If you're a business owner in Florida, you may be wondering how to get bonded and insured to provide peace of mind to your customers and protect yourself against financial losses. The first step is to determine whether you need a surety bond or a fidelity bond. A surety bond is a requirement for certain licences and is mandated by a third party, usually the government, to protect itself or the public. A fidelity bond, on the other hand, is insurance for your business and protects it from employee theft. Once you've determined the type of bond you need, you'll need to contact a surety company or agent for a quote, who will then review your finances. After you're approved, you'll need to complete a bond application and sign a contract agreeing to reimburse the surety company for any claims made against the bond. In addition to bonding, it's important to have adequate insurance coverage to protect your business from risks.

| Characteristics | Values |

|---|---|

| What does it mean to be bonded? | It means a bonding company has done a thorough background check on you and deemed you trustworthy. |

| What does it mean to be insured? | Being insured protects you in the case of injury on the job. Insurance also covers the physical well-being and property of your employer. |

| What does it mean to be licensed? | Being licensed provides proof that you are qualified to work in a specific area, such as electrical work or construction. |

| How to get bonded? | You need to decide which kind of bond you want: a surety bond or a fidelity bond. |

| How to get insured? | Consider the risks involved with your line of work and consult a licensed commercial insurance agent. |

| How to get licensed? | Prove your ability to do your job well by undergoing official training, education, or obtaining experience in your field. |

What You'll Learn

Understand the difference between surety and fidelity bonds

When starting a business in Florida, it is important to understand the difference between surety and fidelity bonds. Both are types of bonds that serve as financial guarantees, but they offer protection in different ways.

Fidelity bonds, on the other hand, are a type of insurance for your business. They protect your company from financial losses due to dishonest practices or misconduct on the part of employees, such as embezzlement of funds. Fidelity bonds are also known as dishonesty coverage or crime insurance. They are typically purchased by employers to protect themselves from employee theft, which can result in significant financial losses or even bankruptcy.

It is important to note that not everyone qualifies for surety bonding, and it is often a mistake to purchase your bonds and insurance together. When considering how to become bonded and insured, it is crucial to consult with experts in the field, such as insurance companies or surety bond brokers, to ensure you obtain the correct type of bond and adequate coverage for your business needs.

Understanding the Basics of Standard Term Insurance: A Comprehensive Guide

You may want to see also

Learn about the benefits of bond insurance

Bond insurance is a type of insurance that acts as a form of credit to you. It will pay your customers if you fail to complete the agreed-upon work. It also helps keep you compliant with all federal and state regulations surrounding business bonding.

Benefits of Bond Insurance

- It protects your company and shows potential customers that you're a reliable business that can be trusted.

- It can help if you're accused of not completing a project or not paying for materials or labour.

- It can be used to pay for accidents or damages to a third party, protect your business against slander or libel, and cover employee injuries.

- It financially protects your business against these types of claims. If you don't have bond insurance and you're faced with a lawsuit, you could be forced to pay out of pocket for any damages or settlements, which could ruin your business financially.

- It can help secure your business' future and give it the financial security to thrive.

- It provides comfort to potential clients.

- It helps keep you compliant with all federal and state regulations surrounding business bonding.

Uber Insurance Complications: Understanding the Grey Areas of Ride-Sharing Coverage

