Voluntary permanent life insurance is a type of long-term life insurance policy that provides coverage for the entire life of the insured individual. Unlike term life insurance, which offers coverage for a specified period, permanent life insurance offers lifelong protection and a cash value component. This means that in addition to the death benefit, the policyholder can also accumulate cash value over time, which can be borrowed against or withdrawn. This type of insurance is often chosen by individuals who want to ensure their loved ones are financially protected for the long term and also want to build a savings component into their insurance policy.

| Characteristics | Values |

|---|---|

| Definition | Voluntary permanent life insurance is a type of life insurance policy that is chosen and purchased by the policyholder, offering lifelong coverage with a fixed death benefit. |

| Coverage | Provides a death benefit to the policyholder's beneficiaries upon the insured individual's death. |

| Premiums | Policyholders pay regular premiums, typically monthly or annually, to maintain the policy. |

| Accumulation | Over time, the policy builds cash value, which can be borrowed against or withdrawn. |

| Flexibility | Allows policyholders to customize the coverage amount and term to their needs. |

| Investment Component | Often includes an investment component, where a portion of the premiums is invested in various assets, growing the cash value. |

| Irrevocability | Once the policy is issued, it cannot be canceled by the insurance company without the policyholder's consent. |

| Portability | Can be portable, meaning the policy can be transferred to a new owner if the insured individual dies. |

| Tax Advantages | May offer tax benefits, including tax-deferred growth of cash value and potential tax-free death benefits. |

| Longevity | Provides coverage for a lifetime, ensuring financial security for beneficiaries regardless of when the insured individual passes away. |

| Cost | Premiums can vary based on factors like age, health, coverage amount, and investment choices. |

| Comparison | It is often compared to term life insurance due to its permanent nature, but it offers more flexibility and potential long-term benefits. |

| Suitability | Suitable for individuals seeking long-term financial protection and those who want to build a personal investment portfolio. |

What You'll Learn

- Definition: Voluntary permanent life insurance is a long-term coverage option chosen by the policyholder

- Benefits: It provides lifelong coverage with guaranteed death benefit and potential cash value accumulation

- Premiums: Policyholders pay regular premiums for coverage, with no age or health restrictions

- Flexibility: This type of insurance offers customizable terms and riders to suit individual needs

- Comparison: It differs from term life by offering permanent coverage and potential investment features

Definition: Voluntary permanent life insurance is a long-term coverage option chosen by the policyholder

Voluntary permanent life insurance is a type of long-term life insurance policy that offers coverage for the entire lifetime of the insured individual. Unlike term life insurance, which provides coverage for a specified period, permanent life insurance is designed to remain in force as long as the policyholder pays the premiums. This type of insurance provides a sense of financial security and peace of mind, knowing that your loved ones will be financially protected even if something happens to you.

The key feature of voluntary permanent life insurance is that it is chosen and owned by the policyholder. This means that the individual has the autonomy to decide when and how to use the policy's benefits. Policyholders can choose to keep the full death benefit in force, allowing it to accumulate cash value over time, which can be borrowed against or withdrawn. This flexibility is a significant advantage, as it enables individuals to adapt the policy to their changing financial needs and goals.

One of the primary benefits of voluntary permanent life insurance is its ability to provide a guaranteed death benefit. This means that, regardless of the insured's age or health at the time of death, the beneficiaries will receive the full death benefit amount. This feature is particularly valuable for those who want to ensure their family's financial security, especially if they have dependents or significant financial obligations.

Another advantage is the potential for cash value accumulation. As premiums are paid, a portion of the premium goes towards building cash value within the policy. This cash value can grow tax-deferred and can be borrowed against or withdrawn, providing financial flexibility. Over time, the policyholder can build a substantial cash reserve, which can be used for various purposes, such as funding education, starting a business, or supplementing retirement income.

In summary, voluntary permanent life insurance is a long-term financial planning tool that offers policyholders the freedom to choose when and how to utilize the policy's benefits. It provides guaranteed coverage, potential cash value accumulation, and the ability to adapt to changing financial circumstances. This type of insurance is an excellent option for individuals seeking a comprehensive and flexible approach to life insurance, ensuring financial protection and peace of mind for themselves and their loved ones.

