Erie Insurance is a company that has been in business for almost 100 years and is currently looking for independent sales professionals to join their team. As an insurance agent, you will be responsible for selling a range of insurance products, including auto, home, life, and business insurance, and building your own business. To become an Erie Insurance agent, you will need to hold a current property/casualty license and life/health license in your state, as well as complete a pre-licensing course or self-study course. The company is looking for individuals with strong interpersonal skills, credibility, a great work ethic, and confidence.

| Characteristics | Values |

|---|---|

| Skills | Sales, marketing, management, strong interpersonal skills, credibility, a great work ethic, confidence |

| Requirements | Current property/casualty license and life/health license in your state, pass the state insurance exam, apply for a license, gain an insurance company appointment |

| Investment | No franchise fee or specific dollar amount of capital to get started, but Erie recommends having money to invest in your new venture |

| Compensation | Commission on both new business and renewal business, bonus programs for growth, profitability and performance |

| Support | Robust support team with an assigned district sales manager, a dedicated underwriter, risk control services and a variety of specialists |

What You'll Learn

- Erie Insurance seeks local, community-oriented, service-driven agency owners

- The appointment process involves meetings with a District Sales Manager, a written business plan, and a credit/background check

- There is no franchise fee or set dollar amount of capital required to get started

- Agents are compensated via commission on new and renewal business, with bonus programs for growth, profitability, and performance

- A current property/casualty license and life/health license in your state are required to become an agent

Erie Insurance seeks local, community-oriented, service-driven agency owners

Erie Insurance is always on the lookout for local, community-oriented, service-driven agency owners to join their team of independent agents. Representing Erie Insurance means managing your own business, realising your income potential, and helping people make good decisions about their insurance protection.

The company is committed to supporting its agents, with a long tradition of trust and collaboration. While insurance experience and prior business ownership are helpful, they are not required. Instead, Erie Insurance looks for individuals with excellent communication and relationship skills, who are enthusiastic, determined, and innovative, with a strong work ethic and a customer-first focus.

The process of becoming an agency owner involves several steps, including meetings with a local District Sales Manager, producing a written business plan, and undergoing a credit and background check. This process typically takes 2-4 months to complete. While there is no franchise fee or specific capital requirement, Erie Insurance recommends having some funds to invest in your new business venture.

As an Erie Insurance agent, you will be part of a company with nine decades of experience and a strong presence in the marketplace. You will represent a highly-rated insurance company, known for its customer satisfaction and competitive prices. The company's culture of dignity and respect, along with its commitment to diversity, equity, and inclusion, creates an atmosphere of mutual respect and safety for all.

With Erie Insurance, you will have the opportunity to develop your own business while being supported by a dedicated team committed to your success.

Living Accommodation Insurance: What's Covered?

You may want to see also

The appointment process involves meetings with a District Sales Manager, a written business plan, and a credit/background check

The appointment process to become an Erie Insurance broker is a thorough one that involves several steps. Firstly, candidates must meet with a District Sales Manager, who will provide an overview of the role and the company. This meeting allows both parties to assess the fit and ensure alignment with Erie Insurance's values and requirements. During this interaction, the District Sales Manager will likely delve into the candidate's background, skills, and experience, seeking indications of strong interpersonal skills, credibility, work ethic, and confidence.

The next step in the process is for the candidate to produce a written business plan or production plan. This plan should showcase the candidate's understanding of the insurance industry, their target market, and their strategy for building a successful insurance agency. It should also reflect Erie Insurance's expectations and goals, demonstrating a clear understanding of the company's culture and vision. The plan should be detailed, outlining the candidate's short-term and long-term objectives, as well as the steps they intend to take to achieve them.

Additionally, the appointment process includes a credit and background check. This step is standard procedure for Erie Insurance to ensure the candidate's financial stability and integrity. The background check verifies the candidate's credentials, work history, and any other relevant information that could impact their suitability for the role. The credit check assesses the candidate's financial responsibility and stability, ensuring they meet the financial requirements necessary to operate as an independent agent.

While the appointment process is comprehensive, it is designed to set up future Erie Insurance brokers for success. The process typically takes around 2 to 4 months to complete, and candidates are supported by a dedicated team throughout. This journey towards becoming an Erie Insurance broker is an exciting one, offering individuals the opportunity to build their own business while representing a respected and established company.

PPO Insurance: How Many Americans?

You may want to see also

There is no franchise fee or set dollar amount of capital required to get started

To become an Erie Insurance broker, you need to become an independent agent representing Erie Insurance. This means you will manage your own business, decide your income, and help people make decisions about their insurance protection.

The process of becoming an appointed agency owner typically takes 2-4 months and involves meetings with your local District Sales Manager, producing a written business/production plan, and a credit/background check.

