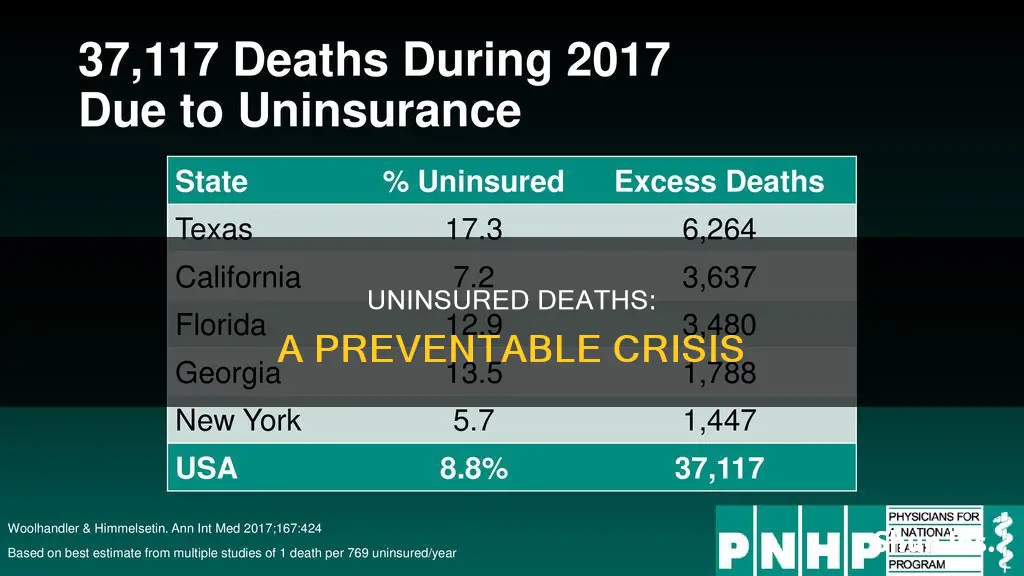

A lack of health insurance is a matter of life and death for many. In the US, it is estimated that between 35,327 to 45,000 people aged 18 to 64 die each year due to a lack of health insurance—a figure that may be even higher. This is a dire situation that results in premature deaths, with the uninsured facing medical debt and forgoing necessary care. The consequences of not having insurance are severe, and those who are uninsured are more likely to delay or go without medical treatment, leading to worsening health conditions and, in some cases, death.

| Characteristics | Values |

|---|---|

| Number of people who die each year in the US due to lack of health insurance | 26,000+ (2006 figure) to 45,000 (2009 figure) |

| Number of people who die each year in the US due to lack of health insurance (2022 figure) | 25.6 million |

| Percentage of Americans delaying medical treatment for serious illness due to cost of care | 25% |

| Number of Americans without health insurance in 2018 | 27.8 million |

| Number of Americans without health insurance in 2022 | 25.6 million |

| Percentage of nonelderly uninsured individuals in the US in 2021 | 10.2% |

| Percentage of nonelderly uninsured individuals in the US in 2022 | 9.6% |

| Percentage of uninsured, working-age Americans with a higher risk of death than their privately insured counterparts | 40% |

What You'll Learn

- People with no health insurance are 40% more likely to die than those with private insurance

- Uninsured people are less likely to receive preventative care and services for major health conditions

- Uninsured people are more likely to delay or forgo medical care

- Uninsured people face unaffordable medical bills and medical debt

- People without insurance are less likely to have a regular source of care outside of emergency departments

People with no health insurance are 40% more likely to die than those with private insurance

People without health insurance are 40% more likely to die than those with private insurance. This is a startling statistic, and it highlights the importance of ensuring that everyone has access to adequate healthcare. The consequences of not having insurance can be dire, and it is an issue that needs to be addressed.

A study published in the Journal of Public Health found that lack of health insurance was a factor in the deaths of as many as 45,000 people in 2005. The study, led by Dr Andrew Wilper of the Cambridge Health Alliance, an affiliate of Harvard Medical School, analysed data from 9,000 adults under the age of 64 who were enrolled in the Third National Health and Nutrition Examination Survey (NHANES III). The survey, which ran from 1986 to 1994, collected information on insurance, health status, income, and education, and included a physical examination by a physician.