Life Insurance Preferred Loans: What You Need to Know

You may want to see also

Benefits: It provides lifelong coverage with guaranteed death benefit and potential cash value accumulation

Voluntary permanent life insurance is a type of long-term life insurance policy that offers several unique advantages. One of its primary benefits is providing lifelong coverage, ensuring that your beneficiaries receive a death benefit regardless of when the policyholder passes away. This is particularly valuable as it guarantees financial security for your loved ones, even in the event of your untimely death. The guaranteed death benefit is a cornerstone of this insurance type, offering peace of mind and financial protection.

In addition to the death benefit, voluntary permanent life insurance also allows for the potential accumulation of cash value. As the policyholder, you can build up a cash reserve within the policy, which grows over time. This cash value can be used for various purposes, such as loaning money to yourself, paying for college tuition, or even supplementing retirement income. The ability to access and utilize this cash value is a significant advantage, providing financial flexibility and control.

The lifelong coverage aspect is crucial, as it ensures that your family is protected throughout their entire lives. Unlike term life insurance, which provides coverage for a specific period, permanent insurance remains in force as long as the premiums are paid. This means that your beneficiaries will receive the death benefit when you pass away, and the policy will continue to provide financial support if you become disabled or unable to work.

Furthermore, the potential for cash value accumulation makes this insurance type an attractive investment option. As the policy grows, the cash value can be invested, potentially earning interest and dividends. This investment component allows your money to work harder over time, providing an opportunity to build a substantial financial reserve. With proper management and investment strategies, the cash value can be utilized to enhance your financial goals and provide additional security.

In summary, voluntary permanent life insurance offers a comprehensive solution for individuals seeking lifelong coverage and financial protection. The guaranteed death benefit ensures that your loved ones are cared for, while the potential for cash value accumulation provides financial flexibility and the possibility of growing your wealth over time. This type of insurance is a valuable tool for anyone looking to secure their family's future and build a financial safety net.

Kids' Life Insurance: Suicide Impact and Parental Options

You may want to see also

Premiums: Policyholders pay regular premiums for coverage, with no age or health restrictions

Voluntary permanent life insurance is a type of long-term life insurance policy that offers coverage for the entire life of the insured individual, providing a sense of financial security and peace of mind. Unlike term life insurance, which provides coverage for a specific period, permanent life insurance offers lifelong protection. One of the key advantages of this policy is that it allows policyholders to pay regular premiums without any age or health restrictions, making it accessible to a wide range of individuals.

When it comes to premiums, voluntary permanent life insurance policies offer a unique structure. Policyholders are required to pay regular premiums to maintain their coverage. These premiums are typically set at a fixed rate, ensuring that the policyholder knows exactly how much they need to pay each period. The beauty of this arrangement is that it provides coverage for life, and the premiums are often calculated based on the insured's age and the desired coverage amount. This means that younger individuals may pay lower premiums, as the risk of death is generally lower at a younger age.

The absence of age or health restrictions is a significant benefit for policyholders. Many traditional insurance policies may require medical exams or have limited coverage options for individuals with pre-existing health conditions. However, with voluntary permanent life insurance, anyone can qualify, regardless of their age or health status. This accessibility ensures that individuals can secure their loved ones' financial future without the barriers often associated with other insurance products.

The regular premium payments provide a consistent and predictable financial commitment. Policyholders can plan their finances accordingly, knowing that their premiums will remain stable over time. This predictability is especially valuable for long-term financial planning, as it allows individuals to budget effectively and ensure that their loved ones are protected. Moreover, the premiums are typically tax-deductible, providing an additional financial advantage for policyholders.

In summary, voluntary permanent life insurance offers a comprehensive solution for individuals seeking lifelong coverage without the constraints of age or health. The regular premium payments provide stability and predictability, allowing policyholders to secure their financial future and protect their loved ones. This type of insurance is an excellent choice for those who want the peace of mind that comes with knowing their family's financial well-being is protected.

Term and Fixed Life Insurance: What's the Difference?

You may want to see also

Flexibility: This type of insurance offers customizable terms and riders to suit individual needs

Voluntary permanent life insurance is a flexible financial product that provides long-term coverage with the potential for cash value accumulation. One of its key advantages is the ability to customize the policy to meet specific individual needs. This level of flexibility is particularly beneficial for those seeking a tailored insurance solution.

