Kentucky has a fully state-run health insurance marketplace, Kynect, which residents use to shop for and purchase ACA Marketplace/exchange plans. During the open enrollment period for 2024 coverage, 74,882 people enrolled in private coverage through Kynect. This is a slight increase from the previous year, but still well below the record high set in 2015.

The average cost of homeowners insurance in Kentucky is $2,190 per year, compared to the national average of $1,915. The average cost of car insurance in Kentucky is $175 per month, or $2,105 per year.

| Characteristics | Values |

|---|---|

| Average annual cost of home insurance | $2,190 |

| Average monthly cost of home insurance | $182.50 |

| Average annual premium for Travelers | $1,915 |

| Average annual cost of car insurance | $2,105 |

| Average monthly cost of car insurance | $175 |

| Average cost for state minimum coverage | $717 |

| Cheapest car insurance company | USAA ($1,538/year) |

| Average cost for young drivers | $3,506 |

| Average cost for senior drivers | $2,026 |

| Average annual premium for car insurance in Louisville | $1,577 |

What You'll Learn

How many people are insured through Kentucky's Marketplace?

Kentucky residents use a fully state-run health insurance marketplace called Kynect to shop for and purchase ACA Marketplace/exchange plans. The platform provides access to health insurance products from private insurers. To qualify for health coverage through the Kentucky Marketplace, you must be lawfully present in the United States and not be enrolled in Medicare.

During the open enrollment period for 2024 coverage, 74,882 people enrolled in private coverage through Kynect. While most states experienced record-high Marketplace enrollment in 2023 and 2024, Kentucky did not follow this trend. Enrollment in Kentucky's Marketplace declined from 2019 through 2023, and while it did grow in 2024, the total was still below the record high set in 2015.

Rite Aid's Insurance Change Conundrum: Privacy or Policy?

You may want to see also

Average cost of car insurance in Kentucky

The average cost of car insurance in Kentucky varies depending on the source and the factors used to calculate the average. According to one source, the average cost is $1,341 per year, which is slightly above the national average of $1,311. Another source gives the average as $1,405 per year. However, the cost of car insurance in Kentucky can vary significantly depending on individual circumstances such as age, gender, driving record, location, and credit score.

For example, the cheapest car insurance option for teens in Kentucky is around $131 per month for minimum coverage and $266 per month for full coverage. On the other hand, senior drivers in Kentucky can find car insurance for around $71-$80 per month for minimum coverage and $140-$144 per month for full coverage.

The cost of car insurance in Kentucky also depends on the level of coverage. State minimum liability policy costs around $97 per month or $1,159 per year. In contrast, full coverage car insurance can cost around $329 per month or $3,947 per year. The specific requirements and coverage options should be considered when choosing a car insurance policy in Kentucky.

Term Insurance: Understanding the Wait for Coverage

You may want to see also

Average cost of home insurance in Kentucky

The average cost of home insurance in Kentucky is $2,190 per year, or $259 per month. This is higher than the national average of $1,915 per year. The cost of home insurance in Kentucky depends on several factors, including the value of the home, location, claims history, and coverage package.

Average Annual Premium

The average annual premium for homeowners insurance in Kentucky is $3,113 for $300,000 in dwelling coverage. This is nearly 40% more than the national average of $2,230. The high cost is likely due to Kentucky's severe weather conditions and the increased risk of natural disasters.

Average Monthly Premium

The average monthly premium for home insurance in Kentucky is $259.

Cheapest Home Insurance Companies

The cheapest home insurance companies in Kentucky include State Farm, Auto-Owners, Encompass, Grange Insurance, and Kentucky Farm Bureau. The average annual premium for Auto-Owners Insurance is $2,489, which is 3% cheaper than the statewide average.

Average Cost by City

The cost of home insurance in Kentucky varies by city. The cheapest cities for home insurance in Kentucky include Fort Thomas, Bellevue, Dayton, Hebron, and Walton. The average annual premium in Fort Thomas is $2,353, which is 24% below the state average. On the other hand, the most expensive cities for home insurance include Fulton, Hickman, Tiline, Arlington, and Bardwell. The average annual premium in Fulton is $4,820, which is 55% above the state average.

Average Cost by Coverage Amount

The cost of home insurance in Kentucky also depends on the coverage amount. For $100,000 in dwelling coverage, the average annual premium is $854, while for $400,000 in dwelling coverage, the average annual premium is $2,415.

Average Cost by Deductible

The deductible is the amount the insured person is responsible for paying toward a covered loss. The average annual premium for a $2,000 deductible in Kentucky is $814, while for a $500 deductible, the average annual premium is $971.

