Texas Farm Bureau Insurance offers auto insurance exclusively to members who live and register their vehicles in Texas. The company's auto insurance rates are higher than average, but its customer satisfaction ratings are high. Texas Farm Bureau also offers unique benefits to its members, such as discounts on other products and services. In addition to auto insurance, the company provides farm and ranch insurance, business property and liability coverage, and health insurance.

| Characteristics | Values |

|---|---|

| Annual membership fee | $35 to $50 |

| Membership perks | Discounts on products and services, access to insurance policies |

| Customer service | Strong ratings, positive reviews |

| Insurance quotes | Not available online |

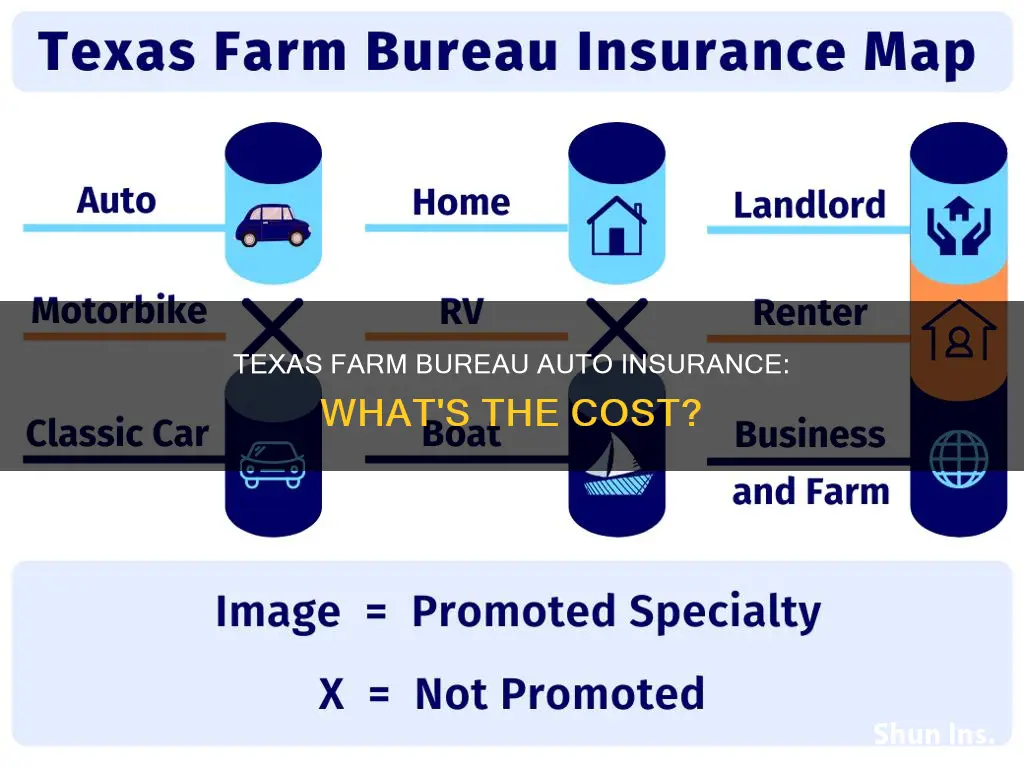

| Insurance offerings | Auto, home, renters, landlord, life, farm and ranch, commercial property, long-term care |

| Auto insurance rates | Higher than average |

| Financial strength | A- from A.M. Best |

| Complaint level | Low |

| Discounts | Multi-policy, multi-vehicle, claim-free record, vehicle safety features, good student, safe driver |

What You'll Learn

Texas Farm Bureau auto insurance rates

Membership

To obtain a Texas Farm Bureau auto insurance policy, you must be a member and pay an annual fee of around $50. Membership is only available to Texas residents.

Factors Affecting Rates

Texas Farm Bureau considers various factors when setting insurance rates, including location, age, gender, coverage, credit score, and driving record.

Discounts

Texas Farm Bureau offers several discounts to its members, including multi-policy, multi-vehicle, claim-free, anti-theft device, good student, and safe driver discounts.

