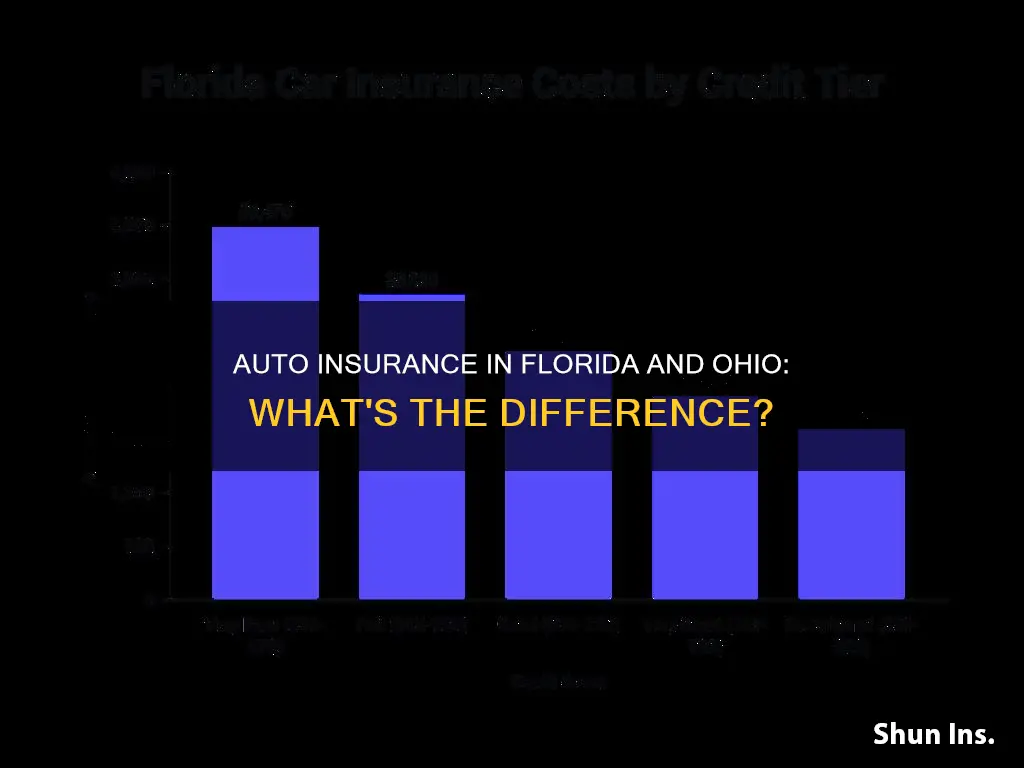

Florida and Ohio are on opposite ends of the car insurance spectrum, with Florida being one of the most expensive states for car insurance and Ohio being one of the cheapest. The average cost of car insurance in Florida is $3,451 for full coverage and $1,055 for minimum coverage, while in Ohio, it is $1,486 for full coverage. Several factors contribute to this difference, including the number of uninsured drivers, frequency of claims, population density, and weather conditions. Florida's high-risk factors, such as its location in hurricane alley, high number of young drivers, and high percentage of uninsured drivers, lead to higher insurance premiums. On the other hand, Ohio benefits from lower population density and a competitive insurance market, resulting in more affordable rates for its residents.

| Characteristics | Values |

|---|---|

| Average annual cost of car insurance in Florida | $3,034 |

| Average annual cost of car insurance in Ohio | $1,486 |

| Average monthly cost of car insurance in Florida | $316 |

| Average monthly cost of car insurance in Ohio | $124 |

| Average annual cost of full coverage car insurance in Florida | $2,011 |

| Average annual cost of full coverage car insurance in Ohio | $1,417 |

| Average annual cost of state minimum coverage car insurance in Florida | $968 |

| Average annual cost of state minimum coverage car insurance in Ohio | $720 |

Population density

Ohio has a population density of 282.3 people per square mile, ranking 10th in the nation, with a total land area of 44,825 square miles, which ranks 34th.

