Life insurance is a vital aspect of financial planning, and understanding consumer behaviour and market trends is crucial for those considering purchasing a policy or reviewing their current coverage. According to recent studies, around 50% of Americans have life insurance, but this figure varies depending on gender, age, income, and other factors. This paragraph will delve into the latest statistics on life insurance ownership in the United States and explore the reasons why some Americans choose to opt out of this type of coverage.

What You'll Learn

51-52% of Americans have life insurance

Life insurance is an important aspect of financial planning, and it's interesting to note that around half of Americans have a life insurance policy. According to the 2024 Insurance Barometer Study, 51% of Americans have at least one life insurance policy, a figure that has remained stable in recent years. This means that approximately 172.5 million people in the country have some form of life insurance coverage.

The study also revealed that 42% of American adults need to either obtain life insurance or increase their current coverage. This gap between those who have insurance and those who need it is significant, highlighting the ongoing challenge of addressing misconceptions about cost and educating consumers about the value and potential affordability of life insurance.

When it comes to gender, there is a notable gap in life insurance ownership between men and women. Women are less likely to have life insurance, with an 11-point gap that has been consistent over the past 14 years. In 2024, 47% of women reported having life insurance, compared to 58% of men. This gap may be due to perceived knowledge, as only 22% of women consider themselves very or extremely knowledgeable about life insurance, while 33% of men feel the same.

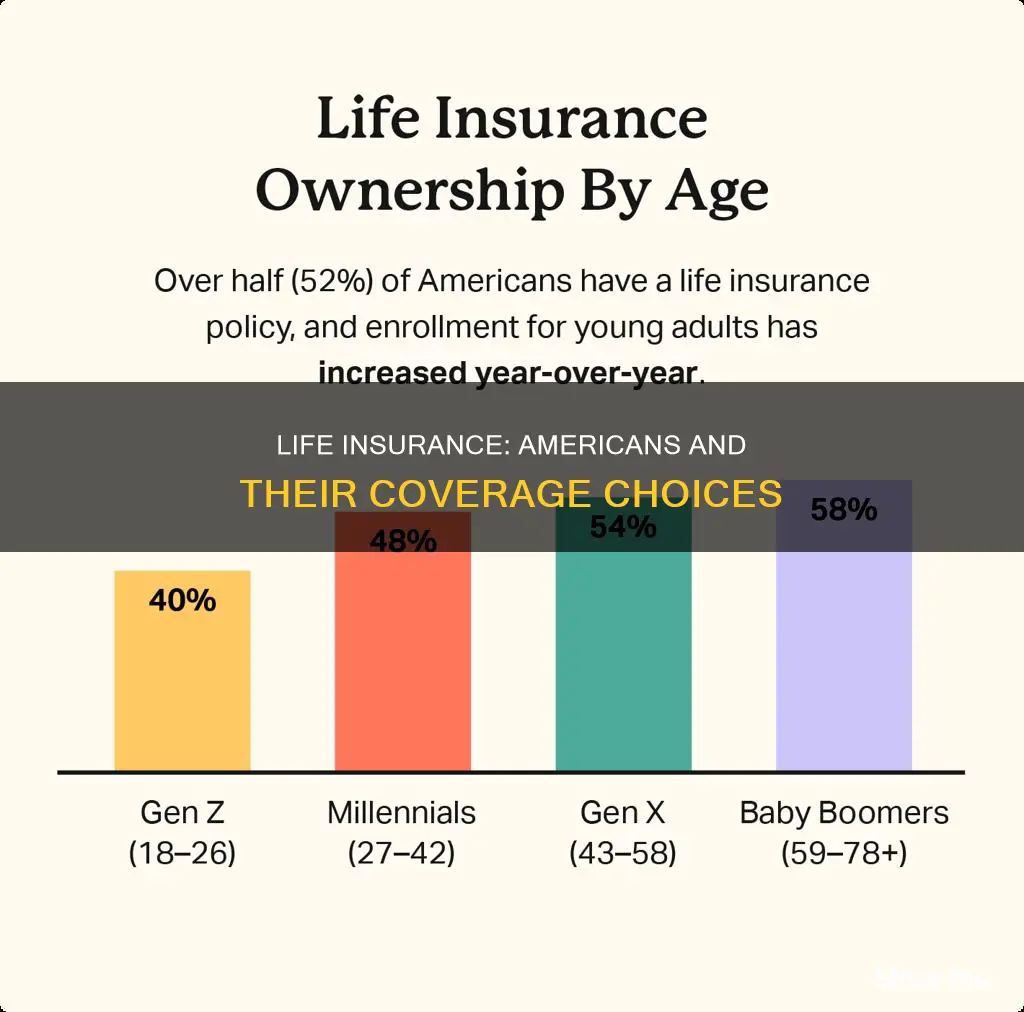

Income level also plays a role in life insurance ownership. Individuals with higher incomes are more likely to purchase life insurance, as they may have a greater focus on asset protection and estate planning. Additionally, older adults have higher enrollment rates, with Baby Boomers having the highest rate of life insurance ownership.

