A Body Mass Index (BMI) of 40.6 is considered dangerously overweight and puts individuals at a severe risk of developing weight-related health problems such as heart disease, diabetes, high blood pressure, gall bladder disease, circulation problems, and some cancers. A BMI over 40 is also used by insurance companies to determine eligibility for weight loss surgery coverage. While a BMI of 40.6 is likely to affect the cost of insurance premiums, it may still be possible to obtain affordable life insurance.

| Characteristics | Values |

|---|---|

| BMI over 40 | Dangerously overweight |

| BMI over 40 | Severe risk of heart disease, diabetes, high blood pressure, gall bladder disease, circulation problems, and some cancers |

| BMI over 40 | Likely to be considered high risk by insurers |

| BMI over 40 | Likely to affect the cost of insurance premiums |

| BMI over 40 | May still be possible to get affordable insurance |

| BMI over 40 | May require a medical exam for insurance |

| BMI over 40 | May be eligible for weight loss surgery |

What You'll Learn

- A BMI over 40 is considered dangerously overweight and puts individuals at severe risk of heart disease, diabetes, and other health issues

- Insurance companies use BMI to determine eligibility for weight loss surgery coverage

- A high BMI can lead to higher insurance premiums due to the increased risk of developing health conditions

- Life insurance is generally available for individuals with a BMI over 40, but it may be more expensive and require additional medical information

- Losing weight before applying for a policy can help individuals receive better insurance rates, but only partial credit is given for recent weight loss

A BMI over 40 is considered dangerously overweight and puts individuals at severe risk of heart disease, diabetes, and other health issues

A Body Mass Index (BMI) over 40 is considered "severely obese" and puts individuals at a severe risk of developing serious health issues.

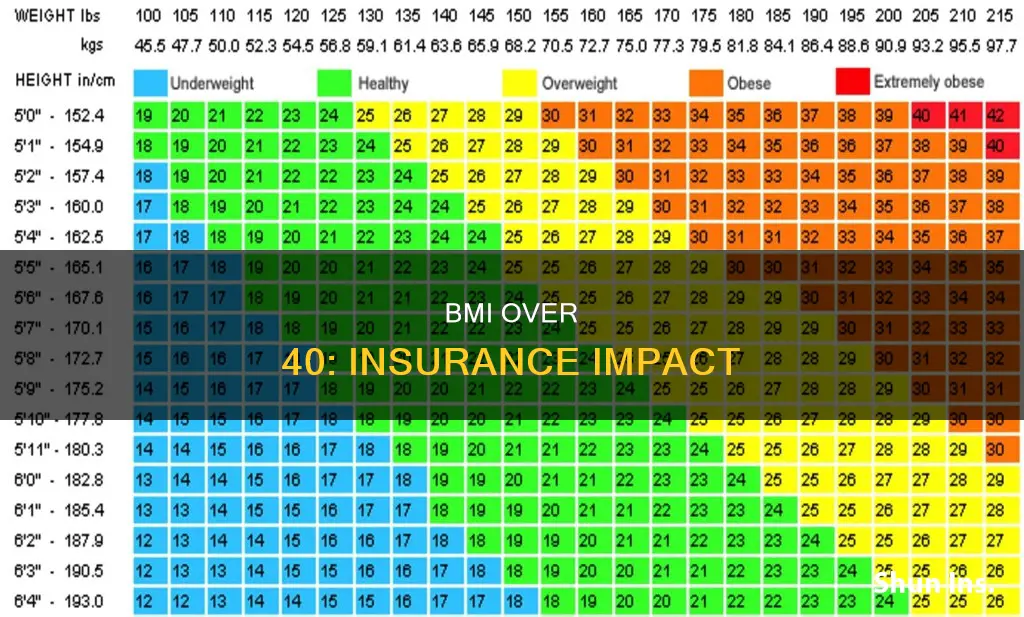

BMI is a screening tool used by healthcare providers to estimate the amount of body fat a person has by using their height and weight measurements. While it is not always an accurate representation of body fatness, it is a quick and useful indicator of overall health. A BMI of 40 or above is considered dangerously overweight and is associated with a range of health risks.

