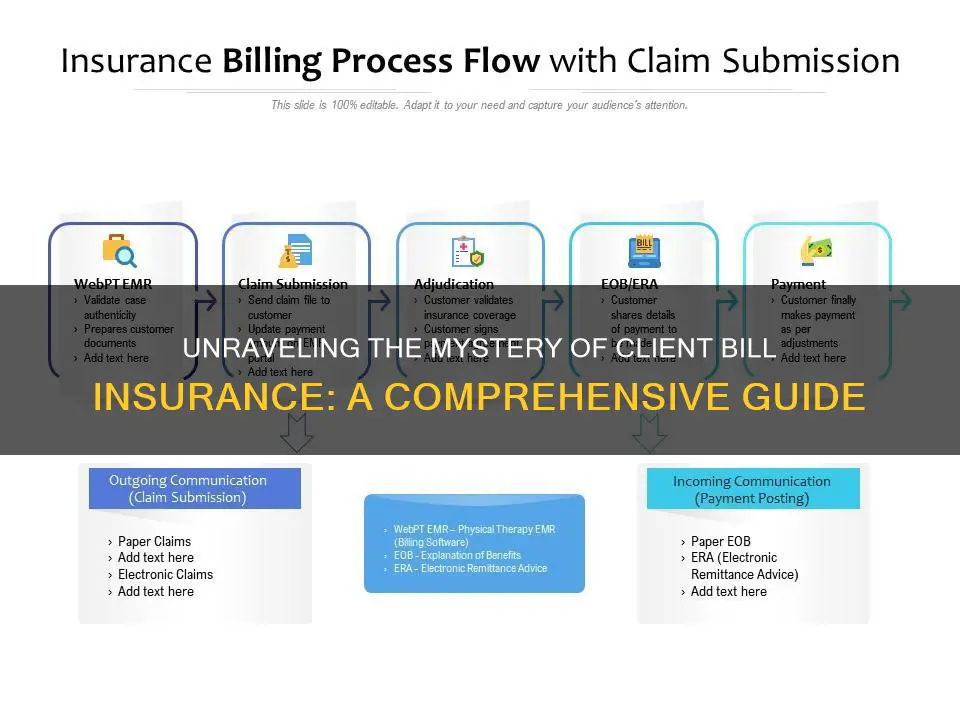

Billing insurance for therapy sessions is a complex and often confusing process, even for seasoned professionals. It requires a good understanding of insurance jargon, claim rejections, diagnosis codes, and more. Credentialing is a crucial aspect of the process, where therapists or practices join an insurance company's provider panel, enabling them to bill the company directly and minimising billing frustrations. This involves verifying the therapist's qualifications and experience as a mental health professional. In-network providers have agreements with insurance companies to offer services at a reduced rate, making therapy more affordable for clients. However, this can limit the choice of preferred providers. Out-of-network providers, on the other hand, do not have contracts with insurance companies, giving patients greater freedom in choosing a provider but typically resulting in higher costs.

| Characteristics | Values |

|---|---|

| Definition | Client bill insurance is when a medical provider compensates a clinical laboratory for the provision of testing services on specimens from patients who are insured by commercial insurance companies. |

| Billing Claims | An insurance claim is a request made by a healthcare professional asking an insurer to cover treatment costs. |

| Claim Status | The phase during which claims are processed and evaluated for validity before a payment is approved. |

| Credentialing | The credentialing process verifies a therapist's qualifications and experience as a mental health professional. |

| CPT Codes | Current Procedural Terminology (CPT) codes are vital when filing an insurance claim. A CPT code helps insurance companies identify the types of treatment offered during therapy. |

| In-Network vs. Out-of-Network Billing | In-network providers have agreements with insurance companies that allow them to offer their services to clients at a reduced rate. Out-of-network providers do not have contracts with an insurance company, which generally leads to higher costs since the insurance plan will not cover as much of the bill. |

| Verification and Authorization | Verification of client coverage lets you confirm that a client's insurance provider will cover the therapy sessions you're offering. Pre-authorization is securing approval from an insurer before starting therapeutic interventions. |

What You'll Learn

Credentialing

The credentialing process involves several steps:

- Determine which companies you want to be credentialed with: Research and make a list of insurance companies with which you want to be credentialed. Consider the largest insurers in your area and ask other therapists about their experiences working with specific insurers.

