The cost of full-coverage car insurance varies depending on the insurance company you choose, where you live, and other factors. The average cost of full-coverage car insurance in the U.S. is $1,718 to $2,681 per year, or $143 to $223 per month. However, rates can vary widely depending on factors such as age, driving history, location, coverage level, and vehicle type. For example, drivers in Idaho, Vermont, Ohio, Maine, and Washington pay the cheapest annual full-coverage rates, while drivers in New York, Louisiana, Florida, Nevada, and Michigan pay the highest rates.

| Characteristics | Values |

|---|---|

| Average cost of full coverage car insurance per year | $1,718 to $2,681 |

| Average cost of full coverage car insurance per month | $143 to $223 |

| Average cost of minimum coverage car insurance per year | $488 to $869 |

| Average cost of minimum coverage car insurance per month | $41 to $72 |

| Cheapest state for full coverage car insurance | Wyoming |

| Most expensive state for full coverage car insurance | Florida |

| Cheapest company for full coverage car insurance | State Farm |

What You'll Learn

How much is full coverage auto insurance per month?

The cost of full-coverage auto insurance varies depending on a range of factors, including the insurance company, the driver's age, location, driving history, and credit score. The national average cost of full-coverage auto insurance in the US is $1,718 per year, or $143 per month, according to a 2024 rate analysis by NerdWallet. However, the monthly cost can range from $72 to $256, depending on the state. For example, Wyoming has the lowest average cost of full-coverage auto insurance at $81 per month, while Florida has the highest at $256 per month.