Among the 9,000 participants, about 16% were uninsured. Younger people, minorities, smokers, and those with lower education and income levels were more likely to be uninsured. By 2000, about 3% of the participants had died. After adjusting for factors such as obesity, exercise habits, alcohol use, and smoking status, the researchers found that those without insurance were 40% more likely to die than those with private insurance. This risk factor is 2.5 times higher than a previous estimate from the Institute of Medicine (IOM), which suggested that about 18,000 people between the ages of 25 and 64 die each year due to lack of health insurance.

The high cost of healthcare in the United States is a significant issue, and it is not just the uninsured who are affected. Even those with insurance can struggle to afford the care they need. A December 2019 Gallup poll found that 25% of Americans said they or a family member had delayed medical treatment for a serious illness due to the cost of care. This issue is particularly prevalent among low-income families, who often cannot afford the high premiums and out-of-pocket expenses associated with healthcare. In 2022, 64% of uninsured non-elderly adults cited the cost of coverage as the main reason they lacked insurance.

The COVID-19 pandemic has also highlighted the importance of having access to healthcare. During the pandemic, coverage expansions put in place by the Affordable Care Act (ACA) served as a safety net for many people who lost their jobs or faced other economic disruptions. As a result, the number of uninsured individuals decreased in 2022, with 25.6 million non-elderly individuals lacking insurance, down from 27.5 million in 2021. However, this number still represents a significant portion of the population who are at risk of facing serious health consequences due to lack of insurance.

The consequences of not having insurance can be devastating, as seen in the cases of Susan Finley and Anamaria Markle, who both passed away after avoiding medical treatment due to the high costs. Finley lost her job and her health insurance, and unfortunately passed away after avoiding going to the doctor for flu-like symptoms. Markle, who was diagnosed with stage three ovarian cancer, stopped receiving medical treatment due to rising costs and debt and passed away at the age of 52. These stories illustrate the very real and tragic impact of not having access to affordable healthcare.

The Intricacies of Insurance Billing Fees: Unraveling the Patient's Perspective

You may want to see also

Uninsured people are less likely to receive preventative care and services for major health conditions

High Cost of Insurance

The high cost of insurance is a significant barrier to accessing preventative care and services. Many uninsured people cite the high cost of insurance as the main reason they lack coverage. In 2022, 64% of uninsured non-elderly adults in the United States said that the cost of coverage was too high. The cost of insurance can be especially burdensome for people with low incomes, who make up a large proportion of the uninsured population.

Ineligibility

Ineligibility for financial assistance is another factor that contributes to the lack of preventative care among the uninsured. Undocumented immigrants, for example, are often ineligible for federally funded coverage, including Medicaid and Marketplace coverage. This leaves many people without access to essential preventative services.

Lack of Understanding of the Importance of Preventative Care

Uninsured people are also less likely to understand the importance of preventative care and services. They may not see the value in investing in preventative measures, such as screenings and check-ups, as they may not have immediate health concerns. This can lead to a delay in seeking medical attention until more serious issues arise.

Impact on Health Outcomes

The lack of preventative care and services can have significant impacts on the health outcomes of uninsured individuals. They are more likely to experience undetected or untreated chronic diseases, such as diabetes, cancer, and cardiovascular disease. Uninsured people are also at a higher risk of hospitalization for avoidable health problems and may experience declines in their overall health.

Addressing the Issue

Addressing the issue of uninsured people lacking preventative care requires a multi-faceted approach. This may include expanding access to affordable insurance coverage, especially for low-income individuals and undocumented immigrants. Additionally, educating people about the importance of preventative care and services can help encourage them to seek out these services. Finally, increasing the availability of safety net providers, such as public hospitals and community clinics, can help ensure that uninsured people have better access to essential health services.

Unraveling the Meaning of 'CV' in Insurance Jargon

You may want to see also

Uninsured people are more likely to delay or forgo medical care

Uninsured people are less likely to receive preventive care and services for major health conditions and chronic diseases. They are also more likely to be hospitalized for avoidable health problems and to experience a decline in their overall health. When they are hospitalized, they receive fewer diagnostic and therapeutic services and have higher mortality rates than those with insurance.