When it comes to voluntary permanent life insurance, policyholders have the freedom to choose the coverage amount, duration, and various other features. The policy terms can be adjusted to align with the insured's financial goals and risk tolerance. For instance, individuals can opt for a higher coverage amount if they wish to provide substantial financial security for their loved ones. Alternatively, those with a lower risk profile might prefer a more conservative approach, ensuring that the insurance remains affordable while still offering adequate protection.

The customization extends beyond the initial policy setup. This type of insurance often allows for the addition of riders, which are optional benefits that enhance the policy's value. Riders can provide additional coverage for specific risks, such as critical illness, accident, or long-term care. For example, a critical illness rider would offer financial support if the insured were diagnosed with a serious illness, helping to cover medical expenses and provide income replacement. These riders can be tailored to individual circumstances, ensuring that the insurance policy is comprehensive and adaptable.

Furthermore, the flexibility of voluntary permanent life insurance enables policyholders to make changes over time. As an individual's financial situation, health, or personal goals evolve, the policy can be adjusted accordingly. This might involve increasing or decreasing the coverage amount, adding or removing riders, or even converting the policy to a different type of insurance if necessary. The ability to review and modify the policy regularly ensures that it remains relevant and effective throughout the insured's lifetime.

In summary, voluntary permanent life insurance stands out for its adaptability and customization. By offering policyholders the freedom to choose and modify various aspects of the insurance, it ensures that the coverage is tailored to individual needs. This flexibility is a significant advantage, allowing individuals to create a comprehensive and effective long-term financial protection plan.

Life Insurance: Am I Covered Enough?