- Gather necessary documents: Collect all the required documents, including professional liability coverage details, your license to practice, your practice tax ID number, and a completed application form.

- Apply to join the insurer's provider panel: Submit your application to the insurance company networks you wish to join. Each company may have slightly different requirements, so be sure to check and provide exactly what they need.

- Complete the Council for Affordable Quality Healthcare (CAQH) application: Most major insurers require the CAQH application. You will need to apply for credentialing, receive a CAQH number, and then complete the CAQH application.

- Follow up: The credentialing process can take several months. Stay in regular contact with the insurance companies to ensure your application is progressing and provide any additional information promptly.

Once your credentialing is approved, you will receive access to the provider portion of the insurance company's website. This will allow you to view client policy information, claims already paid, and claims in the queue. It is important to maintain your credentials by keeping your CAQH profile updated and renewing your credentials as required.

Understanding the Face Value of Term Insurance: Unraveling the Mystery

You may want to see also

In-network vs. out-of-network billing

When it comes to health insurance, understanding the difference between in-network and out-of-network billing can help you avoid unexpected costs. In-network health care providers have negotiated specific discounted rates with insurance companies, so the cost of services rendered by these providers is more predictable. On the other hand, out-of-network providers do not have a contract or agreement with your insurance company and have not agreed on a negotiated rate for their services. This means that you may be responsible for higher out-of-pocket costs when using an out-of-network provider.

When a doctor, hospital, or other provider accepts your health insurance plan, they are considered in-network or participating providers. These providers have agreed to accept the insurance company's allowable amount for their services, which is usually less than their standard charges. For example, a doctor may charge $150 for a service, but the insurance company's allowable amount is only $90. As a member of that insurance plan, you would only be responsible for paying the $90, saving you money.

Conversely, out-of-network providers do not accept the insurance company's allowable amount. If you go to an out-of-network doctor or provider, you will likely be responsible for paying the difference between the provider's full charge and your insurance plan's allowable amount. This is known as balance billing. For example, if the provider charges $160 for an office visit, but your insurance plan's allowable amount is only $120, you may have to pay the remaining $40 out of pocket.

Different types of health plans have different rules regarding out-of-network coverage. Some plans, like HMOs and EPOs, generally do not reimburse out-of-network providers at all, except in emergency situations. This means that you would be responsible for the full amount charged by the out-of-network provider. Other plans, like PPOs, include out-of-network benefits, but you will usually pay a higher percentage of the cost. For instance, your insurance plan may cover 80% of the cost for an in-network doctor, but only 60% for an out-of-network doctor.

It is important to understand your health insurance coverage and which providers are in-network and out-of-network. Planning ahead and staying within your plan's network can often help you avoid balance billing and unexpected costs. Additionally, knowing the specific rules and protections regarding out-of-network billing in your state can also help you navigate these situations effectively.

The Risky Business of Lying on Short-Term Insurance Policies

You may want to see also

CPT codes

CPT, or Current Procedural Terminology, is a set of medical codes used by physicians, health professionals, hospitals, outpatient facilities, and laboratories to describe the procedures and services they perform. CPT codes are used to track and bill medical, surgical, and diagnostic services. Insurers use CPT codes to determine how much money to pay providers.

