When a client has multiple insurance coverages, the first payer responsible for the remittance of the claim is known as the primary insurance, and the second payer is known as the secondary insurance. The primary insurance is responsible for paying their portion of the contracted rate as per the client's insurance plan, and the secondary insurance will often cover the client's copay or sometimes more. It is important to understand the difference between primary and secondary insurance to successfully submit insurance claims for your clients. The order in which a client's claims need to be processed is referred to as the Coordination of Benefits (COB). The client does not get to choose which insurance is primary and which is secondary—this is determined by the insurance payers. Typically, the primary insurance will be the insurance plan under which the client is the primary subscriber.

| Characteristics | Values |

|---|---|

| When to bill secondary insurance | When there is a remaining balance after the primary insurance has paid |

| Order of billing | First, bill the primary payer, then bill the secondary payer |

| Primary payer | The first payer responsible for the remittance of the claim |

| Secondary payer | The second payer responsible for the remaining balance of the claim |

| Who decides which insurance is primary and which is secondary | The insurance payers |

| How to add a client's secondary insurance | Navigate to the client's Overview page, click Edit > Billing and Insurance, scroll to their already entered insurance information, click +Insurance Info, select Secondary Insurance, fill out the relevant information |

| How to create a secondary insurance claim | Within SimplePractice, create a primary claim, then click the Create Secondary Claim button |

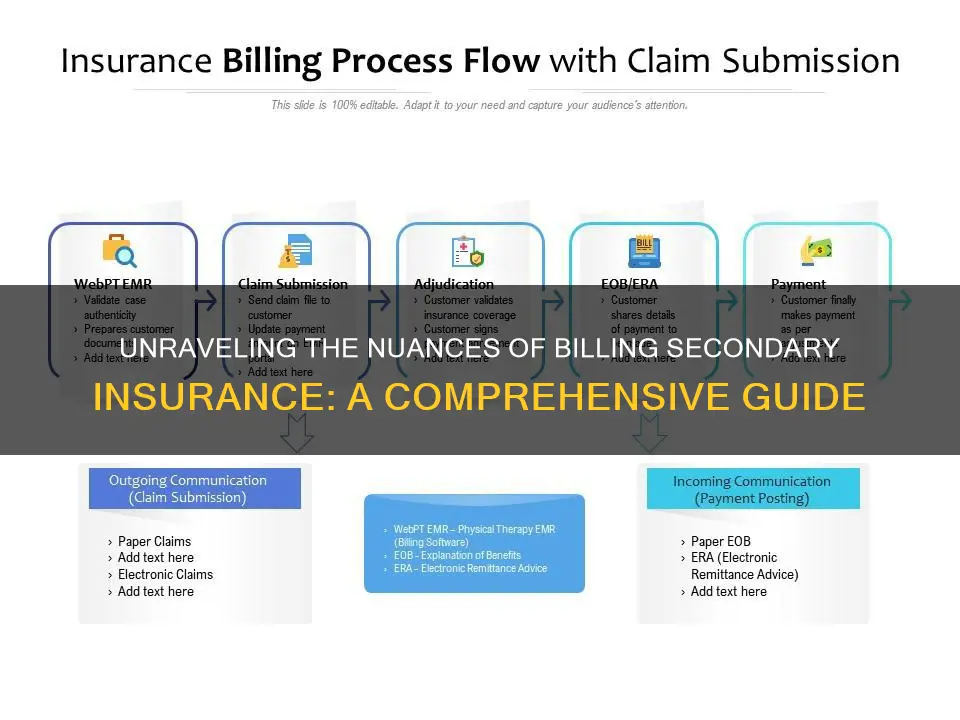

| How to file a secondary insurance claim | File a primary claim, receive a finalized claim status of Paid, Denied, or Deductible, receive an Explanation of Benefits (EOB) or Electronic Remittance Advice (ERA) from the payer, list the necessary remittance information on the secondary claim |

What You'll Learn

Understanding primary and secondary insurance

When a client has more than one form of insurance coverage, the first payer responsible for the remittance of the claim is known as the primary insurance, and the second payer is known as the secondary insurance. The client does not get to choose which insurance is their primary insurance—this is determined by the insurance payers. Typically, the insurance under which the client is the primary subscriber is the client's primary insurance. For example, if a client has insurance coverage from their employer but also has coverage through their spouse's employer, the insurance coverage through their own employer would be primary, and the coverage under their spouse's plan would be secondary.

If a client has two forms of insurance coverage, and one of those plans is TriCare or Medicaid, it is likely that the TriCare or Medicaid coverage is secondary. For Medicare, there are varying instances in which Medicare coverage might be primary or secondary. If you are unsure about which insurance is primary and which is secondary, it is recommended to reach out to the payers to get an answer directly from them.

When billing for primary and secondary claims, the primary claim is sent before the secondary claim. Once the primary payer has remitted the primary claim, you can then send the claim to the secondary payer. It is important to note that the primary and secondary claims are not billed at the same time.

Converting Term Insurance: Timing the Switch for Maximum Benefits

You may want to see also

Adding a client's secondary insurance

Step 1: Navigate to the Client's Profile

Begin by accessing the client's profile in your billing software or insurance management system. This is typically done by clicking on the client's name or account.

Step 2: Edit Billing and Insurance Information

Once you are on the client's profile page, locate the "Edit" or "Billing and Insurance" tab. This may be found under a dropdown menu or as separate options. Click on the appropriate tab to proceed.