Individuals with a BMI over 40 are at a severe risk of developing heart disease, including coronary heart disease, stroke, and high blood pressure. They are also at risk of developing type 2 diabetes, gallbladder disease, circulation problems, and certain types of cancer, such as breast cancer and bowel cancer. Additionally, obesity can affect an individual's quality of life and contribute to mental health problems, such as depression, and can impact self-esteem.

From an insurance perspective, a BMI of 40 or above may impact an individual's eligibility for weight loss surgery coverage. Insurance companies typically consider a BMI of 40 or more as one of the criteria for determining eligibility for weight loss surgery. Furthermore, a high BMI may affect life insurance rates, as insurers take into account an individual's weight and height when setting premiums. While a person with a BMI over 40 is unlikely to be rejected for life insurance coverage, their premiums may be higher due to the increased risk of developing certain health conditions.

Unlocking the Tricare Insurance Billing Process: A Comprehensive Guide

You may want to see also

Insurance companies use BMI to determine eligibility for weight loss surgery coverage

A person's Body Mass Index (BMI) is a calculation that helps determine a healthy body weight based on their height. It is also used by insurance companies to determine eligibility for weight loss surgery coverage.

Insurance companies generally consider you eligible for weight loss surgery coverage if your BMI is 40 or more. If your BMI is 35 to 40 and you have a major health complication, such as cardiovascular disease, high blood pressure, high cholesterol, or significant heart disease, you may also be eligible. However, if your BMI is below 35, your insurance provider will likely deny coverage for weight loss surgery.

In addition to BMI requirements, insurance companies may also require you to meet other criteria to qualify for weight loss surgery coverage. These criteria can include:

- Past attempted weight loss: Most insurance companies require documentation of sufficient efforts to lose weight before approving coverage for weight loss surgery. This can include completing a medically supervised weight-loss program or making other recommended lifestyle changes.

- Psychological evaluation: This evaluation ensures that individuals have realistic expectations of the results from surgery and the information and support they need for long-term success.

- Smoking cessation: Most insurance companies require individuals to quit smoking before approving weight loss surgery.

- No substance abuse: Evidence of substance abuse can disqualify individuals from weight loss surgery coverage.

- Age requirements: Weight loss surgery is generally only available to patients who are 18 years or older, although some plans allow for surgery under the age of 18.

It is important to note that insurance coverage for weight loss surgery can vary depending on the company and specific policy. Therefore, it is recommended to contact your insurance provider directly to understand their specific requirements and criteria for coverage.

The Mystery of Insurance-Only Billing: Unraveling the Complexities of Healthcare Reimbursement

You may want to see also

A high BMI can lead to higher insurance premiums due to the increased risk of developing health conditions

A body mass index (BMI) of 40.6 is considered dangerously overweight and puts individuals at a severe risk of developing serious health conditions. These include heart disease, diabetes, high blood pressure, gallbladder disease, circulation problems, and certain types of cancer.

Due to the increased risk of developing these health issues, a high BMI can lead to higher insurance premiums. Insurers take into account an individual's weight and height when setting premiums, and a high BMI is associated with a higher risk of weight-related health problems. This means that those with a high BMI are more likely to make insurance claims, resulting in higher costs for insurance companies, which are then passed on to the consumer in the form of higher premiums.

In addition, insurance companies set rates based on how risky they determine an applicant to be. A high BMI is linked to an increased chance of developing serious medical issues, and the insurer cannot adjust premiums if an individual's health conditions change. As such, a person with a high BMI is considered a high-risk applicant and is likely to be offered insurance at a higher rate.