You may want to see also

Find out how to get a surety bond

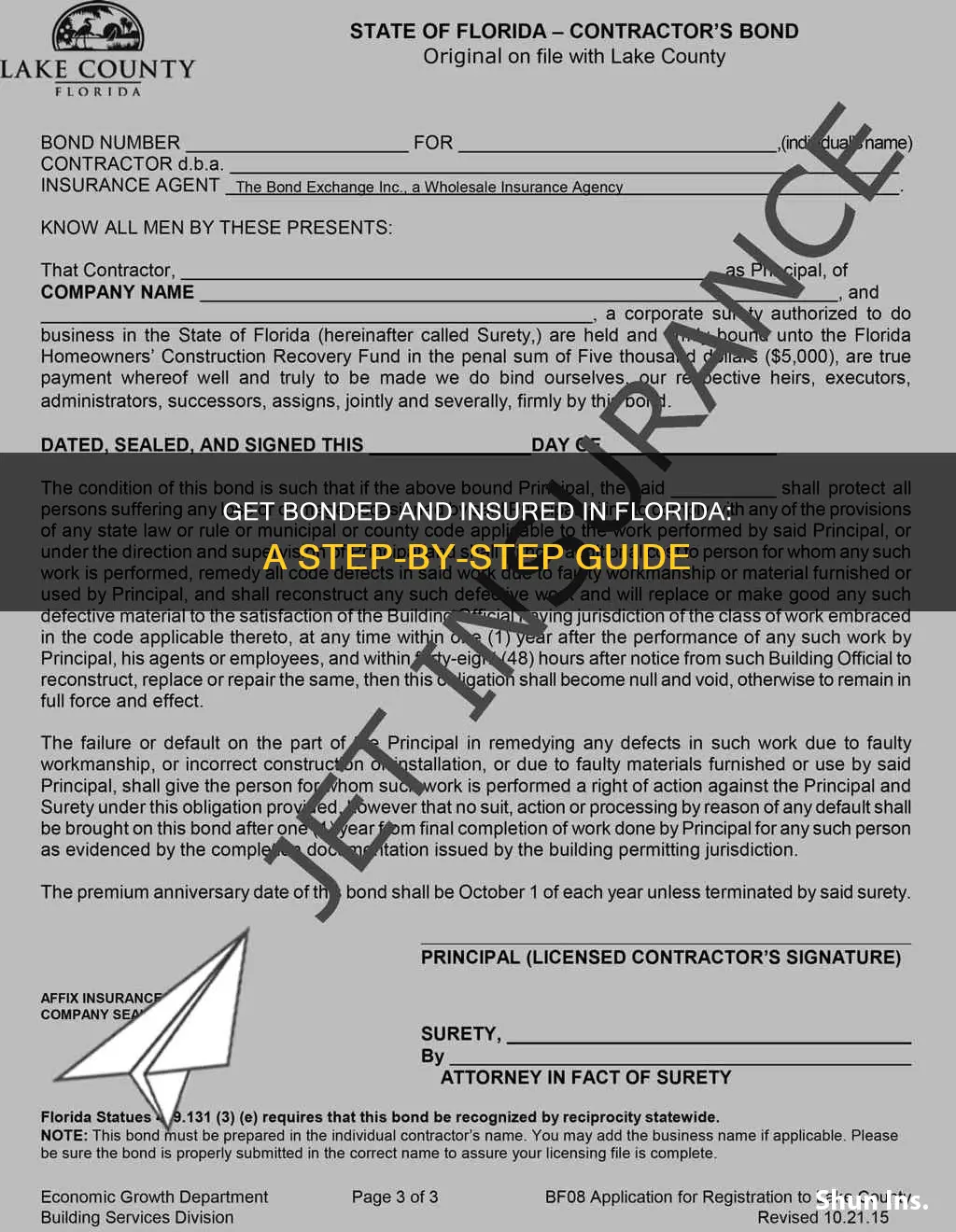

To get a surety bond in Florida, you need to follow these steps:

- Determine the type of surety bond you need: Florida has over 170 different surety bond requirements. Contact the obligee (the entity requiring the bond) to determine the specific bond you need. Common types of surety bonds in Florida include business service bonds, alcoholic beverage and tobacco bonds, contractor license bonds, motor vehicle dealer bonds, and notary bonds.

- Find a surety bond provider: You can obtain surety bonds from your local insurance company or a licensed surety bond company. It is recommended to work with an established and competitively priced broker as they can help you find the best options for your unique needs.

- Apply for the surety bond: Most providers have online applications or forms that you can fill out to apply for the bond. Basic information, such as personal and business finances, may be required to complete the application. A soft credit check may also be performed as part of the application process.

- Receive a quote: After submitting your application, the surety bond provider will review it and provide you with a quote for the bond premium. The cost of a surety bond in Florida typically ranges between 1% and 10% of the total bond amount, depending on your credit score and other factors.