Marital status is another factor, as married individuals are more likely to have life insurance than single people. This may be due to the increased responsibilities that come with marriage, such as joint finances and children.

While life insurance ownership rates vary across different groups, it is clear that a significant portion of Americans have some form of life insurance coverage.

Banks' Secret Weapon: Life Insurance Policies

You may want to see also

30% of Americans need life insurance but don't have it

Life insurance is an important aspect of financial planning, and it's essential to understand consumer behaviour and market trends in this sector. The Insurance Barometer Study by LIMRA and Life Happens revealed that 30% of non-owners expressed a need for life insurance, indicating a significant gap between those who have coverage and those who need it. This gap includes about 102 million adults, comprising both uninsured and underinsured individuals.

The study also highlighted that the primary barrier to purchasing life insurance is the perceived high cost, with many individuals having misconceptions about the actual cost. Other factors contributing to this gap include competing financial priorities and uncertainty about the necessary coverage amount. Addressing these misconceptions and educating consumers about the value and potential affordability of life insurance is crucial to closing this gap.

Furthermore, the study showed that income level plays a role in life insurance ownership. Individuals with lower incomes are less likely to have adequate coverage, with 56% of those earning below $50,000 lacking sufficient coverage. This highlights the financial challenges faced by lower-income households in securing essential protection for their loved ones.

Additionally, the study revealed a gender gap, with women being 11% less likely to have life insurance than men, a consistent trend over the past 14 years. This disparity may be due to perceived knowledge, as only 22% of women consider themselves very or extremely knowledgeable about life insurance, compared to 33% of men.

Understanding these trends and demographics is crucial for the life insurance industry to adapt its products and services to meet the diverse needs of consumers. By doing so, the industry can help ensure that more Americans have access to the financial protection that life insurance provides.

Trusts: The Best Life Insurance Beneficiary Option?

You may want to see also

100 million+ Americans are underinsured or uninsured

The Insurance Barometer Study, conducted by LIMRA and Life Happens, revealed that approximately 51% of Americans have at least one life insurance policy. This means that nearly half of Americans are uninsured or underinsured when it comes to life insurance. This gap between those who have adequate coverage and those who need it is significant, with about 100 million adults lacking the necessary financial protection.

The study also found that 30% of Americans recognize the need for life insurance but have not obtained it due to perceived high costs, financial priorities, or uncertainty about the required coverage amount. Additionally, 10% of policyholders feel they need more coverage than they currently have, indicating a substantial opportunity for the industry to better serve its customers.

The issue of underinsurance or non-insurance is not limited to life insurance. In the context of health insurance, the number of nonelderly uninsured individuals in the US continued a downward trend in 2022, dropping to 25.6 million. However, this still leaves a significant portion of the population without adequate health coverage.

The gap between those who have insurance and those who need it highlights the ongoing challenges faced by the insurance industry. Misconceptions about cost and a lack of understanding about the value and potential affordability of insurance contribute to this gap. Addressing these issues is crucial for ensuring that more people have access to the financial protection provided by insurance.

Factors Affecting Insurance Coverage

Several factors influence the insurance coverage gap in the United States. One of the main barriers is the cost of insurance, with many individuals citing high premiums as a deterrent to purchasing coverage. This is particularly true for life insurance, where 72% of survey participants overestimated the cost of a basic term life insurance policy.

Additionally, income plays a role, with people from lower-income households being less likely to have adequate life insurance. This is also true for health insurance, as most uninsured individuals are from low-income families.

Gender is another factor, with women being less likely to have life insurance than men, a gap that has persisted for over a decade. Similarly, racial and ethnic disparities exist, with Black and Hispanic Americans reporting a higher need for life insurance protection compared to other groups.

Impact of Lack of Insurance Coverage

The consequences of not having adequate insurance coverage can be significant. For those without health insurance, the financial implications can be severe, often resulting in unaffordable medical bills and medical debt. Uninsured individuals are also less likely to seek preventive care and treatment for major health conditions, which can lead to worse health outcomes.

