Life insurance is a tool to financially protect your loved ones and help you achieve your financial goals. Term life insurance and universal life insurance are two popular options with different features and benefits. Term life insurance covers the policyholder for a specific period, such as 10, 20, or 30 years, and is generally more affordable. On the other hand, universal life insurance is a type of permanent coverage that can last a lifetime and includes a savings component called cash value. This cash value grows over time and can be accessed for various purposes. Universal life insurance offers more flexibility and control but requires oversight and comes with varying costs. Understanding these differences is crucial for individuals to make informed decisions about their financial planning and protection.

| Characteristics | Values |

|---|---|

| Coverage Period | Term life insurance covers the policyholder for a fixed period, typically 10, 20, or 30 years. Universal life insurance is a type of permanent coverage that lasts for the lifetime of the policyholder. |

| Cost | Term life insurance is generally more affordable than universal life insurance, especially when the policyholder is younger. Prices for term life insurance tend to increase with age, while universal life insurance premiums remain the same or increase significantly as the policyholder gets older. |

| Cash Value | Term life insurance does not accumulate cash value. Universal life insurance has a savings component, called cash value, that builds up over time, with the potential to earn interest. The policyholder can access this cash value during their lifetime. |

| Flexibility | Term life insurance offers customizable coverage amounts and terms. Universal life insurance allows the policyholder to adjust premium payments, coverage amounts, and frequency within certain limits. |

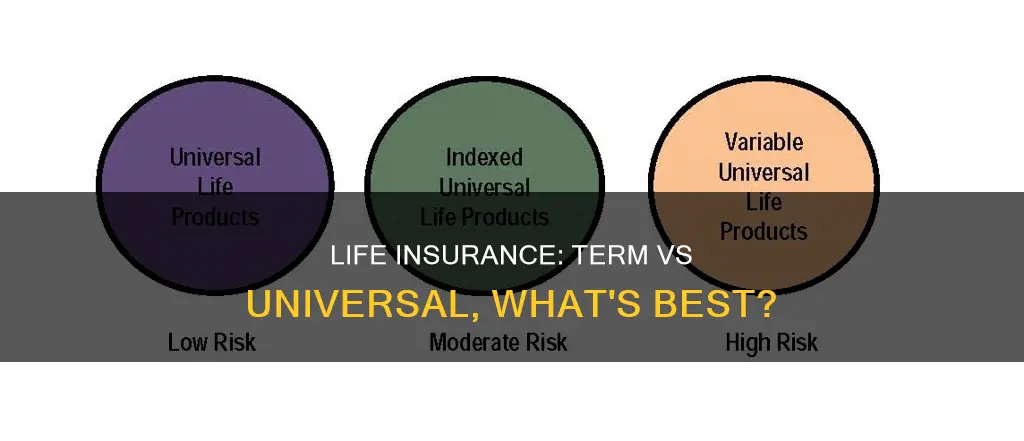

| Complexity | Term life insurance is the most basic type of life insurance. Universal life insurance is more complex, offering various subtypes like traditional, variable, and indexed universal life insurance, each with different risk and reward profiles. |

| Conversion | Term life insurance policies can sometimes be converted into permanent policies. Universal life insurance does not require conversion as it is a form of permanent coverage. |

What You'll Learn

- Term life insurance is more affordable but offers limited coverage

- Universal life insurance is permanent coverage with a savings component

- Variable universal life insurance lets you invest in mutual funds

- Whole life insurance is a combination of insurance and investment

- Term life insurance is good for those who want to invest on their own terms

Term life insurance is more affordable but offers limited coverage

On the other hand, universal life insurance is a type of permanent coverage that can last for the policyholder's lifetime. It offers more long-term protection and has a savings or cash value component that grows over time, providing a safety net during life. Policyholders can access this cash value for various purposes, such as taking out a policy loan, withdrawing funds, or surrendering the policy. Universal life insurance also provides the flexibility to adjust premium payments and coverage amounts to align with changing financial goals and circumstances.

While term life insurance is more affordable, its coverage is limited by the specified term. Once the term ends, the policy may need to be renewed or replaced, resulting in higher rates due to the increased age and risk factors. Universal life insurance, despite being more expensive, offers lifelong coverage without the need for renewal, making it a more comprehensive solution for individuals seeking long-term protection.