While a high BMI can lead to higher insurance premiums, it is important to note that other factors are also considered when determining insurance rates. These include age, gender, smoking status, and existing health conditions. Furthermore, some insurance companies have different BMI thresholds and may offer more favorable rates to those who are considered overweight or obese.

Comparing quotes from multiple insurers can help individuals find the best available deal and secure affordable coverage, even with a high BMI. Leading a healthy lifestyle, quitting smoking, and moderate alcohol consumption can also help lower insurance quotes.

Juggling Multiple Policies: Navigating Short-Term Insurance Overlap with New Coverage

You may want to see also

Life insurance is generally available for individuals with a BMI over 40, but it may be more expensive and require additional medical information

A person with a BMI of over 40 is considered to be in the "dangerously overweight" category and is at severe risk of developing heart disease, diabetes, high blood pressure, gallbladder disease, circulation problems, and certain types of cancer.

When it comes to life insurance, a high BMI can result in higher premiums due to the increased risk of developing certain health conditions. While life insurance is typically available for individuals with a BMI over 40, the application process may be more complex and costly.

Insurers will often request additional medical information, such as waist measurements, details of any recent surgeries or treatments, current medications, and family medical history. In some cases, obese applicants may also be required to undergo a medical examination.

The cost of life insurance for individuals with a BMI over 40 will depend on various factors, including age, health, lifestyle choices, and the specific BMI value. It is recommended to compare quotes from multiple insurers to find the most suitable option.

Additionally, losing weight can positively impact life insurance options and premiums. Lowering one's BMI can reduce the cost of premiums by decreasing the risk associated with weight-related health complications. However, it is important to note that weight loss surgery may lead to higher premiums or even temporary denial of coverage due to the associated health risks and complications.

Term Insurance Comparison: Unraveling the Fine Print for Smart Choices

You may want to see also

Losing weight before applying for a policy can help individuals receive better insurance rates, but only partial credit is given for recent weight loss

Losing weight can help individuals secure more affordable insurance rates, but it is not always easy to find a suitable policy, especially if you are overweight or obese. A person with a Body Mass Index (BMI) of over 30 is considered to be significantly overweight and is at risk of heart disease, diabetes, high blood pressure, and certain types of cancer.

BMI is a calculation that helps determine a healthy body weight based on an individual's height. A higher BMI increases the risk of weight-related health problems, and insurance companies use it to determine eligibility for weight loss surgery coverage and to set premiums. A BMI of 25-30 is considered overweight, and anything over 30 will likely affect the cost of insurance premiums.

If your BMI is over 40, you are considered dangerously overweight, and your insurance options may be limited. Losing weight before applying for a policy can help you access better insurance rates, but it is important to note that only partial credit is given for recent weight loss. Insurance companies want to know that weight loss is sustained, so they focus on long-term weight trends rather than short-term snapshots. They may also require proof that other weight loss methods have been attempted without success before covering weight loss surgery.

Additionally, it is important to be honest about your weight on insurance applications. Lying about your weight could be considered fraud and could result in your policy being canceled or your beneficiary's claim being denied.

Ameritas Insurance: Updating Your Address

You may want to see also

Frequently asked questions

Body Mass Index (BMI) is a calculation that helps determine a healthy body weight based on a person's height. It is also used by insurance companies to determine eligibility for weight loss surgery coverage.

A BMI of 24 or less is considered a healthy weight. A BMI of 25-29.9 is considered overweight, and a BMI of 30 and above is considered obese.

Life insurance rates are typically higher for individuals with a high BMI as insurers take weight and height into account when setting premiums. A high BMI is associated with an increased risk of developing health conditions, which can impact the cost of coverage.

While a high BMI alone is usually not a reason for denial, it can impact your eligibility when combined with other health conditions. If your BMI is over 40, you are considered "dangerously overweight," and your insurance rates may be significantly affected.

The maximum BMI level for life insurance can go up to 45 or even 47 with some mainstream insurers, and some specialist insurers can provide coverage for individuals with a BMI of up to 53.