Billing insurance can be a complicated process, but it's an important part of ensuring that you receive the financial coverage you're entitled to for medical costs. The process will differ depending on your location, the type of insurance you have, and the type of medical care you're claiming for. In the US, for example, therapists must go through a process of credentialing with insurance companies before they can bill insurance directly. This involves applying to become part of the insurer's provider panel and completing the Council for Affordable Quality Healthcare (CAQH) application. When it comes to making a claim, it's important to provide all the necessary patient information, including full legal name, date of birth, address, gender, and insurance details. You'll also need to select the correct billing code for the procedure, which will depend on the type and length of the treatment. Once the claim has been submitted, it's important to follow up to ensure it has been received and processed, and to be prepared to provide additional information if needed.

| Characteristics | Values |

|---|---|

| Required Demographic Information | Full legal name, date of birth, address, gender, phone number, email address |

| Required Insurance Information | Subscriber ID with the Alpha Prefix, customer service phone number |

| CPT Codes | 90832 (30-minute psychotherapy), 90839 (60-minute crisis psychotherapy), 90847 (50-minute family psychotherapy with the primary client present), 90853 (group psychotherapy), 96132 (neuropsychological testing services) |

| Deadlines | Deadlines for submitting a claim vary from insurer to insurer; Medicare and Medicaid typically require claims to be submitted within 365 calendar days from the date of service, while private insurers tend to set shorter deadlines |

| Payment Schedules | Therapists must generally be reimbursed within 30 days |

| Insurance Payouts | Discuss insurance policies with clients, verify insurance coverage and reimbursement rates, help clients navigate insurance reimbursement, establish and discuss policies for when insurance denies a claim |

What You'll Learn

Getting Credentialed with Insurance Companies

Overview

The process of getting credentialed with insurance companies is also known as provider enrollment and is the first step of the process for inclusion in payment panels. While the process can be time-intensive, provider enrollment is the only way a healthcare provider organization can become an in-network provider and be paid by insurance companies.

Steps to Getting Credentialed

Be prepared

You should have your NPI number readily available and be fully licensed and in good standing in the state in which you intend to provide services.

Submit a participation request

Submit a participation request to the health plan using their application process. "Join network" should be a button or link on your insurance company's website.

Panel determination

Once the health plan receives your application, they will perform a credentials verification across a multitude of databases using Primary Source Verifications. Once verification is complete, their credentialing file will go to the Credentialing Committee for approval. During these phases, you should receive a reference number to check your enrollment status.

Contracting

Once the credentialing process is complete, the second step of provider enrollment is contracting with the insurance networks. The contracting process is the agreement that you will make with insurance companies. Contracting is separate from credentialing and is drafted by a contracting representative with whom you will review the language of the contract, discuss reimbursement rates, and all the details and responsibilities of participation.

Tips for Getting Credentialed

- Research the insurance companies and find out which insurance companies you want to be credentialed with.

- Get your NPI number. There are two types of National Provider Identifier (NPI) numbers: Individual (Type 1) and Organizational (Type 2).

- Complete the CAQH application. The Council for Affordable Quality Healthcare (CAQH) runs a national database that most insurance companies use for credentialing.

- Register with Medicare. Unlike medical doctors, chiropractic physicians cannot opt out of Medicare.

- Contact each insurance company with which you want to be in-network. After your CAQH application is complete, contact each insurance company with which you want to participate.

- Expect to devote about 10 hours for every insurance panel you wish to be credentialed with.

The Renewal Riddle: Unraveling the Mystery of Level Term Insurance

You may want to see also

Filling Insurance Paperwork

Filling out insurance paperwork can be a daunting task, but it is a necessary process to ensure you are properly covered in case of any incidents. Here is a step-by-step guide to help you navigate the process of filling out insurance paperwork:

Step 1: Understand the Type of Insurance and Required Paperwork

First, it is important to understand the type of insurance you are dealing with, such as health, auto, or home insurance. Different types of insurance will require different paperwork. For example, when getting car insurance, you will need to provide information about the car, including the Vehicle Identification Number (VIN), the year, make, and model. You will also need to provide personal information, such as your home address and driver's license.

Step 2: Gather the Necessary Information and Documents

Depending on the type of insurance, you will need to gather relevant information and documents. This may include personal information such as your name, address, date of birth, and contact details. You may also need to provide insurance information, such as your policy number, group number, or member number. If you are filing a claim, you will need to collect itemized receipts or bills from your service provider. These documents should include a breakdown of the services provided and the associated costs.

Step 3: Fill Out the Insurance Forms

Insurance companies typically use standardized forms, such as the CMS 1500 for health insurance claims. Carefully fill out the form, providing all the required information. This may include personal information about yourself and the insured, as well as details about the services provided or the incident being claimed. Be sure to review the form before beginning to ensure you have all the necessary information. It is also a good idea to make copies of the completed form for your records.

