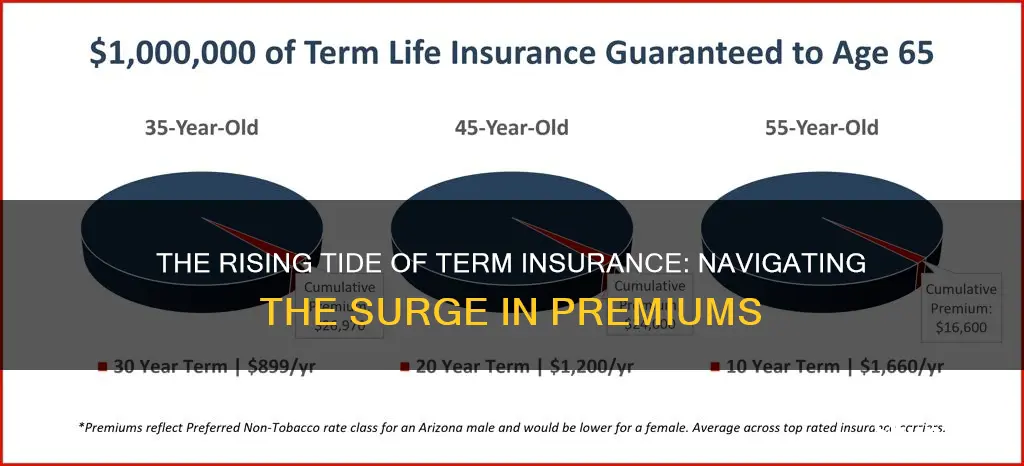

Term insurance rates have increased in recent years, with some reports indicating a sharp rise in premium rates. This increase has been attributed to various factors, including the impact of the COVID-19 pandemic, which resulted in higher claim ratios for insurers due to rising fatalities. However, as life returns to normalcy post-pandemic, claim ratios have started to stabilise, and experts predict that term insurance rates will remain stable or moderate in the coming years.

| Characteristics | Values |

|---|---|

| Term insurance premium rates | Expected to remain stable in 2023 |

| Reason for increment over the past few years | Increase in Covid-19 deaths |

| Pure protection premiums | Increased by 50-100% from pre-Covid-19 lows |

| Term insurance rates | Expected to remain stable in 2023 |

| Term insurance premium rates | Expected to moderate in the future |

| Term insurance premium rates in 2022 | Increased by 20-40% |

| Term insurance premium rates for a 30-year-old healthy, non-smoker male | Rs. 725/month |

| Term insurance premium rates for a 1 crore term plan | Rs.17/day |

| Term insurance premium rates for a 50 lakh life cover | Rs.8/day |

| Term insurance premium rates for a 75 lakh life cover | Rs.12/day |

What You'll Learn

Covid-19's impact on insurance rates

The COVID19 pandemic has had a significant impact on the insurance industry. The pandemic has disrupted economic activity worldwide, resulting in substantial business interruption losses. Most businesses have not acquired coverage for these losses, and only a few companies have business interruption insurance that covers pandemic-related losses. This has exposed a significant protection gap for pandemic-related business interruption losses.

The pandemic has also affected the insurance industry's earnings by changing the pattern of payments on claims and decreasing investment income. In 2020, the increase in COVID-19 hospitalizations and testing requirements put upward pressure on insurer costs. At the same time, the postponement and cancellation of elective procedures placed downward pressure on costs, offsetting the increase in COVID-related expenses. Furthermore, the industry benefited from a large increase in premiums in 2020 due to a general increase in enrollment and premium rates.

The pandemic has also led to a reduction in economic activity, causing a decrease in insurance premiums. Profits have been significantly reduced because more claims are being paid out than premiums collected. Some companies have had to lay off employees, reducing productivity. Budgets of companies have also increased due to more spending on social responsibility to help governments fight the pandemic.

Claims have increased along many lines. As companies transition to virtual working environments, most companies have not seen the impact on claim processing. Companies are advised to carefully evaluate the volume of claims received during the pandemic and as it subsides, as well as their efficiency to process claims virtually.

The pandemic has also brought the travel industry, especially aviation, to a standstill. Travel insurers stopped sales during the pandemic due to travel bans and border closures. There were also more refunds due to the cancellation of travel policies as a result of unutilized travel days.

