Calculating the value of your house for insurance purposes is an important step in ensuring you have adequate cover in the event of damage or loss. This process involves estimating the cost of rebuilding your property, including the structures and fixtures that make up your home, such as garages, fences, and built-in furniture. To do this, you can use a home building replacement calculator, which will take into account factors such as floor area, size, and quality of materials. Alternatively, you may opt for a professional rebuild valuation from a surveyor, builder, or architect, which can provide a more precise estimate. It is worth noting that the replacement value is different from the market value of your home and may vary depending on factors like location, design, and construction details. Regularly reviewing and updating your insurance policy is essential to ensure it reflects the current value of your home.

| Characteristics | Values |

|---|---|

| Location | The likelihood of natural disasters such as bushfires or floods |

| Design | Modern architecture, Federation, or Victorian |

| Construction details | The type of building materials used |

| Quality of construction | |

| Slope of the land | |

| Size | Floor area, number of rooms, garage spaces, and balconies |

| Special features | Solar power, pool house, or granny flat |

| Building insurance | Covers the house, garage, fences, and built-in furniture |

| Contents insurance | Covers furniture, jewellery, TVs, laptops, carpets, and curtains |

What You'll Learn

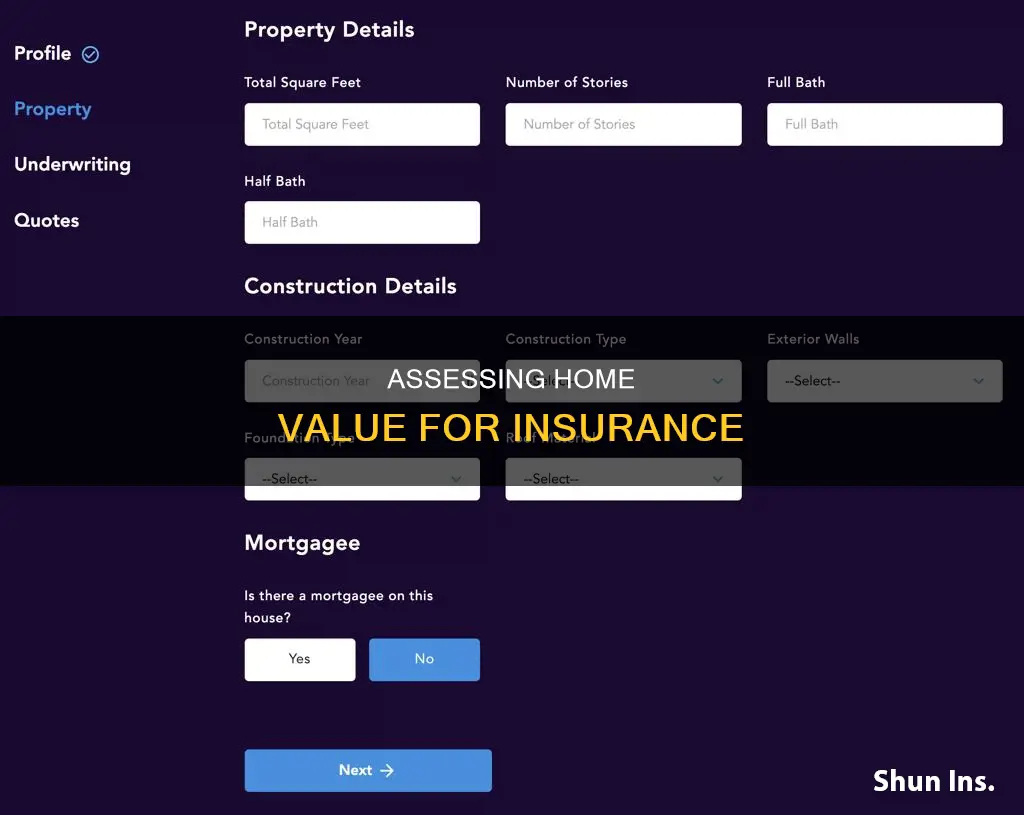

Using a home building replacement calculator

- Gather the necessary details: Before using the calculator, make sure you have information such as the area of your home in square metres, the materials used in its construction, and any additional features like a security system.

- Choose a detailed calculator: Opt for a calculator that allows you to input your specific address, rather than just your postcode. The more detailed the calculator, the more accurate the results are likely to be. Look for options to specify the number and size of rooms, construction materials, and other relevant factors.