Coverage Options

The company offers standard coverage options such as liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, and personal injury protection.

Claims and Customer Satisfaction

Texas Farm Bureau has very few complaints and consistently receives high ratings for customer satisfaction and claims handling. However, there are some issues with the company's mobile app and slow claims response times.

Comparison with Other Companies

While Texas Farm Bureau offers competitive rates for older drivers with clean records, you may find lower quotes with other companies, especially if you are a young driver or seeking the cheapest insurance in Texas.

Direct Auto Insurance: Grace Period?

You may want to see also

Texas Farm Bureau insurance reviews

Texas Farm Bureau has been offering insurance products to Texans since 1952. The company is part of the American Farm Bureau Federation and requires an annual membership fee, which varies depending on the customer's place of residence. Membership is open to all Texas residents and includes several benefits, including discounts on products and services, as well as access to insurance policies.

Pros

Texas Farm Bureau offers a full line of auto insurance coverage, from the minimum liability coverage needed to drive legally in Texas to a full coverage policy with add-ons, including rental reimbursement, roadside assistance, and ridesharing coverage. The company also offers death indemnity coverage, which is not always available with other providers.

The company has more than 850 local agents, 300 claims personnel, and 300 offices across Texas, making it an excellent choice for those who prefer the personalized service that an in-person insurance experience may provide.

Texas Farm Bureau has an excellent financial strength rating with AM Best, indicating that it has met its claims obligations in the past. The company also has a high customer satisfaction rating, scoring first place with 824 points out of 1,000 for overall customer satisfaction in the Texas region during the J.D. Power 2023 U.S. Auto Insurance Study.

Cons

Texas Farm Bureau's auto endorsement options may not be as robust as some carriers. The company does not offer gap insurance or accident forgiveness.

Customer service is only available Monday through Friday during normal business hours. Additionally, premium data for Texas Farm Bureau car insurance is unavailable, so the best way to compare rates is to request a quote online, in person, or over the phone.

Customer Reviews

Reviews for Texas Farm Bureau are mixed. While some customers praise the company for its affordable rates and responsive customer service, others have complained about issues with claims, rising costs, and miscommunication about coverage.

One customer review highlights a unique situation with Texas Farm Bureau: the company does not report to the same insurance database as other insurers, which can cause issues when switching to a different insurance provider. As a result, customers may see elevated rates when leaving Texas Farm Bureau, as it may appear that they do not have insurance. However, this issue can generally be solved by providing a Letter of Experience.

Safco's Auto Insurance: Who's Covered and Who's Not?

You may want to see also

Texas Farm Bureau insurance quotes

Texas Farm Bureau Insurance is only available to Texas residents who are members of the Texas Farm Bureau. Membership costs between $35 and $50 annually and provides access to discount insurance, prescription drugs, farm equipment, and more.

Texas Farm Bureau auto insurance rates are higher than average, but the company outranks competitors in customer satisfaction and offers unique benefits to its members. The company has very few complaints and earns high ratings for financial strength, claims handling, and overall policy satisfaction.

Texas Farm Bureau auto insurance includes standard coverage options such as liability, collision, comprehensive, uninsured/underinsured motorist protection, medical payments coverage, and personal injury protection. There are also three add-ons available: rental car reimbursement, roadside assistance, and death indemnity.

The cost of Texas Farm Bureau auto insurance depends on various factors, including location, age, gender, coverage, credit score, and driving record. Overall, Texas Farm Bureau is affordable for older drivers with clean records who already have other Texas Farm Bureau policies. Members can save by bundling auto insurance with another policy.

In addition to auto insurance, Texas Farm Bureau offers farm and ranch insurance, business property and liability coverage, home insurance, life insurance, and health insurance.

Auto Insurance Premiums: Two Points, How Much is Too Much?

You may want to see also

Texas Farm Bureau insurance discounts

Texas Farm Bureau offers a range of discounts to its customers. While the company does not disclose all the specifics of its auto and home insurance discounts, here is a list of some of the savings opportunities available:

Texas Farm Bureau Auto Insurance Discounts:

- Multi-vehicle discount: Insuring more than one vehicle with Texas Farm Bureau can lead to additional savings.

