Life insurance is a crucial step in financial planning, especially for those in their 30s with financial dependents and long-term commitments. Term life insurance is a popular choice for this age group as it offers straightforward coverage for a fixed period, usually 10, 20, or 30 years, at a lower cost compared to permanent life insurance. The younger and healthier you are, the more advantageous the rates, making it ideal for locking in an affordable premium. When choosing the term length, it's essential to consider factors such as mortgage duration, children's financial dependency, and retirement plans. Additionally, life insurance can provide peace of mind by covering expenses related to debt management, spousal support, and children's well-being.

| Characteristics | Values |

|---|---|

| Term length | 10, 15, 20, 30 years |

| Cost | Depends on term length, age, gender, health status, lifestyle habits, family health history, occupation, hobbies, driving history, criminal record |

| Coverage amount | $50,000 to several million dollars |

| Benefits | Income tax-free benefit, cost-efficient, low premiums |

| Disadvantages | No cash value, ends after the term, higher premiums for new policy after term ends |

What You'll Learn

How long-term life insurance can protect your family

If you have people depending on you financially, it is wise to take out a term life insurance policy lasting as long as those obligations. Term life insurance is often an affordable way to protect your family financially in the event of your death.

When buying term life insurance, you have two main decisions to make: how much life insurance to buy and how long the coverage should last. You want the policy to continue until your last major obligation is taken care of. So, the duration of your financial commitments will generally determine how long your term life insurance policy should last.

Term life insurance policies typically come in 10, 15, 20 or 30-year lengths. You should pick the term length that best lines up with when you'll have dependents and/or big debts.

In general, shorter terms are ideal for those nearing retirement and longer terms are better for younger people. If you're in your mid-30s, you might consider a 20- or 30-year term policy.

How to choose the right term length

- The length of your mortgage: Your mortgage is a big part of your monthly expenses and often the main reason people buy life insurance. If you want your life insurance to cover your mortgage, consider how many years you have left until you pay off your house. You don’t want your policy to expire after 20 years if your mortgage payments will last another decade after that.

- How long until children are on their own: Children can be expensive, requiring food, clothing and education, not to mention summer camps, music lessons, various electronic devices and so much more. How long until you can expect your kids to support themselves? That may be at least a few years beyond age 18, particularly if you’re planning to pay for college.

- The number of years until you retire: Ideally, you’ll have savings for when you stop working. Therefore, if you’re buying term life insurance primarily to replace your income, you may not need it after retirement. Once your kids are grown up, the house is paid off and you’re living off your retirement savings, life insurance is one less thing to worry about.

Life Insurance and Disability: What Happens to Employee Benefits?

You may want to see also

The best time to buy long-term life insurance

Life insurance is a valuable safety net for your loved ones. It's a way to ensure that your family is taken care of financially if something happens to you. When considering the best time to buy long-term life insurance, it's important to think about your current life stage, financial responsibilities, and future plans. Here are some factors to help you decide:

- Age and Health: The younger and healthier you are, the more affordable your life insurance premiums will be. Insurers offer better rates to those who are younger and in good health. As you age, your risk of developing health conditions increases, which can result in higher mortality rates and life insurance rates. Buying life insurance in your mid-30s can help lock in lower rates for the duration of your coverage.

- Financial Responsibilities: If you have financial dependents, such as children, a spouse, or aging parents who rely on your income, then it's a good idea to consider life insurance. It can help cover their well-being, educational expenses, healthcare, and daily expenses in your absence.

- Debt Management: Life insurance can also be crucial if you have debts that your estate would be responsible for in the event of your death. This includes debts such as a mortgage, credit card debt, or private student loans. Life insurance can ensure that your family can remain in their home and manage these financial obligations.

- Homeownership: If you're navigating the financial responsibilities of homeownership, life insurance becomes even more important. A mortgage is often the largest debt a person incurs, and life insurance can help your family stay in their home by covering mortgage payments.

- Long-term Financial Planning: Consider your long-term financial goals and how life insurance fits into them. If you're planning to start a family, your life insurance needs may change. You may want to increase your death benefit amount to ensure your spouse or partner has enough financial support to raise your children.

- Cost-effectiveness: Term life insurance, which provides coverage for a fixed period, is generally the most affordable option, especially for those on a budget or with specific financial obligations, such as a mortgage or raising children. It allows you to lock in a rate for a set number of years, making it easier to plan financially.

In summary, the best time to buy long-term life insurance is as soon as you have financial dependents or significant financial responsibilities. Buying life insurance in your mid-30s can be a smart decision, as it allows you to secure affordable rates and provide a financial safety net for your loved ones. It's important to consider your current life stage, future plans, and the specific needs of your family when deciding on the type and duration of your life insurance coverage.