- Compare results from multiple calculators: It's recommended to use at least three different calculators to compare results. This will give you a range of estimates and help you make a more informed decision.

- Check the included costs: Ensure that the calculator includes all relevant costs, such as demolition, architect's fees, site clearance, waste disposal, and other additional expenses that may be incurred during the rebuilding process.

- Consider the location and risk factors: If you live in an area prone to natural disasters or close to bushland, choose a calculator that takes these factors into account. The distance from your home to potential hazards can significantly impact the cost of rebuilding.

- Understand the limitations: Keep in mind that calculators provide only an estimate, and they may not take into account local government regulations or specific building standards that could affect your rebuilding costs. For a more precise estimate, consider consulting a local builder or professional valuer.

- Regularly review your insurance coverage: Building costs and market values can change over time. It's important to review your insurance coverage periodically to ensure that your sum insured is sufficient to cover the rebuilding or replacement costs at today's prices.

Farmers Insurance: Navigating Louisiana's Unique Insurance Landscape

You may want to see also

Getting a professional rebuild valuation

A rebuild valuation will take into account the cost of labour, materials, and professional fees, as well as the cost of demolishing and clearing away the remains of the original property. It is important to note that the rebuild cost is typically lower than the market value of your home, as it does not include the value of the land. However, if your home is made of non-standard materials or has specialist architectural features, the rebuild cost may be higher.

When choosing a professional to conduct your rebuild valuation, it is important to select someone with the appropriate qualifications and experience. In the UK, you can find a chartered surveyor through the Royal Institution of Chartered Surveyors. Alternatively, you can use a professional valuer, such as those certified by the Australian Valuers Institute. These professionals will have the technical knowledge and expertise to provide an accurate valuation of your property.

A rebuild valuation can give you peace of mind, knowing that in the unfortunate event of loss or damage, your insurance will cover the full cost of rebuilding your home. It can also help streamline the insurance claims process and prevent delays in settlement. Therefore, it is worth considering engaging a professional to conduct a rebuild valuation of your property.

Dashcam Discounts: Do They Impact Farmers' Insurance Policies?

You may want to see also

Including all home building structures

Calculating the value of your house for insurance purposes is a crucial step in ensuring you have adequate coverage in the event of a disaster. Here are some detailed instructions on how to include all home building structures when calculating your house value for insurance:

Understand the concept of replacement cost

The replacement cost is the amount of money required to completely rebuild your home from the ground up, including any attached structures like a deck, garage, granny flat, or pool. This value forms the basis of your homeowners insurance policy's dwelling coverage. It is important to note that replacement cost is not the same as market value, which is the amount you could sell your house for and includes the land value.

Use online calculators

Online home insurance calculators can be a handy starting point for estimating the replacement cost of your home. These calculators take into account factors such as your postcode, construction materials, square metreage, the number and size of rooms, and the slope of your land. However, it is important to remember that these calculators may not cover all the unique aspects of your home, so their estimates should be used as a guide.

Specify your address

When using online calculators, opt for those that allow you to input your specific address rather than just your postcode. This will provide a more accurate estimate, as rebuilding costs can vary significantly depending on your location.

Check for additional costs

Review the details of the calculator to ensure it includes all relevant costs. For example, check if it covers the cost of demolition, architect's fees, site clearance, waste disposal, and building permits. These costs can add up, so it's important to factor them into your calculations.

Consider the proximity to potential hazards

If you live in an area prone to natural disasters, such as bushfires, floods, or storms, choose a calculator that takes this into account. The proximity to potential hazards can significantly impact the cost of rebuilding your home and may also affect your insurance premiums.

Factor in the construction style

The construction style of your home can greatly influence the rebuilding cost. For example, an historic or architect-designed house will likely cost much more to rebuild than a standard project build. Make sure to select the appropriate construction style option in the calculator.

Include all attached structures

When calculating the replacement cost, be sure to include all attached structures, such as a deck, garage, or any other custom additions. These structures can add significant value to your home and should be covered by your insurance.

Get a professional appraisal

For a more precise estimate, consider hiring a professional appraiser or a local builder to assess the replacement cost of your home. They will inspect your property, taking into account its unique features, location, and local building costs. This method provides a more accurate valuation but may come with a higher price tag.

Remember, it is crucial to review and update your home insurance coverage periodically to ensure it keeps up with inflation and changing market conditions. By following these steps and including all home building structures in your calculations, you can be better prepared in the event of a disaster and have the necessary financial protection to rebuild your home.