Step 3: Add New Insurance Information

Look for an option to add new insurance information. This could be a button or link labelled "+Insurance Info", "Add Insurance", or something similar. Clicking on this will allow you to input the new insurance details.

Step 4: Select Insurance Type

When adding the new insurance, you will need to specify the type of insurance. In this case, select "Secondary Insurance" from the available options. This step is crucial in differentiating between primary and secondary insurance coverages.

Step 5: Fill Out Relevant Information

Fill out all the necessary details for the secondary insurance. This includes information such as the payer, member ID, policy number, and any other relevant details. It is important to ensure that all information is accurate to avoid issues with claims.

Step 6: Upload Insurance Card (Optional)

If possible, upload a copy of the client's insurance card. This can be done by scanning or taking a picture of the card. Including the front and back of the card ensures that all necessary information is captured.

Step 7: Save the Information

Once all the details have been entered, click "Save" or a similar option to store the new secondary insurance information.

By following these steps, you will successfully add a client's secondary insurance to their profile. This ensures that you have all the necessary details readily available when creating and submitting insurance claims.

Understanding the Fine Print: Navigating Insurance Policies and Their Terms and Conditions

You may want to see also

Creating a secondary insurance claim

Firstly, it is crucial to understand the difference between primary and secondary insurance. Primary insurance is the patient's main coverage, and the insurer pays towards the claim first. The secondary insurance, which is an additional plan, pays a portion or all of the remaining balance after the primary insurance. The secondary insurance won't cover the deductible of the primary insurance, and patients may still be responsible for copays or coinsurance.

Before submitting a secondary insurance claim, ensure that the patient's secondary insurance information is recorded on the file. This includes demographic information, such as their name, birthdate, and insurance plan subscription. It is also essential to check eligibility and verify insurance for each plan. If you are unsure which plan is primary, ask the patient to verify the Coordination of Benefits (COB) or contact the insurers.

Once you have confirmed the primary insurance, submit the claim to the primary insurer. After the primary insurer processes the claim, note the allowable amount, patient responsibility, and any adjustments.

Now, you can proceed to submit the claim to the secondary insurer. This can be done directly to the payer or through a claims clearinghouse. When submitting the claim, include the original claim amount, the amount paid by the primary insurer, and the reasons why the primary insurer didn't pay the entire claim. Additionally, include the remittance information and Explanation of Benefits (EOB) to avoid a claim denial.

After the secondary insurance pays their portion of the claim, forward any remaining balance to the patient.

The Unseen Protector: Understanding the Role of a Binder in Insurance

You may want to see also

Entering information to file a secondary claim

Once you have billed the primary payer, submitting a claim to the secondary insurance is similar to any other claim. However, there are some additional details you need to include for a successful secondary claim.

Firstly, you must include the total amount billed initially, and how much the primary insurer paid. Secondly, you need to detail why the primary insurer didn't pay the full balance. This is crucial to a seamless secondary claim process. You should also include the remittance information and the Explanation of Benefits (EOB) from the primary insurer. This will help to avoid a claim denial from the secondary insurer.

If you are using SimplePractice, you will need a primary claim that has been successfully processed by the payer. This means the primary claim has been given a finalized claim status of Paid, Denied, or Deductible. You will also need an EOB, ERA, or payment report from the payer or a SimplePractice payment report to complete the next steps.

If you are using TherapyNotes, you will need to ensure that the secondary insurance information is included in the client's chart. You will also need to verify that any billing line items that have already been submitted are updated to include the secondary insurance information.

Once you have the claim prepared, you can submit it to the secondary insurance. You can either submit it directly to the payer or through a claims clearinghouse. If you submit it directly, you will not incur any additional service costs, and you will deal directly with the insurer. However, you will be responsible for catching any errors. If you use a clearinghouse, they will review the claim and check it for errors, and you will benefit from their support.

Uncovering the Mystery of 'Cappers': Understanding Insurance Terminology

You may want to see also

Common secondary claim scenarios

Client's copay/coinsurance is covered by the secondary insurance payer:

In this scenario, the primary payer covered your in-network rate, and the client's copay is being submitted to the secondary payer. There may also be a remaining amount that was written off.

Client's deductible is covered by the secondary insurance payer:

In this scenario, the client's deductible is not met. The primary insurance paid nothing, there is an amount written off, and you are submitting the client's responsibility amount to their secondary insurance plan.

Primary claim is denied as out-of-network:

In this scenario, you are out of network with the client's primary insurance, and the primary claim was denied so that it can be billed to their secondary insurance.

Medicare crossover claims:

Medicare is a unique payer in that they will submit a secondary claim on your behalf, as long as the client's Coordination of Benefits is set up. This is referred to as a crossover claim.

It's important to note that the specific steps for submitting secondary claims may vary depending on the software or platform you are using. Additionally, the rules and guidelines for primary and secondary insurance can differ based on the type of insurance, the client's situation, and other factors.

Exploring Short-Term Insurance Options with Horizon

You may want to see also

Frequently asked questions

When clients have more than one form of insurance coverage, the first payer responsible for the remittance of the claim is known as the primary insurance, and the second payer is known as the secondary insurance.

First, you will submit the claim to the primary payer and once the primary payer has remitted on the claim, then you can submit the claim to the secondary payer.

When sending claims to secondary payers, they will want to see the total billed amount of the claim, the amount the primary insurance paid on the claim, and the reasons why the billed amount was not paid in full by the primary payer.