Florida, on the other hand, does not appear in the list of the top 10 most densely populated states. However, it is worth noting that Florida has a higher population than Ohio, with nearly 11.8 million residents, making it the seventh-most populous state.

The difference in population density between Florida and Ohio can be attributed to various factors, including geographical size, urbanization, and population distribution.

General Auto Insurance: Good or Bad?

You may want to see also

Weather conditions

Weather plays a significant role in determining auto insurance rates, and the differences in weather conditions between Florida and Ohio are notable. Here are 4-6 paragraphs detailing how weather conditions in Florida and Ohio can impact auto insurance rates:

Florida's weather conditions are characterised by its warm, sunny climate and proximity to the ocean, which can increase the risk of hurricanes and flooding. This leads to frequent insurance claims due to severe weather events. On the other hand, Ohio experiences colder winters, with snowfall and frigid temperatures. While both states have their own unique weather patterns, these differences can translate into varying auto insurance rates.

Florida's mild winters and sunny climate contribute to a higher number of drivers on the road throughout the year. This increased traffic density can elevate the risk of accidents, resulting in higher insurance premiums. In contrast, Ohio's colder winters may lead to reduced driving activity during certain months, potentially lowering the overall risk of collisions.

The frequency of severe weather events in Florida, such as hurricanes and flooding, can significantly impact auto insurance rates. Insurers often factor in the likelihood of weather-related damage when calculating premiums. Florida's vulnerability to hurricanes and the resulting property damage can drive up insurance costs for residents.

Ohio, while not immune to extreme weather events, experiences them on a lesser scale compared to Florida. However, Ohio's winters can bring snowfall and icy roads, increasing the risk of collisions and insurance claims. This seasonal variation in weather conditions can influence insurance rates, with higher premiums during winter months.

The average temperatures in Florida and Ohio also differ, with Florida's higher temperatures leading to an increased UV index. This may result in higher rates of sun damage to vehicles, impacting insurance costs. Additionally, the warmer climate in Florida may contribute to a higher number of claims related to vehicle theft, as more people are likely to be outdoors and active throughout the year.

In conclusion, the weather conditions in Florida and Ohio play a significant role in determining auto insurance rates. Florida's warm climate, increased traffic, and vulnerability to hurricanes drive up insurance costs. In contrast, Ohio's colder winters and snowfall can also impact insurance rates, albeit in different ways. These weather-related factors are essential considerations for insurance providers when assessing risk and setting premiums for residents in these states.

Insurance Documents for Uber Drivers

You may want to see also

Traffic congestion

To reduce traffic congestion and improve traffic flow, Florida has implemented several measures. For example, the state has introduced "flex lanes" on Central Florida expressways, allowing drivers to use the shoulder as a driving lane during accidents and rush hour to ease congestion. Additionally, Florida has widened some of its toll roads, such as State Road 417 and State Road 429, which see over 491,000 vehicles per day.

Ohio, on the other hand, is one of the cheapest states for car insurance. The low insurance rates in Ohio can be attributed to its lower population density, milder weather, and rural areas, resulting in fewer accidents and claims. Ohio has also implemented measures to reduce traffic congestion and improve traffic flow. For instance, the state has implemented flex lanes, allowing drivers to use the shoulder as a driving lane during certain conditions. This approach has also been implemented in other states like Wisconsin, Colorado, Hawaii, and Washington.

While Florida struggles with high insurance rates due to various factors, including severe weather and a high number of uninsured drivers, Ohio benefits from lower insurance costs due to its geographical and demographic characteristics. Both states actively address traffic congestion through innovative solutions like flex lanes and road widening projects.

Michigan's Unique Auto Insurance System: Understanding the Basics

You may want to see also

Insurance laws

Florida and Ohio have different insurance laws, which is one of the reasons for the difference in auto insurance costs between the two states. Here is an overview of the insurance laws in each state and how they differ:

Florida Insurance Laws:

- Florida is a no-fault state, which means that drivers are required to have Personal Injury Protection (PIP) coverage to pay for their medical expenses after an accident, regardless of who is at fault. The minimum requirement is $10,000 in PIP coverage.