Farmers Insurance Competitive Landscape in Rockwall, Texas: A Comprehensive Overview

You may want to see also

Keeping track of home improvements

Record All Improvements and Repairs:

Keep a record of all changes made to your property, no matter how minor they may seem. Improvements are more than just everyday repairs, such as fixing a cracked window or painting a room. They include any work that adds value to your home, increases its useful life, or adapts it for new uses. This could be room additions, new bathrooms, decks, fencing, landscaping, wiring upgrades, kitchen renovations, and more.

Document the Details:

When recording improvements, include as much detail as possible. Note down the dates, costs, materials used, and any professionals or contractors involved. Take photos, especially before-and-after shots, as these can be invaluable for reference. Also, keep track of any conversations or advice given by professionals, as this can be easily forgotten over time.

Organise and Store Your Records:

Create a specific folder, either physical or digital, to store all your documentation. This could include purchase orders, receipts, cancelled cheques, and any other relevant paperwork. You can also use a home report tool, such as the Porch Home Report, to help you keep track of improvements, repairs, and maintenance. These tools often provide additional insights, such as background information on professionals who have worked on your home and vital neighbourhood statistics.

Regularly Update Your Records:

Try to update your records as soon as possible after any work is completed. It's easy to forget the details of a project, especially if it's a DIY endeavour. Keeping your records up to date will ensure you don't miss any important information.

Be Aware of Tax Implications:

When it comes to taxes, your home's tax basis is essential. The cost of any improvements you make while owning the property is added to its basis, reducing the amount of gain realised when you sell it. Keep all improvement-related records for as long as you own the home and for at least three years after filing your tax returns for the year of the sale.

Understand What's Not Considered an Improvement:

Some repairs and maintenance tasks don't qualify as improvements. These include any work necessary to keep your home in good condition that doesn't add value or prolong its life, such as painting or fixing leaks. Also, any improvements with a life expectancy of less than one year when installed are not considered.

By diligently tracking your home improvements and following these guidelines, you'll be able to maintain comprehensive records, which can lead to significant savings and a better understanding of your property.

Door-Dashing and Delivering: Does Driving for DoorDash Affect Your Farmers Insurance Policy?

You may want to see also

Reviewing the replacement value annually

It is important to review the replacement value of your home insurance annually. This is because the replacement value of your home changes over time, and you want to make sure you have a full and accurate calculation so that you have enough coverage to replace your home.

The replacement cost of your home is the actual dollar amount required to rebuild your home from the ground up, including any attached structures like a deck. This is the foundation of your homeowners insurance policy. The dwelling coverage on the policy is based on the actual replacement cost of your home.

You can calculate the replacement cost of your home by using a replacement cost calculator or hiring an appraiser. A replacement cost calculator will take into account the interior and exterior features of your home, including building materials, as well as the square footage of the house. An appraiser will come to your home and thoroughly inspect it, taking photos and videos, and examining the following:

- Foundation and footings

- Structural framing and materials

- Roof condition and materials

- Plumbing and electrical fixtures, wiring, and pipe systems

- Heating and cooling equipment and systems

- Interior finishes, including walls, doors, cabinetry, as well as built-ins and other custom touches

After the inspection, the appraiser will research local market rates for construction costs, materials, and labour to produce a report with your home's replacement value.

It is recommended that you review the replacement cost of your home and discuss any changes with your insurance company at each renewal. This will ensure that the dwelling coverage on your policy is up to date and that you are insured for the correct amount.

- Check your insurance policy against the local building cost every year, as building costs can rise dramatically from year to year.

- Report any changes to your home right away, such as new flooring or an addition, as these can affect replacement costs.

- Make a video documenting your home's interior and exterior, including appliances, mechanicals, flooring, cabinets, roofing, and any other structures on your property.

Usaa: Insuring Florida Homes

You may want to see also

Frequently asked questions

You can use a home building replacement calculator or get a professional rebuild valuation. The former is a free and easy way to get an estimate within minutes, while the latter is more accurate but comes at a cost.

The value of your home for insurance depends on a number of factors, including location and the likelihood of natural disasters, design, construction details, quality of construction, slope of the land, size, and any special features.

Building insurance covers the structures and fixtures that make up your home, from the house itself to garages, fences, and built-in furniture. Contents insurance covers a wide range of items, from furniture to jewellery, electronics, and carpets.