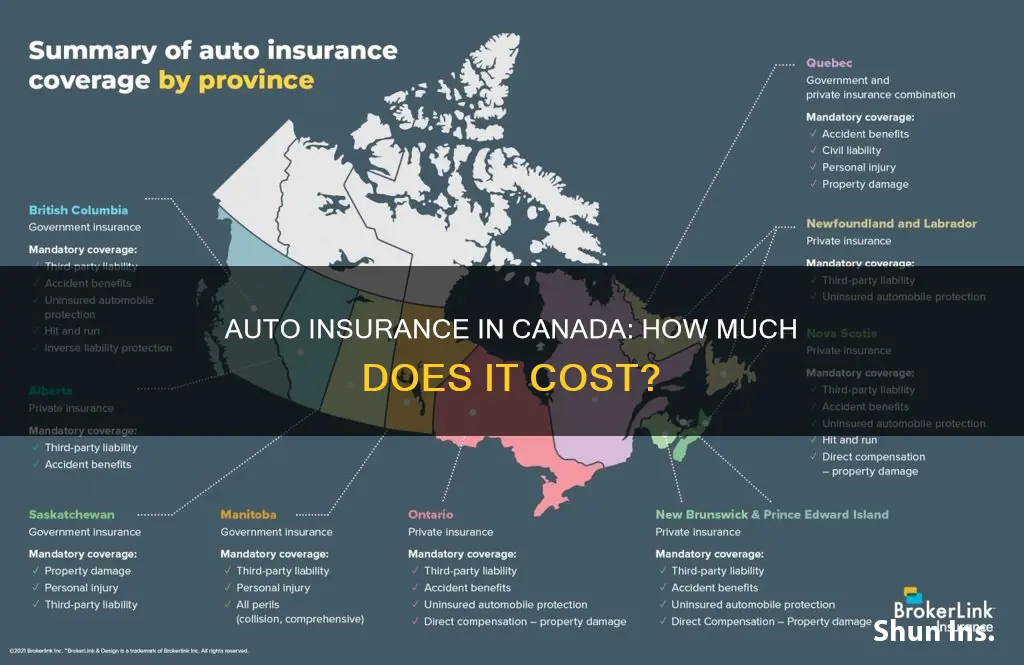

Auto insurance rates in Canada vary across provinces due to factors such as the way provinces offer insurance coverage and the prevalence of insurance fraud. Private insurance coverage is generally more affordable due to market competition. However, provinces like British Columbia, Manitoba, and Saskatchewan have provincially-run coverage. Ontario has the highest auto insurance rates in the country, with an average annual premium of $1,544.86 in 2012, which rose to $1,655 in 2020. The high rates in Ontario are attributed to factors such as insurance fraud, high traffic, and a large number of drivers.

| Characteristics | Values |

|---|---|

| Average Annual Cost of Auto Insurance in Canada | $1,655 according to 2020 estimates |

| Average Annual Cost of Auto Insurance in Ontario | $1,655 according to 2020 estimates; $2,299 according to 2024 data |

| Average Monthly Cost of Auto Insurance in Ontario | $125 |

| Average Annual Cost of Auto Insurance in Alberta | $3,151 |

| Average Annual Cost of Auto Insurance in Nova Scotia | $2,491 |

| Average Annual Cost of Auto Insurance in New Brunswick | $2,187 |

| Average Annual Cost of Auto Insurance in Newfoundland & Labrador | $2,162 |

| Average Annual Cost of Auto Insurance in British Columbia | $1,775 |

| Average Annual Cost of Auto Insurance in Prince Edward Island | $1,703 |

| Average Annual Cost of Auto Insurance in Manitoba | $1,373 |

| Average Annual Cost of Auto Insurance in Saskatchewan | $1,249 |

| Average Annual Cost of Auto Insurance in Quebec | $1,112 |

What You'll Learn

Auto insurance in Ontario

Mandatory Coverage

Ontario's no-fault insurance system requires that drivers carry at least $200,000 in third-party liability insurance for their vehicles. Without this minimum amount of liability coverage, drivers can't register their automobiles. A basic insurance policy in Ontario also includes coverage for medical services and damage to your vehicle.