As an Erie Insurance broker, you will be compensated through commissions on new and renewed business, with additional bonus programs rewarding agencies for growth, profitability, and performance. You will also have the support of a district sales manager, a dedicated underwriter, and a variety of specialists to help you grow your business.

Erie Insurance is looking for local, community-oriented, service-driven agency owners who live and work in their communities. While insurance experience and prior business ownership can be helpful, they are not required. The company is committed to supporting its agents and helping them succeed, so if you are interested in becoming an Erie Insurance broker, reach out to discuss the opportunity further.

Understanding Veterans Insurance: Decoding Insurance Payment on Your Bill

You may want to see also

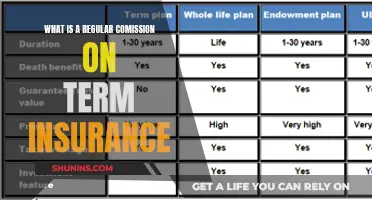

Agents are compensated via commission on new and renewal business, with bonus programs for growth, profitability, and performance

Erie Insurance agents are independent contractors who are compensated through a commission-based structure. This means that agents earn a percentage of the sales they generate, including both new business and the renewal of existing policies. This commission-based model incentivizes agents to focus on growth and profitability, as their income is directly tied to their performance.

The commission structure at Erie Insurance provides a strong motivation for agents to build and maintain long-lasting relationships with their clients. By understanding their clients' needs and providing valuable insurance solutions, agents can increase their earnings over time. This model also encourages agents to proactively seek new business opportunities and expand their client base.

In addition to the commission on sales, Erie Insurance offers a range of bonus programs to further reward agents for their performance. These bonus programs are designed to recognize and incentivize growth, profitability, and exceptional performance. Agents who demonstrate outstanding results in these areas can benefit from additional financial incentives, enhancing their overall compensation.

The commission and bonus structure at Erie Insurance provides a compelling opportunity for driven and successful agents to maximize their earnings. By combining a base commission with performance-based bonuses, agents have the potential to earn substantial income. This compensation model aligns with the company's commitment to supporting its agents and helping them build thriving businesses.

Erie Insurance's approach to agent compensation reflects the value it places on its agents' contributions. By rewarding agents for their sales performance, the company fosters a culture of entrepreneurship and empowers agents to take ownership of their success. This structure also enables agents to have greater control over their earnings and provides a clear path to achieving their financial goals.

Understanding Insurable Interest: Unraveling the Intricacies of Insurance Eligibility

You may want to see also

A current property/casualty license and life/health license in your state are required to become an agent

To become an Erie Insurance broker, you need to hold a current property/casualty license and a life/health license in your state. This is a mandatory requirement to be formally appointed with the Erie Insurance Group. Obtaining these licenses involves several important steps, which are outlined below.

Firstly, you must pick a line of business as agents are required to be licensed for specific lines of business. This step is crucial as it helps you choose your insurance career path and the types of insurance you want to sell. For instance, you may decide to focus on auto, home, life, business, or long-term care insurance.

Secondly, you need to meet the state's education requirements. All states mandate pre-licensing requirements, such as completing a certain number of hours of general pre-licensing education and instruction in ethics. The specific number of hours may vary, so it is important to check the requirements for your particular state.

The third step is to pass the state insurance exam. This exam is typically a timed, multiple-choice test, and test-takers are advised to spend a dedicated amount of time studying for it. The number of questions on the exam will depend on the state and the specific license you are pursuing.

Once you have successfully passed the exam, you can proceed to apply for your license. This can often be done online through platforms such as the National Insurance Producer Registry (NIPR). Having the necessary licenses is a fundamental step towards becoming an Erie Insurance broker, as it demonstrates your knowledge and compliance with state regulations.

After obtaining your licenses, you will need to apply for and secure an appointment with an insurance company. This step involves reaching out and initiating contact with the Erie Insurance Group to discuss the opportunity further. It is worth noting that while insurance experience is beneficial, it is not a prerequisite, and Erie Insurance welcomes individuals with diverse backgrounds and experiences.

Marketplace Insurance: Public Charge Rule Change Impact

You may want to see also

Frequently asked questions

Erie Insurance offers a robust support team, including an assigned district sales manager, a dedicated underwriter, risk control services, and a variety of specialists. The company has a long tradition of trust and collaboration with its agents, valuing relationships and seeking agent input on various aspects of the business. They also offer competitive commissions and bonus opportunities, and their agents are independent contractors.

Erie Insurance seeks local, community-oriented, and service-driven agency owners who live and work in their communities. While insurance experience and prior business ownership are advantageous, they are not required.

The process typically involves meetings with your local District Sales Manager, producing a written business/production plan, and a credit/background check. The entire process usually takes 2-4 months.

Agents are compensated through commissions on both new and renewal business. There are also various bonus programs to reward agencies for growth, profitability, and performance.