy. For example, if you pay $1,000 a year combined for those two coverages, gap insurance may add $50 to $60 extra.

Gap insurance is much cheaper if you buy it through a car insurance company compared to a car dealership. You can get an exact price for gap coverage from Progressive, for example.

Texassure: Legit Vehicle Insurance Verification

You may want to see also

When not to cash out on gap insurance

Gap insurance is not always necessary and there are several scenarios in which it may not be worth cashing out on this type of policy.

Firstly, if you are buying a car with cash, have made a large down payment, or can afford to pay the difference between what your car is worth and what you owe, you probably don't need gap insurance. Gap insurance is intended to cover the difference between what you are paid out by your insurance company and what you owe on your car loan in the event of a total loss. Therefore, if you can afford to cover this difference yourself, gap insurance may be unnecessary.

Secondly, if the amount you owe on your car loan is less than the car's value, or only slightly more, there is no reason to cash out on gap insurance. In this case, there would be little to no gap insurance payout possible, as the payout is calculated based on the difference between the amount owed and the car's value.

Thirdly, if you sell your car, you should cancel your gap insurance as it is no longer needed.

Finally, gap insurance is not required by law and some insurers or states may not even offer it. It is also not required if you are not financing or leasing your car. Check your state laws and the terms of your loan or lease agreement to see if gap insurance is necessary for your situation.

Dropping Vehicle Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the depreciated value of your car and the outstanding loan or lease balance.

Gap insurance is worth considering if you've made a small down payment (less than 20%), have a long financing term, are leasing your car, or have rolled over negative equity from a previous loan.

You may be eligible for a refund on your gap insurance if you no longer want or need it, change insurance companies, pay off your loan, or sell your vehicle. Contact your insurance company to cancel the policy and request a refund for any unused portion of the coverage.

The cost of gap insurance varies depending on the insurer and where you purchase it. It can range from as little as $20 a year from a traditional insurer to up to $400-$700 a year if purchased from a dealer.