Accident Benefits in Ontario

These are the medical benefits that come with a standard auto insurance policy:

- Up to $3,500 per person for injuries that are deemed minor.

- Up to $65,000 per person for combined medical and attendant care for serious, but not catastrophic, injuries for up to five years.

- Up to $1 million for combined medical and attendant care for catastrophic injuries.

Direct Compensation Property Damage Coverage (DCPD)

Ontario drivers are also required to buy direct compensation property damage (DCPD) coverage. DCPD covers your vehicle damages if another driver is found at fault for the accident. Even if someone else damages your car, you collect benefits from your own insurer.

Uninsured Vehicle Insurance

This coverage protects you and your family from losses related to a collision with an uninsured vehicle or a hit-and-run driver. If you are injured or killed, you and your family can be compensated. You will also be protected against damage to your vehicle caused by an uninsured car.

Optional Car Insurance Coverage

You can add coverage to your base policy if you believe you'll need it. There are four types of optional coverages and coverage amounts you can purchase:

- Collision coverage: covers the cost of replacing or repairing your car if it's damaged in a collision and you are at fault for the accident.

- Comprehensive coverage: covers the cost of damage incurred by theft and vandalism, weather events, earthquakes, explosions, and debris.

- Specified perils coverage: covers the cost of damage from fire, theft or attempted theft, lightning, windstorms, hail, water, earthquakes, explosions, civil unrest, and damage during transport.

- All-perils coverage: provides broad coverage, an amalgamation of collision and comprehensive insurance.

Factors Affecting Your Premium

There are many factors that can influence the cost of car insurance:

- The car you drive (the type, make, model, year, trim)

- Your driving history & record (number of years you’ve been driving, number of years you’ve been insured, accidents and tickets)

- How much you drive (how often and how far you drive)

- Where you live (urban areas, rural areas, etc.)

- The type of coverage you chose (adding optional coverage affects your rate)

Reducing Your Premium

There are several ways to help keep your insurance premiums lower:

- Installing snow tires

- Multi-insurance product discounts (bundling)

- Installing a driving app

- Repeated renewal discounts

- Clean driving record

- Claim-free discounts

- Choosing an insurance-friendly vehicle

- Keep your annual mileage low

- Increase your deductible

- Reside in a low-crime area

- Install a driving app

- Successfully complete a driving course

- Purchase all your insurance needs from the same company

- Don’t let your auto insurance lapse

- Keep your auto insurance account in good standing

- Never drink and drive

- Avoid traffic infractions

Cigna Insurance: Primary in Auto Accidents?

You may want to see also

Average annual cost

The average annual cost of auto insurance in Canada varies across provinces. The most expensive province for auto insurance is Ontario, with an average annual premium of $1,544.86 in 2012, $1,655 in 2020, and $2,299 in 2024. The high rates in Ontario are attributed to factors such as high fraud rates, higher traffic, and a higher frequency of claims, lawsuits, and injuries.

Alberta is the third most expensive province for auto insurance, with an average annual premium of $3,151 in 2024, followed by Nova Scotia at $2,491. New Brunswick ($2,187), Newfoundland and Labrador ($2,162), and British Columbia ($1,775) also have relatively high auto insurance rates.

On the other hand, Quebec has the least expensive insurance premiums among all the Canadian provinces, with an average annual premium of $1,112 in 2024. Prince Edward Island ($1,703), Manitoba ($1,373), and Saskatchewan ($1,249) also have lower auto insurance rates compared to other provinces.

It's worth noting that the average annual cost of auto insurance can vary significantly depending on individual factors such as driving experience, driving record, age, gender, vehicle type, and location. Additionally, insurance rates can change over time due to various factors, including inflation, increases in vehicle repair costs, and fluctuations in claim frequencies.