Borrowing from Life Insurance: Employer-Provided Policy Options

You may want to see also

How much long-term life insurance costs

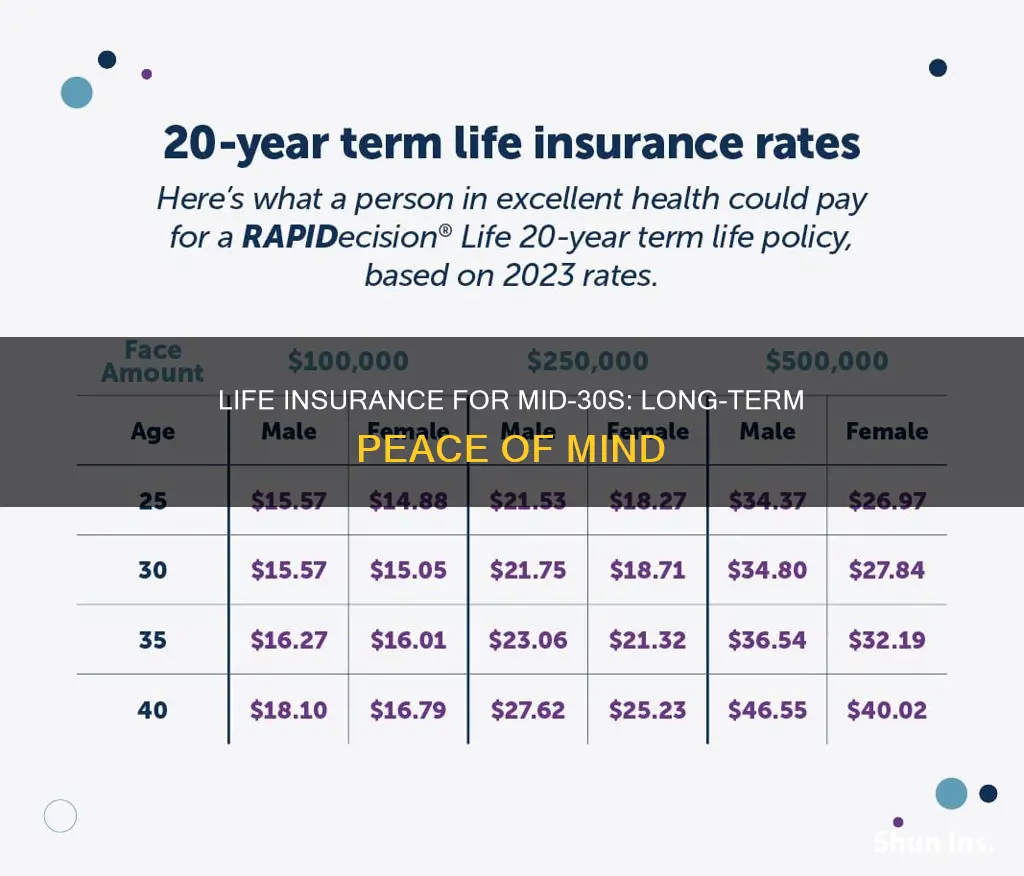

The cost of long-term life insurance will depend on a variety of factors, including age, gender, health, and lifestyle choices.

Term life insurance is a popular option for those in their mid-30s as it is typically more affordable than permanent life insurance. Term life insurance policies usually range from 10 to 30 years and provide beneficiaries with a death benefit payout if the policyholder passes away during the term. The longer the term, the higher the premium will be. This is because there is a higher likelihood that the insurance company will need to pay out a death benefit. For example, a 30-year-old non-smoking female can expect to pay approximately $48 per month for $1,000,000 of 20-year term coverage, while a 30-year policy would double the monthly cost to $96.

When determining the cost of long-term life insurance, insurers consider several factors, including age, medical history, gender, coverage amount, smoking status, occupation, and lifestyle. Age is a significant factor, as younger policyholders tend to pay lower premiums due to their longer life expectancy. Health is another critical factor, with insurers often requiring medical exams to assess any pre-existing conditions, such as diabetes, heart disease, or high blood pressure, which may result in higher premiums.

Gender also plays a role, as women generally pay less for life insurance due to their longer life expectancy. Smoking status is another factor that influences rates, with smokers typically paying more due to the increased risk of health issues. Additionally, your occupation and lifestyle choices can impact your premium. Individuals with hazardous jobs or those who participate in risky activities, such as skydiving, may be subject to higher premiums.

It is worth noting that permanent life insurance, which lasts a lifetime and includes a cash value component, tends to be more expensive than term life insurance. However, the cost of life insurance can vary significantly among applicants, insurers, and policy types, so it is advisable to compare quotes from multiple insurers to find the best rate.

Life Insurance While Hospitalized: Is It Possible?

You may want to see also

The difference between term and permanent life insurance

Term life insurance and permanent life insurance are both designed to protect your loved ones financially in the event of your death. However, they differ in terms of the length of coverage, the benefits offered, and the structure of premium payments.