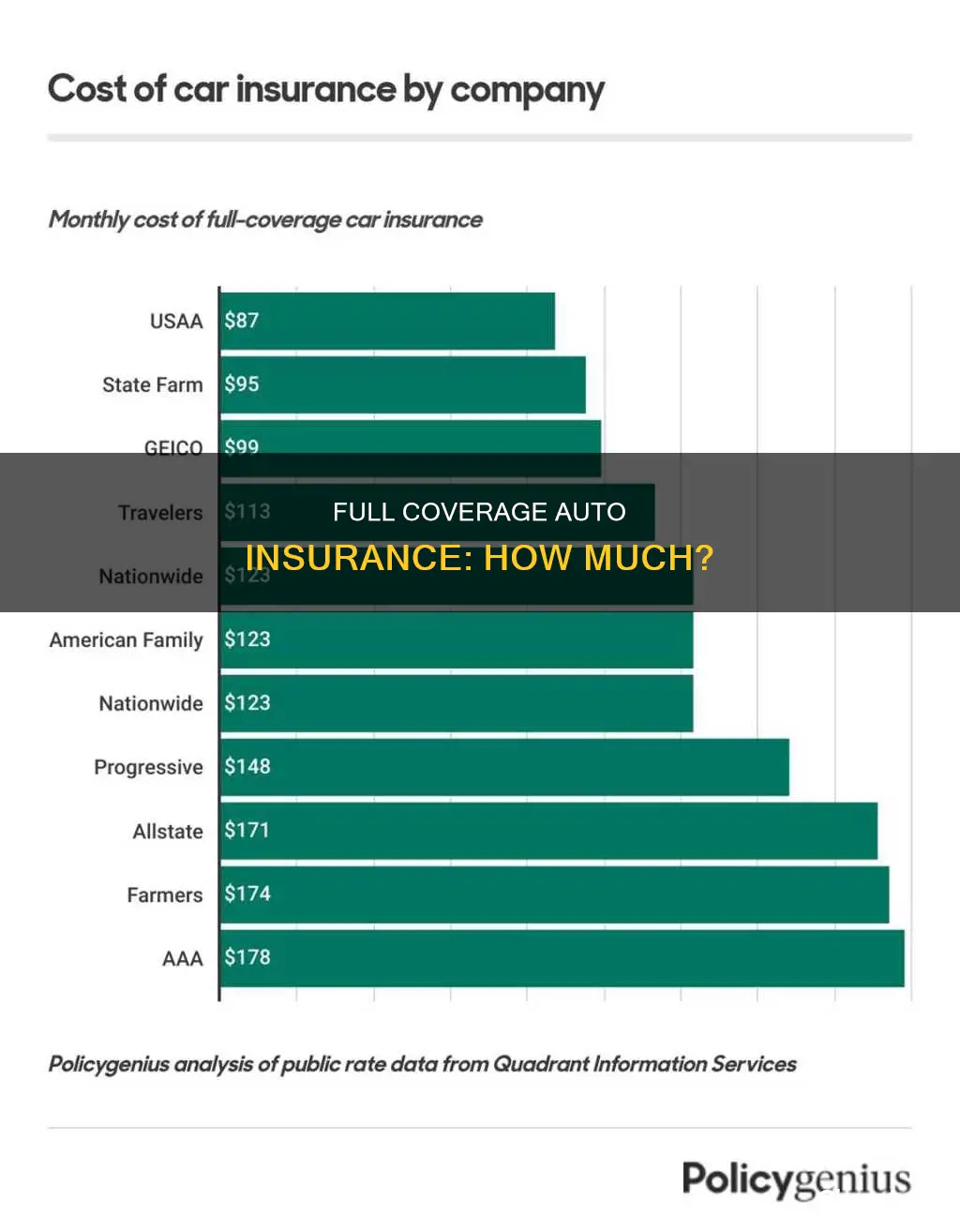

The cost of full-coverage auto insurance also depends on the insurance company. Nationwide offers the best deal on full-coverage auto insurance, with premiums averaging $129 per month, or $1,548 annually. USAA offers cheaper coverage for military members, veterans, and their families.

Other factors that can affect the cost of full-coverage auto insurance include the type and age of the vehicle, as well as the driver's gender and marital status. In most states, males tend to pay more for auto insurance than females, especially at a younger age, due to riskier driving behaviors. Married individuals typically receive lower rates compared to single drivers.

It is worth noting that the cost of full-coverage auto insurance can be reduced by raising the deductible, bundling insurance policies, or taking advantage of various discounts offered by insurance companies.

Uber Vehicle Insurance: What You Need

You may want to see also

How much is full coverage insurance?

The cost of full-coverage auto insurance varies depending on the insurance company, where you live, your age, driving history, credit score, and other factors. The national average cost of full-coverage car insurance is $2,681 per year or $223 per month. However, some sources state that the average cost is $1,718 per year or $143 per month, while others state it is $1,895 per year or $158 per month.

The cheapest full-coverage auto insurance is offered by State Farm, at $125 per month on average. Erie and USAA also offer cheap full-coverage insurance, but Erie is only available in certain states, and USAA is only available to military members, veterans, and their families.

Full-coverage insurance is more expensive than minimum-coverage insurance because it includes liability, collision, and comprehensive coverage. Comprehensive and collision coverage help pay for damage to your car in most types of accidents, whereas minimum-coverage insurance only covers injuries to others and damage to their car or property. Full-coverage insurance typically also includes higher liability limits than minimum-coverage insurance.

The cost of full-coverage auto insurance also depends on the state you live in. Louisiana, New York, and Michigan are three of the most expensive states for full-coverage car insurance, while Maine, Vermont, and Hawaii are the cheapest.

In addition to the state you live in, the cost of full-coverage auto insurance can also depend on your age, driving history, credit score, and other factors. Younger drivers and drivers with a history of accidents, speeding tickets, or DUIs typically pay higher premiums.

Gap Insurance: Essential Protection for Car Owners

You may want to see also

What does full coverage car insurance cover?

While there is no consensus on what "full coverage" car insurance means, it typically includes liability, collision, and comprehensive coverage. It may also include uninsured motorist coverage and personal injury protection (PIP).

Liability insurance covers damage you cause to another driver or their car. It usually includes bodily injury (BI) and property damage (PD). BI deals with injuries you cause to other people, while PD covers damage to other cars or structures. Liability coverage is required by law in most states.

Collision coverage pays for damage to your car from an accident, regardless of who was at fault. Comprehensive coverage pays for damage to your car from events other than collisions, such as weather, theft, or vandalism. These coverages are typically optional but may be required if you lease or finance your car.

Uninsured motorist coverage comes in handy when an uninsured driver causes an accident and damages your car or injures you. Underinsured motorist coverage helps cover costs when another driver doesn't have enough insurance. Personal injury protection (PIP) pays for your injuries, regardless of who was at fault in the accident. It also covers your passengers' injuries and, in some cases, lost wages.

Full coverage car insurance provides financial protection if you're in an accident or if your vehicle is damaged in other incidents, such as vandalism or extreme weather. It can help you avoid expensive repairs and is usually required if you have a leased or financed car.

Baby Gap Insurance: Peace of Mind for Parents

You may want to see also

Is full coverage insurance worth it?

Full coverage insurance is a combination of comprehensive, collision and liability insurance. It provides coverage for most scenarios, including damage to your car from the weather, an at-fault accident, hitting an animal, or vandalism.

The cost of full coverage insurance varies depending on the insurance company, location, and other factors. The national average for full coverage auto insurance is $1,717 per year, or about $143 a month, according to a recent analysis. However, some sources state that the average cost is higher, ranging from $1,810 to $1,895 per year.

