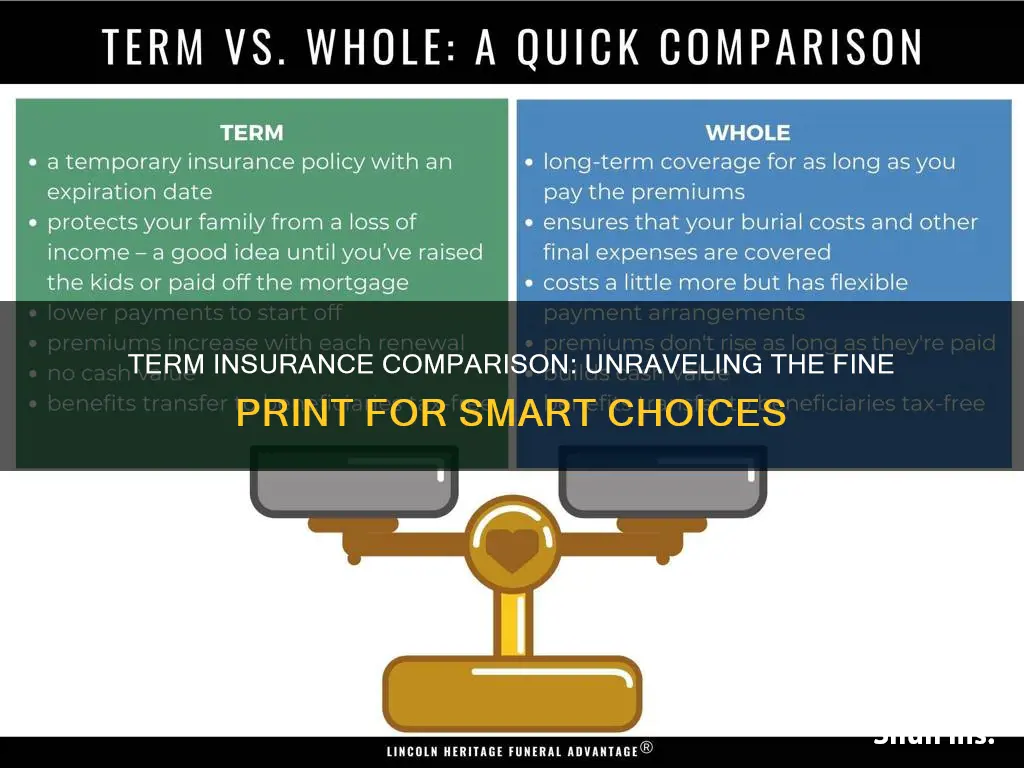

Term insurance is a type of life insurance that provides coverage for a specific period, or term. This type of insurance offers a death benefit to the beneficiary or nominee in the event of the policyholder's death during the policy term. Term insurance is a cost-effective way to ensure financial protection for your loved ones, as it offers high coverage at a low premium. When comparing term insurance plans, it is important to consider factors such as premium payment options, coverage amount, riders offered, policy duration, and the claim settlement ratio of the insurer. By using an online term plan premium calculator, individuals can compare the premium amount payable based on the chosen coverage. Additionally, term insurance plans offer flexible payout options, such as lump-sum or regular instalments, to cater to the diverse needs of families.

| Characteristics | Values |

|---|---|

| Purpose | Financial protection for your family in case of your death |

| Type of insurance | Life insurance |

| Coverage period | Specific number of years |

| Benefit | Death benefit to the beneficiary or nominee |

| Premium | Depends on age, gender, health, lifestyle, etc. |

| Payment options | Monthly, quarterly, or yearly |

| Riders | Critical illness, accidental death, permanent disability, etc. |

What You'll Learn

- Premium Payment Options: Term insurance plans offer the flexibility to choose from various premium payment options, including monthly, quarterly, or yearly payments

- Premium Amount vs. Coverage: The premium payable is determined by the coverage amount chosen; the higher the coverage, the higher the premium

- Riders: Riders such as critical illness, waiver of premium, and accidental death/disability cover can be added to the base plan for enhanced protection

- Policy Duration: Opt for a policy with a longer duration to ensure coverage during your working years and beyond retirement

- Claim Settlement Ratio: Compare the claim settlement ratios of different insurers to assess their credibility and track record of settling claims

Premium Payment Options: Term insurance plans offer the flexibility to choose from various premium payment options, including monthly, quarterly, or yearly payments

Term insurance plans offer a range of premium payment options to suit different financial circumstances and needs. The flexibility to choose from various premium payment frequencies is one of the key benefits of term insurance. The most common premium payment options are monthly, quarterly, or yearly payments, also known as regular premium payments. This option is recommended due to its affordability factor, especially for those who are salaried and belong to the middle-income group. It allows individuals to pay their premiums in smaller, more manageable instalments rather than a large lump sum. This helps maintain financial liquidity, which is crucial during crises, ensuring that individuals can safeguard their family's health while meeting other expenses.