The American Medical Association (AMA) developed CPT codes to ensure that all healthcare providers have a uniform system for reporting the services they give to patients. The CPT code system is managed by the AMA, which updates the CPT code set annually to reflect changes in healthcare. The CPT code set is divided into three categories:

Category I CPT Codes

Category I CPT codes are the most common and widely used set of codes within CPT. They describe most of the procedures performed by healthcare providers in inpatient and outpatient offices and hospitals. These codes are numeric and are five digits long. They are divided into six sections: Evaluation and Management, Anesthesia, Surgery, Radiology, Pathology and Laboratory, and Medicine.

Category II CPT Codes

Category II CPT codes are supplemental tracking codes used primarily for performance management. They are alphanumeric, consisting of four numbers and the letter F. The use of these codes is optional and not required for correct coding.

Category III CPT Codes

Category III CPT codes are temporary alphanumeric codes for new and developing technology, procedures, and services. They are used for data collection, assessment, and, in some instances, payment of new services and procedures that do not meet the criteria for a Category I code. These codes are also five characters long, consisting of four digits and the letter T.

Each CPT code corresponds to a specific procedure or service. For example, the code 99214 is used for a general check-up, while the code 90658 is used for the administration of a flu shot. CPT codes are an integral part of the billing process, telling the insurance payer which procedures the healthcare provider would like to be reimbursed for.

Capitalization Conundrum: Navigating the World of Insurance Terminology

You may want to see also

Deadlines and payment schedules

Therapists generally must be reimbursed within 30 days. However, coding errors can cause delays, so it is important to monitor each bill sent out. If reimbursement is not received within 30 days, it is advisable to follow up with the insurer. To expedite reimbursement, it is crucial to discuss insurance policies with clients, verify coverage and reimbursement rates, and help clients navigate insurance reimbursement.

Understanding Renewable Term Insurance: Unraveling the Benefits and Mechanics

You may want to see also

Handling rejections and denials

Reasons for Rejections and Denials

Rejections and denials are two similar issues, both resulting in non-payment. Rejections often stem from simple errors in a submission, such as incorrect practice tax ID numbers or patient identifiers. Denials, on the other hand, can be due to keystroke errors, services not being covered, or the provider being out-of-network.

How to Handle Rejections and Denials

It is important to carefully review all notifications regarding the claim. If the claim is denied, the notification should specify the reasons and outline the procedures and documentation required to resubmit the claim or file an appeal. If the notification is unclear, contact the insurance company for more information.

If the denial is improper, you may appeal the decision according to the insurance company's guidelines. Be persistent and do not delay in submitting or resubmitting your appeal. Familiarize yourself with the appeals process and be sure to include supporting documents, such as session notes and treatment plans, to establish the necessity of services.

Preventing Rejections and Denials

To prevent rejections and denials, verify your client's insurance coverage prior to each visit. Additionally, ensure that you are billing the correct insurance provider as the primary, secondary, etc. Use a clearinghouse to process your electronic claims, as this will reduce the number of rejected claims.

Understanding Your Insurance Bill: A Step-by-Step Guide to Reading and Interpreting Your Statement

You may want to see also

Frequently asked questions

Client bill insurance is when a therapist or medical practice bills an insurance company directly for the services they have provided to a client. This is done by submitting a claim to the insurance company.

Directly billing insurance companies can reduce the economic burden on the client, as they won't have to pay upfront and wait for reimbursement. It can also be more profitable for therapists, as they can serve clients who cannot afford to pay for coverage on their own.

The process for billing insurance companies involves several steps:

- Credentialing: The therapist or practice must join the insurance company's provider panel and get credentialed to prove their qualifications and competence.

- Understanding terminology: It is important to understand insurance industry jargon, such as CPT codes, claim status, and billing claims.

- Knowing the client's insurance plan: Therapists should verify the client's insurance coverage, including any deductibles, copays, and coinsurance.

- Submitting claims: Claims must be submitted correctly and on time, including filling out insurance claim forms with detailed and specific information.

- Handling rejections and denials: If a claim is rejected or denied, therapists can appeal the decision by providing supporting documents.