Full coverage insurance is typically more expensive than minimum insurance, which only covers damage to another vehicle or person in an at-fault accident. Full coverage insurance pays out for repairs to your own vehicle, which can be valuable if you cannot afford to pay for repairs yourself.

The Value of Your Car

If your car is new, expensive, or has high-value features, full coverage insurance can protect your investment. On the other hand, if your car is older and worth less, comprehensive and collision coverage may not be worth the cost, as the payout may not exceed your deductible.

Your Financial Situation

If you can afford to pay for repairs or replace your car out of pocket, you may not need full coverage insurance. However, if you are financing or leasing your vehicle, lenders or leasing companies usually require full coverage insurance to protect their investment.

Your Risk Tolerance

If you have a high-risk tolerance and prefer to save money on insurance premiums, you may opt for minimum coverage. However, keep in mind that you will be responsible for the financial burden of repairing or replacing your vehicle in the event of an accident.

Your Driving Habits

If you drive frequently, commute in heavy traffic, or live in an area with extreme weather or high car theft rates, full coverage insurance may be worth the extra cost. It can provide peace of mind and financial protection in the event of an accident or damage to your vehicle.

Available Discounts and Deductibles

You can explore ways to lower your full coverage insurance costs, such as shopping around for quotes, increasing your deductible, or taking advantage of discounts offered by insurance companies. This can make full coverage insurance more affordable and worth considering.

Ultimately, the decision to opt for full coverage insurance depends on your personal circumstances, financial situation, and risk tolerance. It is essential to weigh the benefits of having comprehensive protection against the cost of the insurance premiums.

Update Your Root Insurance Vehicle Details

You may want to see also

How to get full coverage insurance quotes

The cost of full-coverage car insurance varies depending on the insurance company, your location, and other factors. The average cost of full-coverage car insurance in the US is $1,895 per year or $158 per month. However, it is important to note that the term "full coverage" can vary from place to place, and its precise definition depends on the state's legal requirements.

To get full-coverage insurance quotes, follow these steps:

- Determine your needs: Consider your driving history, the type of car you own, and the level of coverage you require. Think about the coverage options that are important to you, such as collision, comprehensive, uninsured motorist, and personal injury protection.

- Shop around: Compare quotes from multiple insurance companies. Rates can vary significantly between insurers, so it's worth getting quotes from several providers. You can use online tools and calculators offered by insurance companies and third-party websites to get quotes and compare rates.

- Provide necessary information: When requesting a quote, be prepared to provide details such as your name, address, driver's license number, vehicle identification number (VIN), and information about your driving history. This information will help insurance companies assess your risk and provide an accurate quote.

- Customize your coverage: Once you have quotes from different insurers, you can customize your coverage options to fit your needs and budget. Consider factors such as your state's minimum coverage requirements, the value of your vehicle, and any additional coverages you may need, such as roadside assistance or rental car reimbursement.

- Compare similar policies: To make an accurate comparison, ensure that you are selecting the same coverage limits and deductible amounts across different insurance companies. This will allow you to see the true difference in pricing and the coverage offered.

- Look for discounts: Ask about available discounts, such as those for safe driving, bundling policies, or having safety features in your car. Taking advantage of discounts can help lower your overall insurance costs.

- Review the quotes: Carefully review the quotes you receive, paying attention to the coverage offered, the deductible, and the premium. Consider using an insurance broker or agent to help you navigate the process and find the best coverage for your needs.

- Make your decision: After comparing quotes and reviewing the details, choose the insurance company that offers the best coverage and price for your needs. You can then proceed with purchasing the policy directly from the insurer or through an agent.

By following these steps, you can obtain full-coverage insurance quotes and make an informed decision about which policy is right for you. Remember to review your insurance needs periodically and compare quotes from different insurers to ensure you are getting the best coverage at a competitive price.

Lower Auto Insurance: Tips and Tricks

You may want to see also

Frequently asked questions

The cost of full coverage auto insurance varies depending on the insurance company, where you live, your age, driving history, credit score, and other factors. The national average cost of full-coverage car insurance is $2,681 per year or $223 per month.

State Farm has the cheapest full-coverage auto insurance for most drivers, at $125 per month, on average.

Young drivers with their own insurance policies tend to pay the most for car insurance due to a lack of driving experience. Full-coverage car insurance for an 18-year-old driver costs $5,669 per year or $472 per month on average if they purchase their own policy.

Drivers with a recent DUI pay some of the highest car insurance rates on average. On average, auto insurance costs for full coverage go up about 85% for a driver with a recent DUI, which translates to an average increase of about $1,468 a year.

Drivers with poor credit pay nearly 84% more for full coverage car insurance compared to those with good credit. On average, drivers with poor credit pay $2,741 per year for full coverage.