The regular premium payment option also provides the advantage of flexibility, as individuals can choose to pay at intervals that align with their income frequency. For example, those who are paid monthly may find it more convenient to pay their insurance premiums on a monthly basis, while those who receive quarterly bonuses or investments returns may prefer to pay their premiums quarterly. This option helps individuals budget effectively and ensures that the financial burden of insurance premiums is spread out over time.

In addition to the regular premium payment option, term insurance plans also offer limited and single premium payment options. The limited premium payment option allows policyholders to pay their premiums for a shorter span of time, such as 5 or 10 years, while still enjoying the benefits of an insurance cover for a longer period. This option is useful for those who want to be relieved of the long-term commitment of paying insurance premiums and can be beneficial for those who experience a sharp rise in their incomes, such as through a job posting abroad or successful business ventures.

On the other hand, the single premium payment option involves paying the entire premium amount in one go at the time of policy purchase. While this option may appear more expensive at first glance, it is important to consider the impact of inflation. Consulting an advisor or using an online premium calculator can help individuals make informed decisions and choose the most suitable premium payment option for their needs.

The Perils and Pitfalls of Insurance: Understanding the Risks Covered by Your Policy

You may want to see also

Premium Amount vs. Coverage: The premium payable is determined by the coverage amount chosen; the higher the coverage, the higher the premium

The premium payable on a term insurance policy is determined by the amount of coverage chosen. The more coverage you opt for, the higher your premium will be. This is because the premium reflects the insurer's predicted likelihood of having to pay out on a claim. The more coverage you have, the more likely it is that the insurer will have to pay out, and the more they will charge you for that risk.

The premium is the amount you pay to your insurer at regular intervals to keep your policy active. You can usually choose to pay your premium monthly, quarterly, every six months, or annually, depending on your insurance company and specific policy. If you fail to pay your premium, your policy will be cancelled, and you will lose financial protection for claims.

The price of your premium will depend on several factors, including the type of insurance, your age, your health, your personal information, and your location. For example, older people tend to pay more for health insurance because they are more likely to need medical care. Similarly, younger, less experienced drivers pay more for car insurance than older drivers because they are considered higher-risk.

The type of coverage you choose will also affect the price of your premium. Generally, the more comprehensive the coverage, the higher the premium. For instance, a health insurance policy with a $1,000 deductible will be cheaper than one with a $5,000 deductible. Likewise, a car insurance policy with a $0 deductible will be pricier than a policy with a $500 deductible.

In addition to the type of coverage, the amount of coverage will also impact your premium. The greater the amount of coverage, the higher the premium. For example, it will cost more to insure a $400,000 home than a $200,000 home.

It's important to note that while choosing a higher deductible can reduce your premium, it also means you'll have to pay more out of pocket before your insurance coverage kicks in. Therefore, when selecting a policy, it's crucial to consider your situation and the likelihood of needing to use it.

The Power of Collaboration: Unlocking New Opportunities in the Insurance Industry

You may want to see also

Riders: Riders such as critical illness, waiver of premium, and accidental death/disability cover can be added to the base plan for enhanced protection

Term insurance riders are add-ons to a base term insurance policy that provide additional coverage or benefits. They are designed to enhance the protection offered by the base plan and can be added by paying a nominal extra cost. Here is a detailed overview of the riders mentioned:

Critical Illness Rider

The critical illness rider provides financial support in the event of a critical illness diagnosis. It pays out a lump sum to help with treatment costs, which can be extremely high. The payout can be used to cover ambulance charges, doctor's fees, and other medical expenses. Critical illnesses covered may include heart attack, cancer, stroke, kidney failure, and more. This rider can be purchased during the inception of the policy or any subsequent policy year.

Waiver of Premium Rider

The waiver of premium rider waives off future premium payments under certain conditions, such as total and permanent disability, accident, or death of the policyholder. This rider ensures that the policy remains active even if the policyholder is unable to pay premiums due to job loss or other financial constraints. It provides peace of mind and prevents policy lapse due to missed premium payments.

Accidental Death/Disability Rider

The accidental death benefit rider provides an additional sum assured to the beneficiary/nominee in the event of the policyholder's death due to an accident. This rider typically comes with a provision for a lump-sum payment, with the percentage of the additional sum calculated based on the original sum assured.