- Vehicle safety discount: This discount applies to vehicles equipped with safety features such as curtain airbags and anti-theft systems.

- Claims-free discount: Customers with a claims-free record for a certain number of years can earn a discount for good driving.

- Multipolicy discount: Bundling home and auto insurance purchases with Texas Farm Bureau.

- Multicar discount: Insuring two or more vehicles in the same household.

- Claim-free discount: Not having filed a claim in the past three years.

- Driver training discount: Successfully completing a driver education course.

- Academic achievement discount: A designated operator of the vehicle performing well in school.

- Passive restraint discount: Having a factory-installed airbag or safety belt passive restraint system meeting federal safety standards.

Texas Farm Bureau Home Insurance Discounts:

- Central alarm system discount: Having a burglar or central alarm system protecting your property can qualify you for additional savings.

- Impact-resistant roofing discount: A discount is available if your roof is designed to resist damage from elements such as hail.

- Dry fire hydrants discount: Keeping a dry fire hydrant or fire extinguisher on your property can earn you a discount.

- Underground home discount: A unique discount of 30% off for customers whose main dwelling is insured as underground.

- Companion policy discount: Having more than one qualifying policy with Texas Farm Bureau can earn you a discount.

- Safety features and claim-free history discounts: Texas Farm Bureau also offers generous discounts for safety features and a claim-free history.

Insurance Revoked: DMV Notified?

You may want to see also

Texas Farm Bureau insurance coverage

Texas Farm Bureau Insurance offers a range of insurance products, including auto, home, life, and health insurance. Here is a detailed overview of their insurance coverage:

Texas Farm Bureau Auto Insurance Coverage:

Texas Farm Bureau auto insurance provides standard coverage options such as liability coverage, collision coverage, comprehensive coverage, personal injury protection, uninsured/underinsured motorist coverage, and medical payments coverage. They also offer add-ons like rental car reimbursement, roadside assistance, and death indemnity coverage. Their rates tend to be higher than average, especially for young drivers and those with accidents or violations on their records. However, members can take advantage of various discounts, including multi-policy, multi-vehicle, claim-free, and safe driver discounts.

Texas Farm Bureau Home Insurance Coverage:

Texas Farm Bureau offers standard home insurance coverage, including personal property, loss of use, and medical payments coverage. Their rates for homeowners insurance are competitive and often lower than the state and national averages. They also provide unique benefits like underground home discounts and discounts for impact-resistant roofing. However, their policies are "named-peril," meaning they only cover damages caused by perils specifically listed in the policy.

Texas Farm Bureau Life Insurance Coverage:

Texas Farm Bureau offers term life insurance with options for 10, 20, and 30-year terms, as well as convertible term policies. They also provide whole life insurance options, including basic whole life, modified premium whole life, and single premium whole life. Additionally, they offer a unique 15-pay juvenile life insurance policy, which allows parents to purchase whole life coverage for their children up to the age of 15.

Texas Farm Bureau Health Insurance Coverage:

Texas Farm Bureau members can apply for affordable health care coverage through Texas Farm Bureau Health Plans. They also offer prescription drug discounts and savings on other health care needs, such as virtual access to doctors and dental care.

Marital Status and Auto Insurance: The Impact on Rates

You may want to see also

Frequently asked questions

Texas Farm Bureau auto insurance rates are higher than average. The company does not provide quotes online, but you can request a quote online, in person, or over the phone.

Texas Farm Bureau has very few complaints and offers highly-rated customer satisfaction. However, its auto insurance rates are higher than average, and it charges an annual membership fee of around $50.

Texas Farm Bureau considers factors such as your location, age, gender, coverage, credit score, and driving record when determining your insurance rates.

Texas Farm Bureau offers standard auto insurance coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, and personal injury protection.

Texas Farm Bureau offers various discounts, including multi-policy, multi-vehicle, claim-free, anti-theft device, good student, and safe driver discounts.