Insurers have responded to the crisis on multiple fronts as capital managers, employers, and claim payers. Each insurance company has distinct challenges, but the most pressing concern for all insurers is protecting the health and safety of their employees and partners. Insurers should review and update their crisis management plans and take steps to continue operations with minimal disruption to clients. They should also adapt to working from remote locations and enable and equip staff to work offsite.

While the pandemic persists, insurers must learn to give up-to-date and truthful information to their clients and be proactive rather than reactive in their response. They must continue to relate with clients in a positive working environment to maintain their trust.

The Intricacies of Level Term Insurance: Unraveling the Meaning of "Level

You may want to see also

Factors affecting term life insurance premiums

Term life insurance premiums are influenced by a variety of factors, some of which are within the policyholder's control, while others are not. Here are the key factors that can affect the cost of term life insurance:

- Age: The younger the policyholder, the lower the premiums will be. This is because younger individuals have a longer life expectancy and are less likely to become ill. As a result, the likelihood of the insurer having to pay out on the policy decreases, leading to lower premiums.

- Gender: Women tend to live longer than men, and therefore, pay lower premiums. This is due to the statistical difference in life expectancy between the genders.

- Health: The policyholder's health can significantly impact the cost of term life insurance. Those with serious illnesses or health conditions may have to pay higher premiums. In some cases, the insurance company may even deny coverage.

- Tobacco Use: Individuals who use tobacco products are at a higher risk for various health problems. As a result, life insurance companies often charge higher premiums to smokers. Even occasional smoking or vaping can result in being classified as a smoker by the insurance company.

- Family Medical History: A family history of illnesses, especially hereditary or serious diseases, can increase the cost of coverage. This is because the policyholder may be predisposed to certain medical conditions, increasing the risk for the insurer.

- Lifestyle and Occupation: High-risk hobbies or occupations can lead to higher premiums. Activities such as skydiving or racing cars, and jobs such as logging or roofing, are considered more dangerous and may result in increased premiums.

- Policy Details: The specifics of the policy, such as the coverage amount and duration, can also affect the cost. Longer policies with higher coverage amounts will generally be more expensive. Additionally, term life insurance policies are typically cheaper than whole life insurance policies.

Understanding the Insurance Coverage of Short-Term Bonds

You may want to see also

Pros and cons of term life insurance

Term life insurance is designed for temporary coverage without the additional features of permanent policies. This can be beneficial if you only need life insurance for a definite period, but it can also be a disadvantage if your circumstances change. Here are some pros and cons to help you decide if term life insurance is right for you:

Pros of Term Life Insurance:

- Lower cost: Term life insurance typically has lower premiums than permanent life insurance, making it a more affordable option for those on a tight budget.

- Flexibility: You can choose the term length that aligns with your financial obligations, such as raising a family or paying off a mortgage.

- Simplicity: Term life insurance is straightforward, without the complex tax implications or restrictions of permanent policies.

- Peace of mind: Even if you outlive the policy, term life insurance provides peace of mind that your loved ones will be financially secure if you pass away during the term.

Cons of Term Life Insurance:

- Time-limited coverage: Term life insurance only provides coverage for a specific period, and if you outlive the term, you may be left uninsured or with high premiums to continue coverage.

- No cash value: Term life insurance does not accumulate capital or have an investment component, so there is no option to withdraw money or borrow against the policy while you're still alive.

- Unpredictable future needs: It can be challenging to predict your future needs accurately, and you may find that you need coverage for longer than the term you initially chose.

- Rising premiums: Non-level term life insurance policies have rising premiums as the policyholder ages, which can become unaffordable over time.

Understanding Term Insurance: A Guide to This Essential Coverage

You may want to see also

How to save on car insurance costs

The cost of car insurance has increased by 43% over the past 12 months, with the average cost of a comprehensive car insurance policy now at £941. However, there are several ways to save on car insurance costs.

Shop around for better car insurance rates

It is important to shop around and compare quotes from several companies. This can be done every year or two, or when your policy is up for renewal and the annual premium has increased. It is also important to consider the financial strength of the insurance company and what your contract covers.