Auto Insurance Rates: Can You Negotiate?

You may want to see also

Factors influencing insurance rates

Several factors influence insurance rates in Canada. Here are the key determinants:

Driving History and Record

A driver's history and record are crucial factors in determining insurance rates. Insurance companies typically examine the previous three to five years of a driver's history, including any at-fault accidents, traffic violations, or DUI/DWI convictions. A history of accidents, violations, or convictions can lead to higher insurance rates or even difficulty finding insurance coverage. However, practicing safe driving habits and avoiding incidents can help improve your driving record over time, leading to better insurance rates.

Coverage Selections

The type and amount of insurance coverage selected impact the cost. While opting for only the minimum required coverage may result in cheaper premiums, it could leave individuals financially vulnerable in the event of an accident. It is essential to strike a balance between affordability and adequate protection.

Car Insurance Deductible

The deductible is the amount individuals pay out-of-pocket before their insurance coverage kicks in. A higher deductible typically leads to lower insurance premiums, as individuals are assuming more financial risk. However, it is important to ensure that the deductible amount is affordable in case a claim needs to be filed.

Vehicle Type

The type of vehicle driven plays a significant role in insurance rates. Insurance companies consider the repair costs, theft rates, and comprehensive claims associated with similar models when setting premiums. Newer vehicles with more advanced technology may have higher replacement part costs and require specialized repairs, resulting in higher insurance rates.

Age and Driving Experience

Young and inexperienced drivers generally face higher insurance rates due to their higher risk of accidents. Statistics show that drivers between 16 and 19 are three times more likely to be involved in fatal crashes than those over 20. As drivers gain more experience and maintain a clean driving record, their insurance rates tend to decrease.

Location

Location-related factors, such as population size, accident frequency, theft rates, vandalism, and weather claims, can influence insurance rates. Individuals living in metropolitan areas or areas with severe weather conditions may pay more for coverage due to the increased likelihood of claims.

Other Factors

Other factors that insurance companies may consider include gender, credit history or credit-based insurance scores (where permitted by law), annual mileage, and safety features of the vehicle. Additionally, factors such as education level, marital status, and homeownership can also impact insurance rates, depending on the insurance provider and location.

Overlapping Auto Insurance Policies: Double the Coverage, Double the Benefits?

You may want to see also

Mandatory and optional insurance coverage

Auto insurance is mandatory in all provinces and territories of Canada, even in those with public coverage. However, the specific requirements and options can vary across the country. Here is a breakdown of the mandatory and optional insurance coverage that drivers in Canada typically need to consider:

Mandatory Coverage:

- Third-Party Liability Insurance: This is mandatory across Canada and covers losses such as injury, death, and damage to others' property caused by your vehicle. The recommended coverage limit is $2 million, while the minimum requirement varies by province, with Ontario requiring at least $200,000.

- Accident Benefits: This covers the cost of your medical expenses and loss of income following a car accident, regardless of who is at fault. It includes coverage for injuries ranging from minor to catastrophic.

- Uninsured Automobile Coverage: This protects you and your family in the event of a collision with an uninsured or hit-and-run driver. It covers injuries, death, and damage to your vehicle caused by an uninsured driver.

- Direct Compensation-Property Damage (DCPD): This coverage is mandatory in Ontario and some other provinces. It covers the cost of repairing damage to your vehicle when another driver is at fault for the accident.

Optional Coverage:

- Collision Insurance: This optional coverage pays for repairing or replacing your vehicle if you collide with another vehicle or object and you are at fault.

- Comprehensive Insurance: Comprehensive coverage is optional and pays for repairing or replacing your vehicle due to damage or loss not caused by a collision. This includes vandalism, fire, theft, natural disasters, and more.

- Specified Perils Coverage: This optional coverage is similar to comprehensive insurance but covers specific events like fire, theft, natural disasters, and civil unrest.