It is important to note that both types of insurance serve different purposes and cater to varying financial needs. Term life insurance is ideal for individuals seeking temporary protection, especially during periods when a financial safety net is particularly needed. On the other hand, universal life insurance is suitable for those seeking long-term coverage and interested in building wealth through the cash value component.

When deciding between term life insurance and universal life insurance, it is essential to consider factors such as budget, desired coverage length, and financial goals. Term life insurance provides affordable coverage for a fixed period, while universal life insurance offers permanent protection with added savings and flexibility features.

Life Insurance and Debt: Can It Be Garnished in Texas?

You may want to see also

Universal life insurance is permanent coverage with a savings component

Universal life insurance is a type of permanent life insurance that offers lifetime coverage and builds cash value over time. It is designed to last until the policyholder's death, and penalties are usually incurred for early termination of the policy. This type of insurance is ideal for those seeking long-term coverage and the flexibility to adjust their premium payments and coverage to align with their financial goals.

Universal life insurance policies have a savings component, often referred to as the cash value, which grows over time on a tax-deferred basis. Policyholders can access this cash value in various ways, such as taking out a policy loan, withdrawing funds, or surrendering the policy. The cash value earns interest at a rate set by the insurer, which can change over time, although there is typically a minimum rate guaranteed.

The flexibility of universal life insurance extends to the premium payments as well. Policyholders can choose to increase or decrease their premium payments within certain limits, allowing them to manage their finances more effectively. However, it is important to note that universal life insurance premiums may start lower but tend to increase as the policyholder ages, and insufficient payments can lead to large sums being owed or even policy lapse.

Universal life insurance also provides the option to adjust the death benefit. In most cases, the death benefit remains level throughout the policy, but some policies offer an increasing death benefit option, where the cash value balance is added to the benefit. This flexibility in coverage, premiums, and savings makes universal life insurance a compelling choice for those seeking long-term protection and wealth accumulation.

Compared to term life insurance, universal life insurance offers more longevity and savings potential. While term life insurance covers the policyholder for a fixed period, typically 10 to 30 years, universal life insurance is designed to last a lifetime. Additionally, the cash value component of universal life insurance provides an avenue for building wealth, making it a comprehensive solution for financial protection and long-term planning.

Whole Life Insurance: Understanding Your Payout Options

You may want to see also

Variable universal life insurance lets you invest in mutual funds

Term life insurance and universal life insurance are two popular options for people looking for financial protection for their loved ones. While term life insurance offers coverage for a fixed period, usually 10 to 30 years, universal life insurance provides permanent coverage for the policyholder's entire lifetime. Universal life insurance also has a savings or cash value component that builds up over time, offering tax advantages and the flexibility to adjust premium payments and coverage.

Variable universal life insurance (VUL) is a type of universal life insurance policy that combines lifelong insurance protection with flexible premiums and a cash value component. One of the key features of VUL is that it allows policyholders to invest the cash value in mutual funds, providing the potential for faster cash value growth.

VUL insurance policies offer sub-accounts or investment accounts that operate like mutual funds, allowing policyholders to invest their cash value in various assets, including stocks, bonds, money market securities, ETFs, and other investment funds. These investments can generate high returns, but they also come with higher risks. Policyholders assume the risks of the underlying assets, so there is a possibility of loss if the market performs poorly.

By investing in mutual funds through VUL, individuals can take advantage of market growth potential while also benefiting from the permanent life insurance coverage provided by the policy. The cash value growth in VUL is tax-deferred, and policyholders can access their cash value through withdrawals or loans. However, accessing the cash value will reduce the available cash surrender value and the death benefit.

Variable universal life insurance provides individuals with the flexibility to manage their funds according to their investment preferences and risk tolerance. It is important to carefully assess the risks and seek the guidance of a licensed insurance professional before purchasing VUL due to its complexity and exposure to market fluctuations.

Voluntary Life Insurance: Does It Carry Over?

You may want to see also

Whole life insurance is a combination of insurance and investment

Term life insurance and universal life insurance are two popular options for people looking to secure their loved ones' financial future. While term life insurance offers coverage for a fixed period, usually 10 to 30 years, universal life insurance provides permanent coverage for the policyholder's entire lifetime. Term life insurance is a more affordable option, especially for younger individuals, as the premiums increase with age. On the other hand, universal life insurance offers more long-term protection for the price and has a savings component called the cash value, which grows over time and can be accessed for other financial needs.