Term life insurance provides temporary protection for a set period, typically between one and 30 years, or until a specific age. The coverage can often be renewed, but only up to a certain age, and premiums usually increase with each renewal.

Permanent life insurance, on the other hand, is designed to provide long-term or lifelong coverage. As long as you continue to pay the premiums, your coverage will remain in force. There is no set term or age limit with permanent life insurance.

Term life insurance offers short-term death benefit protection, usually for 10, 15, or 20 years. If the insured person dies during this period, their beneficiaries will receive a lump-sum death benefit. Term life insurance does not offer cash value accumulation, but some policies have flexible features that allow early access to benefits if the insured becomes terminally ill or disabled.

Permanent life insurance provides long-term death benefit protection and additional features. One of its key advantages is the opportunity to build cash value. This accumulated cash value can be accessed to cover unexpected emergencies, college expenses, or retirement funding. Permanent life insurance also offers tax advantages, as the cash value component grows tax-deferred, and the death benefit is usually tax-free.

With term life insurance, premiums are locked in for the selected coverage period. If you renew the policy, the premiums will increase annually. Term life insurance is generally more affordable than permanent life insurance, especially when purchased early in life.

Permanent life insurance, specifically whole life insurance, has premiums that are locked in at the time of purchase and remain stable throughout the policy. While whole life coverage may be more expensive initially, it can be more cost-effective in the long run due to stable premiums.

Who should choose term life insurance?

Term life insurance is ideal for those seeking short-term coverage or additional protection during specific life stages. It is suitable for those on a budget or those who want flexibility if their circumstances change. Term life insurance is also a good option if you have other financial assets to leave as an inheritance.

Who should choose permanent life insurance?

Permanent life insurance is recommended if you need long-term financial protection, wish to create an inheritance for your heirs, or seek a tax-advantaged way to save for future expenses. It is also preferable if you prefer stable premiums, which remain level throughout your lifetime.

Life Insurance: Post-Mortem Options and Possibilities

You may want to see also

How to choose the right term length

When choosing the right term length for life insurance in your mid-30s, it's important to consider your financial responsibilities, such as your mortgage, children's education, and other long-term commitments. Here are some factors to help you determine the appropriate term length:

Mortgage Considerations:

The length of your mortgage is a crucial factor when deciding on the term length of your life insurance policy. Consider how many years you have left on your mortgage payments. You wouldn't want your policy to expire before you finish paying off your house. For example, if you have 20 years left on your mortgage, opting for a 20-year or longer term policy would be advisable.

Dependents and Children's Education:

If you have dependents, especially children, you'll need to ensure they are financially supported until they can support themselves. Consider how many years it will be until your children finish their education and are financially independent. If they are still quite young, a longer-term policy might be more suitable.

Retirement Plans:

Life insurance is often purchased to replace income in case of an untimely death. Once you retire and have savings to rely on, life insurance may become less of a priority. Consider the number of years until your planned retirement age and whether your income will be sufficient to support yourself and your family during retirement.

Other Long-Term Financial Commitments:

Aside from your mortgage, consider any other long-term debts or financial commitments. For example, student loans, credit card debts, or business loans. You may want to ensure these are covered by your life insurance policy, providing financial peace of mind for your family.

Cost Implications:

When deciding on the term length, remember that the longer the policy, the higher the premium is likely to be. This is because you're locking in your rate for a more extended period, and health problems become more likely as you age. However, it's worth noting that buying life insurance when you're younger can help secure more affordable rates for the duration of your coverage.

In conclusion, when choosing the right term length for life insurance in your mid-30s, carefully consider your financial obligations, family situation, and future plans. Opt for a term length that covers your most significant financial commitments, ensuring your family's financial security in the event of your untimely death.

Renewing Your Colorado Life Insurance License: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Yes, it is worth considering life insurance in your mid-30s, especially if you have financial dependents such as children or aging parents. Buying life insurance at a younger age can also help lock in lower rates for the duration of your coverage.

Term life insurance provides coverage for a fixed period, typically 10 to 30 years, and is more affordable. Permanent life insurance, on the other hand, provides coverage for your entire life and includes features such as cash value accumulation and potential dividends, but it is much more expensive.

When choosing a term length, consider aligning it with the duration of your longest financial commitment, such as your mortgage or until your children are financially independent. You can also round up if your financial commitments fall between term lengths; for example, if you have 17 years left on your mortgage, consider a 20-year term policy.

The cost of life insurance depends on various factors, including age, health status, lifestyle habits, and family health history. On average, a person in their mid-30s can expect to pay between $300 and $400 per year for life insurance.

When choosing a life insurance policy, consider your financial goals, budget, and family needs. If you are primarily concerned with covering specific financial obligations, such as a mortgage or raising children, term life insurance may be a good option. If you are looking for lifelong coverage and additional features, permanent life insurance may be more suitable, although it comes at a higher cost.