- Florida has a high number of uninsured drivers, with an estimated rate of more than 20%, which is one of the highest in the country. This increases the risk of accidents and claims, leading to higher insurance premiums.

- Florida is prone to severe weather conditions, such as hurricanes, flooding, and hail, which can cause extensive damage to vehicles and increase insurance claims.

- The state has a dense population and heavy traffic in urban areas, particularly in cities like Miami, Tampa, and Orlando. This increases the risk of accidents and contributes to higher insurance rates.

- Florida has a high number of young drivers due to the presence of many colleges and universities. Young and inexperienced drivers are considered high-risk and often face higher insurance rates.

- The state has seen a significant increase in insurance rates in recent years, with the average cost of full coverage exceeding $3,000 per year.

Ohio Insurance Laws:

- Ohio is not a no-fault state, so it does not require PIP coverage. However, it does have a lower minimum liability coverage requirement compared to Florida.

- Ohio has one of the cheapest average annual rates for car insurance in the country, with an average of $1,486 per year, according to U.S. News.

- The state has a lower population density compared to Florida, which leads to fewer accidents and claims. This helps keep insurance rates low.

- Ohio does not experience the same frequency of severe weather events as Florida, reducing the number of weather-related claims.

- Ohio has a lower rate of uninsured drivers compared to Florida, which can help keep insurance costs down.

- Insurance rates in Ohio have also increased in recent years but at a slower pace than Florida.

In summary, the difference in auto insurance costs between Florida and Ohio can be attributed to their distinct insurance laws, population density, weather conditions, and the number of uninsured drivers. Florida's no-fault law, higher population, and higher number of uninsured drivers contribute to its higher insurance rates, while Ohio's lower minimum requirements and fewer claims help keep its insurance costs relatively low.

Insuring Homes Held in Trust: Unraveling the Complexities for Auto Owners

You may want to see also

Crime rates

Florida has some of the highest auto insurance costs in the country, and this is partially due to the state's high number of uninsured drivers, elevated population density, high fatal accident rate, and extremely costly hurricane damage. Florida also has a high rate of insurance-related fraud and high reinsurance costs. All of these factors contribute to Florida's challenging and expensive insurance market, making it difficult for drivers to find affordable policies.

Ohio, on the other hand, has much lower auto insurance rates. The state's mix of rural and suburban roads helps break up traffic concentration, which may contribute to lower premiums. Ohio also has a lower population density and a lower number of licensed drivers than many other states.

In summary, crime rates and other factors such as population density, traffic congestion, and the number of uninsured drivers influence auto insurance rates in Florida and Ohio. These factors contribute to Florida's high insurance rates and Ohio's more affordable premiums.

Navigating Auto Insurance for New Drivers: A Comprehensive Guide

You may want to see also

Frequently asked questions

In Florida, the average cost of car insurance is $3,034 per year, or $253 per month, for a full coverage policy. The state has the second most expensive car insurance rates in the country.

In Ohio, the average cost of car insurance is $1,486 per year, or $124 per month, for a full coverage policy. The state has the fourth cheapest car insurance rates in the country.

Car insurance in Florida is expensive due to the high number of uninsured drivers, frequent claims due to severe weather, and the state's legal requirements for personal injury protection coverage. Additionally, the dense population and heavy traffic in urban areas contribute to higher risks for insurers, resulting in higher premiums for drivers.

Ohio has a lower population density than Florida, resulting in fewer accidents and insurance claims. This helps to keep insurance rates low in the state.

To save money on car insurance in Florida and Ohio, you can compare rates from multiple insurance companies, increase your deductible, and ask about available discounts. Maintaining a clean driving record and improving your credit score can also help lower your insurance premiums.