Step 4: Submit the Forms and Supporting Documentation

Once you have completed the insurance forms, it is time to submit them to the insurance company. You may be able to submit the forms online, by mail, or through a mobile app, depending on the insurance provider. Be sure to follow the instructions provided by the insurance company. After submitting the forms, give the insurance company a call to review the paperwork and confirm that they have all the necessary documents. Ask about the expected timeline for processing your claim or updating your policy.

Step 5: Follow Up as Needed

Keep track of the expected timeline provided by the insurance company. If you do not receive a response or payment within the specified timeframe, follow up with the insurance company to inquire about the status of your claim or application. It is important to stay organized and proactive throughout the process to ensure your insurance needs are met.

Unveiling the NCB: A Rewarding Feature of Insurance Policies

You may want to see also

Deadlines and Payment Schedules

In the state of Maryland, for instance, Health Maintenance Organizations (HMOs) and commercial indemnity insurers are required to give providers at least six months from the date of service to submit a claim for reimbursement. The Maryland Medical Assistance program, on the other hand, generally requires invoices to be submitted within nine months of the service date, with certain exceptions.

Other insurance providers have their own timely filing deadlines. For example, Medicare, Blue Cross/Blue Shield, and Secure Horizons have a deadline of 365 days from the date of service, while Cigna, United Healthcare, and Medicaid have shorter deadlines of 90, 90, and 95 days, respectively.

It is important to note that failing to meet these deadlines can result in a loss of revenue, as insurance companies may deny claims submitted after the specified timeframe. Therefore, staying up-to-date with rate and billing changes, as well as provider guidelines, is essential for successful insurance billing.

The Policyholder's Shield: Unraveling the Provision that Safeguards Insured Terms

You may want to see also

Getting Insurance Payouts

Insurance payouts can be a confusing and stressful process, especially when dealing with the loss of a loved one or damage to your property. Here's a detailed guide to help you understand the process and get the insurance payout you need.

Understanding the Claim Payout Process

The first step in getting an insurance payout is understanding how the process works. Insurance companies will typically send an adjuster to inspect and evaluate the damage to your property. This could be your home, vehicle, or other insured items. Based on this assessment, they will determine the settlement amount or the reimbursement for repairs.

The initial payment offered by the insurance company is often an advance against the total settlement amount and not the final payment. You can accept this on-the-spot settlement, and if you later discover additional damage, you can reopen the claim and file for an additional amount. It is important to review your policy to understand the timeframe for reopening claims.

Types of Insurance Payouts

There are different types of insurance payouts, and the specific process may vary depending on the type of insurance and the circumstances of the claim. Here are some common types of insurance payouts:

- Lump-sum payment: This is the most common type of payout, where you receive the entire payout amount at once. This option gives you full control over the money, and it is usually tax-free. However, if the payout is large, you may consider splitting it between multiple accounts to ensure FDIC insurance coverage.

- Installment plan: With this option, the insurance company pays you a certain amount of money on a regular schedule (monthly, quarterly, or yearly) over a set period. This can be a good choice if you want a steady income stream, but it may not cover all your needs, and any remaining money will be kept by the insurance company.

- Retained asset account: Some insurers will hold your payout in an interest-bearing account, allowing you to withdraw funds as needed. This option gives you flexibility, but it also means the insurance company controls your money, and you may have limited investment choices.

- Actual cash value: In the case of property damage, you may receive a payout based on the actual cash value of your home or belongings, considering their age, condition, and market value. This may not cover the full cost of repairs or replacements.

- Replacement cost: This type of payout provides funds to cover the costs of rebuilding or repairing your home using similar materials. It is important to note that the replacement cost may differ from the market value of your property.

Factors Affecting Insurance Payouts

The amount and timing of your insurance payout can be influenced by various factors:

- Policy limits: Your insurance policy will have maximum limits on the payout amount. Make sure to review your policy to understand these limits and discuss coverage amounts with your insurer.

- Type of coverage: Different types of insurance, such as collision or comprehensive coverage for vehicles, will have different payout processes and amounts.

- Extenuating circumstances: Claims may be delayed or denied in cases of suspected fraud, suicide, homicide, or if the policyholder died within the two-year contestability period after purchasing the policy.

- Multiple beneficiaries: If there are multiple beneficiaries named in the policy, each must file their own claim and choose their payout option.

- Lender or management company involvement: If you have a mortgage or live in a coop or condominium, the lender or management company may be involved in the insurance payout process and may have control over how the funds are distributed.

It is important to carefully review your insurance policy, understand the terms and coverage, and stay informed about the status of your claim to ensure you receive the insurance payout you are entitled to.