In the case of life insurance, the lack of coverage can burden loved ones with funeral expenses and other financial difficulties in the event of the policyholder's death. This is especially true if the deceased was the primary wage earner in the family.

Addressing the Insurance Coverage Gap

To bridge the insurance coverage gap, it is essential to address the misconceptions and barriers that prevent individuals from obtaining adequate coverage. This includes providing clear and accurate information about insurance costs, as well as educating people about the benefits and importance of insurance.

Simplified underwriting processes, such as those that forgo medical exams, can also make it easier and more accessible for individuals to obtain the coverage they need. Additionally, increasing access to information and offering more flexible policy options can help improve insurance coverage rates.

Becoming a Life Insurance Agent: Steps to Success

You may want to see also

44% of women don't have life insurance

Life insurance is an important aspect of financial planning, but there are still many Americans who don't have it. According to the 2024 Insurance Barometer Study, 51% of Americans have life insurance, while 42% either need to obtain it or increase their coverage. This means that over 100 million Americans are uninsured or underinsured.

Among those without life insurance, 30% recognize the need but haven't purchased it due to perceived high costs, other financial priorities, or uncertainty about the necessary coverage amount. This is a significant gap between those who have life insurance and those who need it, emphasizing the challenge for the industry to address misconceptions about cost and educate consumers on the value and potential affordability of life insurance.

When it comes to gender, there is a notable gap in life insurance ownership between men and women. According to the 2021 Insurance Barometer Study, 47% of women have life insurance compared to 58% of men, which is an 11-point difference. This gap has persisted for the past 14 years of the study.

The reasons for this disparity are multifaceted. One factor could be income gaps between men and women, as many people base their life insurance coverage on a multiplier of their income. Women continue to earn less than men overall, which may contribute to the gap in coverage. Additionally, women may undervalue their contributions to their households, whether as breadwinners or homemakers. The services provided by stay-at-home parents, for example, equate to roughly $180,000 in services every year.

Furthermore, women tend to have less knowledge about life insurance than men. In the 2024 Insurance Barometer Study, only 22% of women surveyed said they felt "very" or "extremely" knowledgeable about life insurance, compared to 33% of men. This lack of knowledge may contribute to the lower rates of life insurance ownership among women.

To close the gender gap in life insurance ownership, women should recognize the value they bring to their households and the financial protection needed if something unexpected were to happen. Life insurance is intended to help protect loved ones from financial difficulties in the event of an individual's death. By assessing their financial situation and the potential needs of their dependents, women can make informed decisions about the level of coverage they require.

Additionally, women can benefit from educating themselves about the different types of life insurance available, such as term life insurance and permanent life insurance, to find the most suitable option for their needs. Seeking advice from independent insurance brokers can also help women find the right coverage, especially if they have health issues that may impact their eligibility or rates.

Strategies to Ace Ohio Life and Health Insurance Exam

You may want to see also

27% of men don't have life insurance

According to the Insurance Barometer Study by LIMRA and Life Happens, 27% of men report not having any life insurance coverage. This is compared to 33% of women, maintaining an 11-point gender gap in ownership rates that has existed since data collection began in 2011.

Men are more likely to perceive themselves as knowledgeable about life insurance than women, with 33% of men reporting feeling "very" or "extremely" knowledgeable compared to just 22% of women. This perceived knowledge gap could be a factor in the higher rates of life insurance ownership among men.

Who Has the Highest Rate of Life Insurance Ownership?

Baby Boomers have the highest rate of life insurance ownership, while Gen Z has the lowest. Half of Gen Z respondents indicated they need more coverage, signalling a growing interest in life insurance among younger generations.

The primary reasons individuals choose to purchase life insurance are financial concerns, such as having enough money to retire, saving for an emergency, and covering long-term care services.

The top reasons for not purchasing life insurance include cost, other financial priorities, and uncertainty about the necessary level of coverage. Additionally, a general disdain for thinking about death, assumptions about not qualifying for coverage, and a lack of trust in insurance companies or agents may also play a role in the decision not to buy life insurance.

Freedom Life Insurance: Hernia Surgery Coverage Explained

You may want to see also

Frequently asked questions

According to recent studies, around 50% of Americans have a life insurance policy, with men being slightly more likely to be insured than women.

It is estimated that around 40% of Americans report not having sufficient life insurance coverage, with over 100 million Americans believed to be uninsured or underinsured.

The main reasons cited for not having life insurance are cost, other financial priorities, and uncertainty about the type and amount of coverage needed.