Nurse Practitioners: Insurance Specialist Status

You may want to see also

Kentucky's Medicaid program

To be eligible for Medicaid in Kentucky, individuals must be lawfully present in the United States and not be enrolled in Medicare. They must also not have access to affordable health coverage through their employer, be eligible for premium-free Medicare Part A, or be able to be claimed as a tax dependent by someone else. Additionally, applicants must meet certain income and asset limits, which are based on the size of their household and their specific circumstances.

Kentucky operates a fully state-run health insurance marketplace called Kynect, which residents can use to shop for and purchase Medicaid plans, as well as other types of health insurance. Kynect offers an online platform that allows users to compare different health plans and choose the one that best suits their needs. The platform also helps determine any available subsidies that residents may be eligible for.

Kentucky had been planning to implement a Basic Health Program by 2024, which would have provided an alternative to Medicaid for low-income residents. However, the state paused the implementation of this program in late 2022. As of now, Minnesota and New York are the only states with operational Basic Health Programs, while Oregon plans to join them by mid-2024.

Billing Insurance for Drug Rehab: Navigating the Complexities of Coverage

You may want to see also

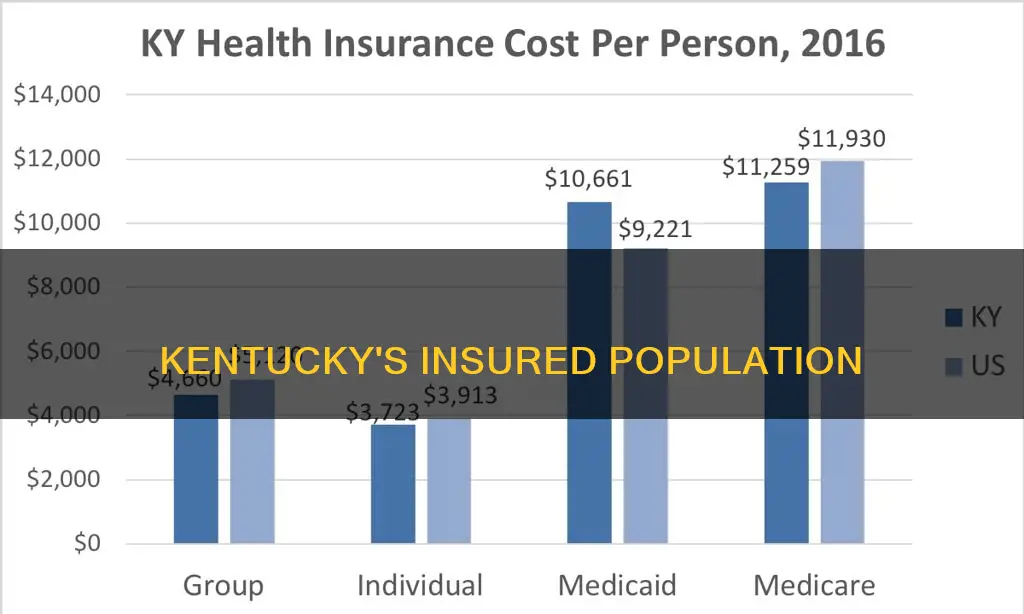

Average cost of health insurance in Kentucky

The average cost of health insurance in Kentucky is $7,111 per person per year, or $592.58 per month. This is $129 per person above the national average for health insurance coverage. However, health insurance costs can vary significantly based on the cost of care and the population insured. For example, the average premium payment for health insurance in Kentucky is $605 per month, while the average premium after the advanced premium tax credit is $199 per month.

The cost of health insurance in Kentucky also depends on the type of plan chosen. The cheapest health insurance plan in Kentucky is the Clear Silver plan from Ambetter, which costs an average of $362 per month. The average cost of a Silver plan in Kentucky is $497 per month, while a Gold plan costs an average of $582 per month. The cheapest Silver plan in Kentucky is the Silver 12 250 with First 4 Primary Care Visits Free by Passport by Molina Healthcare, at a monthly cost of $426. The cheapest Gold plan is the Everyday Gold plan from WellCare Health Plans of Kentucky, Inc, at a monthly cost of $472.

The cost of health insurance in Kentucky also depends on age. For example, the average 18-year-old pays $366 for a Silver plan, while a 60-year-old is charged $1,088 for the same plan. A 40-year-old with a Bronze plan pays $420, and $597 for a Gold plan.

Understanding Your Cigna Insurance Bill: A Breakdown of Charges and Coverage

You may want to see also

Frequently asked questions

74,882 people enrolled in private coverage through Kynect during the open enrollment period for 2024 coverage.

Kentucky ranks 5th in the US for the most expensive average annual car insurance premiums.

The average cost of car insurance in Kentucky is $73 per month, or $872 per year, for minimum liability insurance.

The average cost of home insurance in Kentucky is $2,190 per year.

The average annual premium for Travelers insurance in Kentucky is $1,915, which is less than the state average.