- Purchase the surety bond: Once you have accepted the quote, purchase the bond by paying the bond premium. You will receive a copy of the bond, and the original will be mailed to you. In some cases, the surety bond provider can send the original bond directly to the obligee.

- File the surety bond: After purchasing the bond, sign and file it with the obligee. This completes the process of obtaining a surety bond in Florida.

It is important to note that not everyone qualifies for surety bonding. It is recommended to consult with an expert in the industry to determine if you meet the requirements and to ensure you obtain the correct type of bond.

Navigating Emergency Medical Bills: Strategies for the Uninsured

You may want to see also

Discover what being insured means

When it comes to insurance, it's important to understand the difference between being insured and being bonded. While both provide financial protection, they serve different purposes.

Being insured means having protection against financial losses in the event of a claim. This could include theft, injury, or property damage. When a claim is submitted, a third party, such as an insurance company, will pay out. This protects you from having to pay the full costs out of pocket. There are different types of insurance policies, such as general liability, commercial property, and workers' compensation, each providing coverage for specific risks.

For example, if you have general liability insurance and a customer slips and falls on your premises, your insurance company will cover the costs of any resulting legal or medical expenses. This protects your business from significant financial losses.

Additionally, insurance can also provide coverage for risks such as cyber security threats, malpractice, and employee injuries. It's important to choose the right type of insurance policy based on your business's needs and potential risks.

Being insured is crucial for any business owner as it provides financial security and peace of mind. It helps businesses avoid financial ruin in the event of unexpected claims or lawsuits. By having insurance, businesses can protect themselves and their customers, demonstrating their reliability and trustworthiness.

Overall, understanding what being insured means is an essential step in safeguarding your business and ensuring its long-term success. It's important to consult with experts and choose the right insurance company to get the coverage that best suits your business needs.

Learn how to get insured

When deciding the particular type of insurance you want, consider the risks involved with your line of work. Once you have decided what kind of coverage you are looking for, a licensed commercial insurance agent can help you find the policy that best fits your needs.

Make sure to research an agency before working with them to ensure that they are reputable and have your best interests in mind. You should also do some research comparing the pros and cons of different policies, and be sure to re-examine your needs as your business grows and evolves to decide if it's time for a new policy.

Insurance protects businesses from risks that could put them out of business. It also protects you in the case of injury on the job. If you get injured while working and the company you work for is insured, the claim is filed against the company’s insurance. Otherwise, the individual or individuals you are working for would be responsible for the claim.

Insurance also protects the physical well-being and property of your employer. If, while working, you accidentally injure the person who hired you or damage their belongings, insurance covers the necessary medical costs or repairs.

Being insured helps a company avoid financial losses in the event of a claim. It also helps keep you compliant with all federal and state regulations surrounding business insurance.

General business insurance policies (general liability, commercial property, workers' compensation, etc.) pay your business in the event of a claim. They protect a business from significant financial losses if theft, property damage, or injury occurs.

Some common types of small business insurance coverages include:

- Property coverage for buildings, structures, business contents, and lost rental income.

- In-land marine/equipment/installation floaters covering real property that moves around.

- Auto coverage that covers various on-the-road power units from a liability and physical damage standpoint.

- Cyber Liability coverage helps to protect a business from data security breaches that can negatively affect the company.

- Employers Practices Liability insurance protects owners from employment-related legal actions against the company and its owners, such as discrimination, termination, or harassment lawsuits.

KP Insurance: Deadline for Change

You may want to see also

Frequently asked questions

Being bonded means a bonding company has done a thorough background check on you and deemed you trustworthy. Being insured, on the other hand, protects you in the case of injury on the job.

A surety bond is a bond that a third party, typically the government, mandates you to obtain in order to conduct business. A fidelity bond, on the other hand, is insurance for you or your business and protects your business from employee theft.

Being bonded and insured is not required by law in Florida, but it is highly recommended as it makes your business much more appealing to potential employers.

To get a bond, you will need to decide which kind of bond you want and then go through a licensed agent. Choose an agency that either specializes in bonds or has a separate bond department.

The cost of a bond is based on a percentage of the total contract amount and is paid by the business owner to the surety company. The premium for a small business bond is generally between $100 and $500 for a $10,000 bond policy.