A 2019 Gallup poll found that 25% of Americans say they or a family member have delayed medical treatment for a serious illness due to the cost of care, and an additional 8% reported delaying treatment for less serious illnesses. A study by the American Cancer Society in the same year found that 56% of adults in America reported having at least one medical financial hardship.

The high cost of insurance is the main reason why many are uninsured. In 2022, 64% of uninsured nonelderly adults in the US said they lacked coverage because the cost was too high. Many also do not have access to coverage through their job. As a result, they often face unaffordable medical bills, which can quickly lead to medical debt as most uninsured people have low or moderate incomes and little to no savings.

Georgia's Insured Population

You may want to see also

Uninsured people face unaffordable medical bills and medical debt

A study by Families USA, a non-profit organisation advocating for universal healthcare, found that more than 26,000 Americans aged 25 to 64 died in 2006 due to a lack of health insurance—more than twice the murder rate. From 2000 to 2006, an estimated 162,700 Americans died due to a lack of insurance. The organisation also reported that uninsured people generally have poorer health and die earlier than those with insurance.

The high cost of healthcare in the US poses a significant challenge for uninsured individuals. A 2019 Gallup poll found that 25% of Americans had delayed treatment for serious illnesses due to costs, and an additional 8% had postponed treatment for less severe conditions. The problem is particularly acute for those with chronic illnesses or complex health needs, who may face unaffordable medical bills even with insurance due to high deductibles and cost-sharing requirements.

The lack of insurance coverage can also lead to delayed or forgone care, as uninsured individuals are less likely to have a regular source of care outside of emergency departments. They often delay or forgo necessary medical care, including preventive services and treatments for major health conditions and chronic diseases. This can result in worse health outcomes and higher mortality rates for the uninsured when they are hospitalised.

The financial burden of medical debt can be devastating, with some individuals turning to bankruptcy as a last resort. Medical debt is the leading cause of bankruptcy in the US. Unpaid medical bills can also damage an individual's credit score and financial security.

To mitigate the impact of unaffordable medical bills and medical debt, uninsured individuals may seek assistance through safety net providers, such as public hospitals and community clinics. However, these providers have limited resources and may not be accessible to all uninsured people. Additionally, gaining health insurance may not always be a feasible solution, as the high cost of coverage is often cited as a barrier for the uninsured.

People without insurance are less likely to have a regular source of care outside of emergency departments

People without health insurance are less likely to have a regular source of care outside of emergency departments. This means that they are more likely to delay or forgo care due to costs, and when they do seek medical attention, they often face unaffordable medical bills.

In the US, the high cost of insurance is the main reason people lack coverage. In 2022, 64% of uninsured non-elderly adults cited this as the reason for being uninsured. This is particularly true for low-income families, who make up most of the uninsured population. Undocumented immigrants are also ineligible for federally funded coverage.

The lack of insurance has serious consequences for the health and financial stability of individuals and families. Uninsured people are less likely to receive preventive care and services for major health conditions and chronic diseases. They are also more likely to be hospitalized for avoidable health problems and experience declines in their overall health. When they are hospitalized, they receive fewer diagnostic and therapeutic services and have higher mortality rates than those with insurance.

In addition, uninsured people often face unaffordable medical bills, which can quickly lead to medical debt, especially for those with low or moderate incomes. This can result in negative consequences such as using up savings, difficulty paying living expenses, or borrowing money.

Research has shown that gaining health insurance improves access to healthcare and diminishes the adverse effects of being uninsured. Medicaid expansion, for example, has been associated with increased early-stage cancer diagnosis rates, lower cardiovascular mortality rates, and increased odds of tobacco cessation.

Overall, the lack of health insurance can have significant impacts on the health and financial well-being of individuals and families, and efforts to expand coverage can help mitigate these negative consequences.

Preexisting Conditions: Switching Insurance

You may want to see also

Frequently asked questions

It is estimated that between 35,327 to 44,789 people die each year in the US due to lack of health insurance. This number has increased from previous years, with a study in 2002 putting the figure at 18,000.

Despite having the highest spending on healthcare of any developed nation, the US has lower coverage and worse overall health outcomes. A 2017 analysis found that the US ranked 24th globally in achieving health goals set by the UN.

People without health insurance have lower access to care and are more likely to delay or forgo medical treatment due to costs. This can lead to preventable illnesses and a decline in overall health, resulting in higher mortality rates compared to those with insurance.