You may want to see also

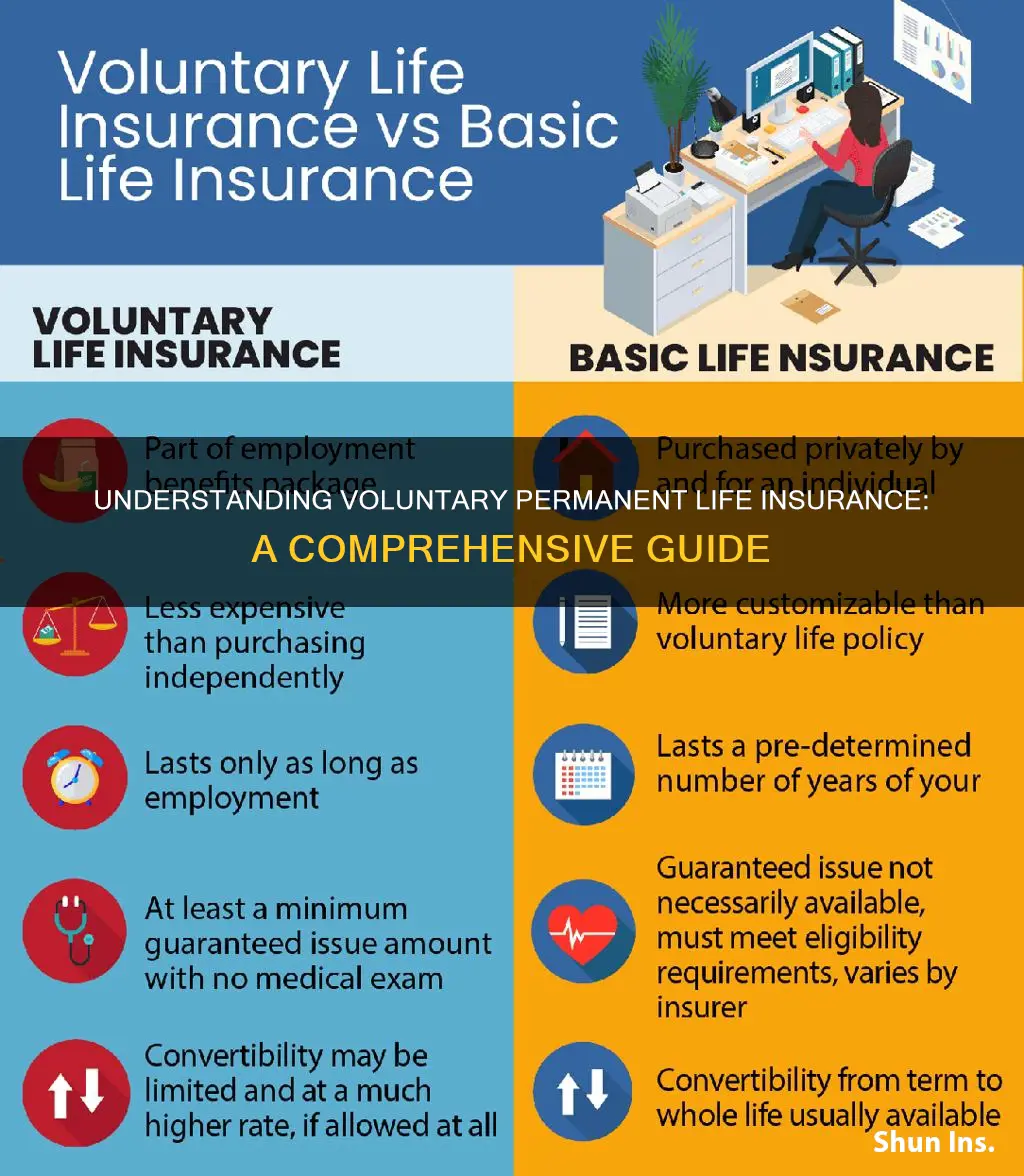

Comparison: It differs from term life by offering permanent coverage and potential investment features

Voluntary permanent life insurance is a type of long-term coverage that provides financial protection and potential investment benefits. It is a permanent policy, meaning it remains in force for the insured's entire life, offering a level of security that term life insurance, which has a defined period, does not. This type of insurance is often offered as a voluntary benefit in group settings, such as through employers, and can be a valuable addition to an individual's financial portfolio.

The key difference between voluntary permanent life insurance and term life insurance is the duration of coverage. Term life insurance is designed to provide protection for a specific period, typically 10, 20, or 30 years. Once the term ends, the policy expires, and the coverage ceases unless the policy is renewed or converted to a permanent policy. In contrast, permanent life insurance provides coverage for the entire life of the insured, ensuring that beneficiaries receive a death benefit regardless of the insured's age or health status at the time of passing.

One of the unique features of voluntary permanent life insurance is its potential investment component. Many permanent life insurance policies include an investment account or component, allowing policyholders to grow their money over time. This investment feature can offer several advantages. Firstly, it provides an opportunity for the policy's cash value to accumulate, which can be borrowed against or withdrawn if needed. Secondly, the investment aspect may offer higher returns compared to traditional savings accounts, potentially outpacing inflation and providing a more substantial financial cushion.

When comparing voluntary permanent life insurance to term life, the former's permanent nature becomes a significant advantage. With permanent coverage, the insured's beneficiaries are guaranteed a death benefit, even if the insured outlives the initial term period. This aspect is particularly valuable for those seeking long-term financial security and a consistent safety net for their loved ones. Additionally, the investment features can provide a sense of financial growth and flexibility, allowing policyholders to potentially build a more substantial financial reserve over time.

In summary, voluntary permanent life insurance stands out from term life due to its permanent coverage and potential investment benefits. The long-term nature of permanent policies ensures that beneficiaries receive a death benefit, providing financial security and peace of mind. The investment features further enhance the policy's value, offering the potential for growth and additional financial advantages. Understanding these differences is essential for individuals to make informed decisions about their life insurance needs and to build a comprehensive financial strategy.

Group Life Insurance: Resignation Impact Explained

You may want to see also

Frequently asked questions

Voluntary permanent life insurance is a type of long-term life insurance policy that provides coverage for the entire life of the insured individual. It is a permanent form of insurance, meaning it remains in force for as long as the policyholder pays the premiums. This type of insurance offers a guaranteed death benefit, which is a fixed amount paid to the policy's beneficiaries upon the insured's passing.

The key difference lies in the duration of coverage. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. Once the term ends, the policy may lapse unless the policyholder renews it. In contrast, voluntary permanent life insurance offers lifelong coverage, ensuring that the death benefit is provided regardless of the insured's age or health status at the time of death.

This insurance offers several advantages. Firstly, it provides financial security for the insured's family, ensuring that loved ones are protected even if the policyholder passes away. Secondly, it can act as an investment, as the cash value of the policy grows over time, which can be borrowed against or withdrawn. Additionally, permanent life insurance offers a fixed premium, which remains the same throughout the policy's duration, providing long-term financial planning stability.