The accidental disability rider, often coupled with the accidental death rider, covers the risk of the policyholder becoming permanently disabled due to an accident. It provides a source of income, paying a certain percentage of the sum assured to the policyholder regularly for a specified period following the accident.

Adding these riders to a term insurance plan enhances the protection offered and provides peace of mind by addressing specific concerns, such as accidental death, disability, and critical illness. They allow for customization of the policy to suit an individual's unique needs and circumstances.

Exploring Healthcare Choices: Beyond Short-Term and ACA Insurance Plans

You may want to see also

Policy Duration: Opt for a policy with a longer duration to ensure coverage during your working years and beyond retirement

When choosing a term insurance plan, it is important to consider the policy duration or term. This refers to the period during which the benefits of the plan remain active and is determined at the time of purchase. Opting for a longer policy duration ensures that you have adequate coverage during your working years and beyond retirement. Here are some reasons why choosing a policy with a longer duration is beneficial:

- Financial Security: A longer policy duration provides financial protection for a more extended period, giving you peace of mind knowing that your loved ones will be taken care of even after you retire. This is especially important if you have financial dependents such as a spouse, children, or elderly parents who rely on your income.

- Coverage for Outstanding Loans: If you have taken out a loan, such as a mortgage, a longer policy duration ensures that your family can use the payout from the term insurance plan to pay off any outstanding debt and secure their home.

- Education Expenses: The funds received from a term insurance plan with a longer duration can also be used to fund your children's education, ensuring they can pursue their academic goals without financial burden.

- Medical Emergencies: As you age, the risk of developing critical illnesses or facing accidental disabilities increases. A longer policy duration provides coverage against these unforeseen events, giving you and your family financial security during medical emergencies.

- Post-Retirement Income: Retirement often brings a reduction in income, and a longer policy duration ensures that you have a source of income during this phase of your life. This can help maintain your standard of living and cover any medical expenses that may arise.

- Flexibility: Opting for a longer policy duration gives you the flexibility to choose a premium payment option that suits your financial situation. You can opt for regular payments throughout the policy term or limited payments for a fixed duration.

- Legacy Planning: A longer policy duration allows you to leave a financial legacy for your loved ones. You can choose a policy with a higher sum assured and longer coverage period, ensuring that your family receives a substantial payout even after your retirement.

The Intricacies of SQ: Unraveling the Insurance Industry's Unique Acronym

You may want to see also

Claim Settlement Ratio: Compare the claim settlement ratios of different insurers to assess their credibility and track record of settling claims

When choosing a term insurance plan, it is important to compare the claim settlement ratios of different insurers. This is because the claim settlement ratio is an indicator of an insurer's credibility and track record in settling claims.

The claim settlement ratio (CSR) refers to the percentage of total claims settled out of the total claims received by an insurer in a given fiscal year. This figure helps buyers compare insurance companies and choose the most dependable insurer to meet their needs. A higher claim ratio assures a higher possibility of hassle-free claim settlement, while a delayed or denied claim defeats the purpose of investing in insurance plans.

The Insurance Regulatory Authority of India (IRDAI) calculates and publishes the claims ratio of all the insurance companies in India in its annual report. The ratio takes into account the annual disclosures of the number of claims received, settled, and outstanding by insurers at the end of every year.

Claim Settlement Ratio = (Total Number of Claims Settled / Total Number of Claims Received) x 100

For example, if an insurer received 200,000 claims in a policy year and settled 198,000 of them, its claim settlement ratio would be (198,000/200,000) x 100, which equals 98.25%.

When comparing insurers, it is important to consider their consistency in claim settlement over the past few years. A company with a consistently high claim settlement ratio indicates that it can reliably settle claims, making it a more attractive option for customers.

In summary, by comparing the claim settlement ratios of different insurers, individuals can assess their credibility and track record in settling claims, helping them make an informed decision when choosing a term insurance plan.

Understanding Reinstatement in Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

Term insurance is a type of life insurance policy that offers financial compensation to the nominees in the event of the untimely death of the policyholder during the policy term.

Term insurance provides financial protection for your family in case of your untimely death. It is also a good way to ensure that your family will be able to maintain their current lifestyle and achieve their goals.

Term insurance provides a death benefit to the nominee in the event of an unforeseen death of the life assured during the policy term. It also helps to maintain the financial stability of your family and can provide peace of mind.

Term insurance provides financial coverage to the policyholder's dependants in the event of their death during the policy term. The coverage amount is typically chosen based on the policyholder's annual income, with the thumb rule being to take a cover of 10 times their annual income.

When choosing a term insurance plan, it is important to compare the benefits and premiums of different plans. You should also consider the financial stability of the insurance provider and their claim settlement ratio. Additionally, look for plans that offer additional benefits such as critical illness coverage or accidental death coverage.