Term insurance is a great way to ensure the security of your family in the event of your passing. It is a type of life insurance that offers protective coverage for a fixed period of time, with the payment of death benefits to the policyholder's dependents. When purchasing term insurance, one of the most important aspects to consider is the coverage amount or minimum sum assured. This amount should be carefully evaluated to meet your family's current and future needs. The minimum sum assured can be paid out in a lump sum or staggered amounts over a predetermined period. It is important to keep the term period in mind, as the sum assured may increase or decrease over time to address issues such as inflation or debt.

There are several factors to consider when determining the ideal minimum sum assured, including regular household expenses, current and future income, existing assets and liabilities, tenure of the policy, future one-time expenses, and retirement funds for dependents. By taking these factors into account, you can estimate a sufficient level of coverage from your term insurance policy to meet your family's financial needs.

| Characteristics | Values |

|---|---|

| Definition | The sum assured is the pre-decided amount payable to the policyholder or beneficiary on the occurrence of an insured event. |

| Calculation | Calculating the sum assured can be done using the Human Life Value (HLV) method, which takes into account current and future expenses, present and future earnings, and age. |

| Factors to Consider | Age, income, number of dependents, lifestyle habits, and future financial needs. |

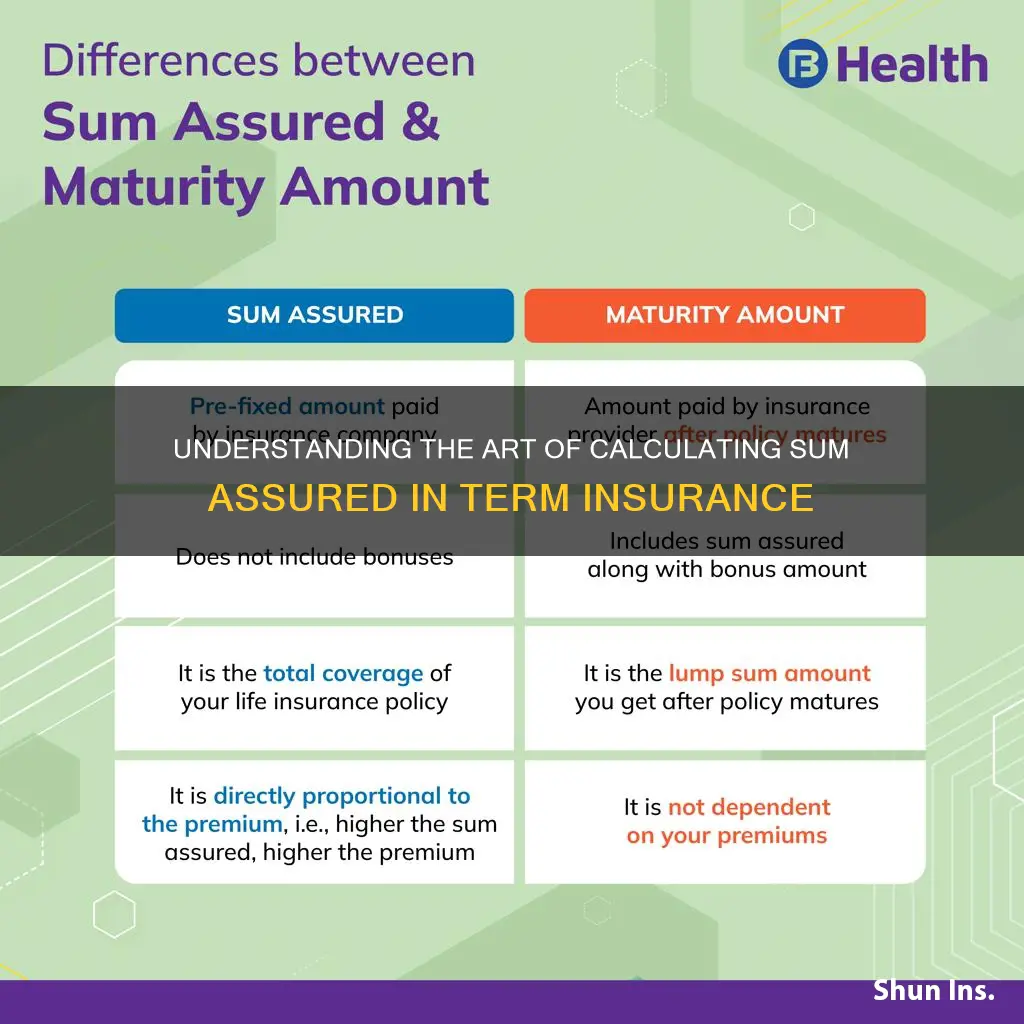

| Difference from Sum Insured | Sum assured is offered by life insurance companies, whereas sum insured is generally offered by non-life insurance companies. Sum assured is a fixed amount, while sum insured is a reimbursement for the costs incurred. |

What You'll Learn

Regular household expenses

- The base amount for the sum assured should typically be 10-20 times your annual household expenses, depending on the tenure of the policy and the number of years you are expected to remain in the workforce. This amount can also be influenced by the number of dependents you have.

- It is important to consider not only your current household expenses but also any potential future increases, especially if you expect your income to rise over time.

- The sum assured should be sufficient to cover all essential expenses, including groceries, utilities, school and college fees, and any other regular costs.

- If you have a spouse or other dependents who are not earning their own income, the sum assured should ideally include a retirement fund to ensure they can maintain a comfortable lifestyle in their later years.

- It is also worth considering any potential future expenses, such as children's education or weddings, and factoring these into the sum assured.