- All-Perils Coverage: This is a combination of collision and comprehensive insurance, providing broad coverage for various types of damage or loss.

- Other Optional Endorsements: Drivers can also opt for additional endorsements or "add-ons," such as loss-of-use coverage, accident forgiveness, and depreciation waivers to ensure they receive the full value of their vehicle.

Property and Casualty Insurance: Does it Cover Your Car?

You may want to see also

How to save on auto insurance

Auto insurance rates vary across Canada due to factors such as the way provinces offer insurance coverage and the insurance companies' loss ratios. However, there are several ways to save on auto insurance.

Compare Quotes

Comparing quotes from different insurance providers is one of the best ways to save on auto insurance. By comparing quotes, you can find the most competitive rates and identify potential savings. This process only takes a few minutes and can help you uncover significant savings.

Take a Reputable Driver Training Course

Enrolling in a reputable driver training course can result in discounts on your auto insurance premiums. These courses are especially beneficial for teens and young drivers, as they can establish good driving habits and improve their skills.

Build a Clean Driving Record

Maintaining a clean driving record free of accidents, convictions, and traffic violations is crucial for keeping insurance costs low. Safe driving practices, including obeying traffic rules, avoiding distracted driving, and wearing a seatbelt, can help keep your insurance rates down.

Only Pay for Necessary Coverage

It is essential to assess your needs and only pay for the coverage you require. For older or less valuable vehicles, consider dropping comprehensive and collision coverage, as the cost of repairs or replacement may not justify the additional insurance expense.

Choose Your Vehicle Wisely

The type of vehicle you drive significantly impacts your insurance rates. Vehicles with high crash-test scores, low theft ratings, and less powerful engines tend to have cheaper insurance rates. Additionally, newer cars may qualify for discounts, and electric or hybrid vehicles may be eligible for additional discounts.

Increase Your Deductible

By increasing your deductible, you agree to pay more out of pocket in the event of a claim, which will result in lower insurance premiums. This strategy can lead to significant savings, especially on collision and comprehensive coverage.

Combine Insurance Policies

Combining your auto insurance with other types of insurance, such as home, tenant, or condo insurance, can result in substantial discounts. Bundling your policies with the same provider can lead to savings of up to 20% on auto insurance and 50% on other types of insurance.

Ask About Discounts

Insurers offer various discounts that may apply to your situation. For example, using winter tires, installing anti-theft devices, or being a loyal customer can all contribute to lower insurance rates. Additionally, membership in certain associations or alumni groups may provide access to group rates.

Pay Premiums in Full

Paying your insurance premiums in full rather than in monthly or quarterly instalments can result in cost savings. Insurance companies often charge administrative fees for processing monthly payments, so paying in a lump sum can help you avoid these extra charges.

Shop Around Annually

Insurance rates can change over time, so it is essential to compare rates annually. By regularly reviewing your policy and exploring alternative options, you can identify potential savings and ensure you are getting the best value for your money.

Auto Insurance: When to Cancel

You may want to see also

Frequently asked questions

The average cost of auto insurance in Canada varies by province. In 2024, the annual premium in Quebec is the lowest at $1112, while in Alberta, it is the highest at $3151.

The average annual cost of auto insurance in Ontario is around $1500 to $1600. However, it can be as high as $2299.

Auto insurance rates in Canada are influenced by various factors, including driving history, age, gender, vehicle type, and geographical location. Additionally, factors such as population density, road conditions, and theft rates can impact rates in specific provinces.

To get cheaper auto insurance in Canada, consider shopping around for the best rates, increasing your deductible, maintaining a clean driving record, and bundling your insurance policies. You may also want to look into discounts for safe driving practices, such as installing winter tires.

Yes, auto insurance is mandatory for all drivers in Canada. The specific coverage requirements may vary by province, but typically include third-party liability, accident benefits, and uninsured automobile coverage.