Whole life insurance is a type of permanent life insurance that combines insurance and investment. It provides lifetime coverage without a fixed term, and it also builds value, making it an attractive option for those looking to invest their money. Whole life insurance policies have fixed premiums that are typically higher than those of term life insurance, and they guarantee coverage for the entire life of the policyholder as long as the premiums are paid. This type of insurance is particularly appealing to high-income individuals who have already maximised their tax-advantaged retirement plans.

The cash value component of whole life insurance is similar to a savings account, where a portion of the premiums is deposited and can be accessed through withdrawals or loans. This cash value grows over time, and the growth rate depends on the policy type. Whole life insurance often offers guaranteed interest rates, while universal life insurance does not, leading to potential faster growth with the latter if the market performs well. However, the investment aspect of whole life insurance may not provide the best returns compared to direct investments in brokerage or retirement accounts.

Whole life insurance also offers dividends, which can be cashed out, reinvested in the cash value, or used to cover premiums. Universal life insurance does not typically offer dividend payments. Additionally, whole life insurance provides guaranteed cash value build-up over the policy's life, whereas universal life insurance's cash value accumulation can fluctuate based on how the policy is funded and other factors.

While whole life insurance offers guaranteed coverage and cash value growth, it may not be the best option for everyone due to its higher premiums and fees. Some individuals might prefer the flexibility of universal life insurance, which allows adjustments to premium payments and coverage amounts to align with their financial goals. Ultimately, the choice between term, universal, and whole life insurance depends on individual needs, financial situation, and long-term objectives.

Life Insurance: Suspended License, What's the Verdict?

You may want to see also

Term life insurance is good for those who want to invest on their own terms

Term life insurance is a good option for those who want to invest on their own terms. While permanent life insurance allows you to grow a cash value, you can't choose your own investments in the same way you could in a brokerage or retirement account. You will likely see better investment growth by investing yourself rather than through a permanent life insurance policy.

Term life insurance is the most basic type of life insurance policy, covering the policyholder for a specific period, typically 10, 20, or 30 years. It is significantly more affordable than universal life insurance, and you can purchase it in a wide variety of policy terms and benefit amounts. It is also flexible, as you can often renew your policy after it expires or sign up for a new one, although your rates will be higher.

Universal life insurance, on the other hand, is a type of permanent life insurance that can provide lifetime protection and build cash value with tax advantages. It offers more control, as you can adjust your policy and premium payments as your life changes. However, it requires oversight, and the cost of keeping the policy can increase significantly as you get older.

Variable universal life insurance allows you to invest your cash value into various mutual funds, including stocks, bonds, or other assets. This offers the potential for fast cash value growth if the investments perform well, but there is a greater risk of loss if they do not.

Term life insurance may be a better option for those who want to invest on their own terms because it is more affordable and flexible, allowing individuals to choose and manage their own investments. It also does not carry the same long-term commitment as universal life insurance, which may be important for those who want the option to change their policy in the future.

Voluntary Permanent Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Term life insurance covers the policyholder for a fixed period, typically 10, 20, or 30 years, whereas universal life insurance is a type of permanent coverage that lasts for the lifetime of the policyholder. Term life insurance is also significantly more affordable than universal life insurance.

Term life insurance is the most basic type of life insurance and is therefore very affordable. It is often purchased by those with a smaller budget. It is also a good option for those who want to invest but want to do so on their own terms. Term life insurance also offers no-penalty cancellation, meaning you can cancel your policy at any time without financial consequences.

Universal life insurance offers more control and flexibility than term life insurance. It allows you to adjust your policy and premium payments (within limits) as your life changes. It also has a savings component, or cash value, that builds up over time and can be accessed for other expenses. Universal life insurance is a good option for those with complex financial needs or those who want long-term coverage.

There is no definitive answer to this question as it depends on each individual's needs and preferences. Term life insurance may be better for those who are on a budget or who are looking for basic, short-term coverage. Universal life insurance may be better for those seeking long-term coverage, more control over their policy, and additional benefits such as the ability to build wealth.