Take advantage of multi-car discounts

Insurance companies often offer what amounts to a bulk rate for insuring several vehicles and drivers on the same policy. Multiple drivers must generally live at the same residence and be related by blood or marriage.

Pay attention on the road

Being a safe driver and avoiding accidents or moving violations can help to keep insurance rates low. Some insurance companies offer safe driver discounts.

Take a defensive driving course

Insurance companies sometimes provide discounts to drivers who complete an approved defensive driving course. These courses can also help to reduce the number of points on a driver's license.

Increase your voluntary excess

Choosing a higher voluntary excess can bring down your overall premium. However, remember that you will have to pay this amount in the event of a claim.

Improve your credit rating

Insurers often use credit-based insurance scores when determining insurance premiums. Improving your credit score can help to lower insurance expenses.

Review your coverage

It is important to periodically review your car insurance policy to ensure that you are not paying for coverage you don't need. For example, if you have an older automobile that is paid off, you may no longer need collision or comprehensive coverage.

Install anti-theft devices

You might be able to reduce your premiums if you install anti-theft devices such as car alarms and LoJacks.

Switch to pay-as-you-go insurance

If you are a safe, low-mileage driver, you may be able to save money with a usage-based insurance program. These programs track your driving through a telemetric device installed in your car and offer discounts for safe driving.

Research additional discounts

There may be other discounts available, such as paying the annual or six-month premium at once, receiving e-bills and documentation, or being a member of certain organizations or groups.

Ditch coverage you might not need

Review your insurance policy line by line and remove any coverage you don't need, such as roadside assistance or car rental coverage.

Speak to your agent

There may be other cost savings available that are specific to your circumstances. It is always worth asking your insurance agent if there are any special discounts available.

Increase your deductibles

You can typically choose how much of a deductible you want to pay when you select car insurance. A higher deductible will usually result in a lower premium. Just make sure that you can afford to pay the higher deductible in the event of a claim.

Consider your location

Car insurance rates vary by state and location, so it is important to factor this into your budget if you are planning a move.

Choose a car that’s cheap to insure

The type of car you drive can affect your insurance rates. Safe and moderately priced vehicles, such as small SUVs, tend to be cheaper to insure than expensive and flashy cars.

Understanding the Intersection of Short-Term Health Plans and Obamacare

You may want to see also

Term insurance for NRIs

Term insurance is a type of life insurance that provides coverage for a specific number of years. It offers a death benefit to the beneficiary or nominee in the event of the insured's death during the policy term. Term insurance for NRIs (non-resident Indians) is essential as living in a foreign country can be challenging for families if the primary breadwinner is no longer there to support them. In the event of the policyholder's death, the insurance payout can help the family in various ways, such as relocating to India, meeting financial needs, and enhancing their quality of life.

- Flexible policy terms: NRIs can choose policy tenures ranging from 5 to 99 years, ensuring coverage for their families throughout their lives.

- Customisable sum assured: NRIs can select the sum assured based on their family's financial needs, typically ranging from ₹50 lakh to ₹5 crore.

- Easy payment options: NRIs can make premium payments through online methods such as net banking or credit cards, as well as through their NRE (Non-Resident External) and NRO (Non-Resident Ordinary) accounts.

- Optional riders: NRIs can enhance their coverage by adding optional riders or add-ons, such as critical illness, accidental death, and disability benefits.

- Tax benefits: NRIs can avail of tax deductions on premiums paid under Section 80C and exemptions on the insurance payout under Section 10(10D) of the Income Tax Act, 1961.

The process of purchasing term insurance for NRIs is straightforward. NRIs can either buy the policy while visiting India or from their country of residence. When buying from abroad, NRIs may need to get verified by a notary and an Indian diplomat. The required documents typically include a copy of the passport, proof of age and income, medical records, and tax-related forms.

Frequently asked questions

Term insurance is a type of life insurance that provides coverage for a specific number of years. This type of insurance offers a death benefit to the beneficiary or nominee in the event of the insured person's death during the policy term.

Term insurance rates increased due to the rise in Covid-19 claims and reinsurance companies raising their charges.

Term insurance rates increased by 50-100% from pre-Covid-19 lows.

While term insurance rates are expected to stabilise, it is difficult to predict when they will go down as it depends on various factors such as the company's financials, mortality rates, and state regulations.