- When calculating your annual household expenses, be sure to include any regular costs such as rent or mortgage payments, transport, and insurance premiums.

- Don't forget to take into account any existing debts or liabilities, such as loans or credit card payments, which may impact your ability to pay the premiums and should be covered by the sum assured.

The Policyholder's Shield: Unraveling the Provision that Safeguards Insured Terms

You may want to see also

Current and future income

When calculating the sum assured, it is important to consider your current and future income. The sum assured should be a high enough amount to compensate for the loss of income that would occur in the event of the policyholder's death. This is especially important for single-income households.

The sum assured should also take into account expected increases in salary due to inflation, as this can significantly impact household expenditure. As a general rule, the sum assured should be 10-20 times your annual income. However, it is important to carefully consider your family's specific needs and future expenses when determining the appropriate sum assured.

Additionally, when selecting a term insurance plan, it is crucial to consider the policy term. The sum assured may increase or decrease over the tenure of the policy to account for factors such as inflation or debt.

The Rising Tide of Term Insurance: Navigating the Surge in Premiums

You may want to see also

Existing assets, debts and liabilities

When calculating the sum assured for a term insurance plan, it is important to consider your existing assets, debts, and liabilities. This will ensure that your family does not face any financial burden after your death. Here are some steps to help you factor in your existing assets, debts, and liabilities when determining the sum assured:

List all your assets:

Include securities, investments, property, vehicles, fixed deposits, mutual funds, and any other valuable assets you own. These assets will be available to your family after your death and can help cover expenses.

Calculate the total value of your assets:

Determine the current market value or worth of each asset. This will give you an understanding of the financial resources your family will have access to.

Identify your current liabilities and debts:

Make a list of all your current liabilities, such as debts, loans, mortgages, credit card payments, and any other financial obligations. These are the financial commitments that your family will need to fulfil or pay off.

Balance your assets against your liabilities:

Subtract the total value of your liabilities from the total value of your assets. This will give you a net value of assets available to your family. Ensure that this net value is sufficient to cover any outstanding financial obligations and provide financial support to your dependents.

Consider any future expenses or liabilities:

In addition to existing liabilities, think about any future expenses or liabilities that your family may incur. For example, your children's education, their weddings, or your spouse's retirement. Make sure the sum assured is sufficient to cover these future expenses as well.

By following these steps, you can effectively factor in your existing assets, debts, and liabilities when calculating the sum assured for your term insurance plan. This will help ensure that your family has the necessary financial resources and support in your absence.

A Comprehensive Guide to Navigating LIC e-Term Insurance Application Process

You may want to see also

Tenure

The ideal tenure for a term insurance plan is one where you don't have to pay any premiums after retirement. However, there are several other factors to consider when deciding on the tenure of a term insurance plan.

Age

The younger you are, the longer the tenure available to you. This is because insurance premiums increase with age, as the risk of health issues rises. So, it's best to buy term insurance at an early age to secure a longer tenure at a lower premium.

Liabilities

If you have debts, your term insurance cover should be equal to the outstanding loan amount, and the tenure should be equal to or longer than the balance of your EMI payments. This ensures that, even in the event of your early death, your family won't be burdened by the loan, as the insurance payout will help them square off the liabilities.

Financial Goals

Consider your short-term and long-term financial goals when deciding on the tenure of your term insurance plan. For example, if you're saving for a new car, you might opt for a shorter tenure, while buying property might require a longer-term investment.

Maximising Tenure

As a rule of thumb, opt for the maximum tenure available for your age and profile. So, if you're 30 years old, even if you only foresee needing life insurance for the next 30 years, opt for a 40-year tenure. This is because financial matters can be uncertain, and it may not be possible to purchase insurance for a longer tenure at an older age.

Another factor to consider is affordability. Longer tenures often involve higher premium payments, so evaluate your current savings and cash flow to ensure you can continue to pay the premium for the entire duration.

Understanding the Complexities of Term Insurance Calculations

You may want to see also

Funds for future one-time expenses

When calculating the sum assured in term insurance, it is important to consider any future one-time expenses. These expenses could include your children's higher education or weddings.

The sum assured is the pre-decided amount payable to the policyholder or beneficiary on the occurrence of an insured event, such as death or critical illness. It is crucial to select an adequate sum assured based on your specific needs. If you already have a life insurance policy, you can increase your sum assured by either buying another life insurance policy or adding specific riders that offer additional protection benefits.

- Estimate the cost of future one-time expenses, such as education or weddings.

- Multiply this amount by the number of dependents who will require financial support.

- Consider the inflation rate and potential increases in expenses over time.

- Evaluate your current income and financial situation to ensure you can afford the premiums.

- Compare different term insurance plans and their benefits to find the most suitable option for your needs.

Understanding the Convertibility Factor in Term Insurance: Unlocking Flexibility

You may want to see also

Frequently asked questions

Sum assured is the minimum guaranteed benefit amount the insurer will pay to your nominee in the unfortunate event of your demise during the policy tenure. It is a fixed, pre-decided amount that is paid to the nominee in case of a policyholder's death during the policy tenure.

There are many different ways to calculate the sum assured for your life insurance policy. One of the most popular methods is Human Life Value or HLV. This method calculates the sum assured based on your current and future expenses, present and future earnings, and age. It helps you calculate your capitalized value based on current inflation.

There are a number of important factors to consider when determining the ideal minimum sum assured for your needs. These include regular household expenses, current/future income and inflation, existing assets, debts and liabilities, tenure, funds for future one-time expenses, retirement funds for spouse/dependents, accidents and illnesses.