The Intricacies of Proximate Cause: Unraveling Insurance's Complexities

You may want to see also

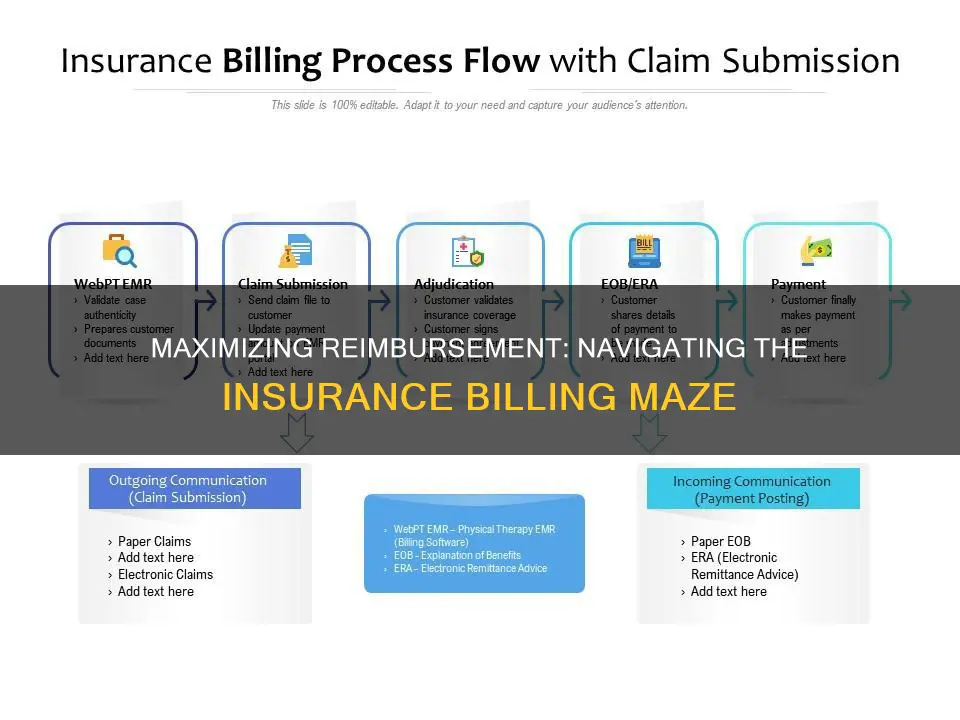

Submitting Claims to an Insurance Company

Step 1: Understand the Basics of Insurance Billing

Before submitting claims, it's important to understand how insurance billing works. Familiarize yourself with key insurance terms such as copay, deductible, coinsurance, and maximum out-of-pocket expenses. Know the difference between preventive care, which is often covered by insurance plans, and other services that may require you to pay out of pocket until you reach your deductible.

Step 2: Gather Necessary Information

When submitting claims, you'll need to provide various types of information. This includes personal information such as your name, address, and date of birth and insurance information like your policy number, group plan number, or member number. Additionally, you'll need to specify who received the services (the insured or a dependent) and the reason for the treatment, such as an injury, illness, or preventive care.

Step 3: Obtain Itemized Receipts

Contact your doctor or medical provider to obtain an itemized bill that lists every service provided, along with the associated costs. This bill should also include special codes that the insurance company uses to process claims. Make sure to collect itemized receipts for all health care services received.

Step 4: Complete the Claim Form

Download the appropriate claim form from your insurance company's website or contact them to obtain one. Carefully fill out the form, providing all the necessary information. The form will typically ask for personal and insurance information, details about the treatment, and out-of-pocket expenses. If you have dual coverage or coinsurance, be sure to include that information as well.

Step 5: Make Copies of Everything

Before submitting your claim, it's crucial to make copies of all the documents, including the completed claim form and itemized receipts. This will help you keep track of the information and facilitate refiling if your claim is lost or denied. Making copies also allows you to retain the original documents if you need to submit them again.

Step 6: Review and Submit the Claim

Once you have all the necessary documents and information, review them thoroughly. Contact your insurance company to let them know you'll be sending in a claim form, and ask if there are any additional documents required. After ensuring that everything is in order, submit the claim form and accompanying paperwork to your insurance company. Most companies accept submissions online, by mail, or sometimes by email or fax. Keep a record of the submission date and follow up with the insurance company if you don't receive a response within the expected timeframe.

Step 7: Handle Claim Denials

If your claim is denied, don't panic. Insurance companies may deny claims for various reasons, including coding errors, lack of prior authorization, missing or incorrect information, or deeming the treatment medically unnecessary. Review the reason for the denial and initiate the appeals process if necessary. Involve your healthcare provider if the claim was denied due to medical necessity. Remember to keep a paper trail of all communications and follow-up activities.

Understanding Rebating in Insurance: Unraveling the Practice and Its Implications

You may want to see also

Frequently asked questions

Insurance billing is a complicated process that requires a large amount of information. It involves creating and submitting claims, and accounting for EOBs. It is important to select the right billing code, as improper coding may trigger an audit, delayed payment, or even removal from a provider panel.

Medical credentialing is the process through which a therapist joins an insurer’s provider panel. Therapists who are not credentialed with insurers cannot bill insurance directly. The steps to get credentialed include making a list of the companies with which you want to be credentialed, applying to become part of the insurer’s provider panel, completing the Council for Affordable Quality Healthcare (CAQH) application, and following up with each insurer.

Common mistakes to avoid when billing insurance include submitting claims with incorrect information, not following up on the status of claims, and not verifying eligibility and benefits. It is also important to be aware of the deadlines and payment schedules of the insurer and to submit claims within the specified time frame.